The price of crude oil declined by more than 12% as optimism of a deal with Saudi Arabia faded. This came after an important virtual meeting between oil producing countries that was to happen today was postponed. The main challenge is that Saudi Arabia has insisted all oil producing countries, including Russia and the US, must cut production in a bid to balance the market. Meanwhile, according to a report by the Financial Times, the US and Canada are considering imposing heavy tariffs on oil from Saudi Arabia and Russia, which would also heighten geopolitical issues between the four countries.

The sterling declined slightly after reports emerged that Boris Johnson had been admitted to hospital. Downing Street said that he was still suffering from symptoms of Coronavirus, which he was tested positive for 10 days ago. Still, Johnson has remained in charge and has continued to chair meetings using a video link. If he gets too ill to work, Dominic Raab, his foreign secretary and first minister of state is expected to fill in for him as he recovers.

The economic calendar will be light today but the focus among traders will continue being on Coronavirus. Over the weekend, the number of cases rose to more than 1.27 million while the number of deaths has risen to almost 70k. Meanwhile, some countries in Europe, including Spain and France have started preparing for easing the recent lockdowns. This is partly because the rate of infections have started to decline. For example, while a record 357 people died yesterday in France, the rate of patients needing intensive care has continued to decline. The biggest data to watch in the economic calendar will be the UK construction PMI data.

EUR/USD

The EUR/USD pair was little changed today as the market continued to reflect on the weak employment data released yesterday. The pair is trading at 1.0810, which is a few pips above Friday’s low of 1.0771. On the hourly chart, the pair is slightly below the 38.2% Fibonacci Retracement level and along the 14-day and 28-day exponential moving average. The RSI was little changed at 42. The pair could remain in consolidation mode today although a significant breakout is also possible.

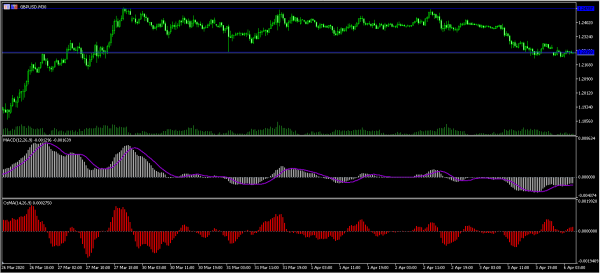

GBP/USD

The GBP/USD pair declined slightly to a low of 1.2235 as the market reacted to news that Boris Johnson had been admitted in the hospital. On the 30-minute chart, the pair is trading along an important support level. The signal line of the MACD has remained below the neutral line while the moving average of oscillator has moved up slightly. At this point, the pair may breakout in either direction.

XBR/USD

The XBR/USD pair fell to an intraday low of 32.15 as the market reacted to the new developments on oil. The pair then moved slightly upwards to the current level of 33.63 as the market priced-in some intervention in the price. The price is slightly above the 14-day and 28-day exponential moving averages while volatility remains being elevated. Today, the pair will likely move in either direction as the market reacts to news from Saudi, Russia, the US, and Canada.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals