The holiday market in Asia is in deep risk aversion as worries on China’s coronavirus intensified, after surge in confirmed cases and death tolls. Yen and Swiss Franc jump notably while New Zealand and Australian Dollars weaken. Risk aversion is also clearly seen as gold gaps up, oil price gaps down, and Chinese Yuan is in free fall.

Technically, EUR/JPY’s break of 120.17 support is seen as a strong sign of near term reversal. That is, whole corrective rise from 115.86 has completed at 122.87 already. A question now is whether USD/JPY (currently at 109.03), would break 107.65 support to align the outlook with EUR/JPY.

In Asia, Nikkei is currently down -1.91%. Japan 10-year JGB yield is down -0.022 at -0.042. China, Hong Kong and Singapore are on lunar new year holiday.

Coronavirus death toll surges, spreads globally

Confirmed cases of coronavirus in China jumped to 2744 as of Monday, up from 1975 yesterday, and 1287 on Saturday. Death tolls also hit 80. The virus has now spread to countries including the US, France, Australia, Taiwan Japan, South Korea, Singapore, Thailand, Malaysia, Vietnam and Nepal.

The Chinese government extends the annual lunar new year break until February 2, from January 30 originally. The US is planning to evacuate some Americans from Wuhan on Tuesday. France is preparing to do the same by mid-week. Japan is also planning to evacuate its nationals.

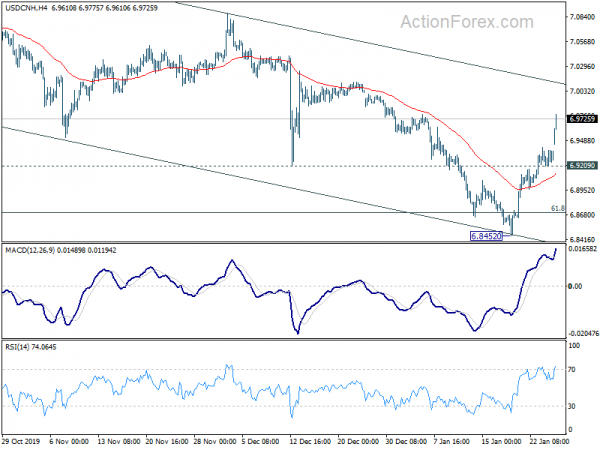

Chinese Yuan in free fall on coronavirus outbreak

USD/CNH surges sharply as offshore Yuan is in suffering heavy selloff on China’s coronavirus outbreak. Rebound from 6.8452 is now targeting channel resistance (7.0135). Decline from 7.1953 high is seen as a corrective move, which might has completed at 6.8452 already. Sustained break of the channel resistance should confirm this case and bring retest of 7.1953 high. Nevertheless, rejection by the channel resistance will retain near term bearishness. Break of 6.9209 will target a test on 6.8452 low instead.

Gold gaps up, heading to retest 1611 high

Gold starts the week with a gap up and hits as high as 1588.51 so far. Further rise is in favor for the near term to retest 1611.37 high. At this point, we don’t rule out that case that 1611.37 is a medium term top. It could be formed after rise from 1160.17 completed a five-wave sequence on bearish divergence condition in daily MACD. Hence, we’d be cautious on topping signal below 1611.37. Break of 1556.52 support will extend the correction from 1611.37 with another leg down. However, decisive break of 1611.37 will resume the medium term up trend instead.

WTI oil gaps down, targeting 50.64 key support

WTI crude oil gaps down as the week starts and hits as low as 52.10 so far. Further fall is expected as long as 55.89 resistance holds. However, overall outlook is unchanged. Current decline from 65.38 is seen as the third leg of the consolidation pattern from 66.49. We’d expect strong support from 50.64, which is close to 61.8% retracement of 42.05 to 66.49 at 51.38, to bring rebound. Break of 55.89 will indicate short term bottoming. However, sustained break of 50.64 will invalidate our view and open up the case for a test on 42.05 low.

FED & BoE to meet; Eurozone, US and Canada to released GDP

Two central banks will meet this week. Fed is expected to keep interest rate unchanged at 1.50-75%. The accompanying statement is unlikely to have any drastic change. No economic projections will be released. Fed officials seem to have a wait-and-see consensus, to let the impact of last years rate cuts to play out. Hence, the FOMC announce could be a non-event. Focus is more on durable goods orders, GDP and PCE inflation.

BoE is also expected to keep interest rate unchanged at 0.75%. Expectations for a rate cut receded drastically last week, after record improvements in business optimism and solid PMIs. Nevertheless, the vote split will be closely watched to see how many of the policy makers are ready to push for a cut should outlook worsens ahead.

Elsewhere, markets pushed expectation of RBA rate cut from February to April after employment data. But the expectations could change again should CPI inflation disappoints. Aussie will also face some test from China PMIs. Germany Ifo, Eurozone GDP as well as Canada GDP will also be watched.

Here are some highlights for the week:

- Monday: Germany Ifo business climate; UK BBA mortgage approvals; US new home sales.

- Tuesday: Japan corporate services price index; Australia NAB business confidence; Swiss trade balance; UK CBI realized sales; US durable goods orders, consumer confidence, S&P Cass-Shiller house price.

- Wednesday: BoJ summary of opinions, Japan consumer confidence; Australia CPI; Germany Gfk consumer sentiment, import prices; Eurozone M3 money supply; US goods trade balance, wholesale inventories, pending home sales; FOMC rate decision.

- Thursday: Australia import prices; Swiss KOF economic barometer; Germany unemployment; Eurozone unemployment; BoE rate decision; US GDP, jobless claims.

- Friday: Australia PPI, private sector credit; China PMIs; Japan housing starts; France GDP, Germany retail sales; Eurozone CPI, GDP; Swiss retail sales; UK M4 money supply, mortgage approvals; Canada GDP, RMPI and IPPI; US personal income and spending, employment cost index, Chicago PMI.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 120.19; (P) 120.73; (R1) 121.03; More….

EUR/JPY reaches as low as 119.93 so far as fall from 122.87 extends. Break of 120.17 support indicates completion of completion of corrective rise from 115.86, on bearish divergence condition in daily MACD. Further fall should be seen to retest 115.86 low. On the upside, above 121.26 minor resistance will turn intraday bias neutral first. But risk will now stay on the downside as long as 122.87 resistance holds, in case of recovery.

In the bigger picture, EUR/JPY is still staying in the falling channel established since 137.49 (2018 high). Rise from 115.86 is seen as a corrective rise. Strong resistance could be seen at falling channel resistance to limit upside. However, sustained break of the channel resistance will carry larger bullish implication and target 127.50 key resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Germany IFO – Business Climate Jan | 97 | 96.3 | ||

| 09:00 | EUR | Germany IFO – Expectations Jan | 95 | 93.8 | ||

| 09:00 | EUR | Germany IFO – Current Assessment Jan | 99.4 | 98.8 | ||

| 09:30 | GBP | BBA Mortgage Approvals Dec | 44.0K | 43.7K | ||

| 15:00 | USD | New Home Sales M/M Dec | 730K | 719K | ||

| 15:00 | USD | New Home Sales Change M/M Dec | 0.80% | 1.30% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals