U.S. Highlights

- Markets continued to see losses this week as the COVID-19 outbreak intensified. Investors made a dash for cash, resulting in tightening financial conditions.

- The Fed reacted quickly, cutting the target range of the federal funds rate by a full percentage point to 0% to 0.25% as well as pledging to buy $700 billion in treasuries and mortgage-backed securities. It also launched funding programs to improve liquidity and satiate investor demand for cash.

- In addition, Congress was finally able to pass the Phase 2 response to COVID-19. It will need to quickly follow this up with the $1 trillion Phase 3 package to cushion the impending decline of the U.S. economy.

Canadian Highlights

- Market sentiment eased in the past two days after a volatile start to the week. However, the S&P/TSX composite was still down around 9% since last week’s close.

- Economic data releases this week painted a picture of weak momentum in Q1, prior to any COVID-19 or oil impacts.

- Policymakers continued to announce coordinated fiscal, monetary, and financial system support initiatives in response to COVID-19 impacts on individuals and the economy.

U.S. – Policy Bazookas on Display

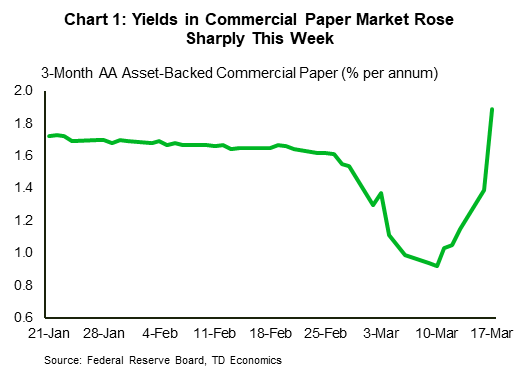

Market turbulence continued this week as the COVID-19 outbreak intensified. As the news of the outbreak worsened, both equity and bond markets saw losses. The S&P 500 fell by 12% from the close last week, while investors made a dash for cash in corporate and bond markets. As a result, financing conditions tightened considerably, with stress particularly elevated in the corporate commercial paper market (Chart 1).

Recognizing the anxiety, the Federal Reserve pulled out a bazooka of policy moves in an emergency meeting over the weekend. It cut the target range of the federal funds rate by a full percentage point to 0% to 0.25%. In addition, it pledged to buy $700 billion in treasuries and mortgage-backed securities. The slew of policy measures also included lowering pricing by 25 basis points on U.S. dollar swap lines with foreign central banks.

Unfortunately, this did not stop financial conditions from further tightening. So, the Fed dug deeper into its toolkit and launched two funding programs: The Commercial Paper Funding Facility, and the Money Market Mutual Fund Liquidity. The programs are intended to improve liquidity and satiate investor demand for cash.

Unlike the Fed, which moved quickly to provide backstops to a faltering economy, the U.S. administration has been slower to act. After deliberating last week and much of this week, it finally enacted “Phase 2” of Congress’ response to the coronavirus pandemic. This $104 billion bill, or roughly 0.5% of GDP, includes free COVID-19 testing, extra funding for food security programs and Medicaid, as well as family and medical leave for workers at companies with between 50 and 500 employees.

This is a good step forward, but more needs to be done, especially for those at the bottom of the income-distribution. Since the outbreak is forcing the shutdown of industries with lower wages, low income households stand to bear the brunt of the COVID-19 impact (Chart 2; see report).

We are already seeing the effects in the economy. Official jobless claims for last week rose by 70,000, larger than any one week during the 2008 crisis. This will move dramatically higher in the coming weeks. In 15 states reporting claims for this week, the number of people seeking benefits was 630,000, roughly in line with the peak month during the financial crisis. It is not unreasonable to expect claims to rise into the millions over the next several weeks.

Understanding the consequences of delaying aid, policymakers are working towards a Phase 3 bill which would provide the support households and businesses need to cushion the COVID-19 impact. Amounting to $1 trillion, the proposals for Phase 3 currently include cash payments of $1,200 per individual, $2,400 to families, with another $500 per child. By easing the financial burden during these difficult times, measures such as this would allow the economy to recover quickly once the coronavirus shock passes. However, time is of the essence. The earlier aid arrives, the better off the economy will be.

Canada – Hits, Responses Keep on Coming

Markets regained some calm in the past two days following wild gyrations earlier in the week. This uptick was likely driven by temporarily improved sentiment as central banks stepped in to prevent funding and liquidity pressures in credit markets. However, the energy-heavy S&P/TSX Composite was still down more than 9% on the week as of 10 AM Friday.

Bond yields fell and some credit spreads eased towards the end of the weak as central banks intervened with a range of measures aimed at ensuring the stable functioning of the financial system. In Canada, the Bank of Canada and Canada Mortgage and Housing Corporation (CMHC) introduced measures that included insured mortgage purchases, a Banker’s Acceptance Purchase Program, a Bond Buyback Program, and a wide range of adjustments to existing liquidity programs (see note).

It was also another wild week for oil markets. WTI prices fell to their lowest levels in eighteen years (near US$20) on expectations of further demand destruction and further signals of a production ramp-up in Saudi Arabia, before partially recovering. In Canada, WCS oil prices fell to their lowest level on record (near US$8). As a result, the loonie also took a step down (see note), falling another two cents from last week’s close (Chart 1). With Canada being a net oil exporter, its economy is now facing a double whammy of the COVID-19 related slowdown and an oil price shock.

Turning to economic data, this week’s releases, while backward looking, only reinforced the scale of the shock, confirming little growth was likely in Q1 even prior to any COVID-19 or oil impacts. Manufacturing sales kicked off the release schedule with nominal and real sales falling 0.2% and 0.4%, respectively. The already-weakened sector will face notable headwinds in the months ahead, given announcements of further auto plant shutdowns amid COVID-19 containment efforts and the sudden stops seen in most global economies. Today, retail sales served to reaffirm the weak momentum heading into Q2, with a -0.3% volumes print. With containment a top priority now, this sector will also be heavily impacted in the months ahead.

Given the lagged nature of these releases, we are turning our attention to more timely information to gauge the impact of COVID-19. On this note, the Canadian Federation of Independent Business is releasing its Small Business Barometer bimonthly. This week saw a drop of 10.7 points to 49.8, the lowest level since 2008 (Chart 2).

For their part, regulatory and monetary authorities announced a suite of coordinated responses in the past week. On the fiscal front, the highlight was a $82 billion package (around 3.4% of GDP). Some of the measures were targeted at those most impacted and include an emergency care benefit, a doubling of the GST tax credit, (see commentary for full details).

In our latest Quarterly Economic Forecast, we anticipate that weakening momentum will drive a contraction in Q1, followed by another COVID-19 and oil-shock driven contraction in Q2. Of course, the outlook remains fluid, much uncertainty remains, and risks are clearly tilted to the downside.

U.S: Upcoming Key Economic Releases

U.S. Initial Jobless Claims – March 21st

Release Date: March 26th, 2020

Previous: 281k

TD Forecast: 2,500k

Consensus: 750k

Most recessions start with a fairly gradual rise in jobless claims, but this one looks quite different. Multiple states have indicated that filings have been running at multiples of previous trends. Our 2.5 million forecast for the total is triple anything previously reported. The all-time high was 695K, in 1982. The high in the 2008-09 recession was 665K. We expect jobless claims to under high pressure in the following months as well.

U.S. Markit PMI – March

Release Date: March 24th, 2020

Previous: Mfg 50.7; Non-mfg 49.4

TD Forecast: Mfg 40.0 Non-mfg 40.0

Consensus: Mfg 45.0; Non-mfg 44.0

The first two regional manufacturing surveys for March—covering the New York and Philadelphia Fed districts—showed significant COVID-related weakening, even with the surveys mainly reflecting responses received before widespread shutdowns began. The data in the Markit surveys will be more timely, and likely even weaker, than the New York and Philadelphia data. Other regional surveys also released during the week are likely to show material declines.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals