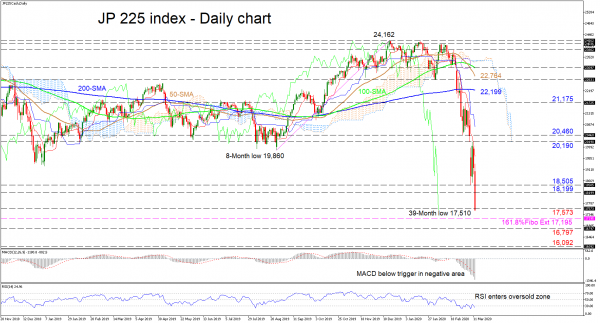

Japan’s 225 stock index (cash) sustains a negative bearing stretching to a thirty-nine-month low of 17,510. The one-month collapse is fortified by the downward sloping 50- and 100-day simple moving averages (SMAs) and the recent bearish crossover between them. Furthermore, the falling Ichimoku lines boost the negative sentiment with the red Tenkan-sen line distancing itself below the blue Kijun-sen line.

Additionally, the MACD is deep in the negative region and below its red trigger line, while the RSI is declining in the oversold territory.

If sellers pick up again and close below the 17,573 immediate support, the index could descend to challenge the 17,195 obstacle, which is the 161.8% Fibonacci extension of the up leg from 19,860 to 24,162. If the bears manage to dive below this barrier too, the 16,797 hurdle could be next to test sellers’ efforts ahead of the 16,092 low from November 2016.

Alternatively, if buyers resurface and drive above the 18,199 level from April 2017 (previous support-now-resistance), the inside swing low of 18,505 could be next to impede the climb. Gaining ground, the red Tenkan-sen line could hinder the price from maintaining its trajectory towards the 20,190 and 20,460 resistances. Recouping more of previous losses, the index may encounter the blue Kijun-sen line before rallying further to the swing high of 21,175 and the 200-day SMA above at 22,199.

Overall, the near-term picture is strongly bearish with no signals of the negative outlook changing for the time being. However, if the 161.8% Fibo extension holds, a pullback could unfold.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals