Gold and oil price strengthen notably in otherwise rather mixed markets. US stocks reversed initial losses overnight and closed higher. Asian markets also follow and are trading up slightly. In the currency markets, Canadian Dollar is currently the strongest one for today, thanks to oil price. Sterling and Yen are the weakest ones. For the week, though, Dollar remains the strongest, followed by Swiss Franc. New Zealand, Australian Dollar and Sterling are the worst performing ones.

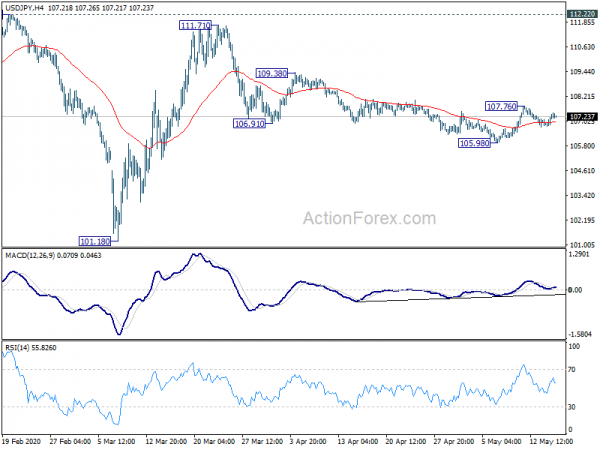

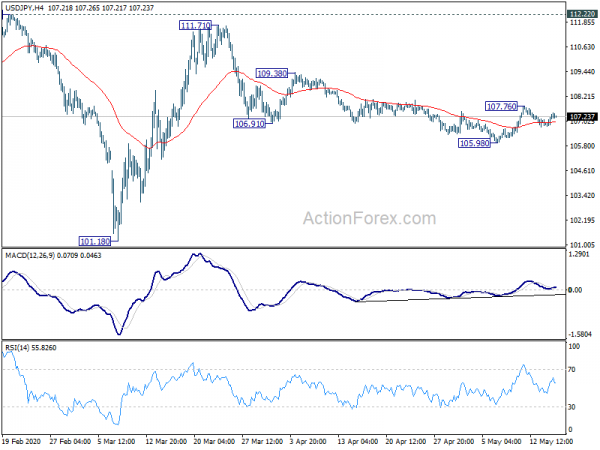

Technically, Dollar’s rally attempt couldn’t sustain so far. Range trading in EUR/USD, AUD/USD, USD/CHF and USD/CAD would likely stay in established range before weekly close. USD/JPY is probably one exception as it recovered after drawing support form 4 hour 55EMA. Focus is back on 107.76 resistance. Break will reaffirm the case that corrective fall from 111.71 has completed and bring further rise to 109.38.

In Asia, currently, Nikkei is up 0.63%. Hong Kong HSI is up 0.56%. China Shanghai SSE is up 0.32%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is up 0.0027 at -0.002. Overnight, DOW rose 1.62%. S&P 500 rose 1.15%. NASDAQ rose 0.91%. 10-year yield dropped -0.030 to 0.619.

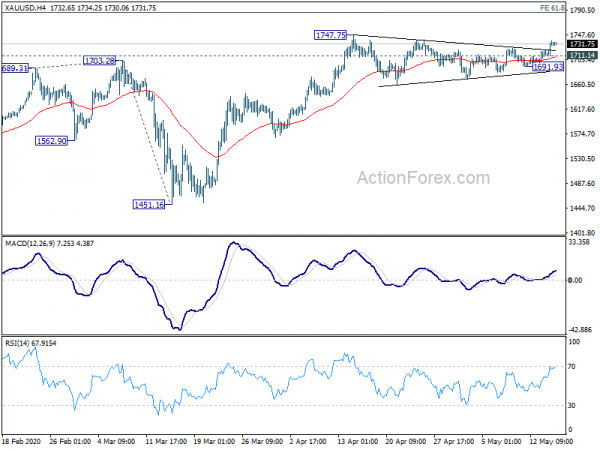

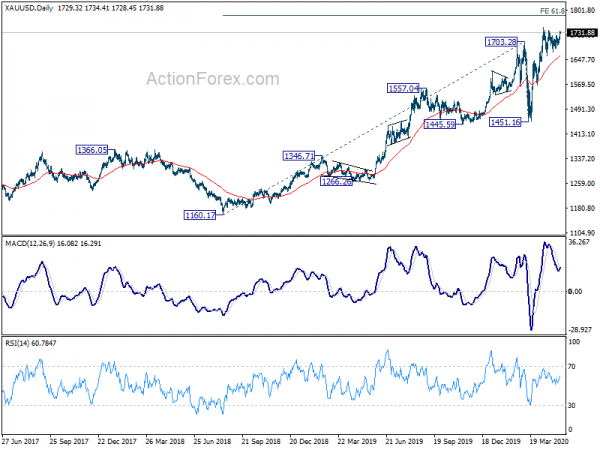

Gold finished triangle consolidation, ready to resume up trend?

Gold’s break of 1723.36 resistance overnight suggests that triangle consolidation from 1747.75 might have finally finished. Focus is immediately back on this high. Break will resume larger up trend. 61.8% projection of 1160.17 to 1703.28 from 1451.16 at 1786.80 will be an important hurdle to overcome. Sustained break there could prompt upside acceleration for the medium term. Meanwhile, break of 1711.14 minor support will dampen the bullish case and bring more range trading first.

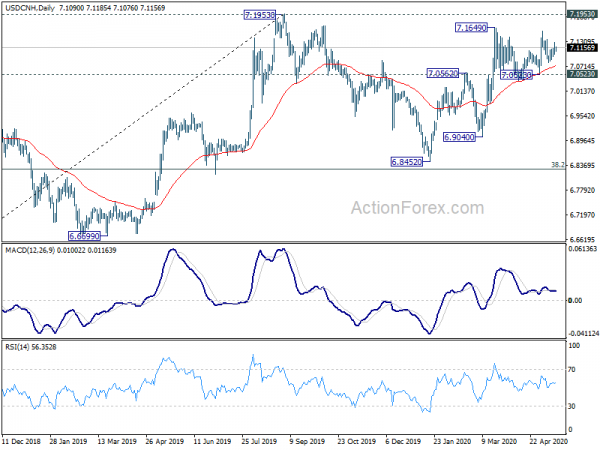

China industrial production grew again, but retail sales contracts, USD/CNH range bound

China’s industrial production grew 3.9% yoy in April, above expectation of 1.5% yoy. That’s the first expansion reading this year as activity was returning to normal from coronavirus pandemic. However, consumption remained weak as retail sales contracted -7.5% yoy in April, matched expectations. That’s already better than -15.8% contraction of sales in March. Fixed asset investment contracted -10.3% ytd yoy in April, worse than expectation of -10.0%.

USD/CNH remains bounded in range after the releases, having little reactions. Outlook is unchanged that the structure of the rebound from 6.8452 suggests that it’s the second leg of the corrective pattern from 7.1953. Hence, we’d expect upside to be limited by this 7.1953 resistance to bring another fall. Break of 7.0523 would start the third leg towards 6.8452/9040 support zone.

Overall, we’d expect range trading to continue between 38.2% retracement of 6.2354 to 7.1953 at 6.8286 and 7.1953. Breakout on either side will need some significant development to fuel.

New Zealand BusinessNZ PMI dropped to 26.1, production and new orders hardest hit

New Zealand BusinessNZ Performance of Manufacturing Index dropped -11.9 to 26.1 in April. That’s the lowest level on record since the survey began, with prior low at 36.1 record in November 2008 during the global financial crisis. Production (down from 31.4 to 19.8) and new orders (down from 36.6 to 17.8) were particularly hit hard.

BusinessNZ’s executive director for manufacturing Catherine Beard said, “looking at comments from respondents, only two words stand out, namely COVID-19 and lockdown, with 89.7% of respondents outlining negative comments”. Lockdown was lowered to level 3 on April 28 and level 2 on May 14. “This should see a return to relatively stronger levels of activity. However, to what extent the sector climbs out of rock bottom will largely depend on the ability to get new orders up and running, along with revised factory floor processes for production”.

BNZ Senior Economist, Doug Steel said that “recent negative PMI readings from around the world illustrate the widespread economic pain being felt. New Zealand’s April reading is lower than other countries we often compare ourselves to, which tallies with suggestions that NZ restrictions have been tighter than many”.

Looking ahead

Germany will release Q1 GDP in European session, together with Eurozone GDP, employment and trade balance. Later in the day, US retail sales, industrial production, Empire State manufacturing, U of Michigan consumer sentiment, and business inventories will be released.

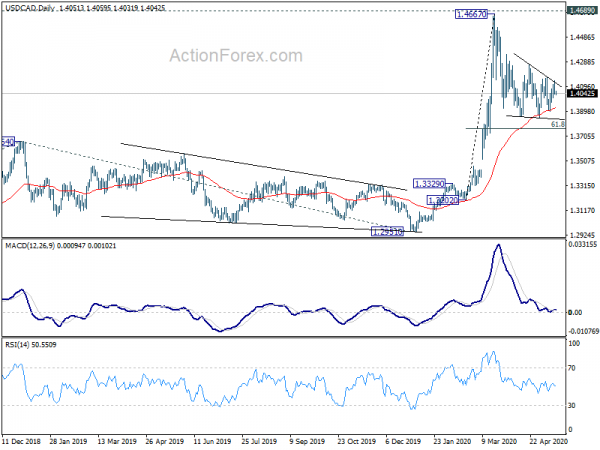

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4005; (P) 1.4073; (R1) 1.4112; More….

USD/CAD’s rebound lost momentum ahead of 1.4173 and intraday bias stays neutral. Outlook is unchanged that correction from 1.4667 might extend. In case of another fall, downside should be contained 61.8% retracement of 1.3202 to 1.4667 at 1.3762 to bring rebound. On the upside, break of 1.4173 resistance will indicate completion of the correction. Intraday bias will be turned back to the upside for retesting 1.4667. However, sustained break of 1.3762 will bring deeper fall to 1.3664 key support next.

In the bigger picture, at this point, we’re still seeing rise from 1.2061 (2017 low) as resuming up trend from 0.9056 (2007 low). Decisive break of 1.4689 (2016 high) will confirm this bullish case. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection by 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Mar | 38 | 53.2 | 53.7 | |

| 23:50 | JPY | PPI Y/Y Apr | -2.30% | -1.60% | -0.40% | |

| 2:00 | CNY | Retail Sales Y/Y Apr | -7.50% | -7.50% | -15.80% | |

| 2:00 | CNY | Industrial Production Y/Y Apr | 3.90% | 1.50% | -1.10% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Apr | -10.30% | -10.00% | -16.10% | |

| 6:00 | EUR | Germany GDP Q/Q Q1 P | -2.10% | 0.00% | ||

| 9:00 | EUR | Eurozone Trade Balance (EUR) Mar | 17.2B | 25.8B | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 P | -3.80% | -3.80% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q1 P | -2.00% | 0.30% | ||

| 12:30 | CAD | Foreign Securities Purchases (CAD) Mar | 20.61B | |||

| 12:30 | USD | Empire State Manufacturing Index May | -65 | -78.2 | ||

| 12:30 | USD | Retail Sales M/M Apr | -10.00% | -8.70% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Apr | -8.60% | -4.50% | ||

| 13:15 | USD | Industrial Production M/M Apr | -11.60% | -5.40% | ||

| 13:15 | USD | Capacity Utilization Apr | 65.00% | 72.70% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 68 | 71.8 | ||

| 14:00 | USD | Business Inventories Mar | -0.50% | -0.40% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals