Dollar’s selloff intensifies in early US session after ADP job report hugely missed expectations. The strong upward revision in prior month’s figure just make the picture looks worse, exaggeration the steep slowdown in labor market rebound. At this point, Yen is following the greenback as then second weakest, then New Zealand Dollar. On the other hand, Australian Dollar is the strongest, followed by Swiss Franc and Euro.

Technically, Gold continues to show some upside acceleration and hits new record of 2044 today. WTI crude oil also finally breaks 42 resistance with some conviction, which should give extra lift to Canadian Dollar. USD/CAD ‘s fall from 1.4667 is on track to long term fibonacci level at 1.3056, and possibly to 1.3 round number. AUD/USD finally follows by breaking 0.7227 temporary top. Near term rise is now heading to long term EMA level at 0.7311. Now, eyes will be on whether EUR/USD would break 1.1908 temporary top to resume recent rally. Similar levels to watch include 1.3170 in GBP/USD and 0.9056 in USD/CHF.

In Europe, currently, FTSE is up 0.89%. DAX is up 0.47%. CAC is up 0.71%. German 10-year yield is up 0.0376 at -0.513. Earlier in Asia, Nikkei dropped -0.26%. Hong Kong HSI rose 0.62%. China Shanghai SSE rose 0.17%. Singapore Strait Times rose 0.68%. Japan 10-year JGB yield dropped -0.0056 to -0.513.

US ADP employment grew only 169k as recovery slowed

ADP report showed only 167k growth in US private employment in July, far below expectation of 1200k. Nevertheless, June’s figure was revised sharply higher from 2369k to 4314k. By company size, small businesses added 63k jobs, medium businesses dropped -25k, large businesses rose 129k. By sector, goods-producing companies added just 1k job. Service-providing companies added 166k jobs.

“The labor market recovery slowed in the month of July,”said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “We have seen the slowdown impact businesses across all sizes and sectors.”

US exports rose 9.4% mom to USD 158.3B in June. Imports rose 4.7% mom to USD 208.9B. Goods and services trade deficit dropped -7.5% mom to USD -50.7B. For the threes months ending in June, average exports dropped USD -10.6B to USD 151.4B. Average imports dropped USD -7.9B to USD -203.1B. Deficit rose USD 2.8B to USD -51.8B.

Canada trade deficit widened to CAD -3.2B in June, larger than expectation of CAD -0.6B.

Eurozone retail sales rose 5.7% in June, back to pre-pandemic level

Eurozone retail sales rose 5.7% mom in June, above expectation of 5.0% mom. Sale rose 5.2% mom in EU in June too. Back in May, retail trade volume rose 20.3% mom in Eurozone and 18.3% in EU. Combined, that means sales volumes have already returned to the pre-pandemic level in February.

For the month, among Member States for which data are available, the highest increases in the total retail trade volume were registered in Ireland (+21.9%), Spain (+16.5%) and Italy (+13.8%). Decreases were observed in Austria (-2.5%) and Germany (-1.6%).

Eurozone PMI composite finalized at 54.9, highest since Jun 2018

Eurozone PMI Services was finalized at 54.7 in July, up from June’s 48.3. PMI Composite was finalized at 54.9, up from June’s 48.5. That’s also the highest level since June 2018.

Looking at some member states, France PMI Composite hit 29-month high of 57.3. Germany hit 23-month high of 55.3. Spain hit 15-month high at 52.8. Italy hit 24-month high of 52.5.

Chris Williamson, Chief Business Economist at IHS Markit said: “Combined with a surge in manufacturing production, the renewed expansion of the service sector bodes well for the economy to rebound in the third quarter after the unprecedented slump seen in the second quarter. Whether the recovery can be sustained will be determined first and foremost by virus case numbers, and the recent signs of a resurgence pose a particular risk to many parts of the service sector, such as travel, tourism and hospitality.

“However, even without a significant increase in infections, social distancing measures will need to be in place until an effective treatment or vaccine is available, dampening the ability of many firms to operate at anything like pre-pandemic capacity, and representing a major constraint on longer-run economic recovery prospects.”

UK PMI composite finalized at 57.0, highest since Jun 2015

UK PMI Services was finalized at 56.5 in July, up from June’s 47.1, best reading since July 2015. PMI Composite was finalized at 57.0, up from 47.7 in June, highest since June 2015.

Tim Moore, Economics Director at IHS Markit: “While the latest survey data provide a number of positive signs that the UK economy is back in expansion mode, the weakness of the employment figures reported in July is clearly a cause for concern and likely to hold back the longer-term recovery in business and consumer spending.”

New Zealand unemployment rate dropped to 4% as people left labor force and worked less hours

New Zealand employment dropped -0.4% qoq in Q2, much smaller than expectation of -1.9% qoq. Unemployment dropped -5.1% qoq. Unemployment also surprised and dropped to 4.0%, down from 4.2%, way better than expectation of 5.7% . However, labor force participation rate also -0.8% to 69.7%. Labor cost index rose 0.2% qoq, below expectation of 0.4% qoq. Also, total weekly paid hours dropped -3.4% while actual weekly hours worked dropped -10.3%.

Both employment and unemployment fell in the quarter, as more people were not even in the labor force. Work hours dropped more sharply than employment, reflecting reduced hours worked during lockdown by the people remain employed.

China Caixin PMI services dropped to 54.1, composite dropped to 54.5

China Caixin PMI Services dropped to 54.1 in July, down from 58.4, missed expectation of 56.8. PMI Composite dropped slightly to 54.5, down from 55.7.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Both the manufacturing and services sectors continued recovering, especially manufacturing. New orders kept increasing and the backlog of work also rose. The gauge for business expectations remained high, suggesting that companies were confident about the economic recovery. Overseas demand continued to be troubled for both sectors.

“Employment was still a key problem. The combination of expanding demand and production with shrinking employment has dogged the economy for several months. In hard times, enterprises look to shore up profits by cutting costs, like labor. Therefore improving employment requires more time and greater confidence among businesses.”

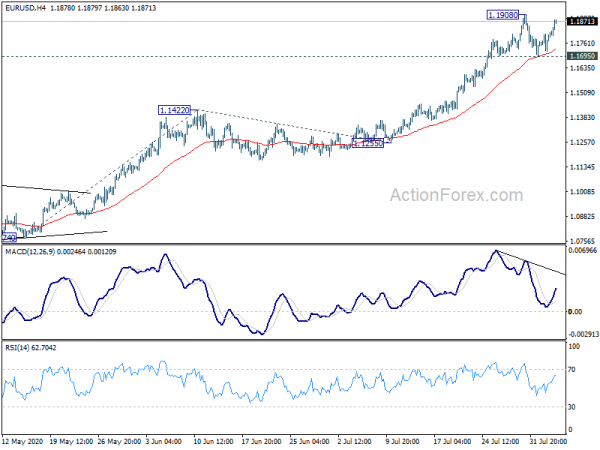

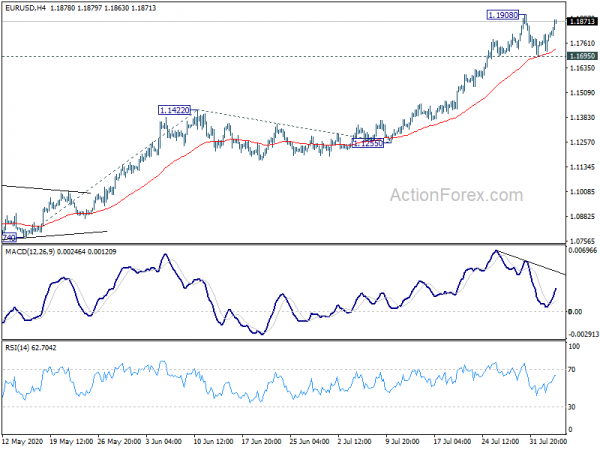

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1746; (P) 1.1776; (R1) 1.1831; More…..

Intraday bias in EUR/USD stays neutral first but focus is back on 1.1908 temporary top with current rebound. Break there will resume whole rise from 1.0635. Next target will be 161.8% projection of 1.0774 to 1.1422 from 1.1255 at 1.2303. nevertheless, on the downside, break of 1.1695 support should finally confirm short term topping and bring deeper correction lower.

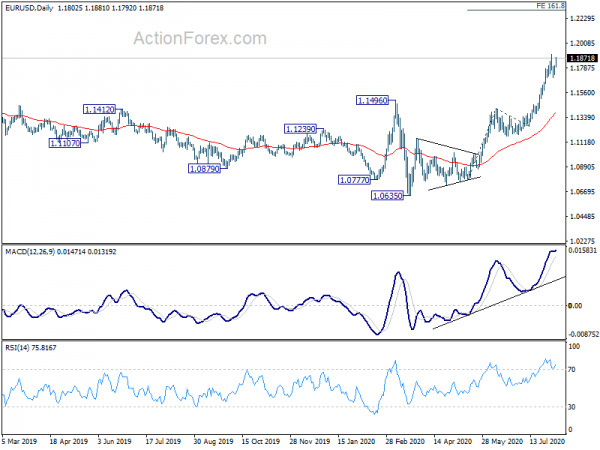

In the bigger picture, the strong break of 1.1496 resistance now suggests that whole down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 should be the third leg of the pattern from 1.0339 (2017 low). Further rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 42.7 | 35.5 | ||

| 22:45 | NZD | Employment Change Q2 | -0.40% | -1.90% | 0.70% | 1.00% |

| 22:45 | NZD | Unemployment Rate Q2 | 4.00% | 5.70% | 4.20% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q2 | 0.20% | 0.40% | 0.30% | |

| 01:45 | CNY | Caixin Services PMI Jul | 54.1 | 56.8 | 58.4 | |

| 07:45 | EUR | Italy Services PMI Jul | 51.6 | 51 | 46.4 | |

| 07:50 | EUR | France Services PMI Jul F | 57.3 | 57.8 | 57.8 | |

| 07:55 | EUR | Germany Services PMI Jul F | 55.6 | 56.7 | 56.7 | |

| 08:00 | EUR | Eurozone Services PMI Jul F | 54.7 | 55.1 | 55.1 | |

| 08:30 | GBP | Services PMI Jul F | 56.5 | 56.6 | 56.6 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | 5.70% | 5.00% | 17.80% | 20.30% |

| 12:15 | USD | ADP Employment Change Jul | 167K | 1200K | 2369K | 4314K |

| 12:30 | USD | Trade Balance (USD) Jun | -50.7B | -50.3B | -54.6B | -54.8B |

| 12:30 | CAD | International Merchandise Trade (CAD) Jun | -3.2B | -0.6B | -0.7B | |

| 13:45 | USD | Services PMI Jul F | 49.6 | 49.6 | ||

| 14:00 | USD | ISM Non-Manufacturing PMI Jul | 54.8 | 57.1 | ||

| 14:00 | USD | ISM Non-Manufacturing Employment Index Jul | 51.1 | 43.1 | ||

| 14:30 | USD | Crude Oil Inventories | -3.4M | -10.6M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals