Dollar is trading with a firm tone as markets await non-farm payrolls report from the US. Bet on a Fed rate cut by June receded this week, currently a 36.6% as indicated by fed fund futures, as stocks extended record runs. A set of solid job data could give the greenback another lift to have a strong close. It’s currently the second strongest next to Australian Dollar, only because the latter suffered a lot last week. Meanwhile, Sterling remains the weakest one for the week, followed by Yen and Swiss Franc.

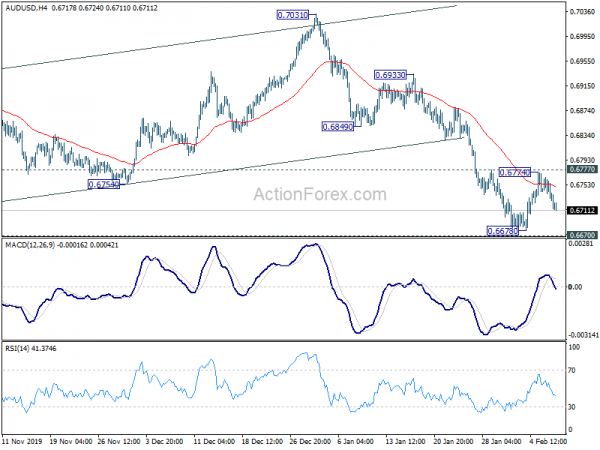

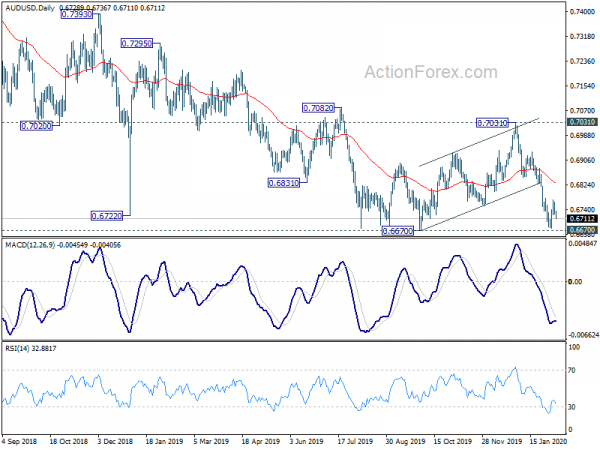

Technically, EUR/USD’s break of 1.0992suggestes resumption of fall from 1.1239. It also reaffirm the case that consolidation pattern from 1.0879 has completed. Retest of this 1.0879 low should be seen next. AUD/USD seems to be rejected by 0.6777 resistance and is heading back to 0.6670 low. Break there will remain larger down trend. USD/JPY and EUR/JPY would be two pairs to watch this week. The former lost upside momentum ahead of 110.28 key resistance. The latter also lose upside momentum ahead 121.26 minor resistance. We might seen deeper retreat today should investors take profits from their long stock position ahead of the weekend.

In Asia, Nikkei closed down -0.19%. Hong Kong HSI is down -0.52%. China Shanghai SSE is up 0.33%. Singapore Strait Times is down -1.52%. Japan 10-year JGB yield is down -0.0243 at -0.039. Overnight, DOW rose 0.30%. S&P 500 rose 0.33%. NASDAQ rose 0.67%. 10-year yield dropped -0.005 to 1.644.

PBoC to boost countercyclical efforts as coronavirus deaths hit 636

PBoC Vice Governor Pan Gongsheng said today that the economy could be disrupted in Q1 due to the coronavirus outbreak. The central bank is closely monitoring the impact and is preparing policy responses to offset the pressure on the economy. He added that countercyclical adjustment efforts will be boosted to keep market liquidity at a reasonably ample level. Separately, Vice Finance Ministry Weiping also indicated there will be tax and fees cuts to help businesses.

According to the National Health Commission, on February 6, total confirmed coronavirus cases rose 3143 to 31161. Deaths increased 73 to 636. Serious cases rose 962 to 4821. Suspected cases rose 1657 to 26359. Globally, total reported cases hit 31481, in over 35 countries, including 86 in Japan, 30 in Singapore, 25 in Thailand, 24 in South Korea and 16 in Taiwan.

Chinese doctor Li Wenliang who tried to warn the public of the coronavirus back in December, died yesterday. He was one of the eight “whistle-blowers” reprimanded by the government for spreading “rumors”. China’s top disciplinary body, the National Supervisory Commission claimed today that they would send a team to Wuhan to investigate the issue. But the doctor’s death has already triggered outcry from the public and a “I Want Freedom of Speech” social media campaign in the country.

RBA cut 2020 growth forecast, Lowe warned of coronavirus risks

RBA Governor Philip Lowe told a parliamentary economics panel that the board is “expecting progress to be made towards the inflation target and full employment”. But the progress will be “only gradual” with uncertainties. The board “has been discussing” the case of further easing. But considering the balance of pros and cons, RBA decided to keep cash rate unchanged this week.

Lowe added, “if the unemployment rate were to be moving materially in the wrong direction and there was no further progress being made towards the inflation target, the balance of arguments would tilt towards a further easing of monetary policy.”

Additionally, he also said it’s “still too early to tell” about the impact of China’s coronavirus outbreak. But he warned, “the impact is going to be large”. And, “given what we know at the moment”, the hit to Australian economy would be worse than SARS. He added, the outbreak could take 0.2% off the Australia’s growth. But, if the virus “persists for an extended period, the effect on economic activity is likely to be larger than currently projected,”

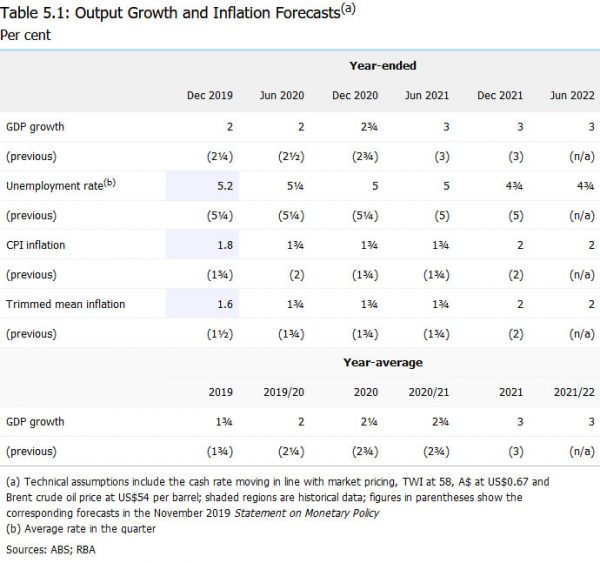

In the Statement of Monetary Policy, RBA cut 2020 year-average GDP growth forecast from 2.75% to 2.25%. But 2020 year-average GDP growth forecasts was held unchanged at 3.00%. Unemployment rate forecast was lowered from 5.25% to 5.00% by December 2020, and from 5.00% to 4.75% by December 2021. Headline CPI forecasts was unchanged at 1.75% by December 2020 and 2.00% by December 2021.

NFP would meet expectation but unlikely to give a large surprise

Dollar is currently trading as the second strongest one for the week, as markets await job data from the US. Non-farm payroll report is expected to show 156k job growth in January. Unemployment rate is expected to be unchanged at 3.50%. Average hourly earnings are expected to grew 0.3% mom.

Looking at other job data, ADP private jobs posted a strong upside surprise with 291k growth. That’s the highest figure in nearly five years. ISM manufacturing employment improved to 46.6 but stayed in contraction region. ISM non-manufacturing employment dropped from 54.8 to 53.1. Four-week moving average of initial jobless claims dropped from 224k to 214.5k.

Overall, other job data suggested that it could be easy to beat the 156k NFP expectation. Yet, there is no hints of an overwhelming surprise. Meanwhile, wage growth could disappoint again.

Here are some previews:

Also

Australia AiG performance of services index dropped from 48.7 to 47.4 in January. Japan labor cash earnings rose 0.0% yoy in December, household spending dropped -4.8% yoy, leading indicator rose form 90.8 to 91.6. Germany industrial production dropped -3.5% mom in December, trade surplus widened to EUR 19.2B.

Swiss will release foreign currency reserves in European session. US will release NFP and wholesale inventory later in the day. Canada will release employment and Ivey PMI.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6717; (P) 0.6741; (R1) 0.6755; More…

Intraday bias in AUD/USD remains neutral first. Recovery from 0.6678 was limited limited by 0.6777 resistance as expected and near term outlook stays bearish. On the downside, decisive break of 0.6670 low will confirm resumption of larger down trend. Next target will be 0.6008 key support. Nevertheless, firm break of 0.6777 will indicate short term bottoming and extend the consolidation pattern from 0.6670 with another near term rise.

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). This will remain the favor case as long as 0.7031 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Index Jan | 47.4 | 48.7 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Dec | 0.00% | -0.10% | 0.10% | |

| 23:30 | JPY | Overall Household Spending Y/Y Dec | -4.80% | -1.70% | -2.00% | |

| 0:30 | AUD | RBA Monetary Policy Statement | ||||

| 5:00 | JPY | Leading Economic Index Dec P | 91.6 | 90.8 | 90.8 | |

| 7:00 | CNY | Trade Balance (USD) Jan | 36.8B | 46.8B | ||

| 7:00 | CNY | Imports (USD) Y/Y Jan | 1.10% | 16.50% | ||

| 7:00 | CNY | Exports (USD) Y/Y Jan | -6.30% | 7.90% | ||

| 7:00 | CNY | Trade Balance (CNY) Jan | 262B | 329B | ||

| 7:00 | CNY | Exports (CNY) Y/Y Jan | -6.30% | 9.00% | ||

| 7:00 | CNY | Imports (CNY) Y/Y Jan | 19.10% | 17.70% | ||

| 7:00 | EUR | Germany Industrial Production M/M Dec | -3.50% | -0.20% | 1.10% | 1.20% |

| 7:00 | EUR | Germany Trade Balance (EUR) Dec | 19.2B | 16.4B | 18.3B | |

| 7:45 | EUR | France Trade Balance (EUR) Dec | -5.1B | -5.6B | ||

| 7:45 | EUR | France Industrial Output M/M Dec | 0.00% | 0.30% | ||

| 8:00 | CHF | Foreign Currency Reserves Ja(CHF) n | 771B | |||

| 9:00 | EUR | Italy Retail Sales M/M Dec | 0.20% | -0.20% | ||

| 13:30 | USD | Nonfarm Payrolls Jan | 156K | 145K | ||

| 13:30 | USD | Unemployment Rate Jan | 3.50% | 3.50% | ||

| 13:30 | USD | Average Hourly Earnings M/M Jan | 0.30% | 0.10% | ||

| 13:30 | CAD | Net Change in Employment Jan | 35.2K | |||

| 13:30 | CAD | Unemployment Rate Jan | 5.80% | 5.60% | ||

| 15:00 | USD | Wholesale Inventories Dec F | -0.10% | -0.10% | ||

| 15:00 | CAD | Ivey PMI Jan | 52.3 | 51.9 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals