The jobs recovery probably extended into August alongside further improvement in the broader economic backdrop. About 1.7 million of the 3 million Canadian jobs lost in March and April came back through July, alongside an initial rebound in GDP as virus containment measures eased that has been sharper than feared.

Indeed, economic activity rose another 3% in July as manufacturing sales rose 8.7 % (even as retail sales growth lost steam, increasing just 0.7%). Similarly powerful gains took place in May and June, led by a rebound in household spending thanks to hefty government income support programs.

Overall, the ongoing strength of the recovery last month suggests the economy may outperform our own call for a 33 per cent increase in GDP in the third quarter (and the Bank of Canada’s 32% projection). Welcome news, especially in light of a decline that was shockingly large in Q2 at 38.7% (annualized rate). We remain cautiously optimistic that the recovery will continue through the rest of 2020 – but at a slower pace that will still leave Q4 GDP well-below levels a year ago.

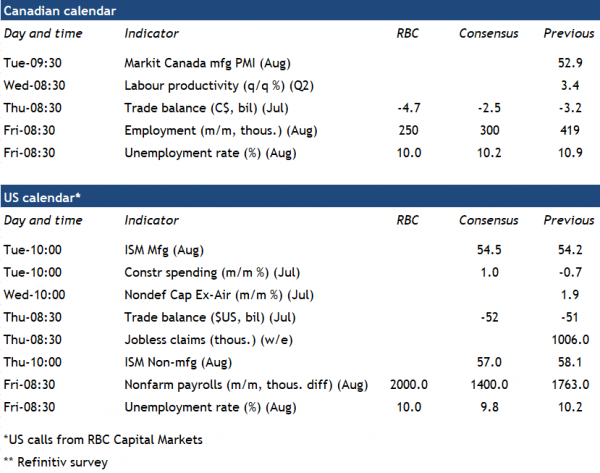

Nevertheless, further job (and GDP) gains will be increasingly hard to come by. And behind what has been a better than expected initial rebound, there remain a number of ongoing concerns. To be sure, labour markets (like the broader economy) are still running well below ‘normal’ levels. The 250k increase in employment we expect in August is down from the 400k increase in July and would still leave the overall jobs count down by about a million from February – a shortfall that is still more than twice the total job losses in the 2008/09 recession.

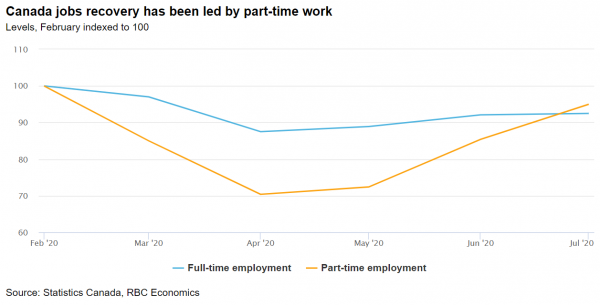

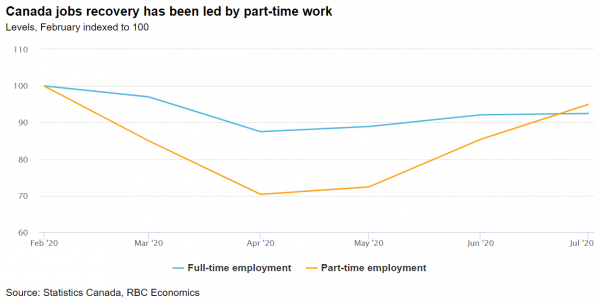

The unemployment rate could stay in double-digit territory for another month, declining to 10% from almost 11% in July. But that measure – while already historically elevated –is still understating the weakness in the current labour market. Though jobs have rebounded substantially from April lows, a large number of people returning to work have been doing so at reduced hours. Around 345k of the 419k increase in July employment came from part-time jobs – and more than a third of those gains were involuntary (that is, these employees would prefer to be working more hours.)

Meantime, demand for services – especially those in the hard-hit travel sector – remains very soft. There were still over 400k fewer jobs in accommodation & food services and entertainment in July compared to February – and those jobs will be among the slowest to return as long as the virus threat continues to restrict tourism.

US job recovery trails Canada – as government support falls off for millions

South of the border, we expect another 2 million jobs to come back in August – a fourth straight job gain measured in the millions – prompting the unemployment rate to tick down to 10%. Still, the U.S will have recovered only half of the 22 million drop it endured in March and April – less than the roughly two-thirds retracement we expect by August in Canada.

The larger concern going forward for the US, along with still elevated virus spread, is the falloff in income supports for those still out of work. Household disposable income rose sharply in both the US and Canada in the second quarter thanks to new government transfer payments designed to offset wage losses. But while a new suite of programs to replace CERB payments in Canada has substantially lowered income risks here, the federal top-up of employment insurance payments in the US has already expired – and new transfers approved by President Trump’s executive order have been sluggish to get out the door.

Industrial recovery to boost trade-flows and business sentiment

For Canada, a strengthening industrial recovery should result in higher international trade flows, particularly in the auto sector where reports suggest production was well-above year ago levels in July. Overall growth in imports (9.5%) is expected to slightly outpace growth in exports (6.5%) as there’s still more to catch up in imports relative to February levels. That should leave the trade deficit slightly wider at $4.7 billion.

We are also starting to receive early sentiment indicators for August. The CFIB barometer ticked lower in the month, but still looks significantly better than it did in the second quarter. Overseas, the “flash” Euro area manufacturing PMI dipped lower in August after rising substantially in July. Still – the same measure in the US, which arguably has bigger implications on the Canadian industrial sector given closely tied production chains – improved further into August. We expect there is still room for the Canadian manufacturing PMI out next week to inch higher.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals