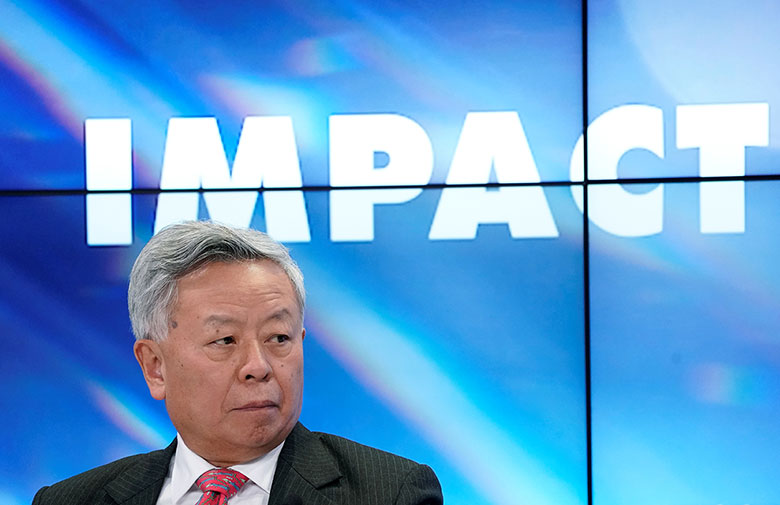

Development banks are forged in tough times, and no one knows that better than Jin Liqun. Coronavirus is a threat to everyone, but also a chance for such international financial institutions to prove their value to member countries, a fact that the president of the Asian Infrastructure Investment Bank knows all too well.

Jin attended a recent virtual meeting chaired by IMF managing director Kristalina Georgieva and World Bank president David Malpass.

“We discussed how IFIs can work together to contain the virus and help member countries get back to business as usual as fast as possible,” Jin says, speaking to Euromoney via video-link from Beijing. “The takeaway was for all development banks to collaborate to combat Covid-19 using their own special abilities and talents, to help the countries that need us. We need to be creative and innovative, and to think outside the box.”

Time for action

He adds: “A public health crisis like this pandemic is a time for IFIs to act – and act quickly. Now is the time to streamline the processing of financial assistance and get rid of red tape, rather than hide behind bureaucracy and procedure.”

Development banks are standing up to be counted.

Jin points to the World Bank’s fast-track financing facility, which was expanded in size on March 18 to $14 billion, from $12 billion, and will be made available to member states struggling to combat the pathogen.

“It is fully supported by us,” says Jin. “It’s a highly visible approach, and I am thinking of setting up a similar kind of facility to be more adaptive, and to handle emergency needs in member countries as they arise.”

Jin knows the threat is omnipresent, and that everyone will be impacted, including the world’s newest development bank.

“[Coronavirus] will definitely impact the operations of our bank, and we take care of the safety and security of our staff,” he says. “It is very hard to carry on as if it were business as usual.”

This is a litmus test of our ability to deal with a crisis and emergency. This is the time for us to demonstrate our adaptability, resilience, responsiveness and relevance

– Jin Liqun, AIIB

AIIB staffers have been working remotely since before Chinese New Year in late January. Many are still scattered across the globe, working from homes and hotels in the likes of Indonesia, South Korea, Italy and the US.

Board, committee and project assessment meetings take place digitally via WeChat, Zoom and Microsoft Teams.

The first coronavirus-related project the AIIB worked on was in mainland China, starting in the first week of March, donating medical equipment including facemasks to hospitals.

“It took us a few weeks to prepare for that, and we have learned from that, and can act faster and more creatively, and scale up our support when others come to us for help,” Jin says. “We have received requests for help from some countries. The Maldives is one, and other requests might come.”

The bank has fast-tracked another project “to invest in public health infrastructure in China, to help them respond to pandemics”, Jin adds.

Litmus test

The AIIB was not around for the 1997/98 Asian financial crisis, or the 2008 global financial crisis, but it was set up to survive an event like this.

“When we were created, the experiences of the past were built in,” he says. “From the beginning, the AIIB was designed to be agile, to be able to mobilise resources.”

He adds: “The outbreak of coronavirus is the first crisis AIIB has ever faced, though many staff on our management team have first-hand experience” of past events.

“This is a litmus test of our ability to deal with a crisis and emergency. This is the time for us to demonstrate our adaptability, resilience, responsiveness and relevance.”

Jin is keeping one eye on the world and one on his IFI. It is built to withstand a lot, but he fears that “if the virus spread goes on for the long term, maintaining our normal business will be a much tougher challenge”.

The AIIB he says, has reviewed its books, and is “trimming and deferring less essential spending items to save cost. This is important to keep our intrinsic financial strength.”

Article 3 of the AIIB’s founding charter states that any member country that asks for help will be given it, be they donor or recipient.

“Helping wipe out this virus is paramount,” he notes. “We are an Asian development bank, but we need to respond to needs of all our member countries.”

The AIIB’s 102 member states are scattered across the world, and include the likes of Algeria, Belarus and Peru.

Jin says the AIIB must prove it can support member states and companies in hard times: “We are trying to be creative. Under extreme situations, you cannot stick to rigid mandates. If we don’t think outside the box at this time, we lose our relevance. You cannot be a go-to institution if people believe you are not relevant to them.”

Development banks, he adds, “have a high sense of social responsibility. We do whatever it takes to help our partners in difficult times. There is a difference between commercial banks and development banks. Development banks focus on profit sustainability, not on profit maximization.”

Jin says the AIIB will “continue to work to complete infrastructure projects, refinance projects where necessary, and even provide liquidity to private-sector companies, in order to support global supply chains.”

Nothing is off the table.

These are tough times, and Asia’s global development bank is determined not to be found wanting.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals