Gold’s up trend accelerates further and finally makes new record high today. That comes in a time when there are increasing evidence of second wave of coronavirus infections globally. Also, US-China relations deteriorate to a new low for decades. Dollar is extending recent selloff and is trading and the worst performing one for today so far, followed by Canadian. Yen is the strongest, followed by New Zealand Dollar and then Euro. The greenback looks rather vulnerable and it’s unlikely to be saved by Fed later in the week.

Technically, a focus would be on whether Euro could maintain last week’s strong upside momentum, or it would finally be overwhelmed by risk aversion. For now, further rise is still in favor in EUR/JPY and break of 124.43 will resume whole rebound from 114.42. But a break of 121.96 support will indicate rejection by 124.43 and bring deeper fall to extend a short term consolidation pattern, towards 119.31/120.27 support zone. Further rise is also in favor in EUR/CHF with 1.0701 minor support intact. Break of 1.0797 should at least target a test on 1.0915 short term top. But break of 1.0701 would bring a test on 1.0602 support instead.

In Asia, currently, Nikkei is down -0.24%. Hong Kong HSI is down -0.36%. China Shanghai SSE is down -0.36%. Singapore Strait Times is down -0.25%. Japan 10-year JGB yield is up 0.0046 at 0.021.

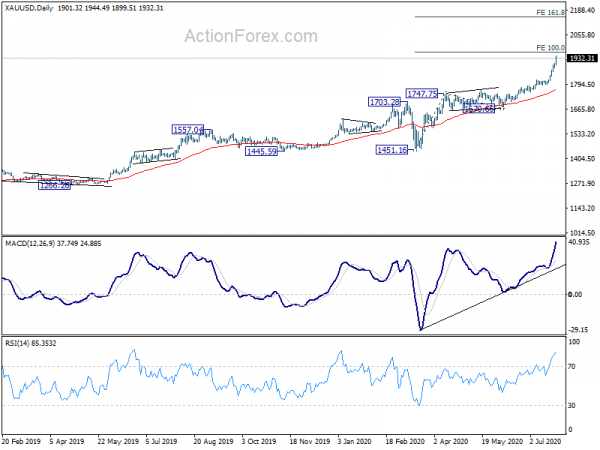

Gold accelerates to new record high, next key target at 2020

Gold’s uptrend accelerates further as another week starts and hits new record high at 1944.349. Prior record of 1920.70 made in 2011 is now taken out. From near term point of view, next target will be 100% projection of 1451.16 to 1747.75 from 1670.66 at 1967.25 next. On the downside, break of 1887.16 minor support will bring some consolidations first.

Though, the real test will be on medium term target of 261.8% projection of 1046.37 to 1375.17 from 1160.17 at 2020.96.

BoJ: Economy unlikely to reach pre-pandemic level even in fiscal 2022

Summary of Opinions of BoJ’s July 14-15 meeting reiterated that the economy is “likely to improve gradually” from H2, but the pace is expected to be “only moderate” as coronavirus impact remains. The economy is “unlikely” to return to pre-pandemic level “even in fiscal 2022”, since it will take time for a “structural change” to overcome the pandemic impacts.

Also, the economic shock of COVID-19 seems to be “largely attributable to a negative demand shock”. There are signs that a decline in short-term inflation expectations is affecting medium- to long-term ones. “Downward pressure will likely be exerted on prices for the time being”.

One opinion noted that it’s appropriate to ” revise the forward guidance to make it a more powerful one that does not allow deflation to take hold and leads to additional easing measures under the concrete conditions related to prices.” One said BoJ should examine the ” transmission channels and effects of policy measures while paying attention to risks that prices and growth expectations will decline further and that such situation will last for a protracted period”.

RBA Kent: Pandemic policy responses represent bread and butter of central banking

RBA Assistant Governor Chris Kent said in a speech that Australian authorities have provided “unprecedented support, including via fiscal, monetary and prudential policies” in response to the severe impact of the coronavirus pandemic. RBA has been focused on “keeping the cost of borrowing low and helping to maintain the supply of credit”.

He described that RBA’s measures can be ” thought of as representing the ‘bread and butter’ of central banking – providing liquidity to meet demand at a time of considerable need, thereby acting to stabilise crucial markets.”

The operations have “worked well” and “contributed to a noticeable improvement in market sentiment and accommodative financial conditions.” Also, in response to a question, Kent said negative rates were not an option for now and new monetary policy measures are not under consideration for the moment.

Fed to stand pat while focuses are on Q2 GDP

FOMC rate decision is the highlight of the week but Fed is not expected to make any change in its monetary policies. Some form of forward guidance could be included in the new statement, formally reflecting Chair Jerome Powell’s comment that he was not “not even thinking about thinking about raising rates”. Nevertheless, the real important meeting would be the September one, as Fed could finally reveal the results of the monetary policy review and publish new forecasts.

On the data front, Q2 GDP from US and Eurozone (including France and Germany) will catch most attentions. For US, durable goods orders, consumer confidence, trade balance, jobless claims and PCE will be watched. Germany IFO, Eurozone CPI, Canada GDP, Australia CPI will also be watched, together with China PMIs. Here are some highlights for the week:

- Monday: BoJ summary of opinions, all industries index; Eurozone M3; Germany Ifo business climate; US durable goods orders.

- Tuesday: Japan corporate service price index; UK CBI realized sales, S&P Case Shiller price index, consumer confidence.

- Wednesday: Australia CPI; Swiss economic expectations; UK M4 money supply, mortgage approvals; US goods trade balance, wholesale inventories, pending home sales, FOMC rate decisions.

- Thursday: New Zealand building permits; Australia building approvals, import prices; Swiss KOF economic barometer; Germany CPI, unemployment, GDP; ECB monthly bulletin, Eurozone unemployment rate; US GDP, jobless claims.

- Friday: UK Gfk consumer confidence,; Japan unemployment rate, industrial production, consumer confidence, housing starts; China PMIs; Australia PPI, private sector credit; France GDP, consumer spending; Germany retail sales, Swiss retail sales; Eurozone CPI, GDP; Canada GDP, IPPI and RMPI; US personal income and spending, employment cost; Chicago PMI.

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.58; (P) 106.24; (R1) 106.80; More…

USD/JPY’s decline continues today and hits as low as 105.44 so far. Intraday bias remains on the downside for 61.8% retracement of 101.18 to 111.71 at 105.20. Break there will target 100% projection of 111.71 to 105.98 from 109.85 at 104.12. On the upside, above 106.13 minor resistance will turn intraday bias neutral first. But recovery should be limited by 106.63 support turned resistance to bring another fall.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 4:30 | JPY | All Industry Activity Index M/M May | -3.50% | -3.50% | -6.40% | |

| 8:00 | EUR | Germany IFO Business Climate Jul | 89.3 | 86.2 | ||

| 8:00 | EUR | Germany IFO Expectations Jul | 93.4 | 91.4 | ||

| 8:00 | EUR | Germany IFO Current Assessment Jul | 85 | 81.3 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 9.30% | 8.90% | ||

| 12:30 | USD | Durable Goods Orders Jun | 6.50% | 15.70% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Jun | 3.50% | 3.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals