Markets are starting another with rather quiet mood. Some economic data might be not as bad as expected, but they’re giving no lift to sentiments. Dollar attempted for a rebound overnight but there was apparently no follow through buying. Gold’s dip was a positive sign for the greenback but there was no follow through selling too. At the momentum, Swiss Franc and Dollar are the relatively stronger ones for today. Canadian, Australian and Sterling are there weakest. But major pairs and crosses are just staying inside yesterday’s tight range.

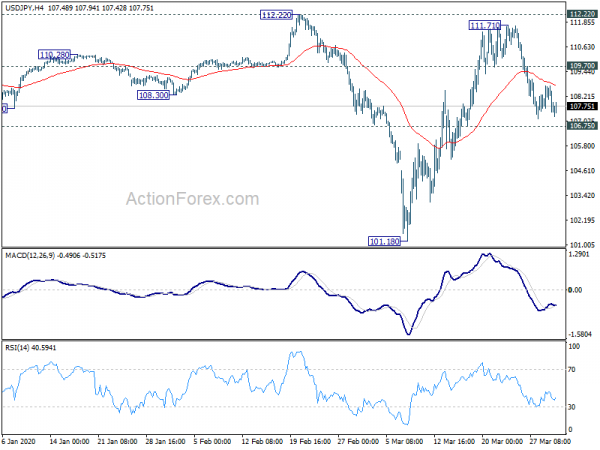

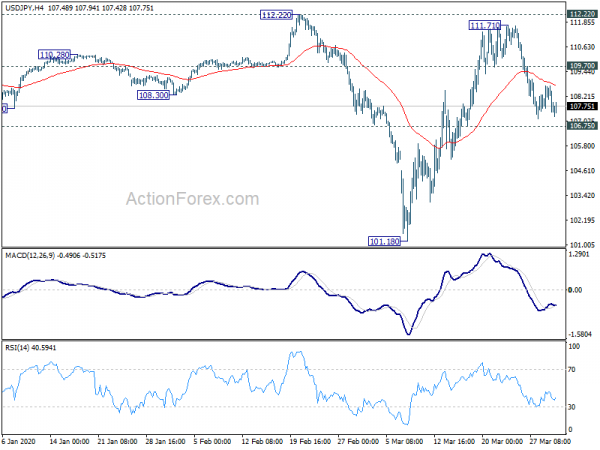

Technically, Yen crosses are showing sign of weakness in general. A focus will be on 106.75 support in USD/JPY. Break will indicate completion of the rebound from 101.18 and bring deeper fall back towards this low. It remains to be seen, if that happens, whether Dollar would be dragged down elsewhere. After yesterday’s decline, gold’s focus remains on 1558 support to confirm completion of rebound from 1451.16.

In Asia, currently, Nikkei is down -1.75%. Hong Kong HSI is down -0.92%. China Shanghai SSE is up 0.30%. Singapore Strait Times is down -1.27%. Japan 10-year JGB yield is down -0.007 at 0.011. Overnight, DOW dropped -1.84%. S&P 500 dropped -1.60%. NASDAQ dropped -0.95%. 10-year yield rose 0.028 to 0.698.

Fed Mester expects some really bad economic numbers, but it’s not a typical recession

Cleveland Fed President Loretta Mester told CNBC it’s “not unrealistic” to see some “really bad economic numbers” in terms of unemployment and economic activity declining. However, she added that the current downturn is “not a typical recession” as it happened in an otherwise healthy economy brought to a near standstill to fight the coronavirus.

“Part of the goal now is to offer the kind of lending and making sure the financial markets stay liquid and making sure they stay on a firm foundation and then bridging people from the economy, which in February looked very good … so that when we get to the other side of this … the economy and economic activity can come back,” Mester said.

“One of the things that makes us in a better spot than some other countries is that our banking system was strong coming into this,” she said. “One of the other actions the Fed has taken is to really encourage the banks to continue lending.”

RBA Minutes: Very material contraction in economic activity across Q1, Q2 and potentially longer

In the minutes of March 18 meeting, RBA said that Australia would likely experience a “very material contraction in economic activity, which would spread across the March and June quarters and potentially longer.”. The size of contraction would depend on the “extent of the social distancing requirements, and potential lockdowns” for containing the coronavirus. Also, there will be “significant job losses over the months ahead”. Economy is expected to recover following containment of the coronavirus, “but the timing of this was uncertain”.

At the meeting, RBA decided to roll out a package a measures of four elements. Cash rate was lowered to 0.25%. Purchase of government bonds to keep 3-year yield at 0.25%. Launched a term funding facility to support credit to businesses, and adjustment of interest rate on ES balance held by financial institutions.

Australia AiG manufacturing surged to 53.7, somewhat surprising expansion

Australia AiG Performance of Manufacturing Index jumped to 53.7 in March, up from 44.3. The reading indicates a return to growth after four months of contraction in the sector.

AiG said: “This somewhat surprising expansion – in the midst of the escalating COVID-19 pandemic and emerging recession – is almost entirely due to a huge surge in demand for manufactured food, groceries and personal care items, as shoppers stock up on processed food, toilet paper, cleaning products and other household essentials”.

Also from Australia, building permits rose 19.9% mom in February, much higher than expectation of 4.5% mom.

Japan Tankan large manufacturing dropped to -8, worst since 2013

Japan’s Tankan large manufacturing index dropped to -8 in Q1, down from 0.That’s the first negative reading in seven years, lowest since March 2013, and the fifth straight decline. Large manufacturing outlook dropped from 0 to -11. Large non-manufacturing index also dropped from 20 to 8 while outlook dropped from 18 to -1. Large all industry capex rose 1.8%, better than expectation of -1.1%.

Also from Japan, PMI manufacturing was finalized at 44.8 in March, down from February’s 47.8. Manufacturing output contracted at the sharpest rate since aftermath of 2011 tsunami. Production volumes slumped at the fastest rate for almost nine years, with sharpest drop in demand since April 2011. Supply chain issues also intensified further.

Joe Hayes, Economist at IHS Markit said, “the cascading impact of COVID-19 on the global economy is diminishing the chances of a V-shaped recovery.”

China Caixin PMI manufacturing rose to 50.1, but sector under double pressure

China Caixin PMI manufacturing rose to 50.1 in March, up from 40.3, above expectation of 45.8. However, demand conditions remained fragile, as highlighted by a second monthly fall in total new business. A number of panel members also mentioned delay or cancellation in orders. New export work declined solidly sue to global spread of coronavirus. Employment data also signalled further headcounts reduction.

Dr. Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said: “To sum up, the manufacturing sector was under double pressure in March: business resumption was insufficient; and worsening external demand and soft domestic consumer demand restricted production from expanding further. Whereas, business confidence was still high and the job market basically returned to the pre-epidemic level, laying a positive foundation for the economy’s rapid recovery after the epidemic.”

Looking ahead

Swiss will release SVME PMI in European session. Germany will release retail sales. Eurozone will release PMI manufacturing final and unemployment rate. UK will also release PMI manufacturing final.

But major focus will be on US ADP employment and ISM manufacturing. US will also release construction spending and crude oil inventories.

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.07; (P) 107.90; (R1) 108.34; More…

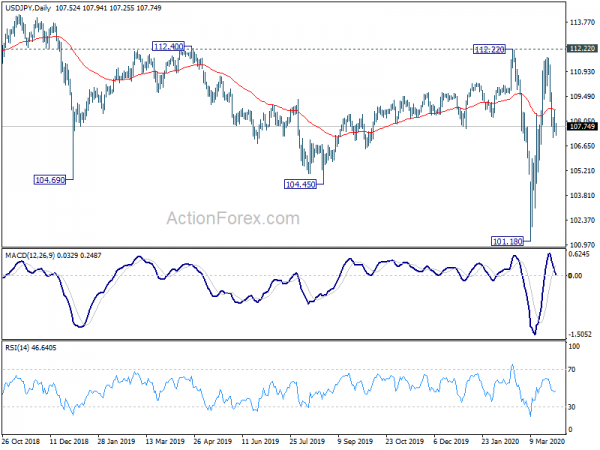

USD/JPY is staying in tight range and intraday bias remains neutral first. On the downside, decisive break of 106.75 support should confirm completion of rebound from 101.18, after failing 112.22 key resistance. Intraday bias will be turned back to the downside for retesting 101.18 low. On the upside, above 109.70 minor resistance will turn bias back to the upside for retesting 111.71. Decisive break of 112.22 carry larger bullish implication and target 114.54 resistance next.

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Mar | 53.7 | 44.3 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Feb | -0.80% | -0.60% | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | -8 | -10 | 0 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | -11 | -14 | 0 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 8 | 6 | 20 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | -1 | 2 | 18 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 1.80% | -1.10% | 6.80% | |

| 0:30 | AUD | Building Permits M/M Feb | 19.90% | 4.50% | -15.30% | -15.10% |

| 0:30 | JPY | Manufacturing PMI Mar F | 44.8 | 44.8 | 44.8 | |

| 1:45 | CNY | Caixin Manufacturing PMI Mar | 50.1 | 45.8 | 40.3 | |

| 5:30 | AUD | RBA Commodity Index SDR Y/Y Mar | -6.10% | |||

| 6:00 | EUR | Germany Retail Sales M/M Feb | 0.00% | 0.90% | ||

| 7:15 | EUR | Spain Manufacturing PMI Mar | 44 | 50.4 | ||

| 7:30 | CHF | SVME PMI Mar | 37 | 49.5 | ||

| 7:45 | EUR | Italy Manufacturing PMI Mar F | 43 | 48.7 | ||

| 7:50 | EUR | France Manufacturing PMI Mar F | 42.9 | 42.9 | ||

| 7:55 | EUR | Germany Manufacturing PMI Mar F | 45.5 | 45.7 | ||

| 8:00 | EUR | Italy Unemployment Feb | 9.80% | 9.80% | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Mar F | 44.8 | 44.8 | ||

| 8:30 | GBP | Manufacturing PMI Mar F | 48 | 48 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Feb | 7.40% | 7.40% | ||

| 12:15 | USD | ADP Employment Change Mar | -150K | 183K | ||

| 13:30 | CAD | Manufacturing PMI Mar F | 53.3 | 51.8 | ||

| 13:45 | USD | Manufacturing PMI Mar F | 49.2 | 49.2 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 44.3 | 50.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 41.2 | 45.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 45.4 | 46.9 | ||

| 14:00 | USD | Construction Spending M/M Feb | 0.50% | 1.80% | ||

| 14:30 | USD | Crude Oil Inventories | 16.8M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals