Global markets lack a clear direction today. European stocks are generally lower for the moment after EU failed to agree on coronavirus rescue stimulus. But US futures point to higher open. In the currency markets, Sterling is the strongest one for now as Prime Minister Boris Johnson is said to be “clinically stable” and “in good spirits” in ICU for coronavirus treatment. Aussie follows as the second strongest. On the other hand, Canadian Dollar is the worst performing one so far, awaiting OPEC++ meeting. Euro and Swiss Franc are also weak.

In Europe, currently, FTSE is down -0.98%. DAX is down -0.61%. CAC is down -1.01%. German 10-year yield is up 0.0011 at -0.294. Earlier in Asia, Nikkei rose 2.13%. Hong Kong HSI dropped -1.17%. China Shanghai SSE dropped -0.19%. Singapore Strait Times dropped -1.26%. Japan 10-year JGB yield rose 0.010 to 0.017.

Released today, Canada building permits dropped -7.3% mom in February versus expectation of -4.0% mom. Housing starts dropped to 195k versus expectation of 205k. Swiss unemployment rate jumped to 2.9% in March, up from 2.3%, above expectation of 2.8%. Japan machine orders rose 2.3% mom in February, above expectation of -2.7% mom. Current account surplus widened to JPY 2.38T in February, above expectation of JPY 2.02T.

Ifo: German economy to shrink 4.2%, unemployment to jump to 4.9%

Ifo economist Timo Wollmershaeuser said in a report that the Germany economy “slumped drastically as a result of the corona pandemic” and GDP could shrink -4.2% in 2020. Unemployment rate will “skyrocket to 5.9%”. Fiscal stabilization measures will lead to a record” deficit of EUR 159B. Though, GDP could rebound next year with 5.8% growth.

Downside risks include:significantly slower weakening of the pandemic; Restarting economic activity works worse than in the base scenario or triggers another wave of infection, further measures to fight infection come into force, which shut down production longer or to a greater extent than assumed here; Faults in the financial system; Sovereign debt crisis; Realignment of global value chains and sales markets

EU failed to agree on coronavirus economic rescue, talks suspended

EU Finance Ministers failed to agree on coordinated coronavirus economic rescue after marathon talks. “After 16 hours of discussions we came close to a deal but we are not there yet,” Eurogroup chairman Mario Centeno said. “I suspended the Eurogroup and continue tomorrow.”

It’s reported that there was a major disagreement between Italy and the Netherlands. Italy required a reference to debt mutualization in the recovery instrument but the Netherlands rejected.

Separately, ECB Governing Council member Martins Kazaks warned that “If policymakers leave monetary policy as the only game in town, that would be irresponsible.”

S&P downgrade Australia’s rating outlook as recession will deteriorate fiscal headroom

Rating agency S&P kept Australia’s sovereign rating unchanged at AAA, but downgraded the outlook from “stable” to “negative”. The outlook was upgraded from “negative” to “stable” less than two years ago in September 2018, when the budget came close to balance.

“The COVID-19 outbreak has dealt Australia a severe economic and fiscal shock” S&P said. “We expect the Australian economy to plunge into recession for the first time in almost 30 years, causing a substantial deterioration of the government’s fiscal headroom at the ‘AAA’ rating level.”

Nevertheless, “while fiscal stimulus measures will soften the blow presented by the COVID-19 outbreak and weigh heavily on public finances in the immediate future, they won’t structurally weaken Australia’s fiscal position,” S&P said.

Treasurer Josh Frydenberg said the outlook downgrade was “a reminder of the importance of maintaining our commitment to medium term fiscal sustainability.”

New Zealand ANZ business confidence dropped to -73.1, times don’t get much tougher than this

New Zealand ANZ business confidence dropped to -73.1 in the April’s preliminary reading, down from March’s -63.5. Own activity outlook dropped sharply from -26.7 to -61.2. Export intentions dropped from -25.8 to -43.6. Investment intentions dropped from -14.4 to -50.2. Employment intention dropped from -22.5 to -53.8.

ANZ said, “firms are reeling from the abruptness and ferocity of the storm that has enveloped them, and with uncertainty extreme, planning a way out is very difficult. The quick-fire fiscal and monetary response will have helped, but times just don’t get much tougher than this.”

South Korea pledges new measures to help exporters and boost domestic demand

South Korean President Moon Jae-in announced additional support to the economy as businesses and domestic demand devastated by the coronavirus pandemic. 36 trillion won of cheap loans will be available to exporters. Measures of 17.7 trillion won will be rolled out to boost consumption and domestic demands. The new measures are on top of the planned economic package of 100 trillion won announced in late March.

Separately reported by the central bank, Household loans rose a net 9.6 trillion won in March, highest jump since record began in 2004. That came after another record of 9.3 trillion won rise back in February. Mortgage lending rose a net 6.3 trillion won, slowed from February’s 7.8 trillion won.

EUR/USD Mid-Day Outlook

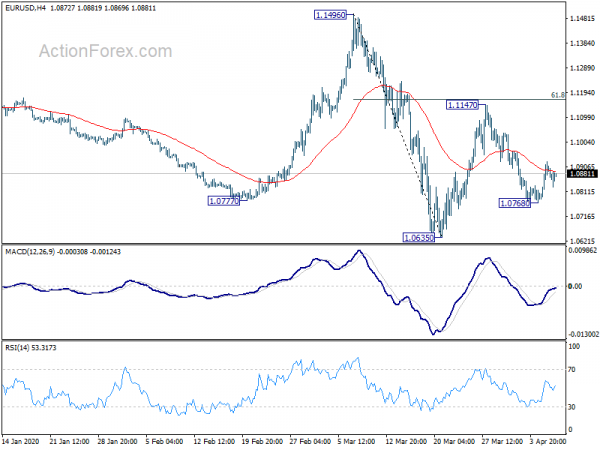

Daily Pivots: (S1) 1.0808; (P) 1.0867; (R1) 1.0950; More…

No change in EUR/USD’s outlook for the moment. Further rise remains mildly in favor. Rise from 1.0768 could be the third leg of the corrective pattern from 1.0635 and would target 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, break of 1.0768 will resume the fall to retest 1.0635 low instead.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Feb | 2.38T | 2.02T | 1.63T | |

| 23:50 | JPY | Machinery Orders M/M Feb | 2.30% | -2.70% | 2.90% | |

| 05:00 | JPY | Eco Watchers Survey: Current Mar | 14.2 | 22.2 | 27.4 | |

| 05:45 | CHF | Unemployment Rate Mar | 2.90% | 2.80% | 2.30% | |

| 12:15 | CAD | Housing Starts Mar | 195K | 205.0K | 210.1K | 211K |

| 12:30 | CAD | Building Permits M/M Feb | -7.30% | -4.00% | 4.00% | |

| 14:30 | USD | Crude Oil Inventories | 9.8M | 13.8M | ||

| 18:00 | USD | FOMC Minutes |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals