Yen and Swiss Franc surge broadly today as risk aversion seems to be back as May starts. Warnings from Amazon and Apple are cited as the reason for the decline in US futures. On the other hand, Chinese is trading sharply lower on concerns that US President Donald Trump would step up tariffs wars with China, and impose restrictions on government retirement fund’s investment in Chinese stocks. Australian Dollar is the worst performing one for today, followed by New Zealand Dollar, for these reasons.

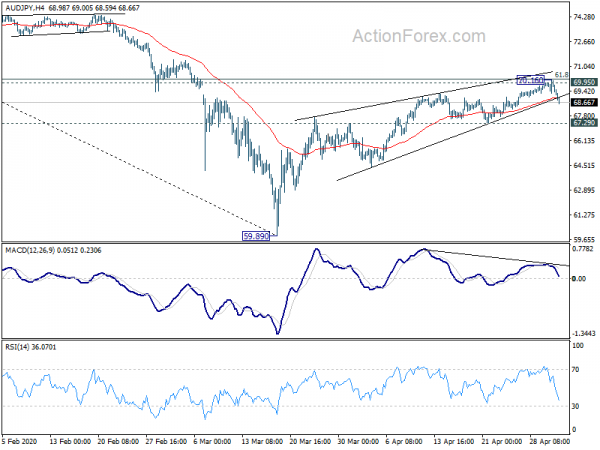

Technically, AUD/USD’s breach of 0.6444 resistance turned support should confirm short term topping. Focus will turn to 0.6253 support for indication of near term bearish reversal. Similarly, AUD/JPY is eyeing 67.29 support for indication of near term bearish reversal too. EUR/USD is pressing 1.0990 resistance for the moment, break will target 111.47 resistance as consolidation pattern form 1.0635 extends.

ECB: GDP to trough at -15%, foreign demand to drop -19% in severe coronavirus scenario

In ECB’s bulletin published today, three scenarios of the economic impact of coronavirus pandemic are presented. In the severe scenario, GDP contraction could trough by -15% in Q2. Foreign demand could contract -19% this year, without returning to pre 2019 level until end of 2022.

In the mild scenario, strict lockdown is relatively short-lived, ending the course of May 2020. There will be a gradual return to normal activity thereafter and only temporary economic losses. In the medium scenario, strict lockdown also ends in May, but it’s followed by relatively stringent and protracted containment measures. Return to normal activity is delayed and output losses persists. In the severe scenario, a longer term strict lockdown period ends in the course of June. Ongoing tough containment measures will remain in place. That will significantly dampen activity across sectors of the economy until a vaccine is available, not until mid 2021.

Eurozone foreign demand will fall by around -7%, -11% and -19% in 2020, under the mild, medium and severe scenarios respectively. Foreign demand would not return to pre 2019 level before end of 2022 under the severe scenario. GDP is expected to contract by -5%, -8% and -12% under the three scenarios. Annual figure under the severe scenario reflects a quarter trough of around -15% in Q2, followed by a protracted and incomplete recovery.

UK PMI manufacturing finalized at 32.6, production, new orders, employment, new exports all at record lows

UK PMI Manufacturing was finalized at 32.6 in April, down from March’s 47.8. Markit said that “manufacturing production, new orders and employment all contracted at the fastest rates in the 28-year survey history”. Also, the coronavirus pandemic “hit overseas demand, leading to a series-record drop in new export business.”

Rob Dobson, Director at IHS Markit: “The outstanding question remains how long the current restrictions will need to remain in place, and which sectors can start to safely reopen. The pressure is mounting, as the longer the global economy remains in lockdown the greater the cost to industry will grow, and the greater the likelihood that more jobs will be cut.”

Also from UK, mortgage approvals dropped to 56k in March. M4 money supply rose 2.8% mom in March.

Tokyo core CPI turned negative, manufacturing finalized at 41.9

Released from Japan, Tokyo all-items CPI slowed to 0.2% in April, down from 0.4% yoy. Core CPI (all items less fresh food) turned negative to -0.1% yoy, down from 0.4% yoy. Core-Core CPI (all items less fresh food and energy) dropped to 0.2% yoy, down from 0.7% yoy.

The capital city reported first decline in core CPI in three years. As an indicator of nationwide inflation trends, it raised concerns that Japan is returning into deflation. But that’s not totally unexpected as BoJ also forecast core inflation to turn negative to -0.7 to -0.3% this fiscal year.

Japan PMI Manufacturing was finalized at 41.9 in April, down from March’s 44.8, hitting an eleven-year low. Markit said plummeting demand led to further sharp production cutbacks. Supply chain disruptions intensified as coronavirus pandemic continued. Manufacturing employment fell at strongest rate since mid-2009.

Joe Hayes, Economist at IHS Markit, said: “Based on comparisons with official statistics, the latest survey data suggest manufacturing output declined by approximately 15% on an annual basis in April… The latest figures show that until we’re past the peak of the COVID-19 pandemic and export demand can begin its slow recovery, a sizeable chunk of Japan’s manufacturing economy is set to remain effectively shut down.”

BoJ minutes: Uncertain whether economy would recover strongly after coronavirus pandemic

In the minutes of BoJ’s March 16 meeting, members agreed there had been “significant uncertainties” over the coronavirus outbreak, “over the size and the persistence” of the economic impact. One member warned that the impact could be “significant and not just temporary”. One member said the downturn could be “serious and prolonged”., and it was “not easy to make up for the lost services consumption”.

Few members also said it’s “uncertain whether the economy would recover strongly after COVID-19 receded”, as economic activity had already shown some weakness due to sales tax hike and natural disasters.

Members “concurred” that downside risks to economic activity and prices “seemed to have been increasing”. They also concurred that outlook for prices was likely to be “somewhat weak for the time being”. But some members said there was a “greater possibility that the momentum toward achieving the price stability target would be lost.”

Australia AiG manufacturing dropped to 35.8 as unusual surge for manufactured food and groceries subsided

Australia AiG Performance of Manufacturing Index dropped sharply by -17.9 pts to 35.8 in April. That’s the largest monthly decline on record, and suggests that manufacturing contracted at its worst pace since April 2009. The sharp positive spike in March was more than reversed “as the unusual surge in demand for manufactured food and groceries subsided”.

Manufacturers cited a range of COVID-19 issues in April, with the most prevalent including: no new sales due to shutdowns; major customers cancelling orders; supply chain problems with inter-state freight movements, and delays; and increased prices for raw materials.

Also from Australia, PPI came in at 0.2% qoq, 1.3% yoy in Q1.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9609; (P) 0.9684; (R1) 0.9729; More…

Intraday bias in USD/CHF remains on the downside at this point. Fall from 0.9802 is seen as the third leg of the corrective pattern form 0.9901. Break of 0.9592 support will target 0.9502 next. But downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, above 0.9700 minor resistance will turn bias neutral first.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tokyo CPI Core Y/Y Apr | -0.10% | 0.10% | 0.40% | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Apr F | 41.9 | 43.7 | 43.7 | |

| 01:30 | AUD | PPI Q/Q Q1 | 0.20% | 0.30% | ||

| 01:30 | AUD | PPI Y/Y Q1 | 1.30% | 1.40% | ||

| 06:30 | AUD | RBA Commodity Index SDR Y/Y Apr | -8.10% | -10.20% | -10.70% | |

| 08:30 | GBP | Manufacturing PMI Apr F | 32.6 | 32.8 | 32.9 | |

| 08:30 | GBP | Mortgage Approvals Mar | 56K | 59K | 74K | |

| 08:30 | GBP | M4 Money Supply M/M Mar | 2.80% | 0.20% | 0.30% | 0.40% |

| 13:30 | CAD | Manufacturing PMI Apr | 46.1 | |||

| 13:45 | USD | Manufacturing PMI Apr F | 36.9 | 36.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 36.7 | 49.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 30.7 | 37.4 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 43.8 | |||

| 14:00 | USD | Construction Spending M/M Mar | -3.90% | -1.30% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals