Risk aversion continues today but selloff in the stock markets seem to be easing a bit, with major European indices off lows at the time of writing. Global coronavirus outbreak remains the main focus, with South Korea’s cases surge again to 1261, with 12 deaths. Cases in Italy rose to 323 with 11 deaths. Cases in Japan rose to 171 with 2 deaths. In Iran, cases rose to 139, with 19 deaths. In the currency markets, Sterling is currently the worst performing one for today, followed by Australian Dollar. Dollar is the strongest, followed by Swiss Franc, and then Euro.

Technically, AUD/USD’s down trend is showing some sign of acceleration for 0.6479 projection level next. EUR/USD breached 1.0898 fibonacci resistance but quickly retreats. We’d continue to expect 1.0898 to hold there to bring larger down trend resumption. USD/CHF also breached 0.9741 but recovered. This level will be closely watched as hint on Dollar’s performance against Euro and Yen.

In Europe, currently, FTSE is down -0.31%. DAX is down -0.25%. CAC is down -0.08%. German 10-year yield is up 0.0261 at -0.484. Earlier in Asia, Nikkei dropped -0.79%. Hong Kong HSI dropped -0.73%. China Shanghai SSE dropped -0.83%. Singapore Strait Times dropped -1.29%. Japan 10-year JGB yield rose 0.0097 to -0.093.

ECB Holzmann said there were heated discussions regarding inflation target

ECB Governing Council member Robert Holzmann said that policymakers had “heated discussions” regarding inflation target last week. Currently the central bank’s definition of price stability is having inflation “below but close to 2%”.

Holzmann said, “Is our monetary policy target – (inflation of) just under 2% – where it should be? Should it be less, should it be more? Should it be symmetrical? Should it be asymmetrical? … We had heated discussions about that last week in the (Governing) Council.”

A focus was on how far inflation could deviate from the the target. Some policymakers support the idea of a band around a target. But some worried that the mechanism would effectively make the bottom of the band the de facto target. Holzmann prefers an inflation target of 1.5%.

ECB Makhlouf: There is uncertainty about exactly what ‘close to, but below’ means

ECB Governing Council member Gabriel Makhlouf said that “we central banks need to do a better job at communicating and explaining”. He criticized “there continues to be uncertainty about exactly what ‘close to, but below’ means” regarding ECB’s price stability definition of “below but close to 2%”.

Makhlouf added, “it has been argued that since central banks are unlikely to hit a point target on a regular basis, having one makes it harder to explain policy to the public and that a range, with or without a focal point, may be more realistic and therefore provide the central bank with more credibility.”

DIW: German economy to grow 0.1% in Q1 only, risk from coronavirus outbreak

German Institute for Economic Research, DIW, said the country’s economy would grew only 0.1% in Q1, nearing stagnation. Economic Director Claus Michelsen warned economic performance could be even worse if global outbreak of China’s coronavirus continue.

“So far, however, the corona effect has been unclear and cannot be quantified”, he said, “The export-dependent German industry would be particularly affected if coronavirus continued to spread worldwide.” Industry will also be affected in case of supply disruption for wholesale products sourced from China.

EUR/USD Mid-Day Outlook

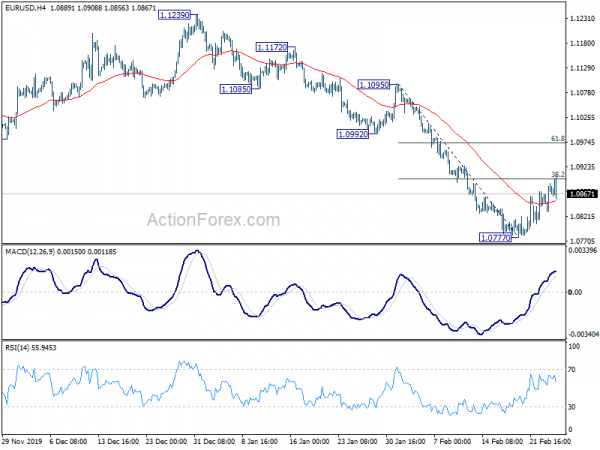

Daily Pivots: (S1) 1.0844; (P) 1.0867; (R1) 1.0904; More…

EUR/USD breached 38.2% retracement of 1.1095 to 1.0777 at 1.0898 briefly but quickly retreated. Intraday bias remains neutral first. We’d still expected upside of recovery to be limited by 1.0898. Firm break of 1.0777 will resume larger down trend. Though, firm break of 1.0898 will target 61.8% retracement at 1.0974.

In the bigger picture, down trend from 1.2555 (2018 high) has just resumed and prior rejection by 55 week EMA affirms medium term bearishness. Sustained break of 78.6% retracement of 1.0339 (2017 low) to 1.2555 at 1.0813 will pave the way to retest 1.0339 low. For now, outlook will remain bearish as long as 1.1239 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | -0.60% | -0.30% | ||

| 00:30 | AUD | Construction Work Done Q4 | -3.00% | -1.00% | -0.40% | 0.40% |

| 15:00 | USD | New Home Sales Jan | 710K | 694K | ||

| 15:30 | USD | Crude Oil Inventories | 2.3M | 0.4M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals