It’s a quiet week as far as scheduled events go, with the main highlight being the EU summit about the recovery fund, which exposes the euro to weekend risk. What will truly drive markets though, is the ongoing clash between hopes for a virus vaccine and worries that the economic recovery is ‘levelling off’. It’s a close call, but the market’s inability to really push higher even after promising vaccine news, combined with the Fed’s balance sheet shrinking, are ominous signs for the bulls. All told, most charts are still trapped in ranges. Risk-reward profile grows uglier

The fierce battle between bulls and bears continues, with both sides receiving some fundamental fuel to back up their case this week. Driving the positive narrative were renewed hopes for a successful coronavirus vaccine, after Moderna announced its latest trials produced a “robust” immune response. Meanwhile, more than half of all US states have now made it mandatory to wear face masks in public, calming fears about a continued acceleration in infections.

As for the bears, they drew strength from high-frequency indicators and even some Fed officials suggesting the US recovery is “levelling off”. Several states have paused their re-opening plans or put them into reverse to bring the outbreak under control, with California being the latest to shut down bars, indoor restaurants, gyms, and other services. Credit card data suggest this is already impacting spending, and the fear is that it could spark another wave of layoffs.

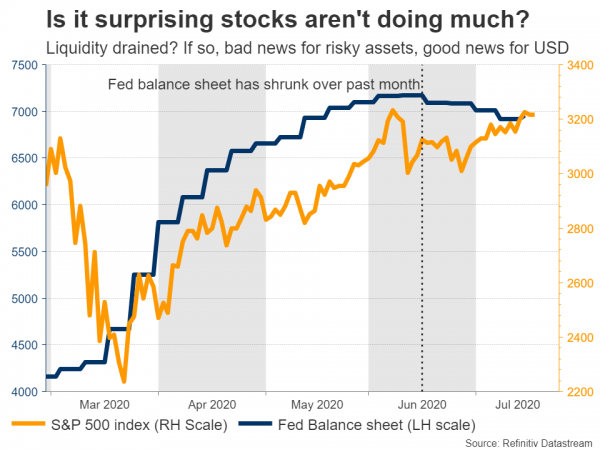

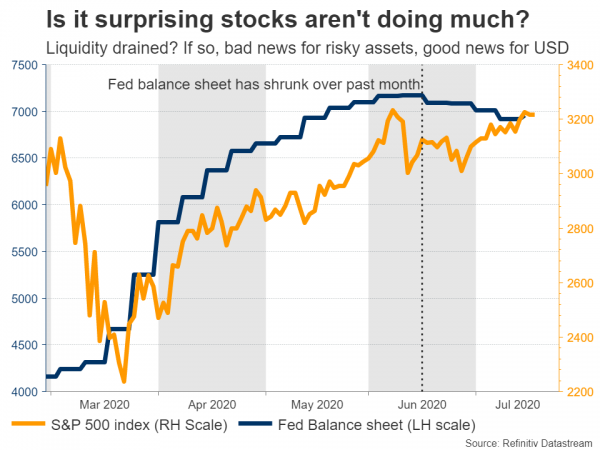

Looking ahead to the coming week(s), the risk/reward profile for riskier assets like stocks and commodity currencies seems rather unattractive from here, and any further gains may be increasingly difficult to come by. First and foremost, the Fed’s balance sheet has shrunk over the past month. Even though the decrease hasn’t been massive, it still implies that some liquidity has been drained from the system, which usually spells trouble for riskier assets.

Then there’s the limited response to encouraging vaccine headlines. Yes, the markets spiked higher on the Moderna news, but not dramatically, and didn’t manage to break into more optimistic ranges. In fact, just a day later, a separate report for a promising vaccine by Oxford passed unnoticed. That’s an ominous sign, as it implies that good news about a vaccine may be increasingly priced in.

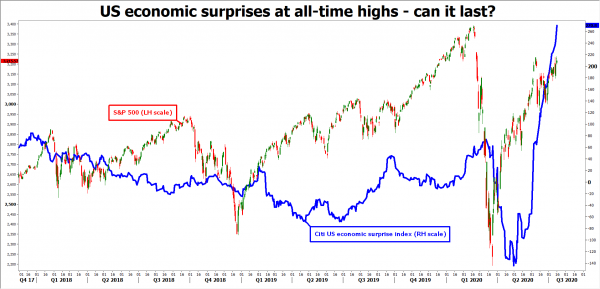

On top of everything, US economic surprises are at record highs, leaving a lot of room for disappointments once the July data that will capture the impact of re-closures start rolling in. There’s also considerable uncertainty around how much more stimulus Congress will authorize, and how quickly, as many crucial aid programs expire at the end of July.

Now to be clear, all this doesn’t mean markets can’t move higher from here – rather, that the potential reward relative to potential risk seem asymmetric and tilted to the downside. The bears appear to have an edge – on paper at least – but all it would take for that to change is some good news from Congress about a large rescue package, or better yet, signals that the Fed will deliver more stimulus at its late-July meeting.

EU summit: Mind the euro gap on Monday

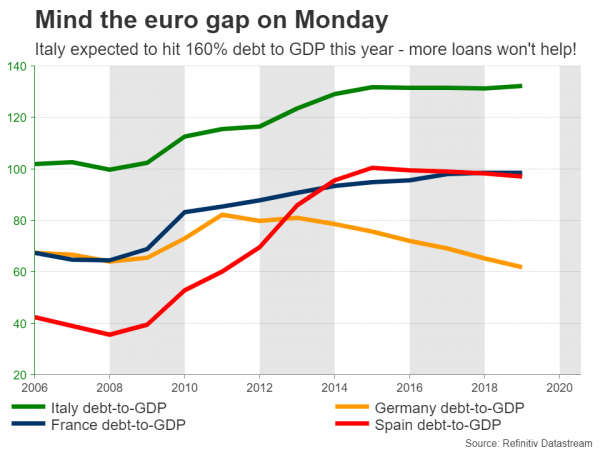

The new week will likely kick off with a blast, as EU leaders will conclude a summit over the weekend to negotiate the specifics of the €750 billion recovery fund. This fund is designed to assist the economies most devastated by the crisis, especially Italy and Spain. However, the Netherlands, Austria, Sweden, and Denmark are opposed to its current structure. They don’t want to hand out the stimulus in grants that won’t have to be paid back, and instead want to give out loans that would be repaid.

Of course, that is like giving an alcoholic more alcohol, as pushing nations like Italy into even more debt will ultimately come back to bite not just Italy but the entire EU, by reigniting sovereign debt concerns that have been buried for years.

Anyhow, some compromise will eventually be reached. The ‘conservative’ countries are pushing for loans, France and Germany are pushing for grants, so they’ll probably find a balance that everyone can live with. The question is, will it be agreed now or later?

The answer will determine whether the euro will open with a gap higher on Monday, or lower. Admittedly, a delay seems more likely, which could clip the high-flying euro’s wings. Earlier on Friday, Dutch PM Rutte said he thinks the chances of a deal are less than 50%, which isn’t exactly reassuring. And if we have learned anything from the EU debt crisis and the Brexit talks, it’s that EU leaders typically don’t compromise until the last moment – and the pressure isn’t overwhelming just yet.

After the summit, the focus will turn to Eurozone’s preliminary PMIs for July, due next Friday. With the European re-openings going smoothly and infections still low overall, most indices will likely tick up.

US PMIs unlikely to change much – dollar driven by stocks, Fed, Congress

In America, the preliminary Markit PMIs for July – due on Friday – are unlikely to shake markets, as investors generally focus more on the ISM indices. As for the dollar, it will be driven by a combination of risk sentiment, and how expectations around more Congressional and Fed stimulus evolve.

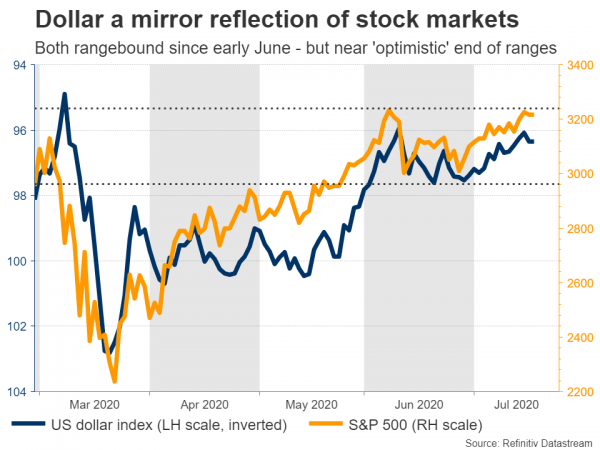

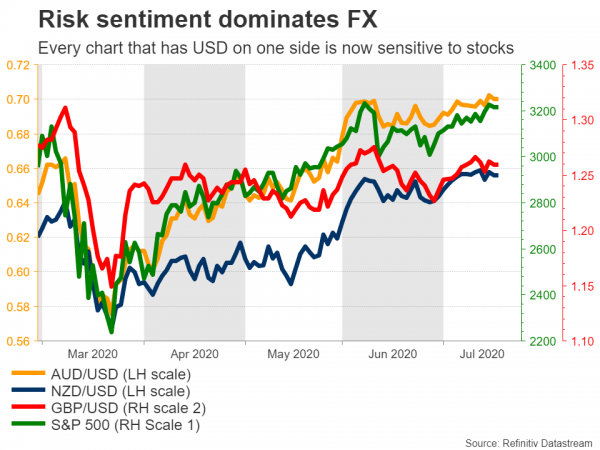

The greenback has turned into a de-facto safe haven throughout this crisis, essentially becoming a mirror reflection of stock markets, so how risk sentiment evolves may be the biggest variable.

Beyond that though, Fed speculation may act against the dollar. The US recovery is clearly stalling, so policymakers will be under pressure to act again when they meet in two weeks. If expectations around more easing start to mount, that could work against the greenback, and likely benefit gold.

Canadian and UK data, RBA minutes coming up

In Canada, retail sales for June will be released Tuesday before inflation data for the same month on Wednesday. In Australia, the minutes of the latest RBA meeting will hit the markets on Tuesday too, ahead of a speech by RBA Governor Lowe.

Turning to Britain, retail sales for June and preliminary PMIs for July are all due on Friday. That said, all these currencies may be driven mainly by risk sentiment, not so much by domestic developments.

Speaking of risk sentiment, the earnings season fires up with Amazon, Microsoft, Tesla, Coca Cola, and Twitter all reporting their second-quarter results. Besides impacting stock markets, any surprises could also spill over into the FX market, given the high correlation between risk appetite and currencies like the pound in recent months.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals