Dollar continues to trade with a soft tone despite better than expected jobless claims data. The decline in claims data is seen more as a result of expiration USD 600 a week supplemental federal benefits, rather than the improvement in the labor market conditions. For now, though, New Zealand Dollar and Yen are the worst performing for today, with the latter pressured by further rally in treasury yields. European majors continue to trade higher with Sterling the strongest.

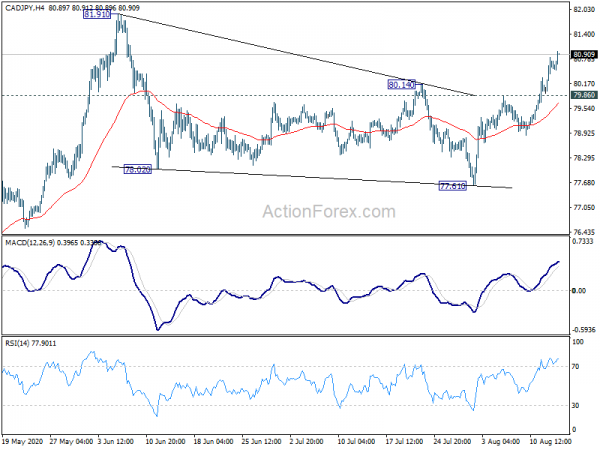

Technically, Yen’s selloff is staying in acceleration mode. CAD/JPY’s rally from 77.61 is in progress as long as 79.86 support holds. Consolidation from 81.91 should have completed with three waves down to 77.61. We’d expect a break of 81.91 resistance in near term. GBP/JPY has resumed the rise from 123.94 towards 141.07 projection level. We’ll watch for sign of acceleration above there. EUR/JPY is also on track to 129.32 projection level.

In Europe, currently, FTSE is down -1.02%. DAX is down -0.40%. CAC is down -0.35%. German 10-year yield is up 0.0221 at -0.424. It might challenge -0.4 handle soon. Earlier in Asia, Nikkei rose 1.78%. Hong Kong HSI dropped -0.05%. China Shanghai SSE rose 0.04%. Singapore Strait Times rose 1.28%. Japan 10-year JGB yield dropped -0.0069 to 0.035.

US initial claims dropped to 963k, below 1m for the first time since pandemic

US initial jobless claims dropped -228k to 963k in the week ending August 8, well below expectation of 1200k. Four-week moving average of initial claims dropped -86.3k to 1253k. Continuing claims dropped -604k to 15486k in the week ending August 1. Four-week moving average of continuing claims dropped -455k to 16170k.

Australia employment rose 11.47 in July, participation rate jumped

Australia employment rose 114.7k to 12.46m in July, better than expectation of 40k. It’s also a positive for full-time job to rise 43.5k to 8.55m. Part-time jobs rose 71.2k to 3.91m. Unemployment rate rose less than 0.1% to 7.5%, better than expectation of 7.8%, even though that’s a 22-year high. Participation rate also rose 0.6% to 64.7%.

Still, Bjorn Jarvis, head of Labour Statistics at the ABS, said: “The July figures indicate that employment had recovered by 343,000 people and hours worked had also recovered 5.5 per cent since May. Employment remained over half a million people lower than seen in March, while hours worked remained 5.5 per cent lower. ”

“The July data provides insight into the Australian labour market during Stage 3 restrictions in Victoria. The August Labour Force data will provide the first indication of the impact of Stage 4 restrictions.” Jarvis said.

RBNZ Bascand would consider more monetary stimulus if coronavirus and lockdown prolong

RBNZ Deputy Governor Geoff Bascand said resurgence of coronavirus infections is “a major risk to out outlook”. “If we get periods of resurgence and have longer lockdown periods then the unfortunate consequence of that is we will see downside risks to our outlook…things will be worse. We would have to consider doing more in terms of our monetary stimulus,” he said.

While New Zealand has been doing better domestically, “this is a big economic shock and its not over,” he added. “It was a little bit of wonderful feeling when we had 100 days of containment, but its a long haul to recovery”.

Separately, chief economist Chief Economist Yuong Ha said the central bank would like a weaker exchange rate and lower bond yields. The expansion of QE from NZD 60B to NZD 100B reflects that intention. Negative rate remains a policy option for RBNZ, but it’s not inevitable.

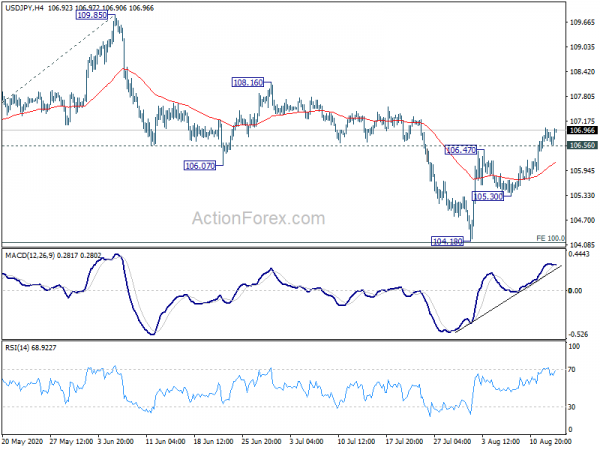

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 106.54; (P) 106.78; (R1) 107.12; More…

Intraday bias in USD/JPY remain son the upside for the moment and outlook is unchanged. Corrective fall from 111.71 should have completed with three waves down to 104.18, after missing 100% projection of 111.71 to 105.98 from 109.85 at 104.12. Further rise should be seen to 108.16 resistance. Firm break will target 109.85 and above. On the downside, below 106.56 minor support will turn intraday bias neutral first. But further rally will remain in favor as long as 105.30 support holds, even in case of retreat.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jul | 12% | -5% | -15% | -13% |

| 23:50 | JPY | PPI Y/Y Jul | -0.90% | -1.10% | -1.60% | |

| 1:00 | AUD | Consumer Inflation Expectations Aug | 3.30% | 3.20% | ||

| 1:30 | AUD | Employment Change Jul | 114.7K | 40.0K | 210.8K | |

| 1:30 | AUD | Unemployment Rate Jul | 7.50% | 7.80% | 7.40% | |

| 6:00 | EUR | Germany CPI M/M Jul F | -0.50% | -0.50% | -0.50% | |

| 6:00 | EUR | Germany CPI Y/Y Jul F | -0.10% | -0.10% | -0.10% | |

| 12:30 | USD | Initial Jobless Claims (Aug 7) | 963K | 1200K | 1186K | 1191 K |

| 12:30 | USD | Import Price Index M/M Jul | 0.70% | 0.30% | 1.40% | |

| 14:30 | USD | Natural Gas Storage | 51B | 33B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals