Markets are steadily mixed in Asian session today. US stocks rose notably overnight but major indices actually closed below Tuesday’s highs. No apparent follow through risk-on in seen in Asia too. Overall, Yen and Dollar remain the weakest ones for the week. Australian Dollar leads commodity currencies higher. Major focuses will turn to OPEC++ meeting today regarding production cut. Canadian Dollar will face additional test from March job data.

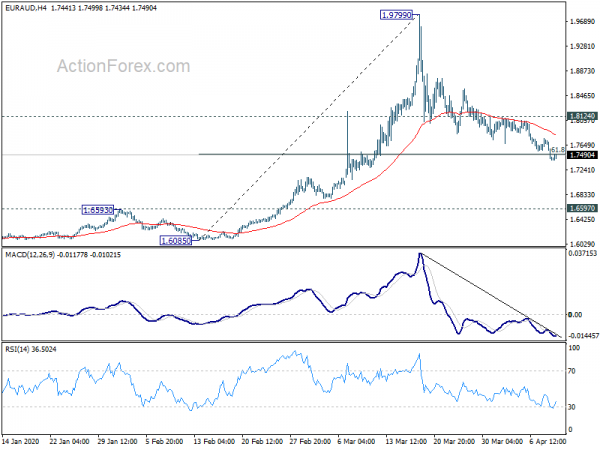

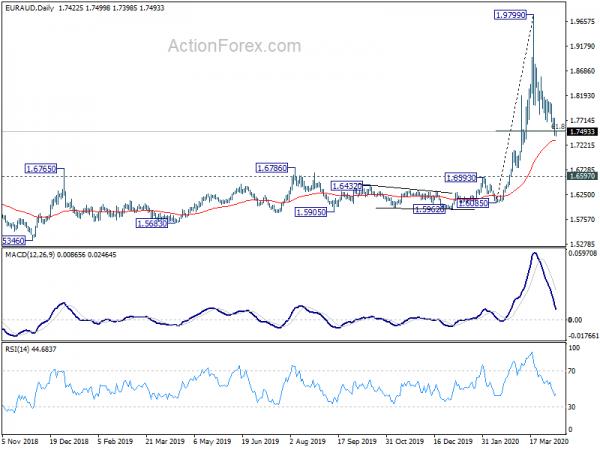

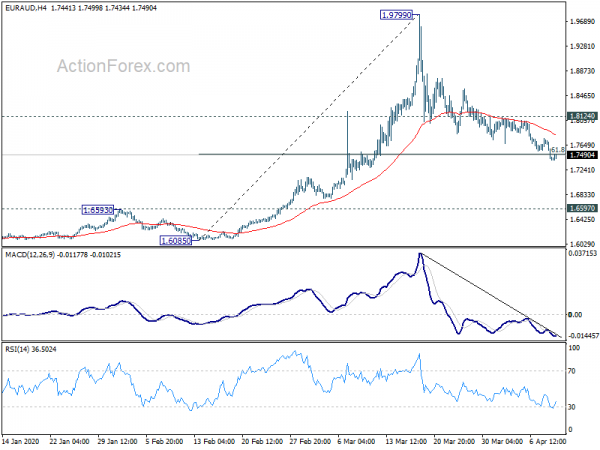

Technically, AUD/USD’s breach of 0.6213 resistance suggests resumption of whole rebound from 0.5506. Further rise is in favor to 0.6416 projection level for the near term. More importantly, EUR/AUD also breaks 1.7504 fibonacci support with yesterday’s decline. Sustained trading below level could open up deeper fall back to 1.6085 support. We’ll see if EUR/AUD could rebound quickly from current level to save near term bullishness.

In Asia, currently, Nikkei is down -0.47%. Hong Kong HSI is up 0.66%. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 1.36%. Japan 10-year JGB yield is down -0.0107 at 0.006. Overnight, DOW rose 3.44%. S&P 500 rose 3.41%. NASDAQ rose 2.58%. 10-year yield rose 0.028 to 0.764.

Fed minutes: All participants viewed near-term outlook as deteriorated sharply

FOMC minutes noted that “all participants viewed the near-term U.S. economic outlook as having deteriorated sharply in recent weeks and as having become profoundly uncertain.” Hence, “almost all members agreed to lower the target range for the federal funds rate to 0 to 1/4 percent.”

“With regard to monetary policy beyond this meeting, these participants judged that it would be appropriate to maintain the target range for the federal funds rate at 0 to ¼ percent until policymakers were confident that the economy had weathered recent events and was on track to achieve the Committee’s maximum employment and price stability goals”, the minutes added.

Separately, Dallas Fed President Robert Kaplan said because of the coronavirus pandemic shock, consumer behavior could be more cautious. “It’s not just the safety concerns… it’s also financial and potentially job insecurity which might cause them to save more and spend less.”

Chicago Fed President Charles Evans warned of a potentially fragile recovery at least until a vaccine is available. Continuing pandemic would risk a “deep and prolonged” downturn. Richmond Fed President Thomas Barkin said “businesses will have to find a way to convince consumers to shop, or eat out, to travel, or go to a concert or a game,” after reopening up.

BoJ Kuroda: Economic outlook is extremely uncertain

BoJ Governor Haruhiko Kuroda said in the regional branch manager meeting that “the spread of the coronavirus is having a severe impact on Japan’s economy through declines in exports, output, demand from overseas tourists and private consumption.” And, “the economic outlook is extremely uncertain.”

“For the time being, we won’t hesitate to take additional monetary easing steps if needed, with a close eye on developments regarding the coronavirus outbreak,” he added.

RBA: Australia financial system well placed to manage coronavirus pandemic risks

RBA said Australia’s financial system faces “increased risks” from the coronavirus pandemic, but it’s “well placed to manage them”. The systems enters the challenging period in a “strong starting position”. “Capital levels are high and the banks’ liquidity position has improved considerably over recent times,” it added. “The Australian banks also enter the downturn with high profitability and very good asset performance.”

While most businesses were in good financial health before the pandemic, “some pockets of vulnerability were evident in the retail trade, food and accommodation services, agricultural and construction sectors.” Increase in business failures and loan arrears are “likely over the coming months”. And, there is “considerable uncertainty” around the trajectory of the economic shock and subsequent recovery

Looking ahead

UK GDP, productions and trade balance will be featured in European session, but they are February’s data. ECCB will release monetary policy meeting accounts too. Later in the day, US will release PPI and jobless claims. But bigger focus would be on Canada March job data.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.7298; (P) 1.7528; (R1) 1.7648; More…

EUR/AUD’s decline from 1.9799 extended further and breached 61.8% retracement of 1.6085 to 1.9799 at 1.7504. There is no clear sign of bottoming yet. Sustained trading below 1.7504 will raise the chance of larger reversal and pave the way to 1.6085/6593 support zone. Nevertheless, break of 1.8124 resistance will suggest that the pull back has completed. Intraday bias will be turned back to the upside for retesting 1.9799 high.

In the bigger picture, up trend from 1.1602 (2012 low) is in progress and further rally would be seen to 2.1127 (2008 high) and possibly to 161.8% projection of 1.1602 to 1.6597 from 1.3524 at 2.1706. On the downside, for now, touching of 1.6597 resistance turned support (2015 high) is needed to indicate medium term reversal. Otherwise, outlook will stay bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Mar | 11% | 14% | 29% | |

| 6:00 | GBP | GDP M/M Feb | 0.10% | 0.00% | ||

| 6:00 | GBP | Index of Services 3M/3M Feb | 0.30% | 0.00% | ||

| 6:00 | GBP | Industrial Production M/M Feb | 0.30% | -0.10% | ||

| 6:00 | GBP | Industrial Production Y/Y Feb | -2.80% | -2.90% | ||

| 6:00 | GBP | Manufacturing Production M/M Feb | 0.30% | 0.20% | ||

| 6:00 | GBP | Manufacturing Production Y/Y Feb | -3.90% | -3.60% | ||

| 6:00 | GBP | Goods Trade Balance (GBP) Feb | -6.0B | -3.7B | ||

| 8:00 | EUR | Italy Industrial Output M/M Feb | 3.70% | |||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:00 | GBP | NIESR GDP Estimate Mar | 0.20% | |||

| 12:30 | USD | PPI M/M Mar | -0.30% | -0.60% | ||

| 12:30 | USD | PPI Y/Y Mar | 1.80% | 1.30% | ||

| 12:30 | USD | PPI Core M/M Mar | 0.00% | -0.30% | ||

| 12:30 | USD | PPI Core Y/Y Mar | 1.70% | 1.40% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 3) | 6 | 648K | ||

| 12:30 | CAD | Net Change in Employment Mar | 30.3K | |||

| 12:30 | CAD | Unemployment Rate Mar | 5.60% | |||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 75 | 89.1 | ||

| 14:00 | USD | Wholesale Inventories Feb F | -0.20% | -0.50% | ||

| 14:30 | USD | Natural Gas Storage | -19B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals