Global markets experienced another wild week, with free falls in risk assets and oil prices. Coronavirus pandemic occupied all headlines, ranging from business news, politics, sports and show business. Massive disruption in economic activity is happening.

Major central banks and governments came to rescue and launched coordinated measures to support the economy. Even the US administration was finally on board, with President Donald Trump declaring national emergency to unlock USD 50B in federal aids.

From market sentiment point of view, bearish mood could have been exhausted for the near term, as seen in Friday’s rebound. We’d likely seen a period of stabilization ahead, even though risks stay heavily on the downside, depending on the outbreak on Europe and US.

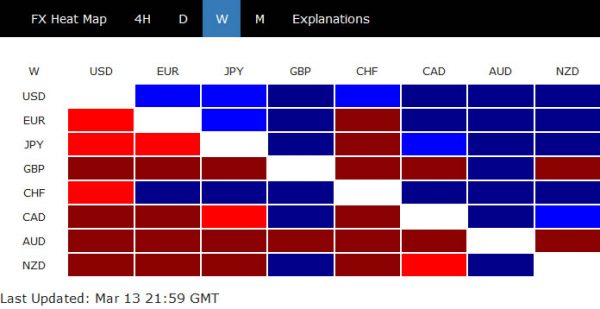

Dollar ended as the strongest one, followed by Swiss Franc and then Euro. Yen lost some appeal toward the end of the week and ended mixed. Australian Dollar, was the worst performing one, followed by Sterling. With Fed back in focus with the March 18 meeting, Dollar’s rally could be capped initially this week.

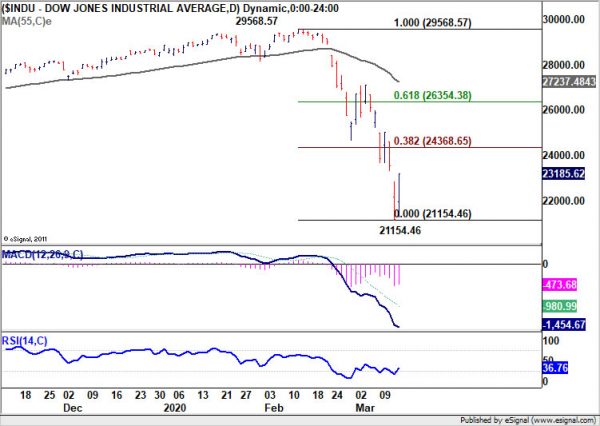

DOW should have bottomed for near term after hitting key support zone

DOW tumbled to as low as 21154.46 last week, after having the worst selloff since Black Monday on Thursday. But then, it staged the strongest rebound since 2008 on Friday, to close at 23815.62. For the week, DOW lost -2679.16pts or -10.4%.

Friday’s rebound argue that it has already drawn strong support from key zone between 38.2% retracement of 6469.95 to 29568.57 at 20744.89 and 55 month EMA (now at 22620.89). Hence, we’d tentatively consider 21154.46 as a short term bottom at least. That is, DOW should now gyrate back towards 38.2% retracement of 29568.57 to 21154.46 at 24368.65 next.

However, there is no doubt that DOW is now correcting whole up trend from 6469.96 (2009 low) to 29568.57. A correction of this scale shouldn’t end that quickly. The strength and time of the current rebound would give some hints on how deep the correction would turn out to be. We’ll keep our mind open first.

Dollar in medium term sideway pattern after strong rebound

Dollar index staged a somewhat miraculous rebound after initial dip to 94.65 last week. There is no change in the view that 99.91 is a major top. Price actions from there are correcting the up trend from 88.25 (2018 low). Though, current development suggests that it should be in a medium term sideway consolidation, rather than a deep correction.

With that in mind, we’re not expecting a break of 99.91 high soon. Instead, there should be at least another fall to extend the consolidation pattern. In that case, nevertheless, downside should be contained by 50% retracement of 88.25 to 99.91 at 94.08.

Gold confirmed medium term topping, turned into sideway consolidation

Gold failed to ride on risk aversion but instead dived on Dollar’s rebound. The break of 1557.04 resistance turned support should confirm medium term topping at 1703.28, on bearish divergence condition in daily MACD.

Considering that we’re not expecting an upside breakout in Dollar index, we’d expect some support from 38.2% retracement of 1160.17 to 1703.28 at 1495.81 to bring rebound. Break of 1597.92 resistance will start the second leg of the consolidation back towards 1703.28 high.

However, sustained break of 1495.81, if accompanied by upside break out in Dollar index, could trigger deeper fall to key cluster level at 1365.26, 61.8% retracement of 1160.17 to 1703.28 at 1367.63.

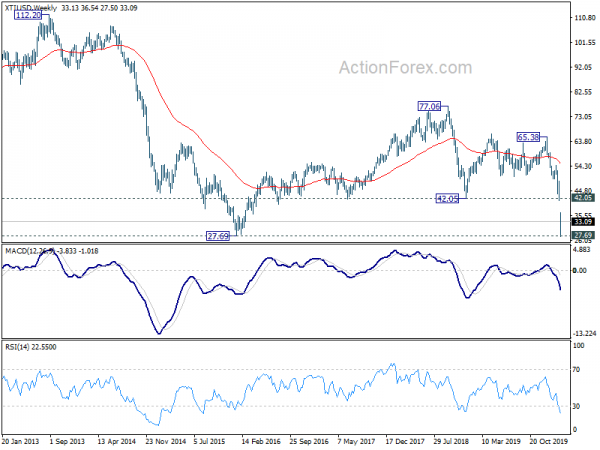

WTI oil to stay in range after free fall

WTI crude oil gapped lower last week and hit as low as 27.50 on double whammy of coronavirus and price war between Saudi Arabia and Russia. 2015 low of 27.69 was breached but it quickly recovered to close at 33.09. Without further development in OPEC+ negotiations, we’d expect range trading to continue for the near term. That is, 27.50/42.05 should now bound any movements in WTI.

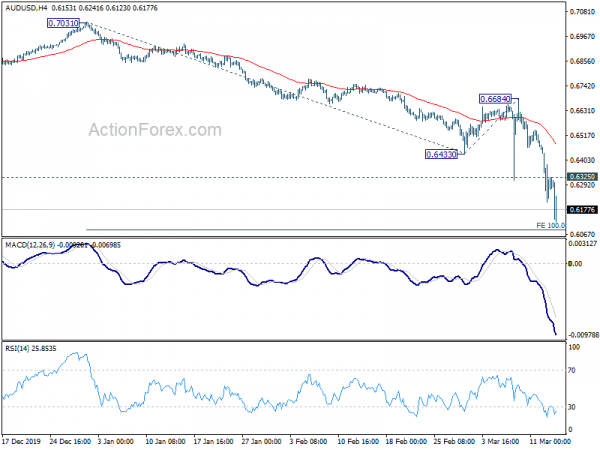

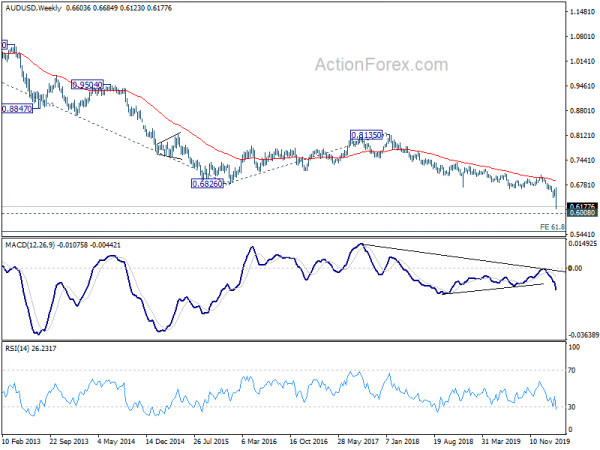

AUD/USD’s down trend resumed last week and dropped to as low as 0.6123. There is no sign of bottoming yet and initial bias stays on the downside this week for 100% projection of 0.7031 to 0.6433 from 0.6684 at 0.6086 next. Some support could be seen fro 0.6008 key support to bring recovery. On the upside, above 0.6325 minor resistance will turn intraday bias neutral and bring consolidations first. But upside should be limited by 0.6433/6884 resistance zone to bring fall resumption.

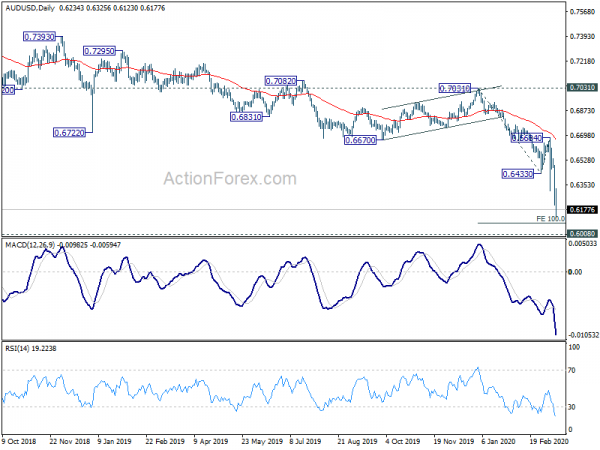

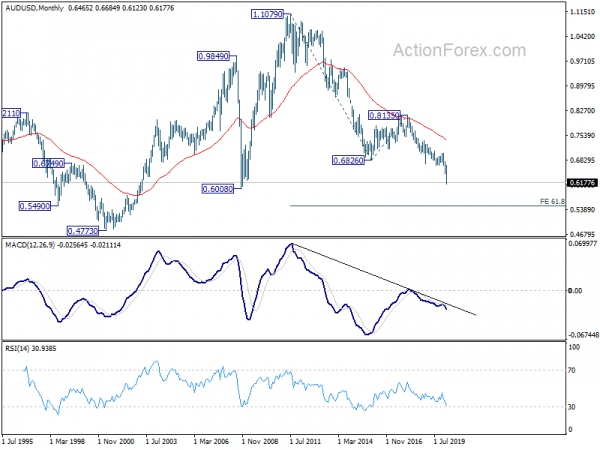

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Prior rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Break will target 0.5507 long term fibonacci projection level. Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.

In the longer term picture, prior rejection by 55 month EMA maintained long term bearishness in AUD/USD. That is, down trend from 1.1079 (2011 high) is still in progress. Next downside target is 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals