Dollar and Yen are trading as the stronger ones today as risk aversion seems to be coming back as another quarter starts. Commodity currencies are thew weakest ones as led by Canadian Dollar for now. Private job data from the US were not as bad as expected. But just like some other data, the full impact of coronavirus pandemic is not fully reflected yet. The outlook for the global economy, including that of the origin of the pandemic China, remains grim, probably except for some industries food manufacturing and pharmaceuticals.

Technically, Dollar is regaining some strength for the rebound that started yesterday. EUR/USD’s break of yesterday’s low is a positive sign for the greenback. But it’s unsure whether Dollar would be dragged down by Yen. 106.75 support and 109.70 resistance in USD/JPY will be watched closely for hints. While it’s still a bit far, EUR/JPY is accelerating down towards 116.12 low. Break there should resume larger down trend.

In Europe, currently, FTSE is down -3.68%. DAX is down -3.88%. CAC is down -4.10%. German 10-year JGB yield is down -0.0283 at -0.496. Earlier in Asia, Nikkei drooped -4.50%. Hong Kong HSI dropped -2.19%. China Shanghai SSE dropped -0.57%. Singapore Strait Times dropped -1.65%. Japan 10-year JGB yield dropped -0.0104 to 0.007.

US ADP employment dropped only -27k, but coronavirus impact not fully reflected

US ADP report shows only -27k job loss in the private sector in March, well better than expectation of -150k. By company size, small businesses lost -90k, medium businesses grew 7k, large businesses grew 56k. By sector, good-producing jobs dropped -9k while service-providing jobs dropped -18k.

“It is important to note that the ADP National Employment Report is based on the total number of payroll records for employees who were active on a company’s payroll through the 12th of the month. This is the same time period the Bureau of Labor and Statistics uses for their survey,” said Ahu Yildirmaz, co-head of the ADP Research Institute. “As such, the March NER does not fully reflect the most recent impact of COVID-19 on the employment situation, including unemployment claims reported on March 26, 2020.”

Eurozone unemployment dropped to 7.3% in Feb, EU unchanged at 6.5%

Eurozone unemployment rate dropped to 7.3% in February, down from 7.4%, beat expectation of 7.4%. That’s the lowest level since March 2008. EU unemployment was unchanged at 6.5%, lowest since the start of the series in 2000.

Among the Member States, the lowest unemployment rates in February 2020 were recorded in Czechia (2.0%), the Netherlands and Poland (both 2.9%). The highest unemployment rates were observed in Greece (16.3% in December 2019) and Spain (13.6%).

Eurozone PMI manufacturing finalized at 44.5, still some way off peak decline

Eurozone PMI Manufacturing was finalized at 44.5 in March, down from February’s 29.2. Markit noted that coronavirus related shutdowns drove output and orders lower. There was record deterioration in supplier delivery performance. Among the member states, Italy hit 131-month low at 40.3. Greece hit 55-month low at 42.5. France hit 86-month low at 43.2. Ireland hit 127-month low at 45.1. Germany hit 2-month low at 45.1. Spain hit 83-month low at 45.7. Austria hit 5-month low at 45.8. Only the Netherlands stayed in expansion, at 2-month low of 50.5.

Chris Williamson, Chief Business Economist at IHS Markit said: “The concern is that we are still some way off peak decline for manufacturing. Besides the hit to output from many factories simply closing their doors, the coming weeks will likely see both business and consumer spending on goods decline markedly as measures to contain the coronavirus result in dramatically reduced orders at those factories still operating. Company closures, lockdowns and rising unemployment are likely to have an unprecedented impact on expenditure around the world, crushing demand for a wide array of products. Exceptions will be food manufacturing and pharmaceuticals, but elsewhere large swathes of manufacturing could see downturns of the likes not seen before”

Also released, German retail sales rose 1.2% mom in February versu expectatoin of 0.0% mom. Swiss SVME PMI dropped to 43.7 in March, down from 49.5.

Italy Gualtieri: 6% GDP contraction realistic, but there will be vigorous rebound

Italy’s Economy Minister Roberto Gualtieri said the forecasts of -6% GDP contraction this year are “realistic”. Though, he insisted the economy can “aim at a vigorous rebound” after the coronavirus pandemic.

Meanwhile, he said a new stimulus package is set to be approved this month. That would be “significantly larger” than the measures of EUR 25B passed in March. The package would include extensions of state-backed guarantees for businesses, unemployment benefits and low incomer support.

Gualtieri also reiterated the push for a coordinated, shared fiscal response within EU, rather than using the European Stability Mechanism. He added, “new solutions are need to grant parity of conditions and to define an adequate shared and responsible response.”

UK PMI manufacturing finalized at 47.8, business optimism slumped to a series-record low

UK PMI Manufacturing was finalized at 47.8 in March, down from February’s 48.0. Business optimism slumped to series-record low and supply chain disruption intensified.

Rob Dobson, Director at IHS Markit:

“The latest survey numbers underscore how the global outbreak of COVID-19 is causing huge disruptions to production, demand and supply chains at UK manufacturers… The effects were felt across most of manufacturing, with output falling sharply in all major sectors except food production and pharmaceuticals… With restrictions aimed at slowing the spread of the virus expected to stay in place for some time, expectations of further economic disruption and uncertainty meant business optimism slumped to a series-record low. However, on a slightly more positive note, manufacturers still expect to see output higher in one year’s time.”

RBA Minutes: Very material contraction in economic activity across Q1, Q2 and potentially longer

In the minutes of March 18 meeting, RBA said that Australia would likely experience a “very material contraction in economic activity, which would spread across the March and June quarters and potentially longer.”. The size of contraction would depend on the “extent of the social distancing requirements, and potential lockdowns” for containing the coronavirus. Also, there will be “significant job losses over the months ahead”. Economy is expected to recover following containment of the coronavirus, “but the timing of this was uncertain”.

At the meeting, RBA decided to roll out a package a measures of four elements. Cash rate was lowered to 0.25%. Purchase of government bonds to keep 3-year yield at 0.25%. Launched a term funding facility to support credit to businesses, and adjustment of interest rate on ES balance held by financial institutions.

Australia AiG manufacturing surged to 53.7, somewhat surprising expansion

Australia AiG Performance of Manufacturing Index jumped to 53.7 in March, up from 44.3. The reading indicates a return to growth after four months of contraction in the sector.

AiG said: “This somewhat surprising expansion – in the midst of the escalating COVID-19 pandemic and emerging recession – is almost entirely due to a huge surge in demand for manufactured food, groceries and personal care items, as shoppers stock up on processed food, toilet paper, cleaning products and other household essentials”.

Also from Australia, building permits rose 19.9% mom in February, much higher than expectation of 4.5% mom.

Japan Tankan large manufacturing dropped to -8, worst since 2013

Japan’s Tankan large manufacturing index dropped to -8 in Q1, down from 0.That’s the first negative reading in seven years, lowest since March 2013, and the fifth straight decline. Large manufacturing outlook dropped from 0 to -11. Large non-manufacturing index also dropped from 20 to 8 while outlook dropped from 18 to -1. Large all industry capex rose 1.8%, better than expectation of -1.1%.

Also from Japan, PMI manufacturing was finalized at 44.8 in March, down from February’s 47.8. Manufacturing output contracted at the sharpest rate since aftermath of 2011 tsunami. Production volumes slumped at the fastest rate for almost nine years, with sharpest drop in demand since April 2011. Supply chain issues also intensified further.

Joe Hayes, Economist at IHS Markit said, “the cascading impact of COVID-19 on the global economy is diminishing the chances of a V-shaped recovery.”

China Caixin PMI manufacturing rose to 50.1, but sector under double pressure

China Caixin PMI manufacturing rose to 50.1 in March, up from 40.3, above expectation of 45.8. However, demand conditions remained fragile, as highlighted by a second monthly fall in total new business. A number of panel members also mentioned delay or cancellation in orders. New export work declined solidly sue to global spread of coronavirus. Employment data also signalled further headcounts reduction.

Dr. Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said: “To sum up, the manufacturing sector was under double pressure in March: business resumption was insufficient; and worsening external demand and soft domestic consumer demand restricted production from expanding further. Whereas, business confidence was still high and the job market basically returned to the pre-epidemic level, laying a positive foundation for the economy’s rapid recovery after the epidemic.”

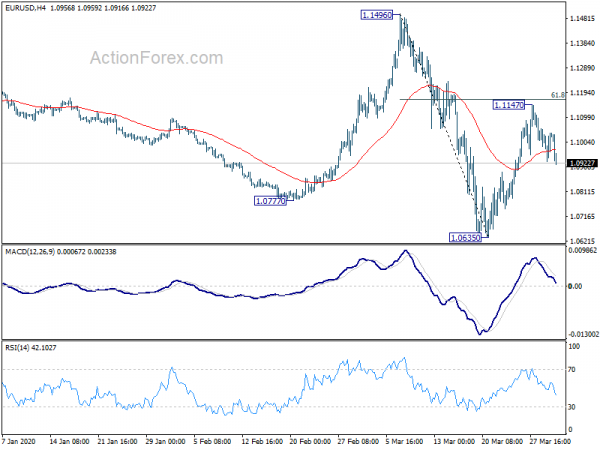

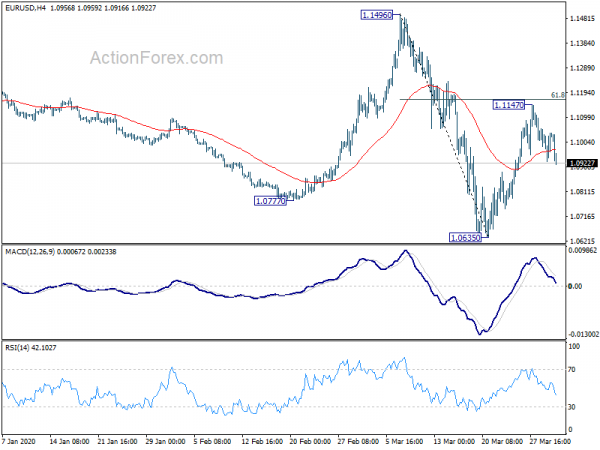

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0957; (P) 1.1005; (R1) 1.1084; More…

EUR/USD’s from 1.1147 is extending today and intraday bias stays on the downside. Rebound from 1.0635 could have completed at 1.1147 already. Deeper fall is mildly in favor for retesting 1.0635 low. On the upside, however, decisive break of 61.8% retracement of 1.1496 to 1.0635 at 1.1167 will raise the chance of larger trend reversal and turn focus to 1.1496 key resistance.

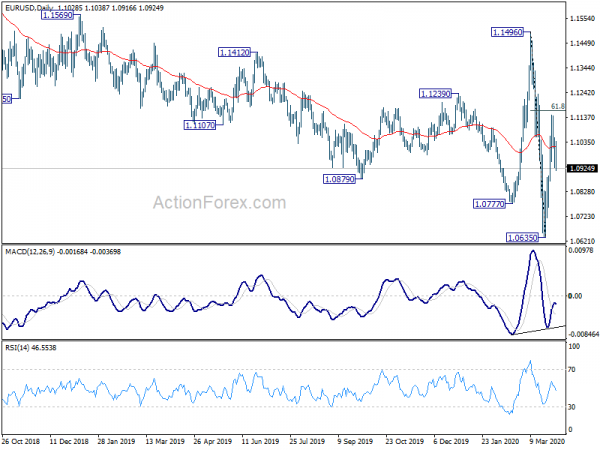

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Mar | 53.7 | 44.3 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Feb | -0.80% | -0.60% | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | -8 | -10 | 0 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | -11 | -14 | 0 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 8 | 6 | 20 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | -1 | 2 | 18 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 1.80% | -1.10% | 6.80% | |

| 00:30 | AUD | Building Permits M/M Feb | 19.90% | 4.50% | -15.30% | -15.10% |

| 00:30 | JPY | Manufacturing PMI Mar F | 44.8 | 44.8 | 44.8 | |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 50.1 | 45.8 | 40.3 | |

| 05:30 | AUD | RBA Commodity Index SDR Y/Y Mar | -10.20% | -6.10% | -6.00% | |

| 06:00 | EUR | Germany Retail Sales M/M Feb | 1.20% | 0.00% | 0.90% | |

| 07:15 | EUR | Spain Manufacturing PMI Mar | 45.7 | 44 | 50.4 | |

| 07:30 | CHF | SVME PMI Mar | 43.7 | 37 | 49.5 | |

| 07:45 | EUR | Italy Manufacturing PMI Mar F | 40.3 | 43 | 48.7 | |

| 07:50 | EUR | France Manufacturing PMI Mar F | 43.2 | 42.9 | 42.9 | |

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 45.4 | 45.5 | 45.7 | |

| 08:00 | EUR | Italy Unemployment Feb | 9.70% | 9.80% | 9.80% | |

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 44.5 | 44.8 | 44.8 | |

| 08:30 | GBP | Manufacturing PMI Mar F | 47.8 | 48 | 48 | |

| 09:00 | EUR | Eurozone Unemployment Rate Feb | 7.30% | 7.40% | 7.40% | |

| 12:15 | USD | ADP Employment Change Mar | -27K | -150K | 183K | 179K |

| 13:30 | CAD | Manufacturing PMI Mar F | 53.3 | 51.8 | ||

| 13:45 | USD | Manufacturing PMI Mar F | 49.2 | 49.2 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 44.3 | 50.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 41.2 | 45.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 45.4 | 46.9 | ||

| 14:00 | USD | Construction Spending M/M Feb | 0.50% | 1.80% | ||

| 14:30 | USD | Crude Oil Inventories | 3.7M | 16.8M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals