Yen surges broadly this week and remains generally firm in Asian session. Pull back in treasury yield is seen as a factor driving the Yen higher. Yet, the lack of selling in Yen despite strong risk appetite, with NASDAQ extending record run, is something to note. it might be an early hint of risk pull back and we’d find out pretty soon. Staying in the currency markets, Dollar is currently trying to recover some ground but stays the weakest for the week. Commodity currencies are generally softer in Asia together with Sterling.

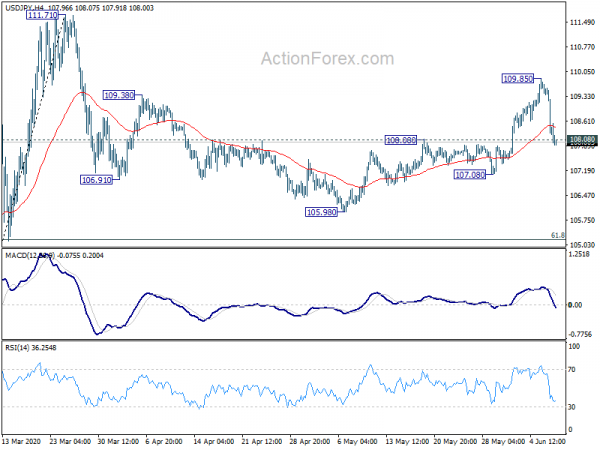

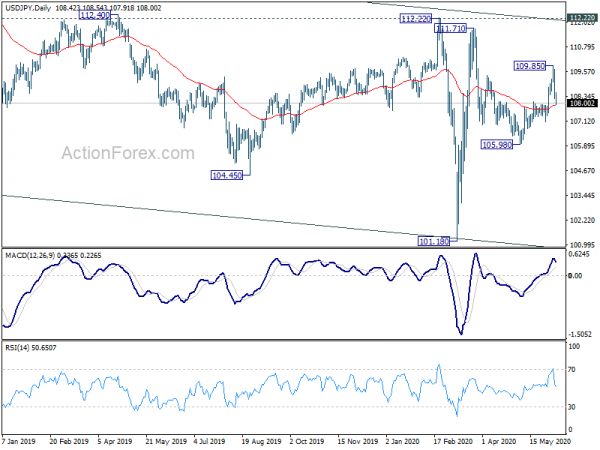

Technically, Yen’s comeback is rather massive. USD/JPY’s break of 108.08 support suggests that rebound from 105.98 has possibly completed at 109.85. EUR/JPY’s touching of 121.84 minor support suggests short term topping at 124.43. 136.95 minor support in GBP/JPY is a level to watch to confirm short term topping. EUR/GBP is back pressing 0.8866 minor support and break will indicate near term bearish reversal. So, Sterling is rather mixed, caught between Yen and Euro.

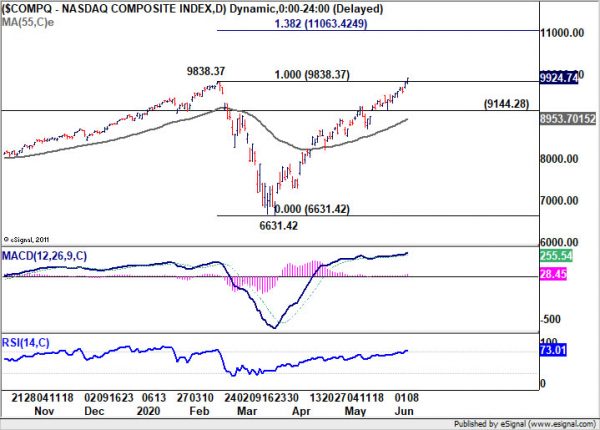

In Asia, currently, Nikkei is down -0.46%. Hong Kong HSI is up 1.66%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 1.30%. Japan 10-year yield is down -0.0247 at 0.021. Overnight, DOW rose 1.7% to 27572.44. S&P 500 rose 1.20% to 3232.39. NADSAQ rose 1.13% to 9924.74, new record high. 10-year yield dropped -0.020 to 0.884.

Australia NAB business confidence rose to -20, key factor in how businesses recover

Australia NAB Business Confidence rose to -20 in May, up from April’s -45. Business Conditions rose to -24, up from 34. Looking at some details, trading conditions rose to -14, up from -31. Profitability rose to -19, up form -35. Employment rose just slightly to -31, up from -34.

According to Alan Oster, NAB Group Chief Economist said negative conditions indicates that “activity was still extremely weak in May.” Also, “forward orders suggest that in the short-term activity is likely to remain weak in the business sector and combined with low capacity utilisation and still very weak confidence points to ongoing restraint in Capex spending”. Recovery in confidence will likely be a “key factor” in how businesses recovery from the largest downturn since 1930s.

New Zealand ANZ business confidence rose to -33, still a huge tourism-shaped hole

New Zealand ANZ Business Confidence rose another 9 pts to -33 in June’s preliminary reading, up from may’s -41.8. Activity outlook rose to -29.1, up from -38.7. Looking at some details, export intentions rose to 17.1, from -32.2. Investment intentions rose to -21.6, up from -31.7. Employment intentions rose to -34.0, from -42.4.

The improvement reflected New Zealand’s “continued steady progress out of lockdown”, but “levels remain very low”. ANZ also noted, emerging into Level 1 lockdown, “disruption has waned, and normality beckons”. But “there is a huge tourism-shaped hole” in the economy. Also, “people will feel comfortable going into a shop or restaurant – that’s a huge win – but whether they’ll feel comfortable spending money is another question again.”

UK and Japan to start trade talks, and Japan pushes for auto tariffs removal

UK and Japan are going to start trade talks today, for a free-trade agreement that would replace the current EU one, after the supposed Brexit date of January 1, 2021.

Ahead of of the video conference, UK International Trade Secretary Liz Truss said “We aim to strike a comprehensive free trade agreement that goes further than the deal previously agreed with the EU, setting ambitious standards in areas such as digital trade and services.” “This deal will provide more opportunities for businesses and individuals across every region and nation of the U.K.” Truss added.

On the other hand, Japan Trade Minister Hiroshi Kajiyama said, “in the negotiations, we hope to urge (Britain) to bring forward the period for which tariffs will be removed mainly for auto and autoparts … as well as adopt high-level rules on digital trade.”

Elsewhere

Japan labor cash earnings dropped -0.6% yoy in April versus expectation of -1.0% yoy. M2 rose 5.1% yoy in May versus expectation of 3.8% yoy. UK BRC retail sales monitor rose 7.9% yoy in May.

Swiss unemployment rate, Germany trade balance, France trade balance and Eurozone GDP revision will be featured in European session. US will release wholesale inventories later in the day.

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.89; (P) 108.79; (R1) 109.34; More..

USD/JPY’s fall from 109.85 extended to as low as 107.91 today. Break of 108.08 resistance turned support argue that rebound from 105.98 has completed with three waves up to 109.85. The development argues that the pattern from 111.71 is possibly in the third leg. Intraday bias is back to the downside for 107.08. Break will target 105.98. For now, risk will stay mildly on the downside as long as 109.85 resistance holds.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec2016). Hence, there is clear indication of trend reversal yet. Break of 105.98 support would extend the down trend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y May | 7.90% | 5.70% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | -0.60% | -1.00% | 0.10% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 5.10% | 3.80% | 3.70% | |

| 1:30 | AUD | NAB Business Conditions May | -24 | -34 | ||

| 1:30 | AUD | NAB Business Confidence May | -20 | -46 | -45 | |

| 5:45 | CHF | Unemployment Rate May | 3.60% | 3.30% | ||

| 6:00 | JPY | Machine Tool Orders Y/Y May P | -48.30% | |||

| 6:00 | EUR | Germany Trade Balance (EUR) Apr | 11.9B | 12.8B | ||

| 6:45 | EUR | France Trade Balance (EUR) Apr | -3.4B | -3.3B | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 | -3.80% | -3.80% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q1 F | -0.20% | -0.20% | ||

| 14:00 | USD | Wholesale Inventories Apr | 0.40% | 0.40% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals