The financial markets are suddenly in deep risk aversion today, particular on fear of a second wave of coronavirus pandemic. A John Hopkins Center senior scholar has already warned that “there is a new wave coming in” parts of the US. In the currency markets, Australian Dollar is trading as the weakest one, leading other commodity currencies lower. On the other hand, Yen and Swiss France are the strongest ones, followed by Dollar.

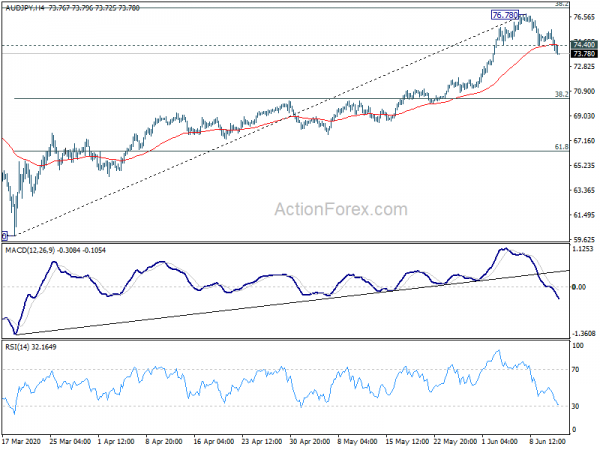

Technically, AUD/JPY broke 74.40 minor support to confirm short term topping at 76.78. CAD/JPY broke 79.95 minor support to confirm short term topping at 81.91. Now, a focus will be on 0.6898 minor support in AUD/USD and break will also confirm short term topping. USD/CAD could also have a take on 1.3572 minor resistance to confirm short term bottoming too.

In Europe, currently, FTSE is down -2.91%. DAX is down -2.90%. CAC is down -3.17%. German 10-year yield is down -0.0795 at -0.406. Earlier in Asia, Nikkei dropped -2.82%. Hong Kong HSI dropped -2.27%. China Shanghai SSE dropped -0.78%. Singapore Strait Times dropped -3.44%. Japan 10-year JGB yield dropped -0.0183 to 0.006.

US initial jobless claims dropped to 1.54m, continuing claims dropped to 20.9m

US initial jobless claims dropped -355k to 1542k in the week ending June 6. Four-week moving average of initial claims dropped -286k to 2002k. Continuing claims dropped -339k to 20929k in the week ending May 30. Four-week moving average of continuing claims dropped -405k to 21988k.

PPI came in at 0.4% mom, -08% yoy in May, above expectation of 0.1% mom, -1.1% yoy. PPI core was at -0.1% mom, 0.3% yoy, versus expectation of 0.1% mom, 0.9% yoy.

ECB Lane: PEPP has proven to be particular effect in current state of uncertainty

ECB Chief Economist Philip Lane told Il Sole 24 that the central bank “will do everything it can to ensure the current crisis won’t be made worse by a credit crunch.” For now, the asset purchases under the Pandemic Emergency Purchase programme “have proven to be particularly effective in the current state of uncertainty, market stress.”

Lane also said the traditional asset purchase program would “bring inflation in line with monetary policy target”. Emergency and temporary PEPP was to “face the very strong unprecedented negative inflation shock” from coronavirus pandemic, and “stabilize the financial markets”. Eurozone’s inflation is still far from the central bank’s target and quantitative easing will “still be needed.

BoJ watching developments in Hong Kong and Asia financial markets

BoJ Governor Haruhiko Kuroda reiterated the central bank’s pledge to take all necessary steps to support the economy. He said, “given the uncertainty over outlook on coronavirus pandemic, government and BO need to take all means available flexibly.”

On the financial markets, he stressed that “Hong Kong dollar’s peg to the US dollar holds key to Hong Kong’s economy.” The central bank is “watching carefully developments in Hong Kong, Asian financial markets.”

Japan large industries BSI dropped to -47.6 in Q2, worst in 11 years

According to Japan’s Finance Ministry and Cabinet Office, Business Sentiment Indicator of all large industries plunged to -47.6 in Q2, down from -10.1 in Q1. That’s the worst reading in 11 years. Large manufacturing BSI dropped to -52.3, down from -17.2. Large non-manufacturing BSI dropped to -45.3, down from -6.6. All industries medium BSI dropped to -54.1, down from -13.1. All industries small BSI dropped to -61.1, down form -25.3.

“There are many small businesses in the service industry which are greatly affected by the coronavirus,” the Ministry of Finance said. “The pandemic has contributed to a larger drop in business sentiment among small and medium-sized companies than during the crisis caused by of Lehman Brothers.”

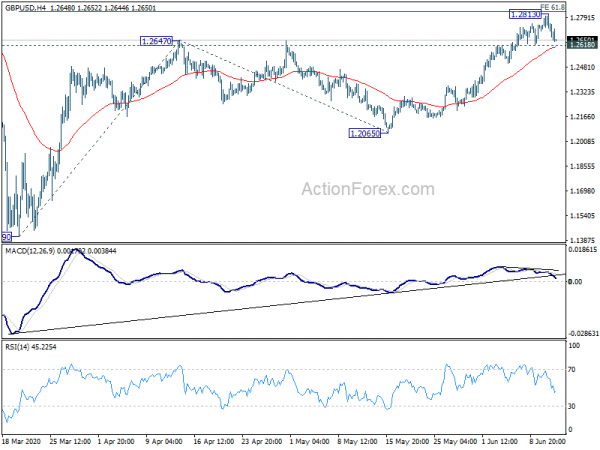

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2699; (P) 1.2756; (R1) 1.2805; More….

Intraday bias in GBP/USD remains neutral for the moment. On the downside, break of 1.2618 minor support will indicate short term topping at 1.2813, ahead of 61.8% projection of 1.1409 to 1.2647 from 1.2065 at 1.2830. Intraday bias will be turned back to the downside for 55 day EMA (now at 1.2457). Sustained break there will argue that whole rebound from 1.1409 has completed. On the upside, firm break of 1.2830 will extend the rise from 1.1409 to 100% projection at 1.3303.

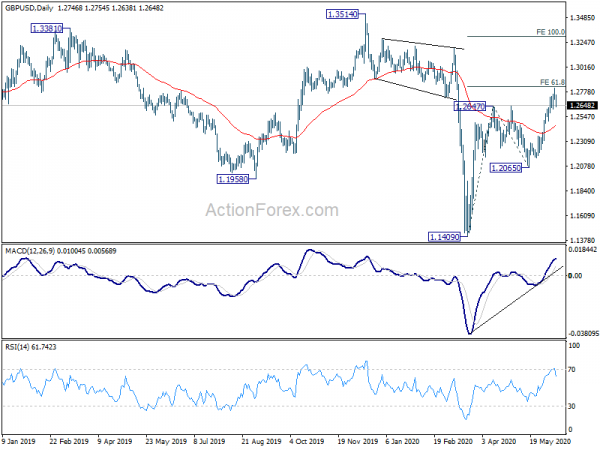

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance May | -32% | -24% | -21% | |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 3.30% | 3.40% | ||

| 08:00 | EUR | Italy Industrial Output M/M Apr | -19.10% | -25.80% | -28.40% | |

| 12:30 | USD | PPI M/M May | 0.40% | 0.10% | -1.30% | |

| 12:30 | USD | PPI Y/Y May | -0.80% | -1.10% | -1.20% | |

| 12:30 | USD | PPI Core M/M May | -0.10% | -0.10% | -0.30% | |

| 12:30 | USD | PPI Core Y/Y May | 0.30% | 0.90% | 0.60% | |

| 12:30 | USD | Initial Jobless Claims (Jun 5) | 1542K | 1877K | 1897K | |

| 14:30 | USD | Natural Gas Storage | 93B | 102B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals