Australian dollar jumps broadly today after RBA kept monetary policies unchanged as widely expected. Aussie is additionally helped by the strong rally in US stocks overnight, even though the rise in Asia markets is relatively muted. Also, China, the origin of the coronavirus pandemic, is set to end the lockdown of Wuhan. New Zealand Dollar follows Aussie closely as the second weakest. Dollar is currently the worst performing one as safe haven flows reverse. Swiss Franc and Euro are the next weakest.

Technically, Dollar’s rebound could have ended and it’s probably starting the third leg of near term correction. 1.0902 minor resistance in EUR/USD and 0.9686 minor support in USD/CHF will be watched for signs of Dollar weakness. For this down leg in the greenback, AUD/USD will likely rise through 0.6213 temporary top while USD/CAD will likely drops through 1.3920 temporary low.

In Asia, currently, Nikkei is up 0.58%. Hong Kong HSI is up 0.28%. China Shanghai SSE is up 1.74%. Singapore Strait Times is up 1.40%. Japan 10-year JGB yield is up 0.0019 at 0.006. Overnight, DOW rose 7.73%. S&P 500 rose 7.03%. NASDAQ rose 7.33%. 10-year yield rose 0.089 to 0.676.

RBA kept cash rate at 0.25%, very large economic contraction expected in Q2

RBA left cash rate unchanged at 0.25% as widely expected. It also reaffirmed the 0.25% target for 3-year government bond yield with asset purchases. The central bank also said that it “will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.”

RBA also said noted there is “considerable uncertainty” about the near-term outlook of the economy. Much depends on the successful of coronavirus containment and the length of social distancing. Nevertheless, “a very large economic contraction” is expected in Q2 and unemployment is expected to rise to its “highest level for many years”.

Australia AiG services index dropped to 38.7, lowest since 2009

Australia AiG Performance of Services Index dropped from 43.0 to 38.7 in March. That’s the lowest level since March 2009 and the fourth month of contracting results. AiG said, “the services sector is now entering a difficult period of pandemic-related closures and adjustments from a base already weakened by summer’s bushfire crisis and by longer-term factors”.

“Restrictions on human movement and gatherings means closures for many businesses in hospitality, retail, transport, recreation, personal services, education and even community services. Businesses that remain open face falling sales and increasing operational restrictions.”

Also from Australia, trade surplus narrowed to AUD 4.36B in February, above expectation of AUD 37.5B.

New York Fed: Consumers see chance of job loss jumped

The March consumer expectations survey by the New York Fed showed that perceived chance of losing they job jumped to series high. Expected growth in household income and spending decline sharply. Meanwhile, inflation uncertainty increased in both horizons.

The mean perceived probability of losing one’s job in the next 12 months increased 4.7 percentage points to 18.5%. The reading is a new series’ high and 4.3 percentage points above the 12-month trailing average.

Median household income growth expectations dropped sharply to 2.1%, 0.9 percentage point below its 12-month trailing average. Median household spending growth expectations declined to 2.3%, 0.9 percentage point below its 12-month trailing average.

Median inflation expectations at the one-year horizon were unchanged at 2.5% but decreased at the three-year horizon to 2.4% in March from 2.6% in February. There was a large increase in median inflation uncertainty—or the uncertainty expressed by each respondent regarding future inflation outcomes—at the one-year horizon, and a moderate increase at the three-year horizon.

Elsewhere

From Japan, labor cash earnings rose 1.0% yoy in February, above expectation of 0.2% yoy. Overall household spending dropped -0.3% yoy in February, versus expectation of -3.9% yoy.

Looking ahead, Germany industrial production, France trade balance, Swiss foreign currency reserves and Italy retail sales will be released in European session. Canada will release Ivey PMI later in the day.

AUD/USD Daily Report

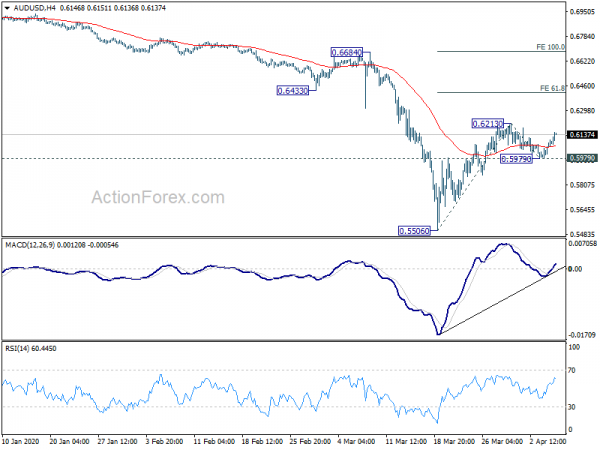

Daily Pivots: (S1) 0.6017; (P) 0.6061; (R1) 0.6132; More…

AUD/USD’s strong rebound suggests that pull back from 0.6213 has completed at 0.5979. Focus is back on 0.6213. Break will resume whole rebound from 0.5506 to 61.8% projection of 0.5506 to 0.6213 from 0.5979 at 0.6416. On the downside, break of 0.5979 will now indicate completion of rise from 0.5506. Intraday bias will be turned back to the downside for retesting 0.5506.

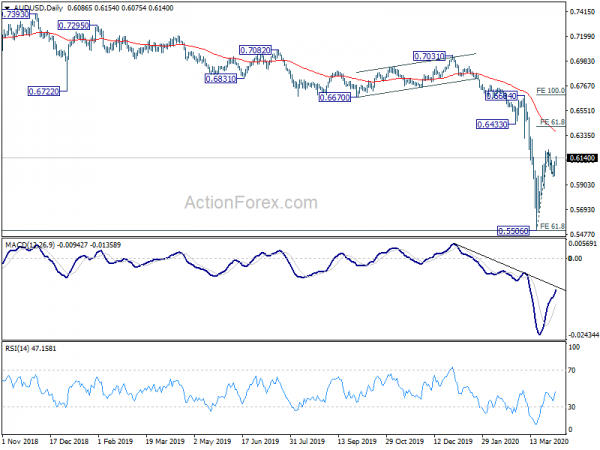

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, break of 0.6670 support turned resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q1 | -70% | -21% | ||

| 22:30 | AUD | AiG Performance of Services Index Mar | 38.7 | 47 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Feb | 1.00% | 0.20% | 1.50% | 1.20% |

| 23:30 | JPY | Overall Household Spending Y/Y Feb | -0.30% | -3.90% | -3.90% | |

| 1:30 | AUD | Trade Balance (AUD) Feb | 4.36B | 3.75B | 5.21B | 4.75B |

| 4:30 | AUD | RBA Interest Rate Decision | 0.25% | 0.25% | 0.25% | |

| 5:00 | JPY | Leading Economic Index Feb P | 92.1 | 90.4 | 90.5 | |

| 6:00 | EUR | Germany Industrial Production M/M Feb | -1.00% | 3.00% | ||

| 6:45 | EUR | France Trade Balance (EUR) Feb | -5.1B | -5.9B | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Mar | 769B | |||

| 8:00 | EUR | Italy Retail Sales M/M Feb | 0.40% | 0.00% | ||

| 14:00 | CAD | Ivey PMI Mar | 50.1 | 54.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals