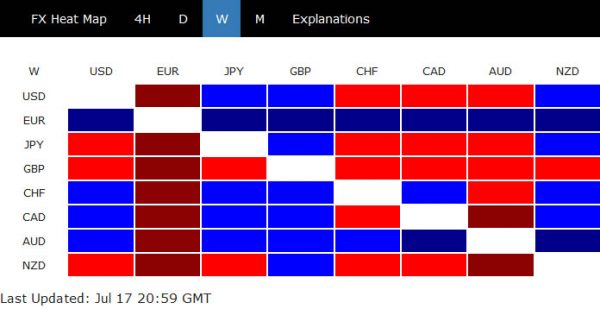

Euro ended last week as the strongest one, as pushed up by hope of an agreement over EU’s post-pandemic recovery fund. The strength was particularly apparent against Swiss Franc and Sterling. Yet, up till the time of writing, there seems to be no consensus reached at the EU summit yet. Dutch Prime Minister Mark Rutte even complained that Germany Chancellor Angela Merkel and France President Emmanuel Macron were “walking away grumpy” from the meeting. Rutte added that a compromise is still “possible” at over-time during Sunday, but “there remain big issues”. Euro’s near term fortunate could have a U-turn if the negotiations collapse.

Back on the currency markets, Australian Dollar ended as the second strongest partly supported by iron ore prices, as well as general risk appetite. But it should be reminded that coronavirus cases in Victoria continued to surge which risk is rising for New South Wales. A sharp risk reversal in China’s stock markets could spill over to Asia and drag down the Aussie too. Sterling was the worst performing one last week, followed by New Zealand Dollar and Yen.

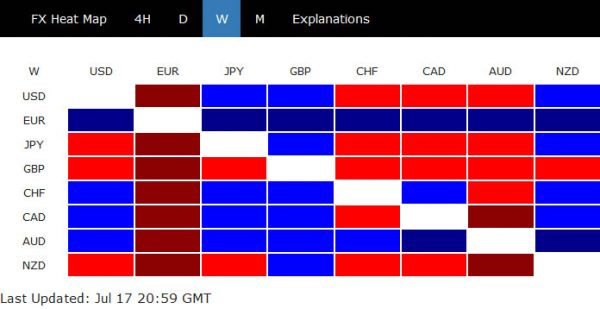

EUR/CHF technically bullish, but next moves depend on EU recovery fund

EUR/CHF will be the first one to watch this week. The strong rebound last week was partly built on hope for an agreement regarding the recovery fund. Purely technically, the development suggests that corrective pull back from 1.0915 has completed at 1.0602. Break of 1.0797 temporary top would reaffirm this bullish case and would probably resume the whole rise from 1.0503 through 1.0915 to 100% projection of 1.0503 to 1.0915 from 1.0602 at 1.1014. But a break of 1.0701 minor support will dampen the bullish case and extend the corrective pattern from 1.0915, probably until the recovery fund issue is resolved.

DAX extended rally with weak momentum, correction overdue

DAX is another one to pay attention too. The index extended the rebound form 8255.65 last week to close at 12919.61. Upside momentum has been rather weak since mid June, considering the price structure, as well as daily MACD. Hence, even in case of further rally, we’d expect strong resistance around 13795.24 high to limit upside and bring a long-overdue correction first. Meanwhile, break of 12416.69 support, if triggered by the collapse of recovery fund talks, would suggest that the correction has already started.

Dollar index pressing 95.71 short term bottom, next move depends on Euro

Dollar index gyrated lower last week, thanks to the greenback’s weakest against Euro and Yen. It’s now pressing 95.71 short term bottom and the next move would depends on the direction of Euro this week. Break of 95.71 would extend the decline form 102.99 to test 94.65 key medium term support before having a sustainable rebound. However, break of 96.97 resistance will argue that the rebound has finally started for 38.2% retracement of 102.99 to 95.71 at 98.49.

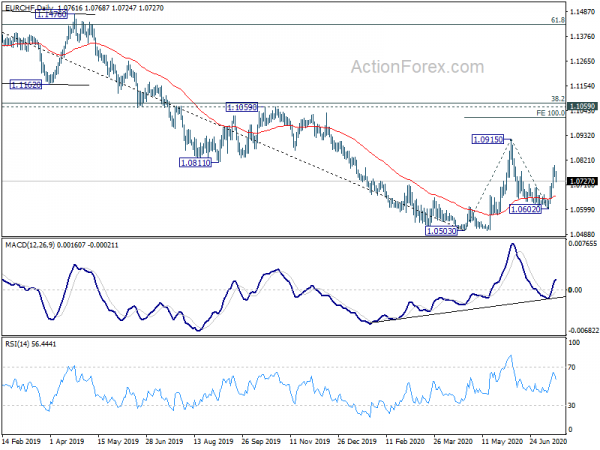

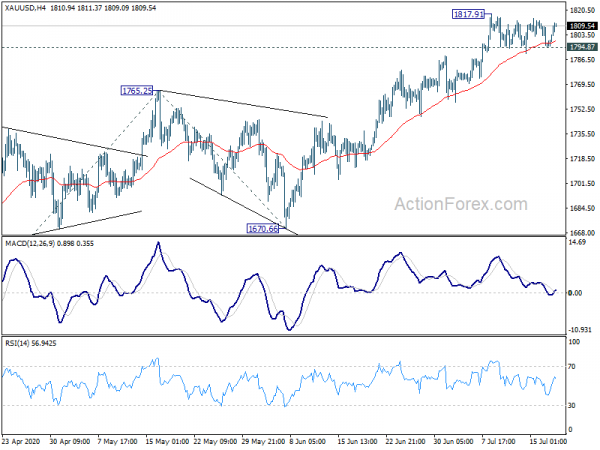

Gold extended sideway trading, upside breakout still in favor

Gold extended sideway consolidation last week, stuck between 4 hour 55 EMA and 1817.91 short term top. A break out should be due soon and an upside one is in favor. Firm break of 1817.91 will extend larger up trend to 61.8% projection of 1451.16 to 1765.25 from 1670.66 at 1864.76. However, break of 1794.87 support would suggest deeper correction is underway back to 1765.25 resistance turned support. Gold’s next move could be used as confirmation to Dollar’s near term direction.

China SSE failed 3486.94 key cluster resistance

As for risks, China’s Shanghai SSE staged a deep pull back last week, after recent massive rally. Key cluster resistance zone (including 100% projection of 2440.9 to 3288.4 from 2646.8 at 3494.35 and 38.2% retracement of 5178.19 to 2440.90 at 3486.54) proved to be too much for now as expected. The selloff could also be attributed to sell-on-news move after better than expected Q2 GDP was reported.

Near term focus is now back to 55 day EMA (now at 3053.12, and close to 3000 hand). Outlook will stay bullish as long as this EMA holds. But a firm break there could declare completion of recent rally attempt. Global equities paid little attention the strong rally in SSE this month. But they may not just shrug it off if a collapse style reversal is next.

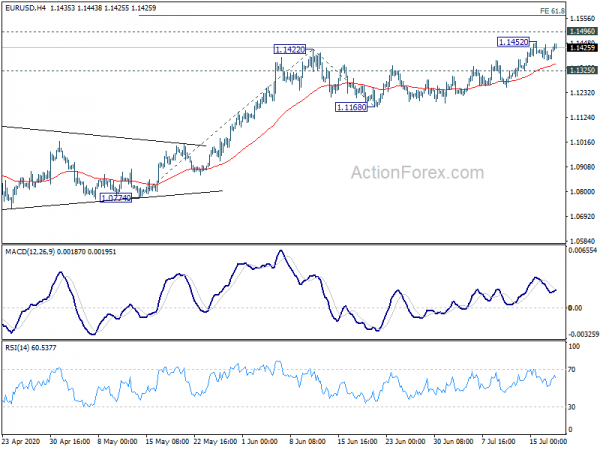

EUR/USD Weekly Outlook

EUR/USD’s break of 1.1422 last week suggests resumption of whole rise from 1.0635. Though, as a temporary top was formed at 1.1452, initial bias is neutral this week first. on the upside, break of 1.1452 will target 1.1496 key resistance. Firm break there will carry larger bullish implications and target 61.8% projection of 1.0774 to 1.1422 from 1.1168 at 1.1568 next. On the downside, break of 1.1325 minor support will turn bias back to the downside for 1.1168 support. Decisive break there will indicate near term bearish reversal.

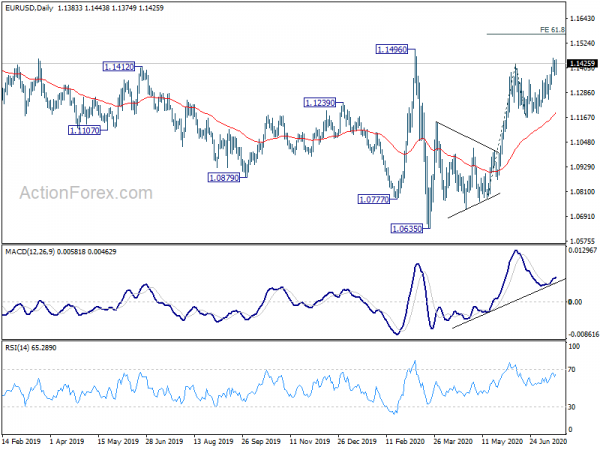

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

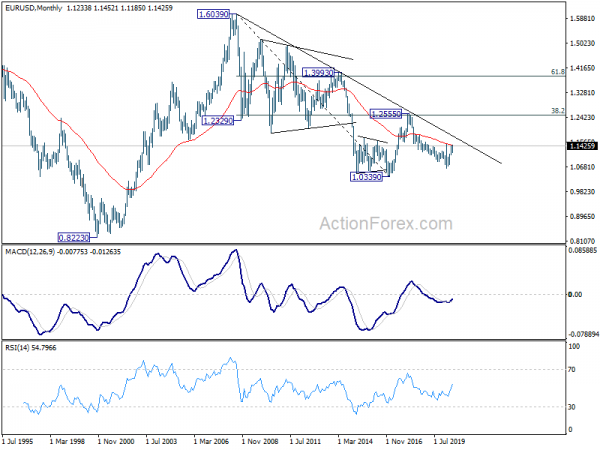

In the long term picture, outlook remains bearish for now as it’s staying below 55 month EMA, as well as decade long falling trend line. Down trend from 1.6039 (2008 high) is still in favor to extend through 1.0339 down the road. However, sustained trading above 55 month EMA will firstly suggest that fall from 1.2555 has completed. It would also be an early indication on long term bullish reversal. Focus would be back on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ).

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals