The Reserve Bank of Australia (RBA) is the sole major central bank that will meet next week but that doesn’t mean the calendar is light, as there’s a cascade of crucial economic data to keep things exciting. The US employment report will reveal whether the recent ‘cracks’ in the labor market were just outliers in an otherwise healthy trend, or early signs of weakness. The answer could determine whether ‘king dollar’ will continue to reign over the FX market. More broadly, risk sentiment will remain sensitive to any virus-related news.

RBA on hold, but dovish guidance likely in store

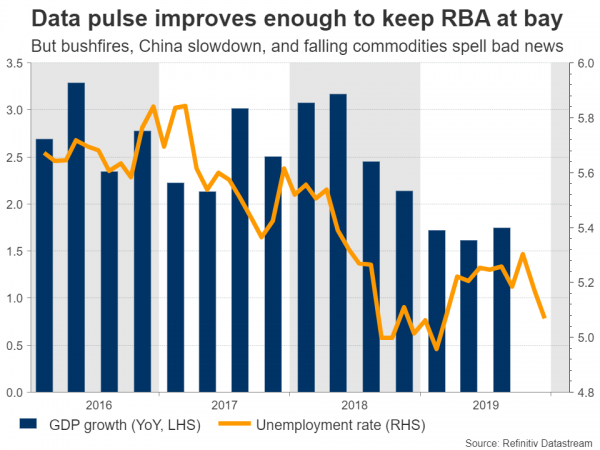

The RBA has a tough balancing act on its hands when it concludes its policy meeting on Tuesday. On the one hand, recent data have been solid enough to dispel market expectations for an immediate rate cut to support the economy, with the implied probability for such an action currently resting at a lowly 15%. The unemployment rate fell back down to 5.1% in December, retail sales accelerated sharply in November, and inflation picked up in Q4 – even if it remains stubbornly below the RBA’s target range.

However, these are backward-looking data and new risks have emerged. For example, several weeks of raging bushfires across Australia threaten to dampen economic growth. Likewise, the coronavirus epidemic amplifies downside risks for Australia’s economy, not only due to spillover effects from a slowdown in China and falling commodity prices, but also due to the sinister impact this might have on Australia’s tourism industry, which relies heavily on Chinese travelers.

And while the data pulse has improved lately, by no means is it ‘great’. Australian households are among the most indebted in the world, and wages aren’t rising fast enough to ease the debt burden, which is ultimately limiting consumption. Meanwhile, underlying inflation remains stuck in low gear, with little sign of an imminent pick up. The bottom line is that although recent data is good enough to keep the RBA’s hand off the rate-cut button for now, the overall situation suggests the Bank will keep a future rate cut very much on the table.

As for the aussie, even if the RBA doesn’t cut rates this time, the risks around the currency still seem tilted to the downside. The Bank will surely maintain a dovish bias, global risk sentiment remains in the doldrums, and Australia’s close trading ties with China expose its currency to any virus-related weakness in the Chinese economy going forward. Admittedly though, the aussie has already fallen dramatically, so whether or not sellers can break below the 10-year low of 0.6670 in aussie/dollar may be crucial.

The nation’s retail sales for December are also due on Thursday.

Nonfarm payrolls and ISM PMIs might steal the show

In the United States, the upcoming data releases might shape market expectations about whether and how soon the Fed will cut rates again. The week kicks off with the ISM manufacturing PMI for January being released on Monday, ahead of the non-manufacturing index on Wednesday. Forecasts point to an uptick in both figures, though that would still leave the manufacturing print stuck below 50, signaling continued contraction in the sector.

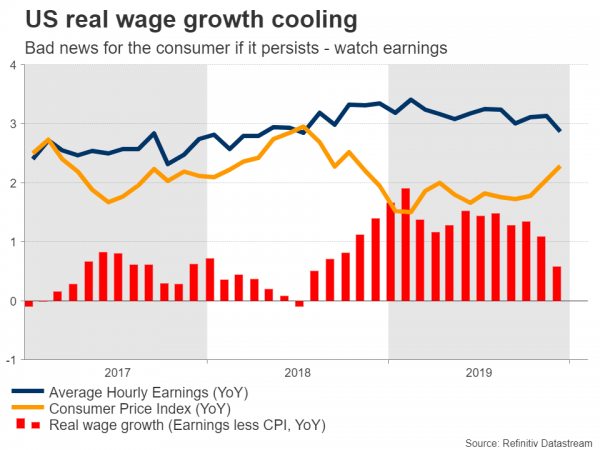

Then on Friday, all eyes will turn to the employment numbers for January. Nonfarm payrolls are expected to clock in at 156k, mildly higher than the 145k in December, and a number consistent with further tightening in the jobs market. The unemployment rate is forecast to hold steady at 3.5%, while average hourly earnings are anticipated to accelerate slightly to 3.0% on a yearly basis, from 2.9% previously.

The US labor market has displayed some signs of stress lately, with real wage growth cooling substantially and job openings as measured by the JOLTS survey declining, which may be an early indication that overall employment growth may be set to slow down. This puts extra emphasis on the upcoming data to either confirm this weakening narrative or dispel such concerns, especially considering markets are already pricing in an ~85% probability for a Fed cut by July.

Turning to the dollar, the big picture still seems positive. To put it bluntly, there’s no alternative to the greenback right now, which offers a special combination of safety and high(er) interest rates relative to other major currencies like the euro and yen. For this narrative to change, either the Fed needs to start cutting rates aggressively, or the Eurozone has to announce a big spending package to boost growth and lift the euro, neither of which seems likely anytime soon.

In the political sphere, the Democratic primary nomination process kicks off with the Iowa caucuses on Monday. This will be the first state to vote on who should represent the Democratic party against Donald Trump at the November presidential election. While markets typically don’t react much to primaries, this time may be different as the frontrunner in Iowa is Senator Bernie Sanders – who advocates for higher taxes – so if he wins the state, that might spook stock markets.

Canadian jobs data eyed as BoC weighs rate cut

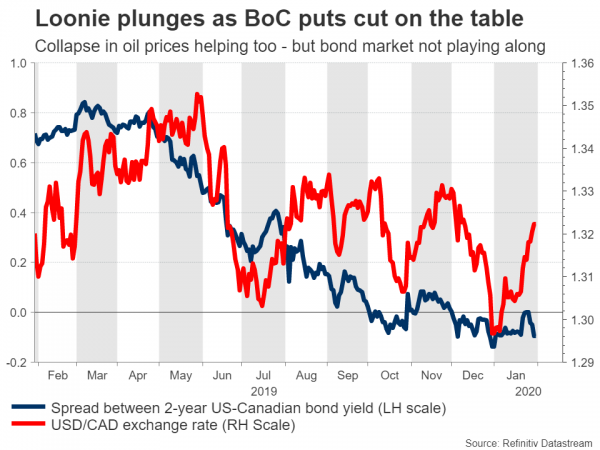

Across the border in Canada, jobs data for January will hit the markets on Friday as well. Following the dovish shift by the Bank of Canada (BoC) lately, the market-derived chance for a rate cut by April now stands at 60%, so incoming data will be crucial in shaping expectations.

The loonie has taken a beating so far this year, amid a triple whammy of rising BoC rate cut odds, collapsing oil prices, and coronavirus concerns dampening the prospects for global growth and thus, for Canada’s export-heavy economy.

Looking ahead, the loonie’s fortunes may be tied to how the virus theme evolves, especially since that will also drive oil prices. In that sense, virus fears could continue to plague markets for a while longer, as there have been no signs yet that the situation is under control, and there’s a real risk that the Chinese – and therefore global – economy will take a more severe hit from this than many expect. Hence, the situation might get even uglier from here, before it gets better.

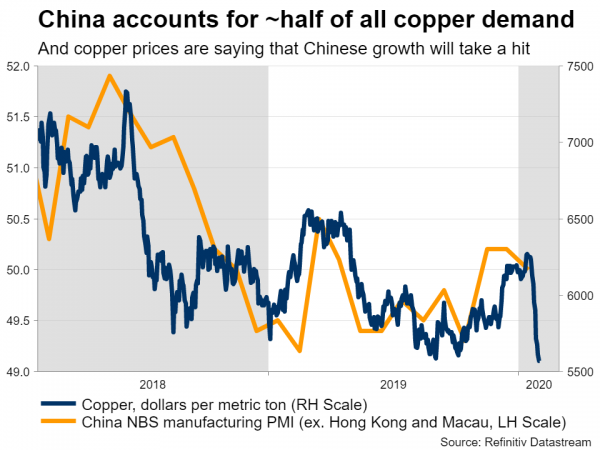

Chinese data unlikely to reveal any virus damage

In the world’s second-largest economy, the Caixin manufacturing PMI (Monday) and the services PMI (Wednesday) for January will be in focus, ahead of the nation’s export and import data for the same month on Friday. Alas, these data are unlikely to reflect any real damage from the recent virus outbreak, as concerns about the disease took center stage only during the final week of January.

Hence, these figures will probably be viewed as outdated by traders, eliciting little market reaction. The lock-down of several Chinese cities, and the fact that numerous companies will remain closed in the coming weeks due to contagion fears, suggest that China’s economic data will take a severe hit from February onwards.

For global stocks and commodity currencies to see relief, investors may first need to see concrete signs that the spread of the disease in China is slowing down drastically. That would be an early indication that things may be about to get back to normal, prompting a violent ‘risk-on’ rally. However, we are not there yet.

Finally, New Zealand’s labor market data for Q4 will also be released, late on Tuesday.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals