Investor sentiments were given only and mild and brief boost by the massive fiscal stimulus of the US. Asian markets quickly reversed initial gains and pessimism over coronavirus pandemic wild likely continue in European markets too. As for currencies, Canadian dollar is currently the weakest one for today, as dragged down by oil prices, followed by Australia. For the week, Yen and Dollar remain the star performers while commodity currencies are weakest, as led by Aussie.

Technically, WTI crude oil’s break of 27.50.69 key support zone is worth a note. Sustained trading below there will confirm resumption of long term down trend that started back at 147.24 (2008 high). We’d then be looking at long term support zone between 10.65 and 17.12 made between 1998/2001. Sterling could also catch some attentions today. GBP/USD is now close to 1.1958 low, GBP/JPY close to 126.54 low and EUR/GBP relatively close to 9324 high. We’ll see if the pound could stage a near term reversal from current levels.

In Asia, Nikkei closed down -1.68%. Hong Kong HSI is down -2.66%. China Shanghai SSE is down -1.02%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is up 0.042 at 0.050. Overnight DOW rose 5.20%. S&P 500 rose 6.00%. NASDAQ rose 6.23%. 10-year yield rose 0.0269 to 0.997, just missed 1% handle.

US to spend $1.2T on coronavirus relief, with checks directly to Americans

US stocks rebounded slightly overnight as investors responded to the administration’s coronavirus stimulus package, that could add up to USD 1.2T in spending. USD 1000 checks will be made available to Americans as Treasury Secretary Steven Mnuchin said, “Americans need cash now, and the president wants to give cash now. And I mean now, in the next two weeks.”

Mnuchin’s proposal is reported to include USD 300B for small business loans, USD 200B in stabilization funds, USD 250B in cash payments with possibility of second round, as well as tax deferrals. He said, “It is a big number. This is a very big situation in this economy, we put a proposal on the table that would inject $1 trillion into the economy.”

Fed Bostic: Everything is on the table at this stage

Atlanta Fed President Raphael Bostic said work continues at the Fed and “at this stage everything is on the table” regarding coronavirus responses. He warned that the challenges are going to be “acute and are going to come fast,” for restaurants, bars and other small firms.

Philadelphia Fed President Patrick Harker said the current coronavirus outbreak “in some ways is the proverbial black swan.” “The suffering and fear that is across the world, not just in this country, it’s palpable, it’s real.” He urged central banks to do what they can to stimulate the economy and keep markets functioning.

Minneapolis Fed President Neel Kashkari said Fed is “not at the front line” of the fight against coronavirus. He added, “but we do have a job to do and we are using our tools aggressively to try to make sure the financial system is ultimately working.” He also rejected the idea that Fed could save the rate cuts for later use. “The notion that we should save our cuts for later is a colorful metaphor, but it’s just flat-out wrong.” Meanwhile, he said “I don’t think there’s much interest in going below zero.”

EU to close external borders for 30 days to slow coronavirus spread

EU leaders agreed overnight to close the external borders for 30 days to slow the spread of coronavirus pandemic. All non-EU citizens are not allowed to enter EU. But movements within EU are allowed. Also, the restrictions do not apply to medical staff nor goods. The restrictions will take effect as soon as individual governments take the necessary internal measure.

“The enemy is the virus and now we have to do our utmost to protect our people and to protect our economies,” European Commission President Ursula von der Leyen said. “We are ready to do everything that is required. We will not hesitate to take additional measures as the situation evolves.”

European Council President Charles Michel pledge that “the union and its member states will do whatever it takes”, and EU will arrange for the repatriation of citizens of member countries.

On the data front

New Zealand current account deficit narrowed to NZD -2.66B in Q4, versus expectation of NZD -2.83B. Australia leading index dropped -0.4% mom in February. Japan trade balance showed JPY 0.50T surplus in February, versus expectation of JPY 0.54T.

Eurozone CPI final will be the only feature in European session. Later in the day, US will release new residential constructions. Canada will release CPI.

GBP/USD Daily Outlook

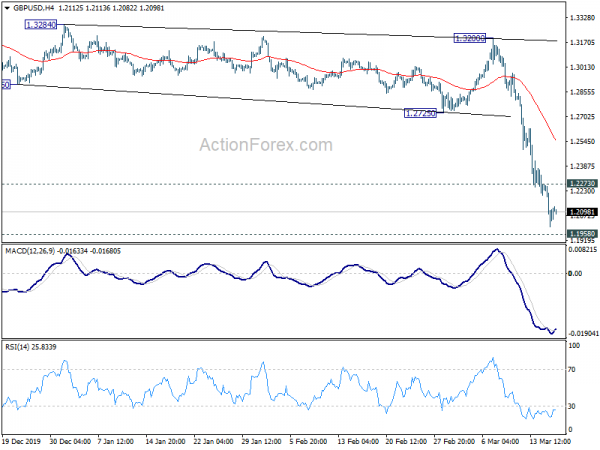

Daily Pivots: (S1) 1.1950; (P) 1.2112; (R1) 1.2221; More…

Interested bias in GBP/USD remains on the downside at this point. Current fall from 1.3514 should target a test on 1.1958 low. Firm break there will confirm larger down trend resumption. On the upside, above 1.2273 minor resistance will turn intraday bias neutral and bring consolidations first. But recovery should be limited well below 1.2725 support turned resistance to bring another fall.

In the bigger picture, current development suggests that price actions from 1.1946 (2016 low) are merely a consolidation pattern, with the third leg completed at 1.3514. Rejection by 55 month EMA also solidify long term bearishness. Focus is back on 1.1946 low. Decisive break there will resume larger down trend from 2.1161 (2007 high). This will remain the favored case as long as 1.3514 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q4 | -2.66B | -2.83B | -6.35B | -6.26B |

| 23:30 | AUD | Westpac Leading Index M/M Feb | -0.40% | 0.10% | 0.00% | |

| 23:50 | JPY | Trade Balance (JPY) Feb | 0.50T | 0.54T | -0.22T | -0.08T |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 19.3B | 22.2B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb | 1.20% | 1.20% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb | 1.20% | 1.20% | ||

| 11:00 | USD | MBA Mortgage Applications (Mar 13) | 55.40% | |||

| 12:30 | USD | Building Permits Feb | 1.50M | 1.55M | ||

| 12:30 | USD | Housing Starts Feb | 1.51M | 1.57M | ||

| 12:30 | CAD | CPI M/M Feb | 0.30% | |||

| 12:30 | CAD | CPI Y/Y Feb | 2.40% | |||

| 12:30 | CAD | CPI Common Y/Y Feb | 1.80% | |||

| 12:30 | CAD | CPI Median Y/Y Feb | 2.20% | |||

| 12:30 | CAD | CPI Trimmed Y/Y Feb | 2.10% | |||

| 14:30 | USD | Crude Oil Inventories | 7.7M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals