Yen is staying as the strongest one today while the financial markets are generally mixed. Dollar is not too bothered by the ADP report which showed -20m private job losses. It’s currently trading as the second strongest, followed by Australian. Sterling is currently the weakest ones with Euro, after poor data and European commission forecasts. But Canadian Dollar has the potential to overtake as WTI crude oil is starting to pare back this week’s gains.

Technically, GBP/JPY’s break of 131.90 support suggests completion of corrective rebound from 123.94. CAD/JPY also breaks 75.40 temporary low and it’s heading back towards 73.86 low. Together with USD/JPY and EUR/JPY, the developments suggest more upside in the Yen ahead. 67.29 support in AUD/JPY and 63.73 support in NZD/JPY are to be watched for more confirmation.

In Europe, currently, FTSE is up 0.47%. DAX is down -0.42%. CAC is down -0.52%. German 10-year yield is up 0.0496 at -0.527. Earlier in Asia, Hong Kong HSI rose 1.13%. China Shanghai SSE rose 0.63%. Singapore Strait Times rose 0.75%. Japan remained on holiday.

US ADP jobs lost -20m, double total of Great Recession

US ADP report showed -20,236k losses in private sector jobs in April. As the report utilized data through April 12, full impact of coronavirus pandemic was not reflected. By sector, goods-producing businesses cut -4,229k jobs. Service-providing businesses cut -16,007k jobs. By company size, small businesses lost -6,005k jobs. Medium businesses lost -5,269k jobs. Large businesses lost -8,963k jobs.

“Job losses of this scale are unprecedented. The total number of job losses for the month of April alone was more than double the total jobs lost during the Great Recession,” said Ahu Yildirmaz, co-head of the ADP Research Institute. “Additionally, it is important to note that the report is based on the total number of payroll records for employees who were active on a company’s payroll through the 12th of the month. This is the same time period the Bureau of Labor and Statistics uses for their survey.”

European Commission forecasts -7.7% contraction in Eurozone GDP this year

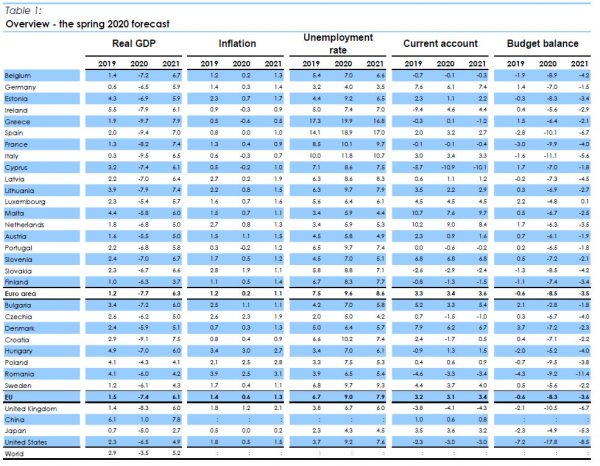

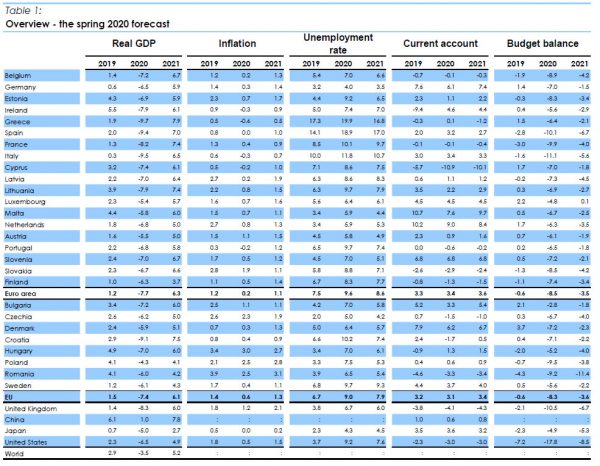

European Commission forecasts Eurozone GDP to contract -7.7% in 2020, then rebound by 6.3% in 2021. Inflation is projected to slow sharply to 0.2% in 20202, then climb back to 1.1% in 2021. Unemployment rate would jump to 9.6% in 2020, then fall back to 8.6% in 2021.

EU GDP is projected to contract -7.4% in 202, then rebound by 6.1% in 2021. Inflation would drop to 0.6% in 2020, then climb back to 1.3% in 2021. Unemployment rate would surge to 9.0% in 2020, then fall back to 7.9% in 2021.

Valdis Dombrovskis, Executive Vice-President for an Economy that works for People, said, the coronavirus pandemic is a “symmetric shock” as all EU countries are expected to fall into recession this year. The collective recovery will “depend on continued strong and coordinated responses at EU and national level.”

Paolo Gentiloni, European Commissioner for the Economy, said, “Both the depth of the recession and the strength of recovery will be uneven, conditioned by the speed at which lockdowns can be lifted, the importance of services like tourism in each economy and by each country’s financial resources. Such divergence poses a threat to the single market and the euro area”.

Eurozone retail sales dropped -11.2% in March, EU dropped -10.4%

Eurozone retail sales dropped -11.2% mom in March, slightly above expectation of -12.0% mom. By sector, volume of retail trade decreased by -23.1% mom for non-food products and by -20.8% mom for automotive fuels, while food, drinks and tobacco increased by 5.0% mom.

EU retail sales dropped -10.4% mom. Among Member States for which data are available, the largest decreases in the total retail trade volume were registered in Bulgaria (-18.1% mom), France (-17.4% mom) and Luxembourg (-16.4% mom). An increase was observed in Ireland (+0.1% mom).

Eurozone PMI composite finalized at 13.6, suggests -7.5% quarterly GDP contraction

Eurozone PMI Services was finalized at 12.0 in April, down from March’s 26.4. PMI Composite was finalized at 13.6, down from 29.7. Looking at some countries, Spain PMI composite was finalized at 9.2, Italy at 10.9, France at 11.1, Ireland at 17.3, Germany at 17.4. All are record lows.

Chris Williamson, Chief Business Economist at IHS Markit said: “With a large part of the region’s economy shut down while COVID-19 infections spiked higher, the economic data for April were inevitably going to be bad, but the scale of the decline is still shocking. The survey data are indicative of GDP falling at a quarterly rate of around 7.5%, far surpassing the worst decline seen in the global financial crisis. Jobs are also being lost at a rate never previously seen… While the rate of decline may ease in coming months, we do not expect to see any material signs of recovery until the second half of the year, and it is likely to be several years before the output lost due to the virus outbreak is fully regained.”

UK PMI construction dropped to 8.2, prospect of severe supply chain disruption will continue

UK PMI Construction dropped to 8.2 in April, down from March’s 39.2. The latest reading was the lowest since data were first collected in April 1997. Prior record low was 27.8 in February 2009.

Tim Moore, Economics Director at IHS Markit: “A drop in construction activity of historic proportions in April looks set to be followed by a gradual reopening of sites in the coming weeks, subject to strict reviews of safety measures. However, the prospect of severe disruption across the supply chain will continue over the longer-term and widespread use of the government job retention scheme has been needed to cushion the impact on employment. Looking ahead, construction companies widely commented on worries about cash flow, rising operating costs and severely reduced productivity, as well as a slump in demand for new construction projects.”

Australia retail sales rose 8.5% with heavy impact from coronavirus

Australia retail sales rose 8.5% mom in March. Growth was recorded in food retailing (24.1%), other retailing (16.6%), and household goods retailing (9.1%). Contraction was seen in cafes, restaurants and takeaway food services (-22.9%), clothing, footwear and personal accessory retailing (-22.6%), and department stores (-8.9%).

“COVID-19 heavily impacted retail trade in March” said Ben James, Director of Quarterly Economy Wide Surveys. “There was unprecedented demand in food retailing, household goods, and other retailing. However the impact of social distancing regulations saw sales fall in cafes, restaurants and takeaway food services, and discretionary spending in clothing footwear and personal accessory retailing, and department stores, was also weak. The March month saw both the strongest rise in food retailing, and the strongest fall in cafes, restaurants and takeaway food services, that we have seen in the history of the series.”

RBNZ: GDP to be lowered by 37 by level 4 coronavirus measures

RBNZ released a paper outlining the economic impacts of coronavirus containment measures. At alert level 4 with lockdown of non-essential activity, GDP would be reduced by -37% during the period. that’s slightly lower than treasury’s estimate of -40%. At alert level 3 with restrictions on trading activity, GDP will only be -19% lower during the period.

The paper also noted that the “ongoing impacts” are not included in the analysis. And, “even with significant support from fiscal and monetary policy, these would add to the overall economic costs.” Though, ” estimates of the direct impacts may be overstated because the decline in global economic activity and international travel would have reduced economic activity in New Zealand even without any containment measures.”

New Zealand employment grew 0.7% in Q1, robust before coronavirus

New Zealand employment grew 0.7% in Q1, well above expectation of -0.2% decline. Unemployment rate rose just 0.2% to 4.2%, matched expectations. Participation rate rose 0.3% to 70.4%. Labor costs index rose 0.3% qoq, below expectation of 0.5% qoq.

“Our surveys captured a robust labour market in the period before New Zealand went into COVID-19 lockdown. The unemployment rate has remained stable at around 4 percent since late 2018, after trending down since late 2012,” labour market and household statistics senior manager Sean Broughton said.

“The impact of COVID-19 on the labour market, including unemployment, hours actually worked, and underemployment, should be clearer in the June 2020 quarter,” Broughton said.

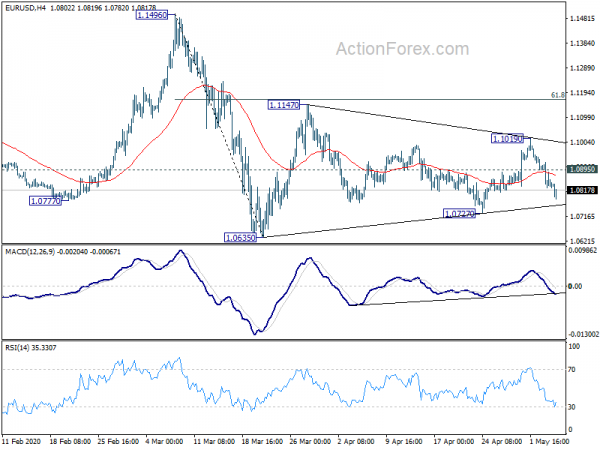

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0798; (P) 1.0862; (R1) 1.0898; More…

Intraday bias in EUR/USD stays on the downside for 1.0727 support. Break will target 1.0635 low. On the upside, above 1.0895 minor resistance will turn intraday bias neutral first. After all, corrective pattern from 1.0635 low is still in progress and could extend. But in case of rebound, upside should be by 61.8% retracement of 1.1496 to 1.0635 at 1.1167.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q1 | 0.70% | -0.20% | 0.00% | 0.10% |

| 22:45 | NZD | Unemployment Rate Q1 | 4.20% | 4.20% | 4.00% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.30% | 0.50% | 0.60% | |

| 01:30 | AUD | Retail Sales M/M Mar | 8.50% | 8.20% | 8.20% | |

| 06:00 | EUR | Germany Factory Orders M/M Mar | -15.60% | -9.00% | -1.40% | -1.20% |

| 07:45 | EUR | Italy Services PMI Apr | 10.8 | 8 | 17.4 | |

| 07:50 | EUR | France Services PMI Apr F | 10.2 | 10.4 | 10.4 | |

| 07:55 | EUR | Germany Services PMI Apr F | 16.2 | 15.9 | 15.9 | |

| 08:00 | EUR | Eurozone Services PMI Apr F | 12 | 11.7 | 11.7 | |

| 08:30 | GBP | Construction PMI Apr | 8.2 | 39.3 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | -11.20% | -12.00% | 0.90% | 0.60% |

| 09:00 | EUR | Eurozone Retail Sales Y/Y Mar | -9.20% | -10% | 3% | 2.50% |

| 12:15 | USD | ADP Employment Change Apr | -20236K | -13050K | -27K | -149K |

| 14:30 | USD | Crude Oil Inventories | 8.5M | 9.0M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals