Swiss Franc surges broadly today and it’s currently the strongest one. There is no clear sign of risk aversion in other markets, with major European indices in black, while DOW futures is slightly higher. Yen is also generally soft too. Franc’s strength might be an indication of concerns over geopolitical tensions. Or it could be some form of positioning ahead of tomorrow’s SNB rate decision. Meanwhile, Euro and Sterling are the weakest ones for today. Sterling is weighed down mildly by CPI inflation data, as well as expectation of BoE QE expansion tomorrow.

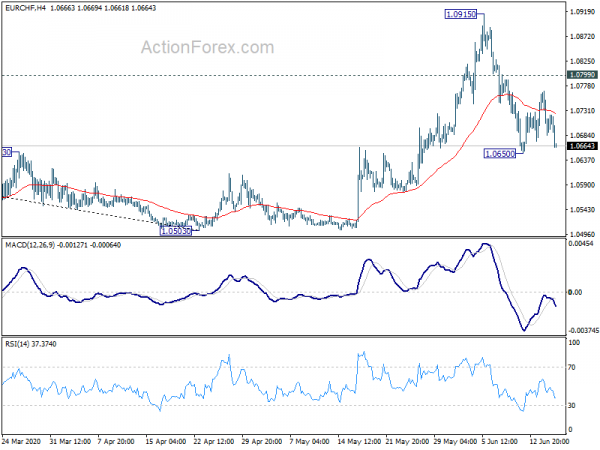

Technically, 1.0650 temporary low in EUR/CHF is a focus for the rest of the day. Break will resume the decline from 1.0915 towards 1.0503 low. GBP/CHF could also be eyeing 1.1837 temporary low and break will extend the fall from 1.2259 to 1.1716 key near term support. Another one to watch is EUR/JPY, and break of 120.25 temporary low will resume the fall from 124.43 too.

In Europe, currently, FTSE is up 0.72%. DAX is up 0.81%. CAC is up 1.35%. German 10-year yield is up 0.0073 at -0.418. Earlier in Asia, Nikkei dropped -0.56%. Hong Kong HSI rose 0.56%. China Shanghai SSE rose 0.14%. Singapore Strait Times rose 0.10%. Japan 10-year JGB yield dropped -0.0025 to 0.020.

Canada CPI turned deeper negative at -0.4% in May

Canada CPI turned deeper negative at -0.4% yoy in May, down from -0.2% yoy in April, below expectation of 0.0% yoy. Prices rose in four of the eight major components on a year-over-year basis. Transportation prices contributed the most to the decline in the CPI, mainly because of lower gas prices compared with May 2019. Food prices (+3.1%) remained high in May, with the largest year-over-year increase among the major components.

CPI common dropped to 1.4% yoy, down from 1.6% yoy, missed expectation of 1.6% yoy. CPI median dropped to 1.9% yoy, down from 2.0% yoy, matched expectations. CPI trimmed dropped to 1.7% yoy, down from 1.8% yoy, matched expectations.

US building permits dropped -14.4% in May to 1.220m annualized rate. Housing starts dropped -4.3% to 0.973m annualized rate.

Eurozone CPI finalized at 0.1% yoy in May, core CPI at 0.9% yoy

Eurozone CPI was finalized at 0.1% yoy in May, down from April’s 0.3% yoy. Core CPI (ex-energy, food, alcohol & tobacco) was finalized at 0.9% yoy, unchanged from April’s reading.

EU CPI was finalized at 0.6% yoy in May, down from April’s 0.7% yoy. The lowest annual rates were registered in Estonia (-1.8%), Luxembourg (-1.6%), Cyprus and Slovenia (both -1.4%). The highest annual rates were recorded in Poland (3.4%), Czechia (3.1%) and Hungary (2.2%).

UK CPI slowed to 0.5% in May, lowest since 2016

UK CPI slowed further to 0.5% yoy in May, down from 0.8% yoy, matched expectations. That’s the lowest level since 2016. Nearly all categories of prices contributed to the decline in CPI, except food and non-alcoholic beverages. Core CPI dropped to 1.2% yoy, down from 1.4% yoy, matched expectations too.

Also released, RPI slowed to 1.0% yoy in May, down from 1.5% yoy, missed expectation of 1.3% yoy. PPI input came in at 0.3% mom, -10.0% yoy, versus expectation of -4.0% mom, -8.7% yoy. PPI output was at -0.3% mom, -1.4% yoy, versus expectation of -0.1% mom, -0.9% yoy. PPI output core was at 0.0% mom, 0.6% yoy versus expectation of 0.1% mom, 0.7% yoy.

RBNZ Orr confident with the plenty of tools

RBNZ Governor Adrian Orr said he’s “very pleased” with the impact of the central bank’s QE program. As for the next steps in monetary easing, he’s confidence that there are “plenty of tools”. But for now, the main game in town is about fiscal policy.

Orr added the next steps for RBNZ could include an increase in the size of QE, and the number of instruments included in the program. Also, negative case rate is still a possibility.

Asian business sentiment plunged to record low in Q2

The Thomson Reuters/ INSEAD Asian Business Sentiment index plunged to 35 in Q2, down from 53. That’s a 11-year low, and the second time the index fell below 50. Around 16% of the 93 companies surveyed said a “deepening recession” was a key risk for the next six months. More than half expects declining staffing and levels and business volumes.

“We ran this survey right at the edge when things were getting really bad,” said Antonio Fatas, economics professor at global business school INSEAD. “We can see this complete pessimism which is spread across sectors and countries in a way that we haven’t seen before.”

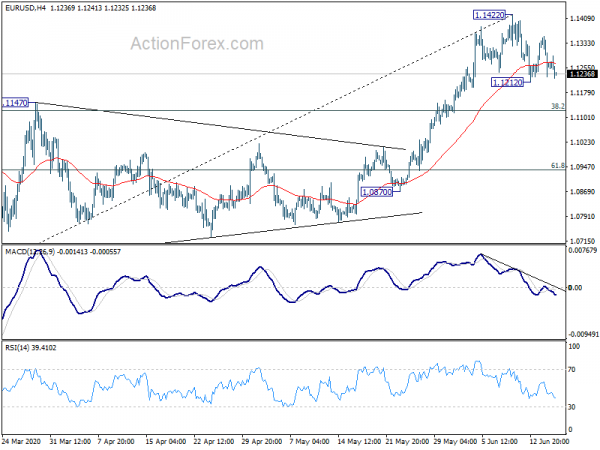

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1208; (P) 1.1281; (R1) 1.1333; More….

Intraday bias in EUR/USD remains neutral for the moment. On the upside, break of 1.1422 will resume whole rebound from 1.0635 and target 1.1495 key resistance next. On the downside, break of 1.1212 will resume the fall from 1.1422 to 38.2% retracement of 1.0635 to 1.1422 at 1.1121. Sustained break there will argue that whole rebound from 1.0635 has completed and bring deeper fall to 61.8% retracement at 1.0936.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q1 | 1.56B | 1.59B | -2.66B | -2.77B |

| 23:50 | JPY | Trade Balance (JPY) May | -0.60T | -0.68T | -1.00T | -1.04T |

| 01:00 | AUD | Westpac Leading Index M/M May | 0.20% | -1.50% | ||

| 06:00 | GBP | CPI M/M May | 0.00% | 0.00% | -0.20% | |

| 06:00 | GBP | CPI Y/Y May | 0.50% | 0.50% | 0.80% | |

| 06:00 | GBP | Core CPI Y/Y May | 1.20% | 1.20% | 1.40% | |

| 06:00 | GBP | RPI M/M May | -0.10% | 0.10% | 0.00% | |

| 06:00 | GBP | RPI Y/Y May | 1.00% | 1.30% | 1.50% | |

| 06:00 | GBP | PPI Input M/M May | 0.30% | -4.00% | -5.10% | -5.50% |

| 06:00 | GBP | PPI Input Y/Y May | -10.00% | -8.70% | -9.80% | -10.20% |

| 06:00 | GBP | PPI Output M/M May | -0.30% | -0.10% | -0.70% | -0.80% |

| 06:00 | GBP | PPI Output Y/Y May | -1.40% | -0.90% | -0.70% | |

| 06:00 | GBP | PPI Output Core M/M May | 0.00% | 0.10% | -0.10% | 0.00% |

| 06:00 | GBP | PPI Output Core Y/Y May | 0.60% | 0.70% | 0.60% | 0.70% |

| 09:00 | EUR | Eurozone CPI Y/Y May F | 0.10% | 0.10% | 0.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May F | 0.90% | 0.90% | 0.90% | |

| 12:30 | USD | Housing Starts May | 0.97M | 1.10M | 0.89M | 0.93M |

| 12:30 | USD | Building Permits May | 1.22M | 1.23M | 1.07M | |

| 12:30 | CAD | CPI M/M May | 0.30% | 0.80% | -0.70% | |

| 12:30 | CAD | CPI Y/Y May | -0.40% | 0.00% | -0.20% | |

| 12:30 | CAD | CPI Common Y/Y May | 1.40% | 1.60% | 1.60% | |

| 12:30 | CAD | CPI Median Y/Y May | 1.90% | 1.90% | 2.00% | |

| 12:30 | CAD | CPI Trimed Y/Y May | 1.70% | 1.70% | 1.80% | |

| 14:30 | USD | Crude Oil Inventories | 0.0M | 5.7M | ||

| 16:00 | USD | Fed’s Chair Powell testifies |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals