Global stocks are staging a recovery today after yesterday’s crash. In the currency markets, Canadian and Dollar are currently the strongest ones for today. Yen and Sterling are the weakest. Governments are preparing or announcing special coronavirus relief packages. EU leaders will also have a video conference today to discuss coordinated responses. ECB President Christine Lagarde will also join the call, just in time for the monetary policy decision on Thursday. But for today, most eyes are on the US as President Donald Trump is set to unveil his measures today, which include payroll tax cuts. markets could turn back into risk off mode if Trump disappoints.

Global cases of the Wuhan coronavirus breaks 116k level today, with 4089 deaths. Numbers in China, the origin of the global outbreak, are plateauing at 80761, 3136 deaths. Similarly, South Korea dropped to number four with 7513 cases, 54 deaths. Italy is now number two with 9172 cases, 463 deaths, as the whole country is in lockdown. Iran surge to 8042, with 291 deaths. Spain (1512 cases, 35 deaths), France (1412 cases, 30 deaths) and Germany (1281 cases, 2 deaths are slowing. US, which surges past Japan, is now having 729 cases and 27 deaths. It seems just a matter of time when US number breaks 1000.

In Europe, currently, FTSE is up 2.39%. DAX is up 1.68%. CAC is up 1.91%. Germany 10-year bund yield is up 0.119 at -0.738. Earlier in Asia, Nikkei rose 0.85%. Hong Kong HSI rose 1.41%. China Shanghai SSE rose 1.82%. Singapore Strait Times rose 1.80%. Japan 10-year JGB yield rose 0.1019 to -0.041.

Eurozone GDP grew 0.1% in Q4, unrevised from prior estimate

Eurozone GDP grew 0.1% qoq in Q4, unrevised from initial estimate. Over the year, GDP grew 1.0% yoy. Household final consumption expenditure rose 0.1% qoq. Gross fixed capital formation rose 4.2% qoq. Exports rose 0.4% qoq. Imports rose 2.2% qoq. Employment grew 0.3% qoq in both Eurozone and EU27.

EU 27 GDP grew 0.2% qoq, 1.2% yoy. Among Member States for which data are available, Ireland (+1.8%), Malta (+1.7%) and Romania (+1.5%) recorded the highest growth compared with the previous quarter, followed by Lithuania and Hungary (both +1.0%). Negative growth was observed in Greece and Finland (both -0.7%), Italy (-0.3%) and France (-0.1%). In Germany, the GDP remained stable.

Also released, France non-farm payrolls were finalized at 0.5% qoq versus expectation of 0.2% qoq. Industrial production rose 1.2% mom, in January, below expectation of 1.6% mom. Italy industrial production rose 3.7% mom in January.

Japan announces JPY 430B coronavirus relief package

Japanese government announced a second coronavirus relief package that is worth JPY 430.8B. Prime Minister Shinzo Abe pledged to “carry out necessary and sufficient economic and fiscal management without hesitation or delay, while fully ascertaining economic moves and effects on the people’s livelihoods from now on as well”.

The government would fund the package by tapping the rest of this fiscal year’s budget reserved around JPY 270B. Finance Minister Taro Aso said, if was not yet clear if the government needed an extra budget. The package will provide support to small and tiny business in needed of financing. It will also support improvements to medical facilities, promoting work from home and subsidies to working parents.

BoJ Governor Haruhiko Kuroda told the parliament today, “there’s uncertainty on when the coronavirus will be contained, and markets are making very unstable moves”. BoJ will “continue to keep an eye out on how the spread of the virus could affect Japan’s economy and prices, particularly via domestic and overseas market developments, and act appropriately as needed without hesitation.”

From Japan, M2 rose 3.0% yoy in February versus expectation of 2.8% yoy. From China, CPI slowed to 5.2% yoy in February. PPI dropped -0.4% yoy.

Australia NAB business confidence dropped to -4, further deterioration likely

Australia NAB business confidence dropped from -1 to -4 in February. Business conditions dropped from 2 to 0. Looking at some details, trading conditions dropped from 5 to 4. Profitability conditions dropped from 1 to -5. Nevertheless, employment conditions ticked up from 1 to 2. Forward orders dropped sharply form -1 to -4. Stocks dropped from 0 to -6. Exports dropped from -1 to -2.

Alan Oster, NAB Group Chief Economist: “Both conditions and confidence fell in the month, but not by as much as we had feared. That said, both continue to track below average and with forward orders weakening its likely we could see further deterioration”.

“With leading indicators softer, it is unlikely we will see a material improvement in conditions in the near term. With conditions and confidence continuing to track below average – there are risks around future capex and employment growth.

From New Zealand, manufacturing sales rose 2.4% in Q4.

Australian PM Morrison: Coronavirus impact could be larger than global financial crisis

Australian Prime Minister Scott Morrison warned today that the coronavirus could have larger impact to Australian economy than the global financial finances in 2008. That’s because “the epicenter of this crisis as opposed to that one is much closer to home”, referring to the close tie with China.

Also, “there is the potential for heightened risk aversion to flow over into reduced business and consumer spending, reduced demand across our economy. These effects would be greater if coronavirus were to have a significant impact on the health of our workforce, which is what we need to plan for, and that’s something we’re working very hard to prevent at the moment.”

Morrison said the government will soon announce stimulus response to the coronavirus outbreak. It’s reported by the Australian newspaper that the measures could worth about AUD 10B.

USD/JPY Mid-Day Outlook

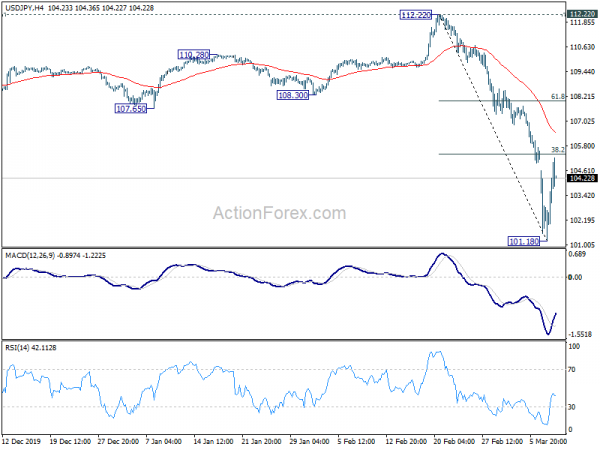

Daily Pivots: (S1) 100.88; (P) 102.74; (R1) 104.29; More..

Intraday bias in USD/JPY remains neutral for consolidation above 101.18 temporary low. Upside should be limited by 38.2% retracement of 112.22 to 101.18 at 105.39. On the downside, break of 101.18 will resume larger down rend to next key support level at 98.97. Though, firm break of 105.39 will bring stronger rebound to 61.8% retracement at 108.00.

In the bigger picture, fall from 118.65 (Dec 2016) is still in progress. It’s seen as part of a larger consolidative pattern from 125.85 (2015 high). Such decline could could extend through 98.97 (2016 low). For now, risk will remain on the downside as long as 112.22 resistance holds, even in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q4 | 2.40% | -0.30% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Feb | 3.00% | 2.80% | 2.80% | |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Feb | -0.40% | -0.20% | 0.00% | |

| 0:30 | AUD | NAB Business Confidence Feb | -4 | -1 | ||

| 0:30 | AUD | NAB Business Conditions Feb | 0 | 3 | ||

| 1:30 | CNY | CPI Y/Y Feb | 5.20% | 4.90% | 5.40% | |

| 1:30 | CNY | PPI Y/Y Feb | -0.40% | 0.10% | 0.10% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Feb P | -30.10% | -35.60% | ||

| 6:30 | EUR | France Nonfarm Payrolls Q/Q Q4 F | 0.50% | 0.20% | 0.20% | |

| 7:45 | EUR | France Industrial Output M/M Jan | 1.20% | 1.60% | -2.80% | -2.50% |

| 9:00 | EUR | Italy Industrial Output M/M Jan | 3.70% | -2.70% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 | 0.10% | 0.10% | 0.10% | |

| 10:00 | EUR | Eurozone Employment Change Q/Q Q4 F | 0.30% | 0.30% | 0.30% | 0.20% |

| 10:00 | USD | NFIB Business Optimism Index Feb | 104.5 | 104.5 | 104.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals