Markets are in mild risk off mode before weekly close, awaiting US President Donald Trump’s “interesting” and “powerful” measures on China. Though, this time, Euro is boosted as the strongest one, followed by Yen. Dollar and Swiss Franc are the weakest for today. Overall, Euro is staying as the best performer for the week, cheering EU’s recovery plan. Dollar and Yen are the weakest ones.

Technically, EUR/CHF’s break of 1.0710/15 cluster resistance is a signal medium term bottoming. Further rise would be seen to 1.0811 key support turned resistance to confirm. EUR/GBP’s rally from 0.8670 is in progress for 0.9182 fibonacci resistance. Focus will now be on 1.5322 resistance in EUR/CAD and firm break will bring stronger rise to 1.5532. Break of 1.6763 resistance will also bring stronger rise to 1.7194 resistance.

In Europe, FTSE is down -0.95% currently. DAX is down -0.70%. CAC is down -0.26%. German 10-year JGB yield is down -0.029 at -0.446. Earlier in Asia, Nikkei dropped -0.18%. Hong Kong HSI dropped -0.74%. China Shanghai SSE rose 0.22%. Singapore Strait Times dropped -0.18%. Japan 10-year JGB yield rose 0.0064 to 0.007.

US personal income grew 10.5% in Apr, spending dropped -13.6

US personal income grew 10.5% mom, or USD 1.97T in April, versus expectation of -7.0% mom decline. Spending, on the other hand, dropped -13.6% mom, or USD 1.89T, worse than expectation of -12.6% mom. Headline PCE price index slowed to 0.5% yoy, down from 1.3% yoy. Core PCE price index also dropped to 1.0% yoy, down from 1.7% yoy.

Also from US, good trade deficit widened to USD -69.7B in April versus expectation of USD -64.1B. Wholesale inventories rose 0.4%.

Canada GDP contracted -7.2% in Mar, prelim data points to -11% decline in Apr

Canada GDP tumbled a massive -7.2% mom in March, but was better than expectation of -9.0% mom. Overall, 19 of the 20 industrial sectors were down, contributing the monthly decline. StatCan also said that preliminary information indicates a further slump of -11% decline in real GDP in April.

IPPI dropped -2.3% mom in April versus expectation of -2.0% mom. RMPI dropped -13.4% mom versus expectation of -23.9% mom.

Eurozone CPI slowed to 0.1% yoy, ECB Visco warns of prices-demand downward spiral

Eurozone CPI slowed to 0.1% yoy in May, down from 0.3% yoy. That’s also the lowest level in four years. Nevertheless, the slow down was largely driving by -12.0% yoy in energy prices. Excluding energy, CPI was unchanged at 1.4%. CPI ex energy and unprocessed food was unchanged at 1.1% yoy. CPI ex energy, good, alcohol & tobacco was also unchanged at 0.9% yoy.

Separately, ECB Governing Council member Ignazio Visco warned, “steps must be taken to counter the significant risk of low inflation and the marked fall in economic activity from translating into a permanent reduction in expected inflation or into the possible resurfacing of the threat of deflation.”

“Also as a result of the high levels of public and private debt in the euro area as a whole, this could trigger a dangerous spiral between the fall in prices and that in aggregate demand.”

France Q1 GDP revised down to -5.3%, consumer spending dropped -20.2% in Apr

According to second estimate, France GDP dropped -5.3% in Q1, revised down from -4.8% in first estimate. Household consumption expenditure recorded an unprecedented drop (-5.6%). Total gross fixed capital formation (GFCF) fell even more sharply (-10.5%). All in all, total domestic demand (excluding changes in inventories) contracted: it contributed -6.0 points to GDP growth.

Imports fell (-5.7%), but less sharply than exports which fell by -6.1%. Overall, the contribution of foreign trade balance to GDP growth was zero. Conversely, changes in inventories contributed positively to GDP growth (+0.6 points).

Also released, France CPI slowed to 0.2% yoy in May, down from 0.4% yoy, missed expectation of 0.3% yoy. Consumer spending dropped -20.2% mom in April, worse than expectation of -15%.

From Germany, retail sales dropped -5.3% mom in April versus expectation of -11.0% mom. Import price index dropped -1.8% mom versus expectation of -1.5% mom.

Swiss KOF dropped to 53.2, manufacturing continues to have strongest negative impact

Swiss KOF Economic Barometer dropped to 53.2 in May, down from 59.7, missed expectation of 70.2. The reading has halved now since the beginning of the year. KOF said that as in April, “the manufacturing sector continues to have the strongest negative impact. Indicators relating to foreign demand also have a clearly negative impact on the barometer.” By contrast, “private consumption and the construction industry are sending slightly improved signals.”

Japan industrial production plunged -9.1% in April, auto sector particularly severe

Japan’s industrial production plunged -9.1% mom in April, even worse than expectation of -5.1% mom. That’s the biggest decline since comparable data became available back in 2013. “Conditions among manufacturers particularly in the auto sector are severe, but production has already restarted in China and I think that they will be resumed in the United States and Europe as well,” said Economy Minister Yasutoshi Nishimura after the release of the data.

Also from Japan, unemployment rate edged up by 0.1% to 2.6% in April, better than expectation of 2.7%. Retail sales dropped -13.7% yoy, worse than expectation of -11.5% yoy. Housing starts dropped -12.9% yoy versus expectation of -12.0% yoy. On the other hand, consumer confidence rose to 24.0, up form 21.6 and beat expectation of 19.2. Tokyo CPI core turned positive to 0.2% yoy in May, up from -0.1% yoy.

New Zealand consumer confidence improved to 97.3, success in fighting coronavirus

New Zealand ANZ Consumer Confidence rebounded by 12pts to 97.3 in May, but remained at “very subdued levels”. Consumers’ perceptions regarding next year’s economic outlook lifted 10 pts -46, still at very low level.

ANZ said: We absolutely should celebrate our success in beating back COVID-19, but the wreckage lies all around us. The loss of jobs in international tourism in particular is a hole that won’t be filled easily or quickly. We see elevated unemployment affecting household sentiment and spending for a long time yet.”

The government relaxed the coronavirus restrictions further today, allowing gatherings of up to 100 people. Finance Minister Grant Robertson said New Zealand “now has some of the most relaxed settings in the world. Because of our success in fighting this virus, our public health efforts to go hard and go early have allowed us to open up our economy much quicker than many other countries,” he said.”

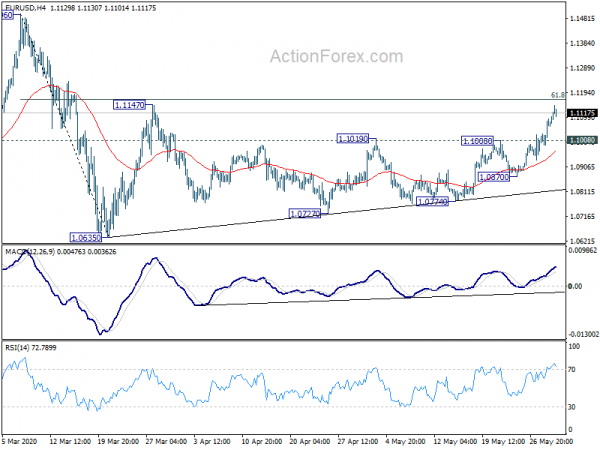

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1017; (P) 1.1055; (R1) 1.1119; More…

EUR/USD rises to as high as 1.1145 so far today and intraday bias stays on the upside. We’re still seeing price actions from 1.0635 as a corrective pattern. Upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, below 1.1008 resistance turned support will turn intraday bias to the downside for 1.0870 support. However, sustained break of 1.1167 will pave the way to 1.1496 key resistance next.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y May | 0.20% | -0.20% | -0.10% | |

| 23:30 | JPY | Unemployment Rate Apr | 2.60% | 2.70% | 2.50% | |

| 23:50 | JPY | Industrial Production M/M Apr P | -9.10% | -5.10% | -3.70% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | -13.70% | -11.50% | -4.70% | |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.00% | 0.60% | 1.10% | |

| 05:00 | JPY | Housing Starts Y/Y Apr | -12.90% | -16.00% | -7.60% | |

| 05:00 | JPY | Consumer Confidence Index May | 24 | 19.2 | 21.6 | |

| 06:00 | EUR | Germany Import Price Index M/M Apr | -1.80% | -1.50% | -3.50% | |

| 06:00 | EUR | Germany Retail Sales M/M Apr | -5.30% | -11.00% | -5.60% | |

| 06:45 | EUR | France GDP Q/Q Q1 | -5.30% | -5.80% | -5.80% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 8.30% | 7.60% | 7.50% | |

| 08:00 | CHF | KOF Leading Indicator May | 53.2 | 70.2 | 63.5 | 59.7 |

| 09:00 | EUR | Eurozone CPI Y/Y May P | 0.10% | 0.20% | 0.30% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y May P | 0.90% | 0.90% | 0.90% | |

| 12:30 | CAD | Raw Material Price Index Apr | -13.40% | -23.90% | -15.60% | |

| 12:30 | CAD | Industrial Product Price M/M Apr | -2.30% | -2.00% | -0.90% | |

| 12:30 | CAD | GDP Annualized Q/Q Q1 | -8.20% | 0.30% | 0.60% | |

| 12:30 | CAD | GDP M/M Mar | -7.20% | -9.00% | 0.00% | |

| 12:30 | USD | Personal Income M/M Apr | 10.50% | -7.00% | -2.00% | -2.20% |

| 12:30 | USD | Personal Spending Apr | -13.60% | -12.60% | -7.50% | -6.90% |

| 12:30 | USD | PCE Price Index M/M Apr | -0.50% | -0.30% | -0.20% | |

| 12:30 | USD | PCE Price Index Y/Y Apr | 0.50% | 1.30% | ||

| 12:30 | USD | Core PCE Price Index M/M Apr | -0.40% | -0.10% | 0.00% | |

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 1.00% | 1.70% | ||

| 12:30 | USD | Wholesale Inventories Apr P | 0.40% | -0.80% | -1.00% | |

| 12:30 | USD | Goods Trade Balance (USD) Apr | -69.68 B | -64.1B | -64.2B | -64.98 B |

| 13:45 | USD | Chicago PMI May | 40 | 35.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May F | 73.7 | 73.7 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals