The financial markets seem to have stabilized from coronavirus fears. Following the strong rebound in US stocks overnight, Asian indices are also trading generally higher. Yen and Swiss Franc continue to trade as two of the weakest for the week. But Sterling is the worst performing one on Brexit negotiation risks. On the other hand, Australian and New Zealand Dollars are the strongest. Focus will likely turn back to economic data for now, especially with US ADP employment and ISM services featured today.

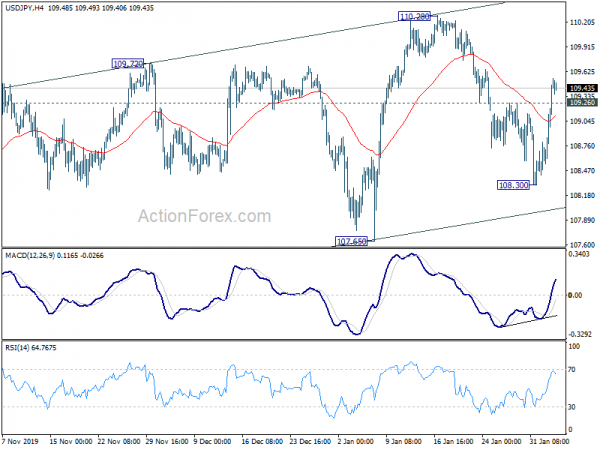

Technically, USD/JPY’s break of 109.26 minor resistance suggests that pull back from 110.28 has completed at 108.30. More importantly, with 107.65 support intact, whole rebound from 104.45 is likely still in progress for another high. Focus is now on 121.26 minor resistance in EUR/JPY. Break there will realign the outlook with USD/JPY and bring retest of 112.87 high.

In Asia, Nikkei is currently up 1.41%. Hong Kong HSI is up 0.45%. China Shanghai SSE is up 1.57%. Singapore Strait Times is up 1.00%. Japan 10-year JGB yield is up 0.014 at -0.035. Overnight, DOW rose 1.44%. S&P 500 rose 1.50%. NASDAQ rose 2.10%. 10-year yield rose 0.083 to 1.603.

China’s coronavirus cases rose to 24k, outbreak may delay fulfillment of trade deal

According to China’s National Health Commission, on January 4, total number of confirmed coronavirus cases rose 3887 to 24324. Death tolls rose 65 to 490. Serious cases rose 431 to 3219. Suspected cases rose 46 to 23260. Number of people tracked rose from 31139 to 252154.

US White House economic adviser Larry Kudlow admitted in a Fox Business interview that Chinese purchase of American goods would be delayed due to the corona virus outbreak. He said, “it is true the trade deal, the Phase 1 trade deal, the export boom from that trade deal will take longer because of the Chinese virus.”

The US-China Economic and Security Review commission also noted, “the ongoing spread of the coronavirus is taking a toll on China’s public health and economy, and may impact its ability and willingness to meet the commitments in the Phase 1 deal.”

BoJ Wakatabe warned of heightening uncertainties from coronavirus, a cruise liner quarantined in Yokohama

BoJ Deputy Governor Masazumi Wakatabe warned of the “heightening uncertainties” regarding the spread of China’s coronavirus on the global economy. BoJ should scrutinize the impact of the outbreak on its economic forecasts. For now, downside risks remain. He reiterated the usual pledge that the central bank ” won’t hesitate to take additional easing steps if momentum for hitting price goal is lost.”

In Japan’s port of Yokohama, a cruise liner with 3700 passengers was quarantined yesterday. Health screened started after a Hong Kong passenger was tested positive for the coronavirus. Chief Cabinet Secretary Yoshihide Suga said authorities would decide whether to let people leave the ship after all tests are completed.

RBA to continue to look at both sides of the rate cut equation

In an address to the National Press Club today, RBA Governor Philip Lowe said the rate hold yesterday “reflects a judgement about the benefits from a further reduction in interest rates against some of the costs and risks associated with very low interest rates.”

He added, a further cut would help households balance sheet adjustment and “bring forward the day that consumption strengthens”. It would also have a further effect on the exchange rate which would ” boost demand for our exports and therefore support jobs growth.” However, there were global concerns on the “resource allocation” and “confidence” on very low interest rates. It could also encourage more borrowing for house purchases and increase risk of problems down the track.

But the board will continue to look at “both sides of the equation”. “If the unemployment rate were to be trending in the wrong direction and there was no further progress being made towards the inflation target, the balance of arguments would change.” There would be a “strong case for further monetary easing” in those circumstances.

New Zealand unemployment rate dropped to 4%

New Zealand unemployment rate dropped to 4.0% in Q4, down from 4.1%, better than expectation of 4.2%. However, participation rate also dropped to 70.1%, down from 70.4%. Employment was actually flat versus expectation of 0.3% growth. Labor cost index rose 0.6% qoq, unchanged from Q3, slightly better than expectation of 0.5% qoq.

Also released in Asia, China Caixin services PMI dropped to 51.8 in January, missed expectationof 52.6.

Looking ahead

Services data are the focuses today. Eurozone and UK will release services PMI final. Eurozone will also release retail sales. Swiss will release SECO consumer climate. Later in the day, US will release ADP employment, trade balance and ISM non-manufacturing. Canada will release trade balance too.

USD/JPY Daily Outlook

Daily Pivots: (S1) 108.86; (P) 109.21; (R1) 109.86; More..

USD/JPY’s break of 109.26 minor resistance suggests that pull back from 110.28 has completed at 108.30. More importantly, with 107.65 support intact, larger rebound from 104.45 is likely still in progress. Intraday bias is turned back to the upside for 110.28 first. Break there will target medium term channel resistance at 111.23. On the downside, break of 108.30 will target 107.65 key near term support instead.

In the bigger picture, there is no change in the bearish outlook yet in spite of the rebound from 104.45. The pair is staying in long term falling channel that started at 118.65 (Dec. 2016). Rise from 104.45 is seen as a correction and the down trend could still extend through 104.45 low. However, sustained break of the channel resistance will be an important sign of bullish reversal and target 114.54 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.00% | 0.30% | 0.20% | |

| 21:45 | NZD | Unemployment Rate Q4 | 4.00% | 4.20% | 4.20% | 4.10% |

| 21:45 | NZD | Participation Rate Q4 | 70.10% | 70.40% | 70.40% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q4 | 0.60% | 0.50% | 0.60% | |

| 0:00 | NZD | ANZ Commodity Price Jan | -0.90% | 1.60% | -2.80% | -3.40% |

| 1:45 | CNY | Caixin Services PMI Jan | 51.8 | 52.6 | 52.5 | |

| 6:45 | CHF | SECO Consumer Climate Q1 | -8 | -10 | ||

| 8:45 | EUR | Italy Services PMI Jan | 51 | 51.1 | ||

| 8:50 | EUR | France Services PMI Jan F | 52.4 | 51.7 | ||

| 8:55 | EUR | Germany Services PMI Jan F | 52 | 54.2 | ||

| 9:00 | EUR | Eurozone Services PMI Jan F | 52.4 | 52.2 | ||

| 9:30 | GBP | Services PMI Jan F | 49.1 | 52.9 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | -0.50% | 1.00% | ||

| 13:15 | USD | ADP Employment Change Jan | 155K | 202K | ||

| 13:30 | USD | Trade Balance (USD) Dec | -47.4B | -43.1B | ||

| 13:30 | CAD | International Merchandise Trade (CAD) Dec | -1.2B | -1.1B | ||

| 14:45 | USD | Services PMI Jan F | 53.2 | 53.2 | ||

| 14:45 | USD | PMI Composite Jan | 53.1 | 53.1 | ||

| 15:00 | USD | ISM Non-Manufacturing PMI Jan | 55.1 | 55 | ||

| 15:30 | USD | Crude Oil Inventories | 3.5M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals