Markets are generally back in risk aversion, as selloff was sparked by historic move in oil prices. Yen and Dollar strengthen broadly as a result. Canadian dollar was weighed down slightly too but selloff is limited so far. Instead, New Zealand and Australian Dollars are the weakest for now. European majors are mixed together with Gold.

Technically, immediate focus is now on 1.4182 minor temporary top in USD/CAD. Break there will solidify the case that corrective pattern from 1.4667 has indeed completed at 1.3855. Further rise would be seen to 1.4349 resistance next. 116.33 support in EUR/JPY is another focus too. Break will bring deeper fall to 115.86 low and break will resume medium term down trend.

In Asia, Nikkei closed down -1.97%. Hong Kong HSI is down -2.08%. China Shanghai SSE is down -1.17%. Singapore Strait Times is down -1.48%. Japan 10-year JGB yield is up 0.0042 at 0.017. Overnight, DOW dropped -2.44%. S&P 500 dropped -1.79%. NASDAQ dropped -1.03%. 10-year yield dropped -0.028 to 0.626.

Historical negative oil price on storage concerns

A day ahead of expiration, WTI crude oil futures for May delivery slumped into the negative territory for the first time on history. Plunging by over 100%, the May contract slumped to as low as -40.32 before settling at -37.63. In Asian session today, the contract recovered to positive territory.

Key explanation for this bizarre phenomenon – negative oil price – is the structure of oil futures. As the May WTI contract expires on April 21. Buyers of the contract will have to take delivery of the product (WTI crude oil). Delivery shall be made by transferring into a designated pipeline or storage facility with access to seller’s incoming pipeline or storage facility. Buyers would have to square the positions before the settlement date if they do not prefer to take care of the storage.

More in WTI Crude Oil Price Dived to Negative as Oversupply Sparks Concerns about Storage.

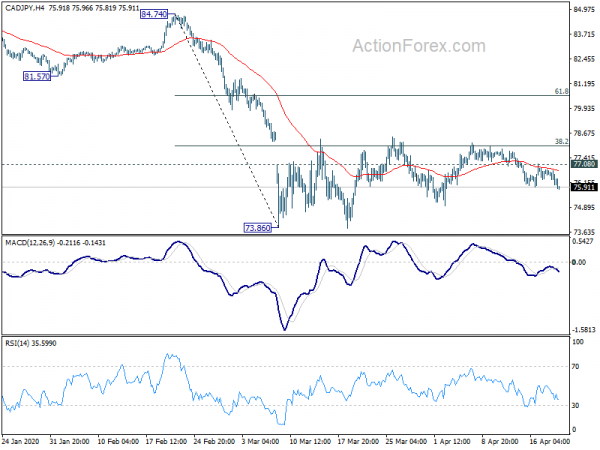

CADJPY staying in sideway consolidation despite massive oil price move

CAD/JPY is staying in consolidation pattern from 73.86. With this week’s decline and break of 75.93 minor support, intraday bias is mildly on the downside for retest 73.86 low. On the upside, break of 77.08 could bring another rise to retest 38.2% retracement of 84.74 to 73.86 at 78.01, to extend the consolidation.

RBA Lowe: Health and economic emergencies will cast a shadow over our economy

RBA Governor Philip Lowe said today that the economy will likely contract by around -10% in the first half. Most of the decline would take place in Q2 due to the coronavirus pandemic. At the same time, unemployment rate could jump from March’s 5.2% to around 10% by June.

He also sounded cautious regarding the post pandemic recovery. “Whatever the timing of the recovery, when it does come, we should not be expecting that we will return quickly to business as usual,” he said. “Rather, the twin health and economic emergencies that we are experiencing now will cast a shadow over our economy for some time to come.”

Elsewhere

Swiss will release trade balance in European session while UK will release employment data. But main focus will be on German ZEW economic sentiment. Later in the day, Canada retail sales and US existing home sales will be featured.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4058; (P) 1.4102; (R1) 1.4188; More….

USD/CAD recovered after drawing support from 4 hour 55 EMA. But upside is limited below 1.4182 temporary top so far. Intraday bias remains neutral first. On the upside, break of 1.4182 will solidify the case that correction from 1.4667 has completed at 1.3855. Intraday bias will be turned back to the upside for 1.4349 resistance, and then 1.4667. In case of another fall, downside should be contained by 61.8% retracement of 1.3202 to 1.4667 at 1.3762 to bring rebound.

In the bigger picture, rise from 1.2061 is likely resuming whole up trend from 0.9056 (2007 low). Decisive break of 1.4689 will confirm this bullish case. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection by 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Mar | 3.23B | 3.57B | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 3.90% | 3.90% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 3.00% | 3.10% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 3.20% | 3.10% | ||

| 06:00 | GBP | Claimant Count Change Mar | 17.3K | |||

| 06:00 | GBP | Claimant Count Rate Mar | 3.50% | |||

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | -43.0 | -49.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | -38.2 | -49.5 | ||

| 09:00 | EUR | Germany ZEW Current Situation Apr | -30.0 | -43.1 | ||

| 12:30 | CAD | Retail Sales M/M Feb | 0.00% | 0.40% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | -0.10% | -0.10% | ||

| 14:00 | USD | Existing Home Sales Mar | 5.40M | 5.77M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals