Selloff in Yen and Dollar intensifies mildly today while Australian Dollar and Euro are picking up some rally. Investors sentiments are generally lifted by better than expected PMIs. In particular, France and Australia appear to be back in expansion. European indices are trading higher while US futures point to higher open. In particular, NASDAQ looks set to resume recent record run after much briefer than expected consolidations.

Technically the strong rebound in EUR/USD suggests the near term correction from 1.1422 has completed. Focus is now on 1.1353 minor resistance and break will likely send the pair through 1.1422 high. USD/CHF’s break of 0.9463 minor support turns focus back to 0.9376 low and break will resume the fall from 0.9901. USD/CAD also breaks 1.3504 minor support and focus is back on 1.3315 low.

In Europe, currently, FTSE is up 1.44%. DAX is up 2.71%. CAC is up 1.77%. Germany 10-year yield is up 0.022 at -0.446. Earlier in Asia, Nikkei rose 0.50%. Hong Kong HSI rose 1.62%. China Shanghai SSE rose 0.18%. Singapore Strait Times rose 1.49%. Japan 10-year JGB yield dropped -0.0003 to 0.010.

UK PMIs: Return to growth in Q3, but longer term recovery prospects highly uncertain

UK PMI Manufacturing rose to 50.1 in June, up from 40.7, beat expectation of 45.3. The reading is a four-month high, and back in expansion. PMI Services rose to 47.0, up from 29.0, above expectation of 39.4, also a four-month high. PMI Composite rose to 47.6, up from 30.0, a four-month high too.

Chris Williamson, Chief Business Economist at IHS Markit, said:

“June’s PMI data add to signs that the economy looks likely return to growth in the third quarter… However, … the longer term recovery prospects remain highly uncertain…. Uncertainty over recovery prospects and job prospects also mean demand for many goods, especially non-essential big-ticket items, is likely to remain weak for many months, with Brexit uncertainty also continuing to cast a shadow over the economy.

“Our forecasting team therefore expects the economy to contract by 11.9% this year before expanding by a relatively modest 4.9% in 2021, which is far more cautious than the 15% surge anticipated in 2021 by the Bank of England.”

Eurozone PMI composite rose to 47.5, lifting of lockdown to bring downturn to an end into summer

Eurozone PMI Manufacturing rose to 48.9 in June, up from 39.4, above expectation of 43.8. PMI Services rose to 47.3, up from 30.5, above expectation of 40.5. PMI Composite rose to 47.5, up from 31.9, hitting at 4-month high but stayed in contraction.

Chris Williamson, Chief Business Economist at IHS Markit said: “The flash eurozone PMI indicated another substantial easing of the region’s downturn in June… While second quarter GDP is still likely to have dropped at an unprecedented rate, the rise in the PMI adds to expectations that the lifting of lockdown restrictions will help bring the downturn to an end as we head into the summer… However, with the timing of a return to normal still something that can only be speculated upon, and virus-related restrictions likely to continue to hit many businesses for the rest of the year, we remain very cautious of the strength and sustainability of any economic rebound.”

Germany PMIs stay in contraction, likely to be a protracted recovery

Germany PMI Manufacturing rose to 44.6 in June, up from 36.6, above expectation of 41.0. PMI Services rose to 45.8, up form 32.6, above expectation of 41.1. PMI Composite rose to 45.8, up from 32.3, hitting a four-month high but stayed in contraction.

Phil Smith, Principal Economist at IHS Markit said: “While the loosening of lockdown restrictions has had a positive effect on some parts of the economy, the PMI’s latest reading is still within contraction territory, which shows this is likely to be a protracted recovery as coronavirus-related disruption and uncertainty continue to weigh on demand. There was no separating manufacturing and services in terms of output trends in June, with both seemingly over the worst but far from firing on all cylinders.”

France PMIs: Finally enter recovery, manufacturing at 21-month high

France PMI Manufacturing rose to 52.1 in June, up from 40.6, well above expectation of 46.0. That’s also the highest level in 21 months. PMI Services rose to 50.3, up from 31.1, beat expectation of 45.2. That’s the highest level in 4 months. PMI Composite rose to 51.3, up from May’s 32.1, also a four-month high.

Eliot Kerr, Economist at IHS Markit said: “The latest PMI data suggests that France is finally entering a period of recovery as we move past the peak of the coronavirus crisis. The further loosening of restrictions has allowed some semblance of normality to resume, with many businesses and workers returning to work, particularly in the manufacturing sector. Barring any large scale second outbreak, demand should also follow activity into expansion territory, as confidence continues to recover. Given ongoing cross-border restrictions in many countries around the world, this will most likely be driven by the domestic market in the short-run, with international demand taking a little longer to recover.”

Japan PMIs: Two-speed recovery to undermine a sustainable return to pre-coronavirus level

Japan PMI Manufacturing dropped to 37.8 in June, down from May’s 38.4. The data indicates productions fell at the more severe pace since March 2009. PMI Services, on the other hand, recovered to 42.3, up from 26.5. PMI Composite rose to 37.9, up from 27.8, staying well in contraction region.

Joe Hayes, Economists at IHS Markit, said: “While the services sector downturn eased noticeably, goods production fell at at accelerated pace in June. The rate of decline in manufacturing order books remained severe, hinting that the shape of the recoveries in the services and manufacturing sector could be very different. A two-speed recovery would undermine a sustainable return to -pre-COID-19 levels of economic activity”.

Australia CBA PMI composite rose to 52.6, economy back in expansion

Australia CBA PMI Services rebounded strongly to 53.2 in June, up from 26.9, back in expansionary region. PMI Manufacturing also rose to 49.8, up from 44.0, very close to 50 stabilization level. PMI composite rose to 52.6, up from 28.1, also back in expansion, and hit the highest level in 9 months.

CBA Head of Australian Economics, Gareth Aird said: “The June PMIs are consistent with our view that we are now past the low point in economic activity. Overall conditions are still very soft, but there were a few encouraging pieces of information in the PMIs. Confidence has improved in both the manufacturing and services sectors. And the lift in both input and output prices is welcome as it suggests we are more likely to be in a period of disinflation rather than deflation. The further decline in employment was disappointing, but given the lagging relationship between employment and output it is not surprising. We should see headcount lift from here.”

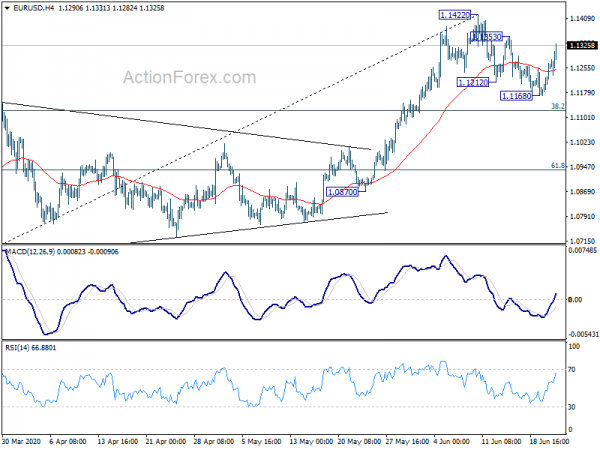

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1199; (P) 1.1235; (R1) 1.1300; More….

EUR/USD’s strong rebound today argues that corrective pull back from 1.1422 might have completed. Focus is back on 1.1351 minor resistance. Break will turn bias to the upside for 1.1422 and then 1.1496 key resistance. Nevertheless, break of 1.1168 will resume the correction to 38.2% retracement of 1.0635 to 1.1422 at 1.1121.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | CBA Manufacturing PMI Jun P | 49.8 | 44 | ||

| 23:00 | AUD | CBA Services PMI Jun P | 53.2 | 26.9 | ||

| 00:30 | JPY | Jibun Bank Manufacturing PMI Jun P | 37.8 | 39.5 | 38.4 | |

| 07:15 | EUR | France Manufacturing PMI Jun P | 52.1 | 46 | 40.6 | |

| 07:15 | EUR | France Services PMI Jun P | 50.3 | 45.2 | 31.1 | |

| 07:30 | EUR | Germany Manufacturing PMI Jun P | 44.6 | 41 | 36.6 | |

| 07:30 | EUR | Germany Services PMI Jun P | 45.8 | 41.1 | 32.6 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jun P | 46.9 | 43.8 | 39.4 | |

| 08:00 | EUR | Eurozone Services PMI Jun P | 47.3 | 40.5 | 30.5 | |

| 08:30 | GBP | Manufacturing PMI Jun P | 50.1 | 45.3 | 40.7 | |

| 08:30 | GBP | Services PMI Jun P | 47 | 39.5 | 29 | |

| 13:45 | USD | Manufacturing PMI Jun P | 44 | 39.8 | ||

| 13:45 | USD | Services PMI Jun P | 43.7 | 37.5 | ||

| 14:00 | USD | New Home Sales May | 630K | 623K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals