Risk appetite stays strong in the global markets, with European indices registering solid gains. US futures also point higher open for extending recent record runs. Yen is under some selling pressure today, together with Dollar and Euro. On the other hand, commodity currencies are generally higher, with Kiwi being supported by hawkish RBNZ hold.

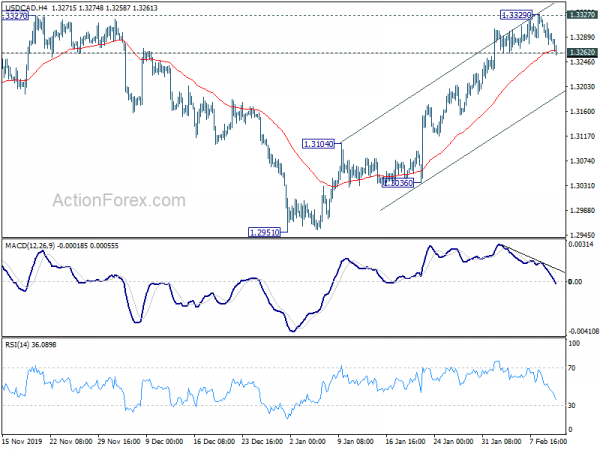

Technically, USD/CAD’s break of 1.3262 minor support suggests short term topping at 1.3329, after failing to sustain above 1.3327 key resistance. Deeper retreat should be seen to 55 day EMA (now at 1.3177). USD/CHF is also pressing 0.9740 and break will also turn bias back to the downside, possibly for 0.9629 support. The question now is whether EUR/USD could bottom around 1.0879 low and stage a rebound from there. Focus is on 1.0957 minor resistance.

In Europe, currently, FTSE is up 0.41%. DAX is up 0.82%. CAC is up 0.55%. German 10-year yield is up 0.015 at -0.373. Earlier in Asia, Nikkei rose 0.74%. Hong Kong HSI rose 0.87%. China Shanghai SSE rose 0.87%. Singapore Strait Times rose 1.51%. Japan 10-year JGB yield rose 0.0162 to -0.040.

OPEC slashes global oil demand growth on China’s coronavirus

In the latest monthly report published today, OPEC sharply lower 2020 global oil demand growth to 0.99m barrels per day, down -0.23m bpd from the estimate released a month ago.

The report warned, “the impact of the Coronavirus outbreak on China’s economy has added to the uncertainties surrounding global economic growth in 2020, and by extension global oil demand growth in 2020.”

And, “clearly, the ongoing developments in China require continuous monitoring and assessment to gauge the implications on the oil market in 2020.”

Eurozone industrial production dropped -2.1%, EU 27 dropped -2.0%

Eurozone industrial production dropped sharply by -2.1% mom in December, much worse than expectation of -0.4% mom. In the month, production of capital goods fell by- 4.0%, intermediate goods by -1.7%, non-durable consumer goods by -1.3%, durable consumer goods by -1.1% and energy by -0.5%.

EU27 industrial production dropped -2.0% mom. Among Member States for which data are available, the largest decreases in industrial production were registered in Ireland (-6.2%), Hungary (-3.8%) and Poland (-3.0%). The highest increases were observed in Denmark (+7.2%), Portugal (+2.9%) and Greece (+2.5%).

S&P Global: China’s coronavirus to drag Eurozone, UK and US growth

S&P Global estimated that China’s coronavirus outbreak could drag Eurozone and UK growth by -0.1% to -0.2% this year. The impact will likely be felt mostly in Q1 though. It noted, “a large share of economic activity hindered by the outbreak of the virus, especially goods production, would just be postponed rather than canceled altogether.” However, “if a catch-up effect materializes, the economic outlook for 2021 could even be slightly higher than our current baseline forecast of 1.2%.”

The agency’s US chief economist also warned that “most of the drag on U.S. growth to be in the first quarter, with a smaller hit in the second quarter and a rebound in the latter half.” And, “along with the potentially devastating human toll, if the virus spreads further and lasts longer, the impact on virtually every economy could be far worse,.” US GDP growth in Q1 could be dragged to just 1% annualized, from previous forecasts of 2.2%.

NZD rebounds after RBNZ’s hawkish hold

RBNZ left the Official Cash Rate unchanged at 1.00% as widely expected. In the accompanying statement, its noted “soft momentum” has continued in 2020″. But “growth is expected to accelerate over the second half of 2020 driven by monetary and fiscal stimulus, and the high terms of trade.” Impact of outbreak of China’s coronavirus will be “of a short duration” only.

The statement is seen as slightly more hawkish than November’s. Employment is seen by RBNZ as “at or slightly above its maximum sustainable level”, somewhat upgraded from “around” the level. Consumer inflation is “close to” the 2% mid-point of target range too. While low interest remain necessary, the overall statement suggests that RBNZ is more likely to be on hold for the rest of the year than not.

Suggested readings on RBNZ:

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3270; (P) 1.3295; (R1) 1.3313; More….

USD/CAD’s break of 1.3262 minor support suggests short term topping at 1.3329, after failing to sustain above 1.3327 resistance. Intraday bias is turned back to the downside for 55 day EMA (now at 1.3177). But downside should be contained above 1.3104 resistance turned support to bring another rally. On the upside, sustained break of 1.3327 should confirm completion of consolidation pattern from 1.3664. Further rise should be seen to retest 1.3664 high.

In the bigger picture, price actions from 1.3664 (2018 high) is seen as a corrective move that has probably completed. Rise from 1.2061 (2017 low) might be ready to resume. Decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | 2.30% | -1.80% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Jan | 2.80% | 2.60% | 2.70% | |

| 1:00 | NZD | RBNZ Interest Rate Decision | 1.00% | 1.00% | 1.00% | |

| 2:00 | NZD | RBNZ Press Conference | ||||

| 6:00 | JPY | Machine Tool Orders Y/Y Jan P | -35.60% | -33.60% | -33.50% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | -2.10% | -0.40% | 0.20% | 0.00% |

| 15:00 | USD | Fed Chair Powell Testifies | ||||

| 15:30 | USD | Crude Oil Inventories | 3.4M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals