Euro suffers heavy selling in today on terrible PMI data, which suggests that the coronavirus pandemic damage could be far more severe than imaginable. The common currency drags down the Swiss Franc too. Dollar couldn’t ride on Euro’s weakness and even faces some selling after another set of astronomical jobless claims numbers. Commodity currencies are generally higher for today. For the week, Aussie and Yen are now the strongest ones while Sterling and Euro are the worst performing.

Technically, EUR/JPY hits as low as 115.71 so far and sustained trading below 115.86 support will confirm medium term down trend resumption. Next target will be 109.48 (2016 low). EUR/AUD’s break of 1.7003 support suggests resumption of whole fall from 1.9799. It should now target key support level at 1.6597 (2015 high). EUR/USD’s break of 1.0768 support also suggests resumption of fall from 1.1147, towards 1.0635 low. 0.8681 temporary low in EUR/GBP will now be a focus for the rest of the week.

In Europe, currently, FTSE is up 0.16%. DAX is down -0.02%. CAC is up 0.44%. German 10-year yield is down -0.0185 at 0.426. Earlier in Asia, Nikkei rose 1.52%. Hong Kong HSI rose 0.35%. China Shanghai SSE dropped -0.19%. Singapore Strait Times dropped -0.30%. Japan 10-year JGB yield dropped -0.0011 to -0.008.

US initial jobless claims dropped to 4.4m, continuing claims rose to 16m

US initial jobless claims dropped -810k to 4427k in the week ending April 18. Four-week moving average of initial claims rose 280k to 5787k. Continuing claims rose 4064k to 15976k in the week ending April 11, highest on record. Four-week moving average of continuing claims rose 3548k to 9598k.

BoE Vlieghe: In principle, economy should return approximately to the pre-virus trajectory afterwards

BoE MPC member Gertjan Vlieghe said in a speech that “based on the early indicators, and based on the experience in other countries that were hit (by the coronavirus pandemic) somewhat earlier than the UK, it seems that we are experiencing an economic contraction that is faster and deeper than anything we have seen in the past century, or possibly several centuries.”

“The economy’s potential is severely disrupted at the moment,” he added, “but once the pandemic is over, and other things equal, in principle it should return approximately to the pre-virus trajectory.” “The current priority for monetary policy, with a lot of help from fiscal policy, is to return the economy to that pre-virus trajectory as soon as possible.”

“The MPC stands ready to take further action to support the economy consistent with its remit,” Vlieghe noted.

UK PMI composite dropped to 12.9, indicates quarterly GDP contraction of -7%, maybe even more

UK PMI Manufacturing dropped to 32.9 in April, down from 47.8. PMI Services dropped to 12.3, down from 34.5. PMI Composite dropped to 12.9, down from 36.0. All are record lows.

Chris Williamson, Chief Business Economist at IHS Markit, said: “Simple historical comparisons of the PMI with GDP indicate that the April survey reading is consistent with GDP falling at a quarterly rate of approximately 7%. The actual decline in GDP could be even greater, in part because the PMI excludes the vast majority of the self-employed and the retail sector, which have been especially hard-hit by the COVID-19 containment measures.

Eurozone PMI composite dropped to 13.5, ferocity of slump surpassed imaginable

Eurozone PMI Manufacturing dropped to 33.6 in April, down from 44.5, a 134-month low. PMI Services dropped to 11.7, down from 26.4, a record low. PMI Composite dropped to 13.5, down from 29.7, also a record low.

Chris Williamson, Chief Business Economist at IHS Markit said: “April saw unprecedented damage to the eurozone economy amid virus lockdown measures coupled with slumping global demand and shortages of both staff and inputs. The extent to which the PMI survey has shown business to have collapsed across the eurozone greatly exceeds anything ever seen before in over 20 years of data collection. The ferocity of the slump has also surpassed that thought imaginable by most economists, the headline index falling far below consensus estimates.

“Our model which compares the PMI with GDP suggests that the April survey is indicative of the eurozone economy contracting at a quarterly rate of approximately 7.5%. With large swathes of the economy likely to remain locked down to contain the spread of COVID-19 in coming weeks, the second quarter looks set to record the fiercest downturn the region has seen in recent history.

“Hopes are pinned on containment measures being slowly lifted to help ease the paralysis that businesses have reported in April. However, progress looks set to be painfully slow to prevent a second wave of infections. In the face of such a prolonged slump in demand, job losses could intensify from the current record pace and new fears will be raised as to the economic cost of containing the virus.”

Germany PMI Manufacturing dropped to 34.4 in April, down from 45.4, a 133-month low. PMI services dropped to 15.9, down from 31.7, record low. PMI Composite dropped to 17.1, down from 35.0, also a record low.

France PMI Manufacturing dropped to 31.5 in April, down from 43.2. PMI Services dropped to 10.4, down from 27.4. PMI Composite dropped to 11.2, down from 28.9. All are record lows.

Germany Gfk consumer sentiment cliff dived to -23.7, income expectations plunged

Germany Gfk consumer sentiment for May dropped to a historic low of -23.7, down from April’s 2.3. Economic expectations dropped further from -19.2 to -21.4. That was slightly better than the lowest reading of -26 recorded in May 2009. Income expectations, on the other hand, plunged from 27.8 to -19.3. A higher monthly loss in income expectations has never been recorded since monthly data collection on consumer sentiment began in 1980.

“Given that the economy is largely frozen, this unprecedented cliff dive is hardly surprising. Retailers, manufacturers and service providers must prepare for a tough recession in the immediate future,” explains Rolf Bürkl, GfK Consumer Expert. “Since it now seems evident that the easing of the COVID-19 containment measures will be very slow in order to take a cautious approach, the consumer climate can expect to face tough times in the coming months too.”

Japan PMI composite dropped to 27.8, harsh economic effects likely to drag out further

Japan PMI Manufacturing dropped from 44.8 to 43.7 in April, biggest contraction in 2009. PMI Services dropped from 33.8 to 22.8, worst contraction since survey began in 2007. PMI Composite dropped from 36.2 to 27.8.

Joe Hayes, Economist at IHS Markit, said: “The crippling economic impact from global coronavirus pandemic intensified in April… The decline in combined output across both manufacturing and services was the strongest ever recorded by the survey in almost 13 years of data collection, surpassing declines seen during the global financial crisis and in the aftermath of the 2011 tsunami.

“Overall, GDP looks set to decline at an annual rate in excess of 10% in the second quarter. The current state of emergency will stay in place until 6 May, although given Japan’s lagged response relative to other parts of the world, one would expect this to be extended, meaning the the harsh economic effects are likely to drag out further”.

Australia PMI manufacturing dropped to 45.6, services down to 19.5

Australia CBA PMI Manufacturing dropped fro 49.7 to 45.6 in April. Manufacturing output decreased for the eighth successive month in April, and to the greatest extent since the survey began in May 2016. PMI Services dropped from 38.5 to 19.5. Company shutdowns and coronavirus restrictions resulted in severe declines in both business activity and new orders in the service sector. PMI Composite dropped from 39.4 to 22.4.

CBA Head of Australian Economics, Gareth Aird said: “This is an astonishing result. The collapse in the headline index reflects the severe contraction in economic activity currently taking place. The services sector has been hit a lot harder than the manufacturing sector. And the pace of job shedding is concerning though not surprising given the large number of Australian businesses that remain shut. The extent to which the PMIs rebound will be dictated in large part by the duration of the enforced shutdown”.

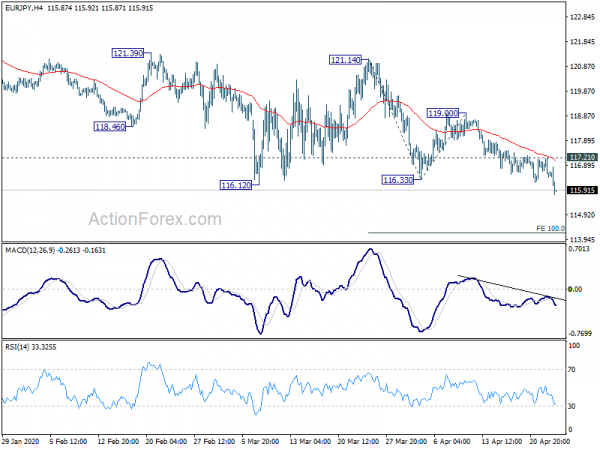

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 116.27; (P) 116.74; (R1) 117.05; More….

EUR/JPY drops to as low as 115.72 so far. Intraday bias is back on the downside. Sustained trading below 115.86 low will confirm larger down trend resumption. Next near term target will be 100% projection of 121.14 to 116.33 from 119.00 at 114.19. On the upside, however, break of 117.21 minor resistance will indicate short term bottoming and turn bias to the upside for rebound.

In the bigger picture, outlook remains bearish as the cross is staying well inside falling channel established since 137.49 (2018 high), as well as below falling 55 week EMA. As long as 122.87 resistance holds, the down trend form 137.49 should extend to 109.48 (2016 low). However, sustained break of 122.87 will indicate medium term bullish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | CBA Manufacturing PMI Apr P | 45.6 | 49.7 | ||

| 23:00 | AUD | CBA Services PMI Apr P | 19.6 | 38.5 | ||

| 00:30 | JPY | Manufacturing PMI Apr P | 43.7 | 44.8 | ||

| 03:00 | NZD | Credit Card Spending Y/Y Mar | -8.20% | 2.50% | 2.20% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence May | -23.4 | -2 | 2.7 | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Mar | 2.3B | 1.7B | -0.4B | |

| 07:15 | EUR | France Manufacturing PMI Apr P | 31.5 | 40 | 43.2 | |

| 07:15 | EUR | France Services PMI Apr P | 10.4 | 25.1 | 27.4 | |

| 07:30 | EUR | Germany Manufacturing PMI Apr P | 34.4 | 39.6 | 45.4 | |

| 07:30 | EUR | Germany Services PMI Apr P | 15.9 | 29 | 31.7 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Apr P | 33.6 | 39 | 44.5 | |

| 08:00 | EUR | Eurozone Services PMI Apr P | 11.7 | 24.9 | 26.4 | |

| 08:30 | GBP | Manufacturing PMI Apr P | 32.9 | 42.5 | 47.8 | |

| 08:30 | GBP | Services PMI Apr P | 12.3 | 29.6 | 34.5 | |

| 10:00 | GBP | CBI Industrial Trends Orders M/M Apr | -56 | -35 | -29 | |

| 12:30 | USD | Initial Jobless Claims (Apr 17) | 4427K | 5245K | 5237K | |

| 13:45 | USD | Manufacturing PMI Apr P | 48.5 | |||

| 13:45 | USD | Services PMI Apr P | 39.8 | |||

| 14:00 | USD | New Home Sales Mar | 661K | 765K | ||

| 14:30 | USD | Natural Gas Storage | 73B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals