The markets turn into mild risk-off mode in Asia, after US President Donald Trump stepped up the tech war with China, by banning TikTok and WeChat. Commodity currencies are generally lower as lead by Australian Dollar. On the other hand, Dollar and Yen strengthen broadly. Nevertheless, for the week, the greenback is still the worst performing one. It will look into today’s non-farm payrolls report for some needed strengthen for rebound. Yet, disappointment is probably more likely then not.

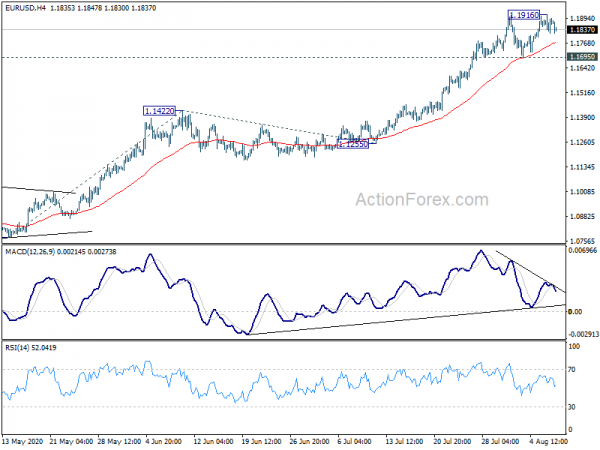

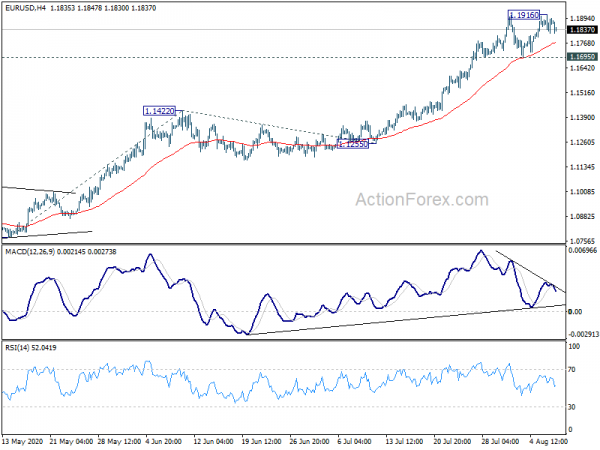

Technically, Dollar’s rebound is not troubling Gold’s rally for now. as it edged higher to new record of 2075 earlier today. Upside momentum is diminishing mildly as seen in 4 hour MACD. But as long as 2028.34 minor support holds, Gold is still on track to 161.8% projection of 1451.16 to 1747.75 from 1670.66 at 2150.54. EUR/USD failed to sustain above 1.1908 and it’s probably extending the consolidation from there with another falling leg. But as long as 1.1695 support holds, further rally expected. However, break of 1.1695 will suggest short term topping and bring near term reversal. Reactions to NFP would decide the next move.

In Asia, Nikkei closed down -0.39%. Hong Kong HSI is down -1.69%. China Shanghai SSE is down -0.67%. Singapore Strait Times is down -0.64%. Japan 10-year JGB yield is down -0.0063 at 0.013. Overnight, DOW rose 0.68%. S&P 500 rose 0.64%. NASDAQ rose 1.00% to 11108.07, another record. 10-year yield dropped -0.007 to 0.536.

Asian stocks tumble as Trump moves to ban TikTok and WeChat

Asia markets tumble broadly, particularly serious in Hong Kong, after US President Donald Trump issued an executive order to ban China’s TikTok and WeChat apps. The orders will go into effect in 45 days, and block all transactions with TikTok’s owner ByteDance, and transactions involving WeChat. The move was made under the International Emergency Economic Powers Act, which allows the president to declare a national emergency, block transactions and seize assets, in response to “unusual and extraordinary threat”.

“To protect our Nation, I took action to address the threat posed by one mobile application, TikTok. Further action is needed to address a similar threat posed by another mobile application, WeChat,” Trump said. “This data collection threatens to allow the Chinese Communist Party access to Americans’ personal and proprietary information — potentially allowing China to track the locations of Federal employees and contractors, build dossiers of personal information for blackmail, and conduct corporate espionage”.

China exports rose 7.2% in July, imports dropped -1.4%

In USD term, China’s exports rose 7.2% yoy to USD 237.6B in July. Imports dropped -1.4% yoy to USD 175.3B. Trade surplus came in at USD 62.3B, widened from June’s USD 46.4B, beat expectation of USD 42.5B.

Year-to-July, overall:

- Exports dropped -4.1% yoy to USD 1336B.

- Imports dropped -5.7% yoy to USD 1106B.

- Trade surplus was at USD 230B.

Year-to-July, with EU:

- Exports rose 0.7% yoy to USD 209.2B.

- Imports dropped -8.5% yoy to USD 133.5B.

- Trade surplus was at USD 75.7B.

Year-to July, with US

- Exports dropped -7.3% yoy to USD 221.3B.

- Imports dropped -3.5% yoy to USD 67.7B.

- Trade surplus was at USD 153.6B.

RBA paints slower recovery, says no to negative rates and intervention

In the Monetary Policy Statement, RBA revised down GDP projections for 2021, projecting a slower recovery. There were also upward revisions in unemployment rate forecasts and downward in inflation forecasts. The central bank also reiterated that currency intervention and negative rates no appropriate for the moment.

GDP contraction for year ending December 2020 was maintained at -6%. But a slower recovery is projected, at 5% for year ending December 2021, revised down from 6%. Growth is expected to slow further to 4% in the year ending December 2022.

Unemployment rate is projected be at 10% (revised from 9%) by 2020 end, then drop to 8.5% (revised up from 7.5%) in 2021 end, then to 7% in 2022 end. Trimmed mean inflation projections were also revised down to 1.00% (from 1.25%) in 2020 end, then 1.00% (from 1.25%) in 2021 end, and crawl back to 1.50% in 2020 end.

RBA said: “At a time when the value of the Australian dollar is broadly in line with its fundamentals and the market was working well, there was not a case for intervention in the foreign exchange market. Intervention in such circumstances is likely to have limited effectiveness.”

“The Board continues to view negative interest rates as being extraordinary unlikely in Australia. The main potential benefit is downward pressure on the exchange rate. But negative rates come with costs too. They can cause stresses in the financial system that are harmful to the supply of credit, and they can encourage people to save rather than spend.”

On the data front

Australia AiG performance of services rose to 44 in July, up from 31.5. Japan leading index rose to 84 in June, up from 78.4, above expectation of 78.8. Household spending dropped -1.2% yoy in June, better than expectation of -7.5% yoy. Labor cash earnings dropped -1.7% yoy in June, worse than expectation of -0.6% yoy. Germany industrial production rose 8.9% mom in June, slightly better than expectation of 8.8% mom. Trade surplus widened to EUR 14.5B in June.

Looking ahead. US non-farm payrolls is the major focus today. Markets are expecting 1510k growth in July. But given the huge ADP miss, there is prospect of downside surprise. Unemployment rate is expected to drop back to 10.7%. Average hourly earnings are expected to dropped -0.5% mom. Canada will also release employment data, and Ivey PMI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1825; (P) 1.1871; (R1) 1.1923; More…..

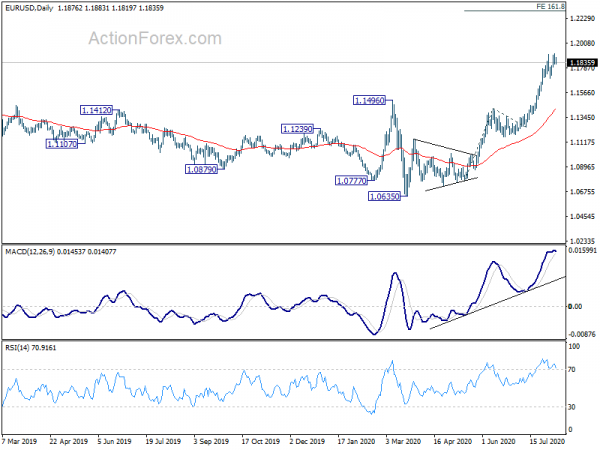

Intraday bias in EUR/USD is turned neutral as it retreated again after hitting 1.1916. But overall, further rise is expected as long as 1.1695 support holds. On the upside, break of 1.1916 will extend larger rally to 161.8% projection of 1.0774 to 1.1422 from 1.1255 at 1.2303. Nevertheless, on the downside, break of 1.1695 support will now indicate short term topping and bring deeper correction lower.

In the bigger picture, the strong break of 1.1496 resistance now suggests that whole down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 should be the third leg of the pattern from 1.0339 (2017 low). Further rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Jul | 44 | 31.5 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jun | -1.70% | -0.60% | -2.30% | |

| 23:30 | JPY | Household Spending Y/Y Jun | -1.2 | -7.50% | -16.20% | |

| 1:30 | AUD | RBA Monetary Policy Statement | ||||

| 2:00 | CNY | Trade Balance (USD) Jul | 62.3B | 42.5B | 46.4B | |

| 2:00 | CNY | Exports (USD) Y/Y Jul | 7.20% | -0.60% | 0.50% | |

| 2:00 | CNY | Imports (USD) Y/Y Jul | -1.40% | 1.00% | 2.70% | |

| 2:00 | CNY | Trade Balance (CNY) Jul | 442B | 265B | 329B | |

| 2:00 | CNY | Exports (CNY) Y/Y Jul | 10.40% | 2.30% | 4.30% | |

| 2:00 | CNY | Imports (CNY) Y/Y Jul | 1.60% | -0.70% | 6.20% | |

| 5:00 | JPY | Leading Economic Index Jun P | 85 | 78.8 | 78.4 | |

| 6:00 | EUR | Germany Industrial Production M/M Jun | 8.90% | 8.80% | 7.80% | 7.40% |

| 6:00 | EUR | Germany Trade Balance (EUR) Jun | 14.5B | 10.3B | 7.6B | |

| 6:45 | EUR | France Trade Balance (EUR) Jun | -7.1B | |||

| 6:45 | EUR | France Industrial Output M/M Jun | 10.00% | 19.60% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Jul | 850B | |||

| 8:00 | EUR | Italy Trade Balance(EUR) Jun | 5.58B | |||

| 12:30 | USD | Nonfarm Payrolls Jul | 1510K | 4800K | ||

| 12:30 | USD | Unemployment Rate Jul | 10.70% | 11.10% | ||

| 12:30 | USD | Average Hourly Earnings M/M Jul | -0.50% | -1.20% | ||

| 12:30 | CAD | Net Change in Employment Jul | 653.3K | 952.9K | ||

| 12:30 | CAD | Unemployment Rate Jul | 12.80% | 12.30% | ||

| 14:00 | USD | Wholesale Inventories Jun F | -2.00% | -2.00% | ||

| 15:00 | CAD | Ivey PMI Jul | 58.2 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals