Dollar retreats mildly in early US session after non-farm payroll reports missed market expectation. But loss is limited as the set of data was decent even thought not spectacular. Indeed, there is prospect of more Dollar rally once the knee-jerk reactions fade. For now, Swiss Franc and Yen is the weakest for today, followed by Dollar. Australian Dollar is the strongest, followed by New Zealand Dollar and Sterling. For the week, Sterling is the strongest, followed by Dollar. Yen is the weakest, followed by Aussie.

Technically, USD/CAD dips notably after failing to break through 1.3102 resistance decisively. Canadian Dollar is also lifted by stronger than expected job data. USD/CAD’s near term outlook remains bearish and could be heading back to 1.2951 low. USD/JPY is still eyeing 109.72 resistance. Break will resume recent rally from 104.45.

In Europe, currently, FTSE is down -0.08%. DAX is up 0.21%. CAC is flat. German 10-year yield is up 0.002 at -0.214. Earlier in Asia, Nikkei rose 0.47%. Hong Kong HSI rose 0.27%. China Shanghai SSE dropped -0.08%. Singapore Strait Times rose 0.26%. Japan 10-year JGB yield dropped -0.0071 to 0.000.

US NFP grew 145k, unemployment rate unchanged at 3.5%

US Non-Farm Payroll report showed 145k in December, below expectation of 160k. Notable job gains occurred in retail trade (+41k) and health care (+28k), while mining lost jobs (-8k). Unemployment rate was unchanged at 3.5%, matched expectations. Labor force participation rate was unchanged at 63.2%. Average hourly earnings rose 0.1% mom, missed expectation of 0.3% mom.

Canada employment rose 35.2k, unemployment rate down to 5.6%

Canada employment rose 35.2k in December, above expectation of 20.0k. Unemployment rate dropped to 5.6%, down from 5.9%, beat expectation of 5.8%. In the 12 months to December, employment increased by 320k (+1.7%), the result of gains in full-time work (+283k or +1.9%).

BoE Tenreyro to discuss possibility of further stimulus in the coming months

BoE policymaker Silvana Tenreyro “if uncertainty over the future trading arrangement or subdued global growth continue to weigh on demand, then my inclination is towards voting for a cut in Bank Rate in the near term.”

She added that “a key input in the decision is how uncertainty unwinds going forward, and how that impacts on demand. We will be watching very closely how firms and households respond to Brexit developments.”

“We are talking about the coming months, or I am talking about the coming months, on the possibility of further stimulus”, she said.

Releaed elsewhere

France industrial output rose 0.3% mom in November, above expectation of 0.1% mom. Italy industrial output rose 0.1% mom in November versus expectation of 0.0% mom. Swiss unemployment rate was unchanged at 2.3% in December. Australia retail sales rose 0.9% mom in November, seasonally adjusted, above expectation of 0.4% mom. AiG Performance of Services Index dropped sharply to 48.7 in December, down from 53.7. Japan overall household spending dropped -2.0% yoy in November, matched expectations. Japan leading economic index dropped to 90.9 in November.

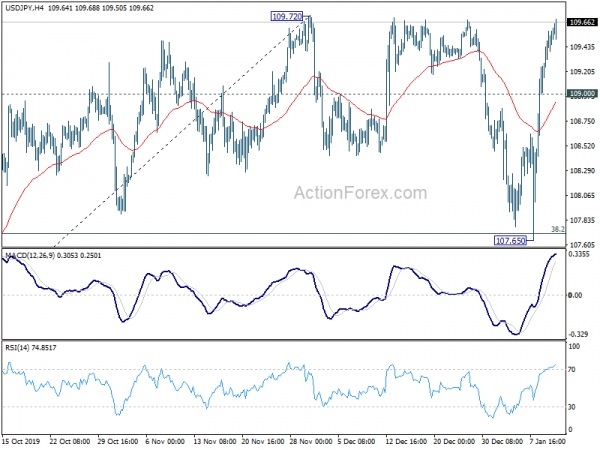

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.16; (P) 109.37; (R1) 109.73; More..

Intraday bias in USD/JPY remains on the upside as rise from 107.65 is in progress. Sustained break of 109.72 resistance will resume whole rise from 104.45 to channel resistance (now at 111.46). On the downside, below 109.00 minor support will turn intraday bias neutral first. But overall outlook will remain bullish as long as 38.2% retracement of 104.45 to 109.72 at 107.70 holds.

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). Recovery from 104.45 also failed to sustain above 55 week EMA (now at 109.02). Overall outlook remains bearish and fall from 118.65 is in favor to extend through 104.45 low. This will now stay as the favored case as long as 109.72 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Index Dec | 48.7 | 53.7 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Nov | -2.00% | -2.00% | -5.10% | |

| 00:30 | AUD | Retail Sales M/M Nov | 0.90% | 0.40% | 0.00% | 0.10% |

| 05:00 | JPY | Leading Economic Index Nov P | 90.9 | 90.6 | 91.6 | |

| 06:45 | CHF | Unemployment Rate Dec | 2.30% | 2.30% | 2.30% | |

| 07:45 | EUR | France Industrial Output M/M Nov | 0.30% | 0.10% | 0.40% | 0.50% |

| 09:00 | EUR | Italy Industrial Output M/M Nov | 0.10% | 0.00% | -0.30% | |

| 13:30 | USD | Nonfarm Payrolls Dec | 145K | 160K | 266K | 256K |

| 13:30 | USD | Unemployment Rate Dec | 3.50% | 3.50% | 3.50% | |

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.10% | 0.30% | 0.20% | 0.30% |

| 13:30 | CAD | Net Change in Employment Dec | 35.2K | 20.0K | -71.2K | |

| 13:30 | CAD | Unemployment Rate Dec | 5.60% | 5.80% | 5.90% | |

| 15:00 | USD | Wholesale Inventories Nov | 0.00% | 0.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals