Dollar is trying to recover today as Asian markets turned into risk-off. Better than expected Q2 GDP data from China is largely ignored. Instead, Chinese stock lead Asia lower on concern of escalating geopolitical tension in South China Sea. Sterling is so the weakest for today as job data hinted that more people left the job markets. Australian Dollar also receives little support from better than expected job data, which was driven by part-time employment. New Zealand Dollar is also weak as CPI affirms more RBNZ easing ahead. Euro is mixed, awaiting ECB rate decision and press conference.

Technically, we’d believe that if Dollar is to stage a strong rebound, it should happen soon. EUR/USD is close to 1.1496 key medium term resistance. AUD/USD is also pressing 0.7031/7064 key resistance zone too. But the development doesn’t favor a comeback of the greenback, with USD/CAD back pressing 1.3490 near term support. Similar, USD/JPY is also pressing 106.63 support level. There is prospect of deeper fall in both USD/CAD and USD/JPY for the near term. In any case, we should find out which way is the way for Dollar soon.

In Asia, Nikkei closed down -0.76%. Hong Kong HSI is down -1.71%. China Shanghai SSE is down -4.50%. Singapore Strait Times is down -0.74%. Japan 10-year JGB yield is down -0.0076 at 0.017. Overnight, DOW rose 0.85%. S&P 500 rose 0.91%. NASDAQ rose 0.59%. 10-year yield rose 0.015 to 0.630.

UK unemployment rate unchanged at 3.9% in May

UK unemployment rate was unchanged at 3.9% in the three months to May, much better than expectation of a surge to 4.7%. Regarding income, average earnings excluding bonus rose 0.3% 3moy in May, slightly above expectation of 0.6%. Average earnings including bonus dropped -3moy, better than expectation of -0.5%.

ONS noted: “The relative flatness of the unemployment figures may seem surprising, given that there are notable decreases in the number in employment. However, some initial exploratory analysis has suggested that a larger than usual proportion of those leaving employment are not currently looking for a new job and therefore becoming economically inactive, rather than unemployed.”

Claimant counts dropped -28.1k in June, versus expectation of 250k rise. Nevertheless, since March, the claimant count has increased 112.2%, or 1.4m.

Australia unemployment rate jumped to 22-yr high, PM unveils trainer support

Australia employment rose 210.8k to 12.33m in June, above expectation of 112.5k rise. Full time job dropped -38.1k to 8.49m. Part-time jobs, on the other hand, surged 249k to 3.84m. Unemployment rise rose 0.4% to 7.4%, matched expectations. That’s the highest level since November 1998. Nevertheless, the positive sign is that participation rate jumped back by 1.3% to 64.0%, as people are back in the job markets.

Prime Minister Scott Morrison unveiled today a new AUD 2B JobTrainer plan aimed at reskilling and upskilling Australians. He said, the program “doesn’t just support those who have left the workforce through no fault of their own, but that also is supporting school leavers as well at the end of this year.”

AUD/JPY weakens mildly after the release but stays above 4 hour 55 EMA. We’re viewing the sideway price actions from 72.52 as the second leg of the pattern form 76.78 high only. That is, we’d expect at least another decline before the pattern completes. Break of 73.98 support should target 72.52 and below.

New Zealand CPI dropped -0.5% qoq in Q2, affirming more RBNZ easing

New Zealand CPI dropped -0.5% qoq in Q2, matched expectations. That’s the first quarterly fall in inflation since December 2015 quarter. Petrol prices dripped -12% qoq, biggest quarterly decline since December 2008 quarter. Annually, CPI slowed to 1.5% yoy, down from 2.5% yoy, matched expectations too. Stats NZ prices senior manager Aaron Beck said “the COVID-19 pandemic has created a lot of volatility and uncertainty. These have resulted in some large price fluctuations as well as several measurement challenges.”

The data suggests that inflation could move back to target slower than RBNZ is expecting. The development reaffirms the easing case for the central bank ahead. It’s generally expected to expand the asset purchase program in the coming months. As RBNZ is also preparing the financial system for, negative rate is still a likely option to be adopted next year.

China GDP grew 3.2% yoy in Q2, June retail sales weak

China’s GDP grew 3.2% yoy in Q2, above expectation of 2.5% yoy. Barring the steep -6.8% contraction in Q1, Q2’s figure is still the worst on record. For H1 as a whole, the economy contracted -1.6% yoy from a year earlier. On quarter-on-quarter basis, GDP rose 11.5% qoq in Q2, higher than expectation of -9.6% qoq, and sufficient to reverse the -9..8% qoq decline in Q1.

Also from China, retail sales dropped -1.8% yoy in June, below expectation of 0.3% yoy rise. Industrial production rose 4.8% yoy in June, slightly above expectation of 4.7% yoy. Fixed asset investment dropped -3.1% ytd yoy in June, slightly above expectation of -3.2% ytd yoy.

Fed: Economic activity increased in almost all districts

Fed’s Beige Book economic report noted that “economic activity increased in almost all Districts, but remained well below where it was prior to the COVID-19 pandemic.”

Looking at some details, consumer spending “picked up” while retail sales “rose”, but was “far below year-ago levels”. Manufacturing activity “moved up” in most districts, from a “very low levels”.

Employment “increased on net in almost all districts”, but payrolls in all districts were “well below pre-pandemic levels”. Prices were “little changed overall”.

Looking ahead

ECB rate decision is a major focus today. It’s widely expected to keep the main refinancing rate unchagned at 0.00% and the deposit rate at -0.50%. President Christine Lagarde might acknowledge the consumption drive improvement in the economy since last meeting. Yet, the overall tone would remain cautious, highlighting the high uncertainty and downside risks to economic outlook. Also, ECB would reiterate the commitment to maintaining “substantial monetary policy stimulus”. More in ECB Preview – Sounding Cautiously Optimistic on Economic Recovery.

Elsehwere, US retail sales will be another major focus. Jobless claims, Philly Fed survey, business invetories and NAHB housing index will also be released. Canada will also release ADP employment and foreign securities purchases.

GBP/USD Daily Outlook

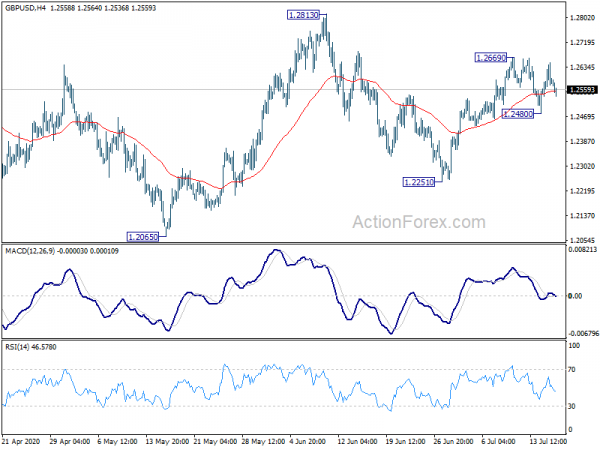

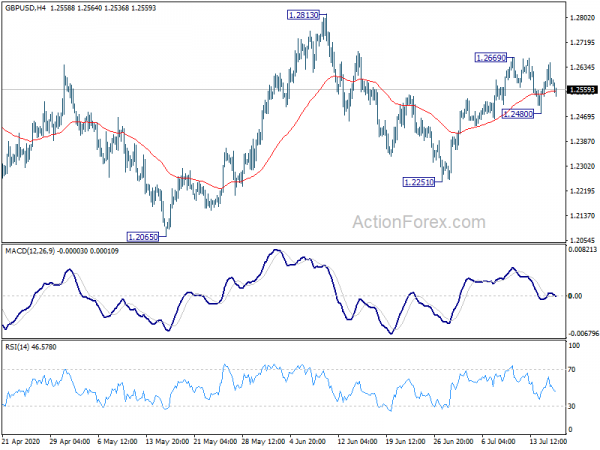

Daily Pivots: (S1) 1.2543; (P) 1.2597; (R1) 1.2642; More….

GBP/USD retreats mildly after failing break through 1.2669 temporary top. Intraday bias remains neutral first. On the upside, break of 1.2669 will resume the rebound from 1.2251 to 1.2813 high next. On the downside, though, break of 1.2480 minor support will turn bias to the downside for retesting 1.2251 support.

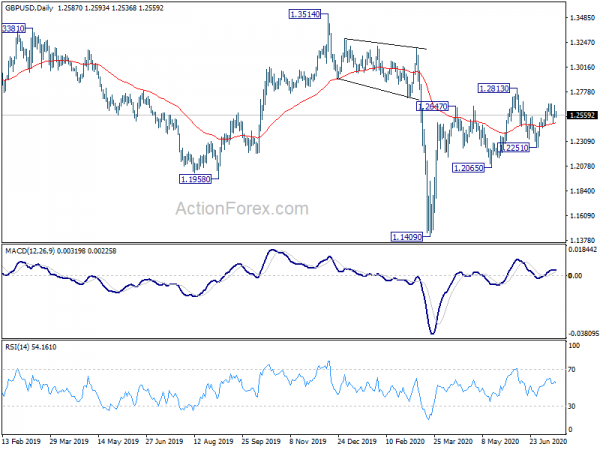

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | -0.50% | -0.50% | 0.80% | |

| 22:45 | NZD | CPI Y/Y Q2 | 1.50% | 1.50% | 2.50% | |

| 1:00 | AUD | Consumer Inflation Expectations Jul | 3.20% | 3.30% | ||

| 1:30 | AUD | Employment Change Jun | 210.8K | 112.5K | -227.7K | |

| 1:30 | AUD | Unemployment Rate Jun | 7.40% | 7.40% | 7.10% | |

| 2:00 | CNY | GDP Y/Y Q2 | 3.20% | 2.50% | -6.80% | |

| 2:00 | CNY | Retail Sales Y/Y Jun | -1.80% | 0.30% | -2.80% | |

| 2:00 | CNY | Industrial Production Y/Y Jun | 4.80% | 4.70% | 4.40% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Jun | -3.10% | -3.20% | -6.30% | |

| 6:00 | GBP | Claimant Count Change Jun | -28.1K | 250.0K | 528.9K | |

| 6:00 | GBP | Claimant Count Rate Jun | 7.30% | 7.80% | ||

| 6:00 | GBP | ILO Unemployment Rate (3M) May | 3.90% | 4.70% | 3.90% | |

| 6:00 | GBP | Average Earnings Excluding Bonus 3M/Y May | 0.70% | 0.60% | 1.70% | |

| 6:00 | GBP | Average Earnings Including Bonus 3M/Y May | -0.30% | -0.50% | 1.00% | |

| 9:00 | EUR | Eurozone Trade Balance (EUR) May | 5.0B | 1.2B | ||

| 11:45 | EUR | ECB Interest Rate Decision | 0% | 0% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | ADP Employment Change Jun | 208.4K | |||

| 12:30 | CAD | Foreign Securities Purchases (CAD) May | 49.04B | |||

| 12:30 | USD | Retail Sales M/M Jun | 4.80% | 17.70% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 4.50% | 12.40% | ||

| 12:30 | USD | Initial Jobless Claims (Jul 10) | 1250K | 1314K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Jul | 20 | 27.5 | ||

| 14:00 | USD | Business Inventories May | -2.10% | -1.30% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 59 | 58 | ||

| 14:30 | USD | Natural Gas Storage | 48B | 56B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals