Markets are in strong risk-on mode again on coronavirus vaccine hopes. Moderna group said earlier that the vaccine candidate produced a robust immune system response in a large group of people. Next will be a decisive clinical trial in July. Major indices in Asia and Europe record strong gains, except China and Hong Kong. DOW future is also up more than 500pts just ahead of open. In the currency markets, Australian Dollar is currently the strongest one followed by New Zealand and Sterling. Swiss Franc takes the lead lower, followed by Dollar.

Technically, Dollar will be testing key support level against Euro and Aussie very soon. These levels are 1.1496 resistance in EUR/USD and 0.7064 in AUD/USD. Sustained break of these level will medium term bullish implications. Gold is still struggling to break through 1817.91 short term top as sideway trading continues. But any downside acceleration in the greenback could easily push gold through this resistance level.

In Europe, currently, FTSE is up 1.95%. DAX is up 1.71%. CAC is up 2.34%. Germany 10-year yield is up 0.0126 to -0.431. Earlier in Asia, Nikkei rose 1.59%. Hong Kong HSI rose 0.01%. China Shanghai SSE dropped -1.56%. Singapore Strait Times rose 1.10%. Japan 10-year JGB yield dropped -0.0015 to 0.024.

US Empire State manufacturing rose to 17.2, but 6-month outlook dropped to 38.4

US Empire State Manufacturing index rose to 17.2 in July, up from -0.2, above expectation of 7.85. It’s also the first positive reading since February. However, six-months ahead business conditions dropped -18.1 pts to 38.4, down from 56.5.

The indexes for future new orders and future shipments fell somewhat, but remained near 40. The index for future employment rose to 21.1, suggesting firms expect to increase employment in the months ahead. The capital expenditures index rose to 9.1, a sign that firms, on net, planned to increase capital spending.

Also released, US import price index rose 1.4% mom in June versus expectation of 1.0% mom. Canada manufacturing sales rose 10.7% mom in May versus expectation of 8.6% mom.

BoE Tenreyro: GDP to follow an interrupted or incomplete V-shaped trajectory

Bank of England policymaker Silvana Tenreyro said the UK economic outlook will “continue to depend on the global and domestic spread of COVID-19.” “Assuming prevalence gradually falls, my central case forecast is for GDP to follow an interrupted or incomplete ‘V-shaped’ trajectory, with the first quarterly step-up in Q3,” she added.

She also noted, “we are already seeing indications of a sharp recovery in purchases that were restricted only because of mandated business closures.” “But I think that this will be interrupted by continued risk aversion and voluntary social distancing in some sectors, remaining restrictions on activities in others, and in general, by higher unemployment.”

On monetary policy, she said “I remain ready to vote for further action as necessary to support the economy.”

UK CPI accelerated to 0.6% in June, core CPI up to 1.4%

UK CPI accelerated to 0.6% yoy in June, up from 0.5% yoy, beat expectation of 0.6% yoy. That’s also the first in 12-month CPI rate since January. Core CPI also accelerated to 1.4% yoy, up from 1.2% yoy, beat expectation of 1.2% yoy. RPI also climbed to 1.1% yoy, up from 1.0% yoy, matched expectations.

Also released, PPI input came in at 2.4% mom, -5.4% yoy, versus expectation of 2.5% mom, -6.0% yoy. PPI output was at 0.3% mom, -0.8% yoy, versus expectation of 0.2% mom, -0.9% yoy. PPI core output came in at 0.0% mom, 0.5% yoy.

BoJ stands pat, forecasts deeper contraction in 2020

BoJ left monetary policy unchanged as widely expected. Under the Yield Curve Control framework, short term policy interest rate is held at -0.1%. BoJ will also continue to purchase unlimited JGBs to keep 10-year yield at around 0%. It maintained the pledge to continue with QQE “as long as it is necessary” for achieving 2% price target in a stable manner. The decision was made by 8-1 vote, as Kataoka Goushi dissented again, pushing for more stimulus by lowering short and long term interest rates. He also pushed for revising the forward guidance to relate it to price stability target.

In the Outlook for Economic Activity and Prices, BoJ said the economy is “likely to improve gradually from the second half of this year” But the pace is expected to be “only moderate while the impact of the novel coronavirus remains worldwide”. Year-on-year CPI less fresh food is “likely to be negative for the time being”. The projected growth rates and projected CPI in the report are “broadly within the range” or prior forecasts. Nevertheless, outlook is “extremely unclear” with risks “skewed to the downside”.

In the new forecasts:

- GDP to contract -5.7% to -4.5% in fiscal 2020 (versus prior -5.0% to -3.0%).

- GDP to grow 3.0% to 4.0% in fiscal 2021 (vs prior 2.8% to 3.9%).

- GDP to growth to grow 1.3% to 1.6% in fiscal 2022 (vs prior 0.8% to 1.6%).

- Core CPI at -0.6% to 0.4% in fiscal 2020 (vs prior -0.7% to -0.3%).

- Core CPI at 0.2% to 0.5% in fiscal 2021 (vs prior 0.0% to 0.7%).

- Core CPI at 0.5% to 0.8% in fiscal 2022 (vs prior 0.4% to 1.0%).

Australia Westpac consumer sentiment dropped -6.1% on coronavirus resurgence

Australia Westpac Consumer Sentiment Index dropped -6.1% to 87.9 in July, down from June’s 93.7. The decline reversed all of June’s impressive gain and took the index back to the weak levels seen in May. Nevertheless, it’s still 16% above April’s extreme low of 75. Westpac said “sentiment has been rocked by the resurgence in Coronavirus cases over the last month.” The survey cover the week Melbourne returned to lockdown. And it’s of “some concern” that it pre-dates the news of a significant cluster of coronavirus cases in Sydney.

Westpac expects RBA to “maintain its current highly stimulatory stance and continue to commit to steady policy for the foreseeable future” at the upcoming meeting on August 4. More immediately, the government would likely release revised economic forecasts on July 23 fiscal update, with further fiscal stimulus.

EUR/USD Mid-Day Outlook

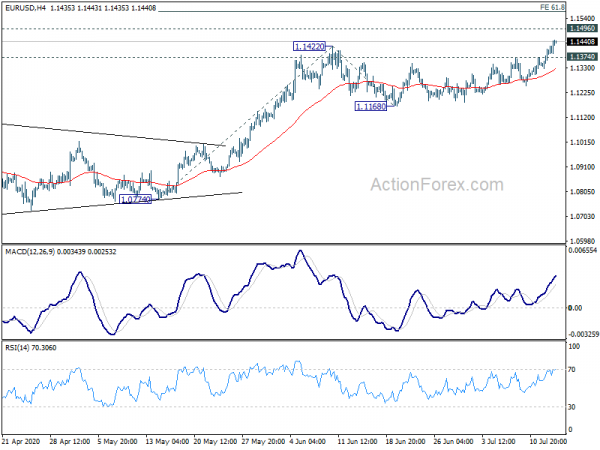

Daily Pivots: (S1) 1.1346; (P) 1.1377; (R1) 1.1430; More….

EUR/USD’s rally accelerates to as high as 1.1447 so far today. Intraday bias remains on the upside for 1.1496 key resistance first. Firm break there will carry larger bullish implications and target 61.8% projection of 1.0774 to 1.1422 from 1.1168 at 1.1568 first. On the downside, break of 1.1374 minor support will turn intraday bias neutral first.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Consumer Confidence Jul | -6.10% | 6.30% | ||

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 03:00 | JPY | BoJ Monetary Policy Statement | ||||

| 06:00 | GBP | CPI M/M Jun | 0.10% | 0.00% | 0.00% | |

| 06:00 | GBP | CPI Y/Y Jun | 0.60% | 0.50% | 0.50% | |

| 06:00 | GBP | Core CPI Y/Y Jun | 1.40% | 1.20% | 1.20% | |

| 06:00 | GBP | RPI M/M Jun | 0.20% | 0.20% | -0.10% | |

| 06:00 | GBP | RPI Y/Y Jun | 1.10% | 1.10% | 1.00% | |

| 06:00 | GBP | PPI Input M/M Jun | 2.40% | 4.50% | 0.30% | 0.90% |

| 06:00 | GBP | PPI Input Y/Y Jun | -5.40% | -6.00% | -10% | -9.40% |

| 06:00 | GBP | PPI Output M/M Jun | 0.30% | 0.20% | -0.30% | -0.20% |

| 06:00 | GBP | PPI Output Y/Y Jun | -0.80% | -0.90% | -1.40% | -1.20% |

| 06:00 | GBP | PPI Core Output M/M Jun | 0.00% | 0.00% | ||

| 06:00 | GBP | PPI Core Output Y/Y Jun | 0.50% | 0.60% | 0.60% | |

| 12:30 | CAD | Manufacturing Sales M/M May | 10.70% | 8.60% | -28.50% | -27.90% |

| 12:30 | USD | Empire State Manufacturing Index Jul | 17.2 | 7.85 | -0.2 | |

| 12:30 | USD | Import Price Index M/M Jun | 1.40% | 1.00% | 1.00% | 0.80% |

| 13:15 | USD | Industrial Production M/M Jun | 4.30% | 1.40% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | -1.3M | 5.7M | ||

| 15:00 | CAD | BOC Press Conference | ||||

| 18:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals