The financial markets are generally in risk-off mode in Asia, following the selloff in US overnight. Worries over a double dip recession increased after initial jobless claims unexpectedly rose for the first time in nearly four months. Selloff was most serious in NASDAQ,, which closed down -2.29% just after making another record high earlier this week. DOW also lost -1.31% while S&P 500 ended -1.23% lower. Tech stocks were plunged with Apple, Microsoft and Amazon all dropped by around 4%.

Sentiments are additionally weighed down by intensifying US-China tensions. China finally delivers the promised retaliation to US closure of its Houston consulate general. At the time of writing, Hong Kong HSI is down -1.83%. China Shanghai SSE is down -2.25%. Singapore Strait Times is down -1.31%. Japan is still on holiday today.

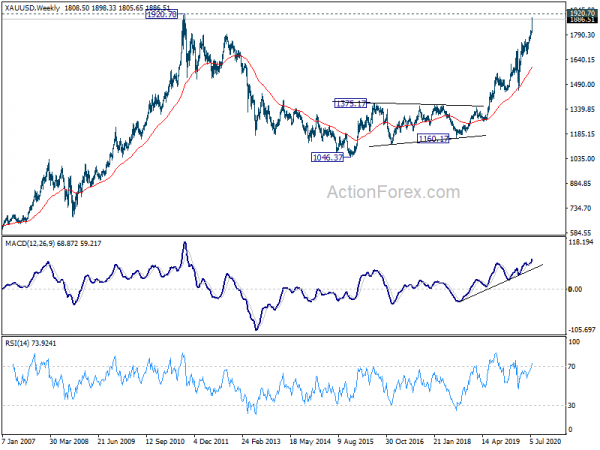

In the currency markets, Australian Dollar leads commodity currencies lower. Yen and Swiss franc are the strongest, followed by Euro and Dollar. Technically, USD/JPY finally broke 106.63 support. 106.07 looks vulnerable now and break will extend whole pattern from 111.71 to 105.20 fibonacci level. Gold is also a focus as it’s heading to 1920 record high with solid momentum.

China orders closure of US Chengdu consulate as Pompeo called for free world against CCP

In a furious speech titled “Communist China and the Free World’s Future“, US Secretary of State Michael Pompeo warned “if the free world doesn’t change Communist China, Communist China will change us,” He called for American’s allies to “triumph over this new tyranny” of the Chinese Communist Party. Separately, President Donald Trump also said the trade deal with China “means less to me now than when I made it”.

On the China’s side, it ordered the US to close the consulate general in city of Chengdu. It said in a statement, “the Ministry of Foreign Affairs of China informed the U.S. Embassy in China of its decision to withdraw its consent for the establishment and operation of the U.S. Consulate General in Chengdu. This is the long awaited response to US’s order to close China’s consulate general in Houston earlier this week.

Australia CBA PMI services rose to record 58.5, PMI manufacturing up to 53.4

Australia CBA PMI Composite rose to 57.9, up from 52.7, highest since April 2017. PMI Services rose to 58.5, up from 53.1, highest on record since the survey began in May 2016. PMI Manufacturing rose to 53.4 in July, up from 51.2.

CBA Head of Australian Economics, Gareth Aird said: “The improvement in growth momentum in July is welcome, but concerns around COVID-19 and the potential policy responses to a lift in the number of new cases continue to weigh on activity. The fall in employment looks a little surprising given some other measures of labour demand have firmed more recently. But encouragingly the acceleration of growth in new orders suggests labour demand should improve. The lack of any inflationary pulse was once again evident. That supports our view that we will be in a low inflation environment for an extended period of time”.

New Zealand reported first quarterly trade surplus since 2014, NZD/JPY rejected by 71.66 resistance

New Zealand’s good exports rose 2.2% yoy, or NZD 107m, to NZD 5.1B in June. Goods imports rose 0.2% yoy, or NZD 11m, to NZD 4.6B. Monthly trade surplus narrowed to NZD 426m, down from may’s NZD 1286m, slightly below expectation of NZD 450m.

Over June quarter, goods exports dropped -5.8% yoy, or NZD 904m, to NZD 14.7B. Goods imports dropped -16% yoy, or NZD 2.5B, to NZD 13.2B. Quarterly trade balance was a surplus of NZD 1.4B, first quarterly surplus since Q1 2014.

UK Gfk consumer confidence unchanged at -27, little to boost the public’s mood

UK Gfk Consumer Confidence came in at -27 in July, up from June’s -30, unchanged from flash reading. Joe Staton, GfK’s Client Strategy Director, says: “There’s been little to boost the public’s mood as the cost of the pandemic to the UK’s economy is becoming apparent. Amidst significant job losses and the end of the furlough scheme, it is perhaps surprising Consumer Confidence has held steady at -27 this month.

“Many people have been savvy and saved money during lockdown, as the most recent GDP figures show. That could explain the one bright spark on the horizon — the three-point uptick in consumer expectations for the financial position of their households in the next 12 months. The way we perceive our ‘future wallets’ is key as it’s the one area over which we have day-to-day control and is a good indicator of our personal financial outlook for the year to come.”

Looking ahead

UK will release retail sales and PMIs today. Eurozone PMIs flash will also be a focus. Later in the day, US will release PMIs and new home sales.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.64; (P) 106.94; (R1) 107.16; More…

USD/JPY drops to as low as 106.36 so far and break of 106.63 suggests resumption of fall from 108.16. Intraday bias is back on the downside for 106.07 support. Break there will extend the corrective pattern from 111.71 to 61.8% retracement of 101.18 to 111.71 at 105.20. On the upside, break of 107.54 resistance is needed to indicate completion of the decline. Otherwise, outlook will remain cautiously bearish in case of recovery.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jun | 426M | 450M | 1253M | 1286M |

| 23:00 | AUD | CBA Manufacturing PMI Jul P | 53.4 | 51.2 | ||

| 23:00 | AUD | CBA Services PMI Jul P | 58.5 | 53.1 | ||

| 23:01 | GBP | GfK Consumer Confidence Jul | -27 | -26 | -27 | |

| 6:00 | GBP | Retail Sales M/M Jun | 8.50% | 12.00% | ||

| 6:00 | GBP | Retail Sales Y/Y Jun | -6.20% | -13.10% | ||

| 6:00 | GBP | Retail Sales ex-Fuel M/M Jun | 7.50% | 10.20% | ||

| 6:00 | GBP | Retail Sales ex-Fuel Y/Y Jun | -3.70% | -9.80% | ||

| 7:15 | EUR | France Manufacturing PMI Jul P | 53.2 | 52.3 | ||

| 7:15 | EUR | France PMI Services Jul P | 52.3 | 50.7 | ||

| 7:30 | EUR | Germany Manufacturing PMI Jul P | 48.3 | 45.2 | ||

| 7:30 | EUR | Germany Services PMI Jul P | 50.4 | 47.3 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Jul P | 49.5 | 47.4 | ||

| 8:00 | EUR | Eurozone Services PMI Jul P | 51 | 48.3 | ||

| 8:30 | GBP | Manufacturing PMI Jul P | 51 | 50.1 | ||

| 8:30 | GBP | Services PMI Jul P | 51 | 47.1 | ||

| 13:45 | USD | Manufacturing PMI Jul P | 51.3 | 49.8 | ||

| 13:45 | USD | Services PMI Jul P | 50.2 | 47.9 | ||

| 14:00 | USD | New Home Sales Jun | 700K | 676K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals