Risk appetite continues in Asian session, with help from positive data from China. China’s economy appears to be on track for recovery even though the road would remain bumpy. In the currency markets, New Zealand Dollar is leading Australian Dollar higher, followed by Euro. Dollar, Yen, Swiss Franc continue to be the weakest ones on current market sentiments.

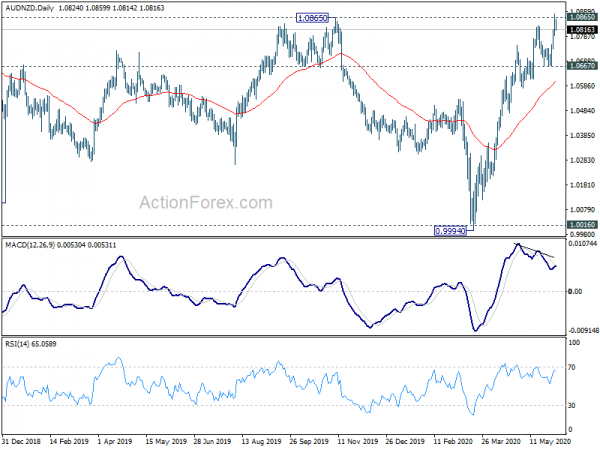

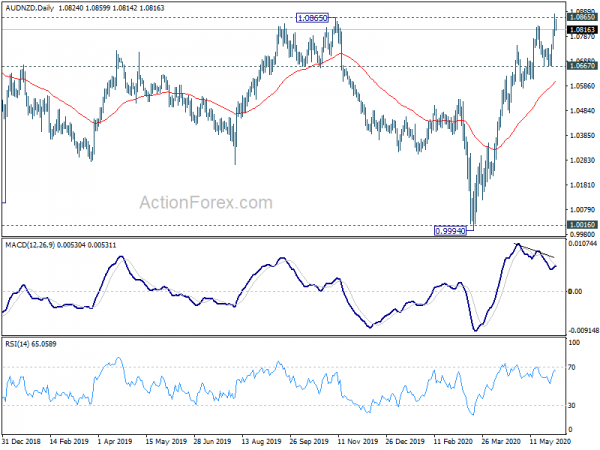

Technically, AUD/NZD is pressing 1.0865 near term resistance but struggles to break through clearly so far. Reaction to this resistance level will decide which of Aussie or Kiwi would lead the next risk rally move. Meanwhile, EUR/GBP is also pressing 0.8880 support now and break will suggest completion of near term rebound from 0.8670. This development would also decide who’d be the stronger European major in the next move.

In Asia, Nikkei closed up 1.29%. Hong Kong HSI is up 1.34%. China Shanghai SSE is up 0.21%. Singapore Strait Times is up 2.12%. Japan 10-year JGB yield is up 0.0038%. Overnight, DOW rose 1.05%. S&P 500 rose 0.82%. NASDAQ rose 0.59%. 10-year yield rose 0.0018 to 0.680.

Swiss GDP contracted -2.6% in Q1, worse than expectation

Swiss GDP contracted -2.6% qoq in Q1, worse than expectation of -2.2% qoq. “Due to the coronavirus pandemic and the measures to contain it, economic activity in March was severely restricted. The international economic slump also slowed down exports.”

By production approach, manufacturing dropped -1.3% qoq. Construction dropped -4.2% qoq. Trade dropped -4.4%. Accommodation and food dropped -23.4% qoq. Business services dropped -1.9% qoq. Health and social activities dropped -3.9% qoq. Arts, entertainment and recreation dropped -5.4% qoq. On the other hand, finance and insurance rose 1.5% qoq. Public administration rose 0.8% qoq.

By expenditure approach, private consumption dropped -3.5% qoq. Equipment and software investment dropped -4.0% qoq. Construction investment dropped -0.4% qoq. Export of services dropped -4.4% qoq. Import of goods dropped -1.1% qoq while imports of services dropped -1.2% qoq. On the other and, government consumption rose 0.7% qoq. Exports of goods rose 3.4% qoq.

Australia GDP contracted -0.3% in Q1, started first recession in 29 years

Australia GDP contracted -0.3% qoq in Q1, matched expectations. That’s the first contraction in 9 years. Also, the recession should have started in Q1, for the first time in 29 years. Annually, growth slowed to 1.4% yoy, lowest since September 2009 when Australia was in the midst of the global financial crisis.

Treasurer Josh Frydenberg confirmed that the economy is in recession and “that is on the basis of the advice that I have from the Treasury department about where the June quarter is expected to be.” “Based on what we know from Treasury, we’re going to see a contraction in the June quarter, which is going to be a lot more substantial than what we have seen in the March quarter,” he added.

Though, Frydenberg also said “in the face of a one-in-100-year global pandemic, the Australian economy has been remarkably resilient.” “This strength gave us the fiscal firepower to respond as we have done; Around $260 billion in economic support, or the equivalent of more than 13 per cent of GDP.”

Also from Australia, AiG Performance of Construction Index rose to 24.9 in May, up from 21.6. Building permits dropped -1.8% mom in April, better than expectation of -15.0% mom.

Japan PMI composite rose to 27.8 in May, indicative of -10% annualized GDP contraction

Japan PMI Services improved to 26.5 in May, up from April’s record low of 21.5. PMI Composite also rose slightly to 27.8, up from April’s record low of 25.8. The data signed “historically unparalleled” decline in output.

Joe Hayes, Economist at IHS Markit, said: “While the month of May has seen the Japanese government reduce the stringency of its lockdown, latest survey data indicated that economic activity continued to sink at a rate which had previously been unrivalled before the coronavirus crisis began… Looking at May’s survey data in isolation, the reading of the Composite PMI is indicative of GDP falling by around 10% on an annual basis. Taking into consideration the April reading, which was even worse, it is clear that the impact on second quarter GDP is going to be enormous.”

China Caixin PMI composite rose to 54.5, more time still needed to return to normal

China Caixin PMI Services rose to 55.0 in May, up from April’s 44.4. PMI Composite rose to 54.5, up from 47.6, back in expansion territory. Markit said that business activity and new work rose at quickest pace since late 2010. Pandemic continued to weigh heavily on export orders. Employment fell slightly as firms look to raise efficiency.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In general, the improvement in supply and demand was still not able to fully offset the fallout from the pandemic, and more time is needed for the economy to get back to normal. The composite employment gauge stayed in negative territory as companies were cautious about increasing headcounts. But they were relatively optimistic about the economy’s forward momentum, and look forward to implementation of the policies announced during the annual session of China’s top legislature.”

Looking ahead

Tiff Macklem will have his first meeting as BoC governor today. BoC is widely expected to keep interest rate unchanged at 0.25%. The unconventional monetary policy, i.e.: QE, will also remain the same. Given the disappointing GDP and inflation data, the accompanying statement will maintain a cautious tone, with the pledge to extend the stimulus if needed to return inflation to the range of 1-3%. Also, there will be no economic projections nor press conference. More in New BOC Governor to Carry On Legacy, Keeping Rate and QE Intact.

Eurozone will release services PMI final, unemployment rate and PPI. Germany will also release unemployment. UK will release PMI services final too. Later in the day, US ISM non-manufacturing and ADP employment are the major focuses. Factory orders will also be featured.

USD/CAD Daily Outlook

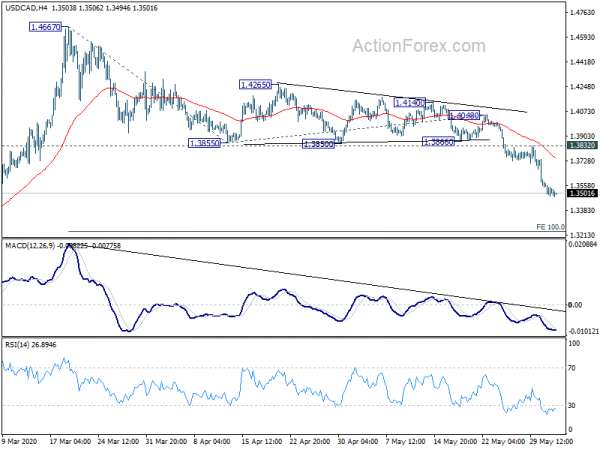

Daily Pivots: (S1) 1.3474; (P) 1.3530; (R1) 1.3575; More….

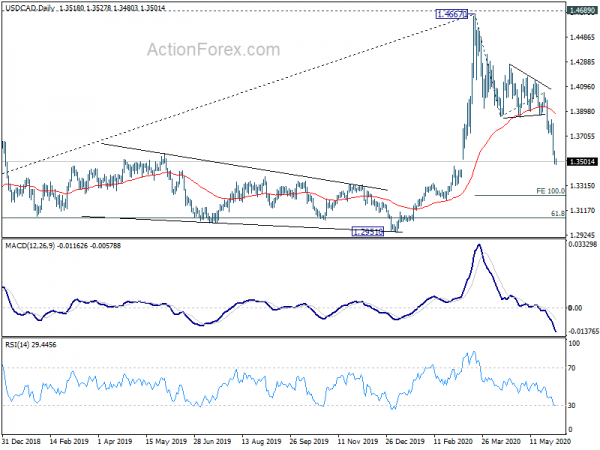

Intraday bias in USD/CAD remains on the downside at this point. Decline from 1.4667 is in progress and should target 100% projection of 1.4667 to 1.3855 from 1.4048 at 1.3236 next. On the upside, break of 1.3832 resistance is needed to indicate short term topping. Otherwise, outlook will stay mildly bearish in case of recovery.

In the bigger picture, current development suggests that whole rise from 1.2061 (2017 low) has completed at 1.4667, after failing (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement at 1.3056 and possibly below. This will now remain the favored case as long as 1.3855 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 24.9 | 21.6 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Apr | -2.40% | -1.70% | ||

| 1:30 | AUD | GDP Q/Q Q1 | -0.30% | -0.30% | 0.50% | |

| 1:30 | AUD | Building Permits M/M Apr | -1.80% | -15.00% | -4.00% | -2.50% |

| 1:45 | CNY | Caixin Services PMI May | 55 | 47.4 | 44.4 | |

| 5:45 | CHF | GDP Q/Q Q1 | -2.60% | -2.20% | 0.30% | |

| 7:45 | EUR | Italy Services PMI May | 27 | 10.8 | ||

| 7:50 | EUR | France Services PMI May F | 29.4 | 29.4 | ||

| 7:55 | EUR | Germany Services PMI May F | 31.4 | 31.4 | ||

| 7:55 | EUR | Germany Unemployment Rate May | 6.20% | 5.80% | ||

| 7:55 | EUR | Germany Unemployment Change May | 200K | 373K | ||

| 8:00 | EUR | Italy Unemployment Apr | 9.20% | 8.40% | ||

| 8:00 | EUR | Eurozone Services PMI May F | 28.7 | 28.7 | ||

| 8:30 | GBP | Services PMI May | 27.9 | 27.8 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Apr | 8.20% | 7.40% | ||

| 9:00 | EUR | Eurozone PPI M/M Apr | -1.70% | -1.50% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Apr | -4.00% | -2.80% | ||

| 12:15 | USD | ADP Employment Change May | -9500K | -20236K | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | -0.10% | |||

| 13:45 | USD | Services PMI May F | 36.9 | 36.9 | ||

| 14:00 | USD | ISM Non-Manufacturing PMI Apr | 43 | 41.8 | ||

| 14:00 | USD | ISM Non-Manufacturing Employment Apr | 35.8 | 30 | ||

| 14:00 | USD | Factory Orders M/M Apr | -12.40% | -10.40% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | 7.9M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals