Executive Summary

- The United Kingdom is the latest major economy to report the negative effects of COVID-19 on economic activity. Q1 GDP fell 2% quarter-over-quarter, with weakness in the services and industrial sector. In addition, March monthly GDP was very soft, falling 5.9% month-overmonth, largely guaranteeing another sizable contraction in the second quarter.

- Against the backdrop of soft economic trends and with COVID-19 restrictions being lifted only gradually, monetary policymakers have indicated their willingness to ease policy further. We now expect the Bank of England to raise its asset purchase target a further £100 billion at its June meeting.

U.K. Q1 GDP Weak, Q2 Will be Even Weaker

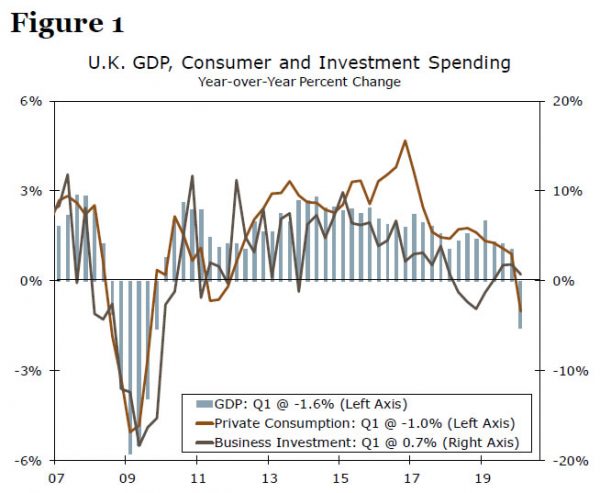

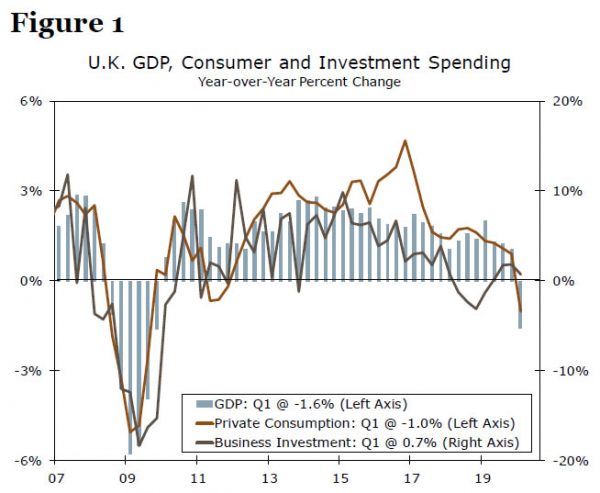

The release of U.K. Q1 GDP figures this week offered the most comprehensive indication yet of the early economic damage inflicted by COVID-19 and the associated lockdown measures. First quarter GDP fell 2% quarter-over-quarter, a bit less than expected, and 1.6% year-over-year. On a quarterly basis, the fall in Q1 GDP was the largest since 2008. Softness was widespread across the economy, including a 1.7% quarter-over-quarter fall in private consumption, a 10.8% quarter-over-quarter fall in exports and a decline in government spending. On an industry basis, service sector output fell 1.9% quarter-over-quarter and industrial output fell 2.1% quarterover- quarter in Q1.

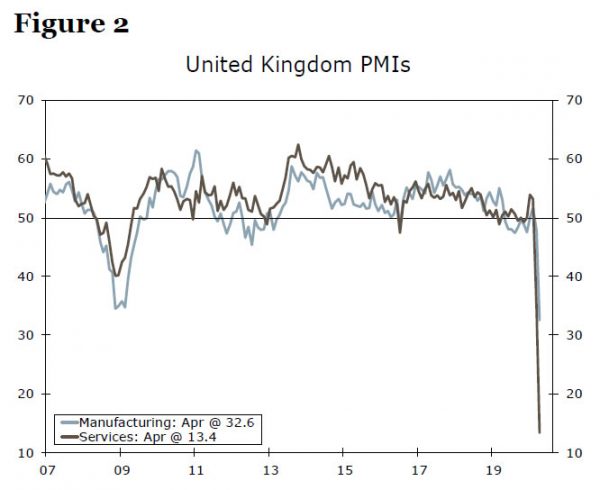

In addition to the quarterly summary of economic activity, a separate release of monthly GDP figures provided an additional level of granularity that largely guarantees an even bigger contraction in Q2—a period where lockdown measures to control the spread of the COVID-19 virus became much more stringent. For the month of March alone, U.K. GDP fell 5.9% monthover- month, led by a decline in service sector output. As a result, the level of GDP for March was 4% below its Q1 average, a soft starting point for Q2. Moreover, survey data for April suggest U.K. GDP probably fell further last month. The services PMI fell to a record low 13.4, while the manufacturing PMI fell to 32.6.

For the second quarter, we forecast U.K. GDP to decline by around 13% quarter-over-quarter, yet that is nowhere near the most pessimistic outlook, with some analysts predicting Q2 GDP could fall by 20% or more quarter-over-quarter. We do expect the U.K. economy to return to positive growth in the second half of this year, although we do not expect that gradual recovery to be anywhere near as rapid as the contraction in the first half of this year. As a result, for full-year 2020 we have revised our forecast for U.K. economic growth lower, and now expect the economy to contract 8.1% this year. Finally, we note that the March CPI eased to 1.5% year-over-year and core CPI eased to 1.6% year-over-year, although we suspect that inflation trends are of more limited focus for Bank of England policymakers at the current juncture.

Expect More Bank of England Easing Soon

The month of March saw a flurry of activity from the Bank of England (BoE) as it became increasingly clear the U.K. economy was likely to take a severe hit from COVID-19. Among the many actions from the BoE:

- The central bank lowered its policy interest rate by a cumulative 65 bps to just 0.10% during March.

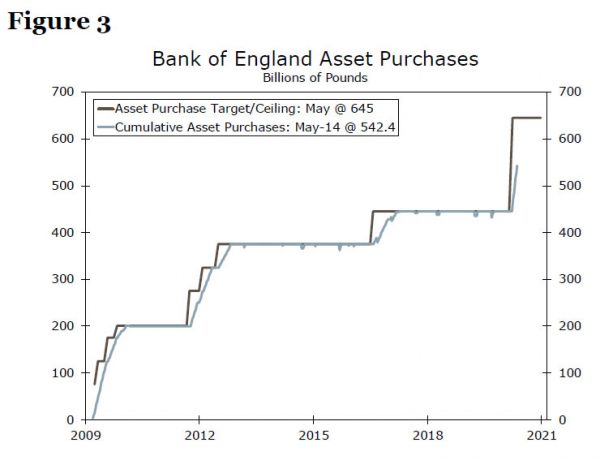

- Resumed its asset purchase program, increasing its asset purchase target by £200 billion to £645 billion.

- Introduced a Term Funding scheme with additional incentives for small- and medium-sized enterprises.

While policy activity has been a bit calmer since March, policymaker rhetoric has remained active. Of particular note is the BoE’s most recent monetary policy announcement in early May. The BoE held rates steady and made no adjustments to its other monetary policy initiatives. However, the central bank did offer an illustrative scenario in which it saw Q2 GDP slumping 25% quarter-over-quarter, while BoE Governor Bailey said the bank will “act as necessary to deliver the monetary and financial stability that are essential,” referring to that as a “total and unwavering commitment.” Speaking in an interview, Bailey said the central bank could do more quantitative easing and that it was keeping all options open, and indeed, two of nine policymakers voted for an immediate £100 billion increase in quantitative easing at the May meeting.

To date, the BoE has forcefully implemented its non-conventional monetary policy measures announced in March. By mid-May, the central bank had conducted a further £98 billion of asset purchases, or a pace of around £14 billion per week. Meanwhile, the Term Funding scheme amounted to £11.3 billion. At the current rate, asset purchases would reach their target of £645 billion by early July. Considering that timeline and with the U.K. economy likely to be suffering from severe weakness through much of Q2, we expect the Bank of England to increase its asset purchase target by a further £100 billion to £745 billion at its June meeting. In addition, we would not rule out either a larger increase in June (that is, more than £100 billion), or another announcement of a further increase at the BoE’s September meeting.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals