Dollar is back in selloff mode again after rebound attempt failed. The broad based trend against the greenback is clear, with gold hitting new record high above 2000 handle. WTI crude oil is also back above 41, pressing 42 handle. Overall risk-on sentiments, with NADSAQ making new record high, is also unfavorable to Dollar. As for today, commodity currencies are the strongest ones, as led by Aussie. Swiss Franc and Yen are following Dollar as next weakest.

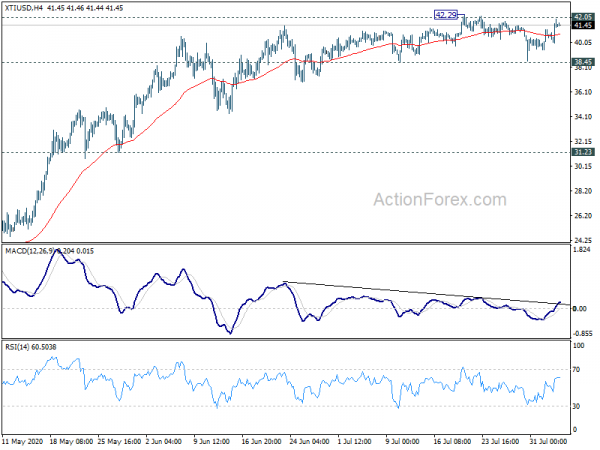

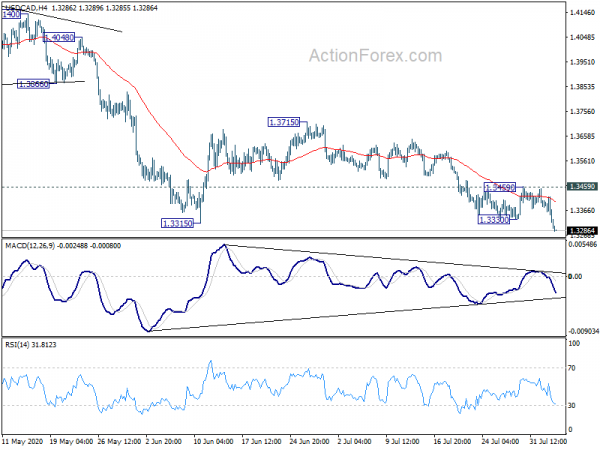

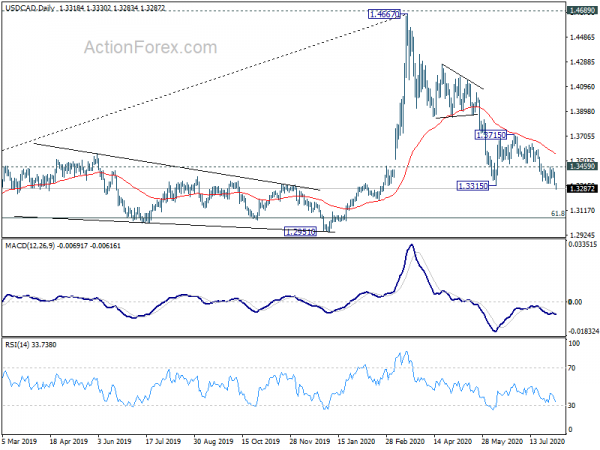

Technically, USD/CAD’s break of 1.3315 short term bottom suggests decline from 1.4667 has finally resumed. Eyes should also be on 42.29 short term top in WTI crude oil. Firm break there could trigger stronger buying and both oil and the Loonie, and prompt more downside acceleration in USD/CAD. As for other dollar pairs, focus is now back on 1.1908 temporary top in EUR/USD, 1.3170 temporary top in GBP/USD and 0.7227 temporary top in AUD/USD.

In Asia, Nikkei is currently down -0.24%. Hong Kong HSI is up 0.57%. China Shanghai SSE is up 0.29%. Singapore Strait Times is up 0.68%. Japan 10-year JGB yield is down -0.008 at 0.007. Overnight, DOW rose 0.62%. S&P 500 rose 0.62%. NASDAQ rose 0.35%. 10-year yield dropped notably by -0.048 to 0.515.

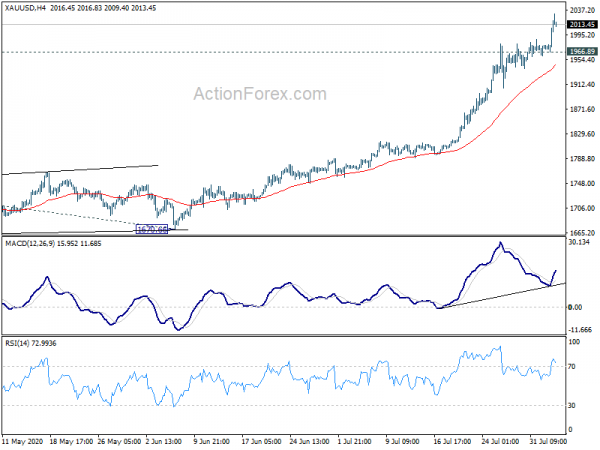

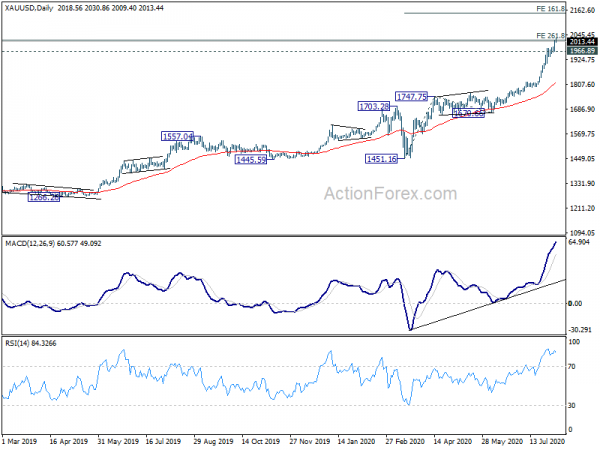

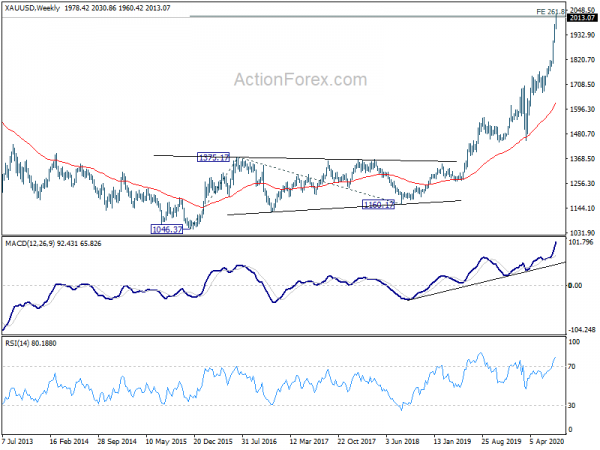

Gold breaks 2000 with powerful move, 2150 next?

Gold’s up trend finally resumes with a powerful move to as high as 2030.86 so far, breaking 2000 handle for the first time ever. It’s now pressing an important long term projection level, 261.8% projection of 1046.37 to 1375.17 from 1160.17 at 2020.96. It remains to be seen if this projection level, together with overbought conditions, would cap gold’s upside and bring an overdue correction.

But for now, near term outlook will remain bullish as long as 1966.89 holds. Sustained trading above 2020.96 will pave the way to next medium term target of 161.8% projection of 1451.16 to 1747.75 from 1670.66 at 2150.54.

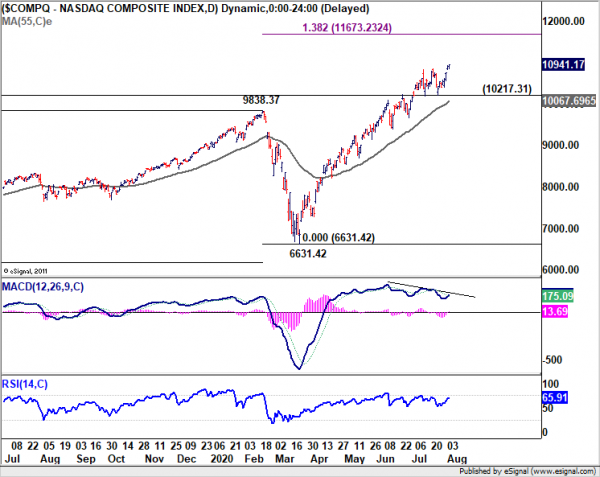

NASDAQ gained 0.35% to new record high, up trend in progress to 11673

NASDAQ gained another 0.35% overnight to close at new record of 10941.17. The upside range breakout is a sign of strength. But we’d need daily MACD to break sits trend line to confirm re-acceleration. If it happens, it’s likely that NASDAQ would have a take on 138.2% projection of 6190.17 to 9838.37 from 6631.42 at 11673.23 before making a top.

On the downside, the lower part of this week’s gap, last week’s high of 10747.80, is the first line of defense. 10217.31 support is the key near term structural level to maintain bullishness.

New Zealand unemployment rate dropped to 4% as people left labor force and worked less hours

New Zealand employment dropped -0.4% qoq in Q2, much smaller than expectation of -1.9% qoq. Unemployment dropped -5.1% qoq. Unemployment also surprised and dropped to 4.0%, down from 4.2%, way better than expectation of 5.7% . However, labor force participation rate also -0.8% to 69.7%. Labor cost index rose 0.2% qoq, below expectation of 0.4% qoq. Also, total weekly paid hours dropped -3.4% while actual weekly hours worked dropped -10.3%.

Both employment and unemployment fell in the quarter, as more people were not even in the labor force. Work hours dropped more sharply than employment, reflecting reduced hours worked during lockdown by the people remain employed.

China Caixin PMI services dropped to 54.1, composite dropped to 54.5

China Caixin PMI Services dropped to 54.1 in July, down from 58.4, missed expectation of 56.8. PMI Composite dropped slightly to 54.5, down from 55.7.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Both the manufacturing and services sectors continued recovering, especially manufacturing. New orders kept increasing and the backlog of work also rose. The gauge for business expectations remained high, suggesting that companies were confident about the economic recovery. Overseas demand continued to be troubled for both sectors.

“Employment was still a key problem. The combination of expanding demand and production with shrinking employment has dogged the economy for several months. In hard times, enterprises look to shore up profits by cutting costs, like labor. Therefore improving employment requires more time and greater confidence among businesses.”

Looking ahead

Eurozone and Eurozone PMI services will be featured in European session, together with Eurozone retail sales. But major focus will be US ADP employment and ISM non-manufacturing. US will also release trade balance. From Canada, trade balance will also be featured.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3287; (P) 1.3354; (R1) 1.3389; More….

USD/CAD’s break of 1.3315 suggests resumption of whole decline from 1.4667. Intraday bias is back on the downside. Deeper fall should be seen to long term fibonacci level at 1.3056. On the upside, break of 1.3459 resistance is needed to indicate short term bottoming. Otherwise, near term outlook will remain bearish in case of recovery.

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement of 1.2061 to 1.4667 at 1.3056 and possibly below. This will now remain the favored case as long as 1.3715 resistance holds. However, sustained break of 1.3715 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 42.7 | 35.5 | ||

| 22:45 | NZD | Employment Change Q2 | -0.40% | -1.90% | 0.70% | 1.00% |

| 22:45 | NZD | Unemployment Rate Q2 | 4.00% | 5.70% | 4.20% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q2 | 0.20% | 0.40% | 0.30% | |

| 01:45 | CNY | Caixin Services PMI Jul | 54.3 | 56.8 | 58.4 | |

| 07:45 | EUR | Italy Services PMI Jul | 51 | 46.4 | ||

| 07:50 | EUR | France Services PMI Jul F | 57.8 | 57.8 | ||

| 07:55 | EUR | Germany Services PMI Jul F | 56.7 | 56.7 | ||

| 08:00 | EUR | Eurozone Services PMI Jul F | 55.1 | 55.1 | ||

| 08:30 | GBP | Services PMI Jul F | 56.6 | 56.6 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | 5.00% | 17.80% | ||

| 12:15 | USD | ADP Employment Change Jul | 1200K | 2369K | ||

| 12:30 | USD | Trade Balance (USD) Jun | -50.3B | -54.6B | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Jun | -0.7B | |||

| 13:45 | USD | Services PMI Jul F | 49.6 | 49.6 | ||

| 14:00 | USD | ISM Non-Manufacturing PMI Jul | 54.8 | 57.1 | ||

| 14:00 | USD | ISM Non-Manufacturing Employment Index Jul | 51.1 | 43.1 | ||

| 14:30 | USD | Crude Oil Inventories | -3.4M | -10.6M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals