Yen is trading with an undertone today despite mixed risk markets. Treasury yield is a factor weighing on Yen again, with US 10-year yield staying firm around 0.73 handle. Germany 10-year is also back above -0.4% handle. US stocks open slightly lower, following mild weakness in Europe, but that’s just a mild retreat. Euro and Canadian Dollar are the relatively stronger ones for now. Dollar is mixed as the recovery attempt is relatively short-lived. Aussie is also mixed, awaiting tomorrow’s RBA guidance.

Technically, EUR/USD is now close to 1.1965 resistance, break there will resume larger rise from 1.0635. We’ll see if that would drag down the greenback elsewhere. But at this point, it looks like Euro buying is the main driving force with EUR/JPY also close to 126.75 resistance. EUR/GBP also recovers with eyes on 0.8974 minor resistance.

In other markets, currently, DOW is down -150 pts. In Europe, FTSE is down -0.61%. DAX is down -0.24%. CAC is down -0.43%. German 10-year yield is up 0.019 at -0.390, back above -0.4 handle. Earlier in Asia, Nikkei rose 1.12%. Hong Kong HSI dropped -0.96%. China Shanghai SSE dropped -0.24%. Singapore Strait Times dropped -0.28%. Japan 10-year JGB yield dropped -0.0082 to 0.053.

Fed Clarida: Symmetric inflation outcomes requires asymmetric monetary policy reaction function

Fed Vice Chair Richard Clarida explained in a speech that if monetary policy “seeks only to return inflation to 2 percent”, the policy will tend to generate inflation that averages less than 2%. That would in turn “tend to put persistent downward pressure on inflation expectations”.

To “achieve symmetric outcomes for inflation requires an asymmetric monetary policy reactions reaction function in a low r* world with binding ELB constraints in economic downturns,” he added. Hence, FOMC will no longer refers to 2% inflation goal as “symmetric”, but “averages 2% over time”.

He also said said forward guidance and large-scale asset purchases “have been and continue to be effective” with federal funds rate at effective lower bound. He reiterated that “we do not see negative rates as an attractive policy option”. Yield caps and targets were “not warranted” in the current environment.

ECB Schnabel: No reason to adjust monetary policy with baseline scenario intact

In an interview with Reuters, ECB Executive Board Member Isabel Schnabel, said Eurozone’s Q2 GDP contraction of -12.1% qoq was “very large” but “close to our projection of -13%”. Incoming data also “by and large” support the baseline of June projections. She believed that the economic is close to the baseline with a “strong rebound” in Q3, and there will be a “protracted recovery”.

Despite recent resurgence of infections, “it looks unlikely that we are going to see a full lockdown again”, she added. And this is “precisely what we assumed in our baseline scenario”. As long as the baseline scenario remains intact, “there is no reason to adjust the monetary policy stance”.

Released in European session, Germany CPI rise back to 0.0% yoy in August, missed expectation of 0.2% yoy. Swiss retail sales rose 4.1% yoy in July, above expectation of 0.9% yoy.

Japan industrial production rose record 8.0% mom, still way off pre-pandemic level

According data from Japan’s Ministry of Economy, Trade and Industry, industrial production grew 8.0% mom in July, well above expectation of 5.0% mom. That’s also the quickest jump on record since 1978. Manufacturers are expect output to grow further by 4.0% mom in August, and further by 1.9% in September. However, METI expects output to remain below pre-pandemic level for some time. Over the year, production was down -16.1% yoy.

On the other hand, retail sales dropped -2.8% yoy in July, much worse than expectation of -1.7% yoy. Housing starts dropped -11.4%, better than expectation of -13.7% yoy. Consumer confidence edged down to 29.3, down from 29.5, missed expectation of 29.4.

As Prime Minister Shinzo Abe is stepping down, it’s reported that the ruling LDP will vote on September 14 to select a new leader.

New Zealand ANZ business confidence dropped to -41.8, activity dropped to -17.5

New Zealand ANZ Business Confidence dropped to -41.8 in August, down from July’s -31.8, but was revised slightly up from Aug preliminary reading of -42.4. Confidence is particularly weak in agriculture at -80.6, with services at -43.3, retail at -33.3, manufacturing at -37.3, and construction at -16.1.

Own activity outlook also dropped back to -17.5, down form July’s -8.9, worse than preliminary reading of -17.0. Retail was worst at -27.5, followed by agriculture at -22.6, manufacturing at -19.4, services at -13.9 and construction at -12.1.

ANZ added, “The recent re-emergence of COVID-19 is disheartening, and has taken a real toll on businesses, particularly in Auckland. However, it appears that firms are looking through it to some extent, in that intentions and expectations saw relatively modest falls compared to the first half of the month.”

From Australia, TD securities inflation rose 0.1% mom in August. Private sector credit dropped -0.1% mom in July. Company gross operating profits rose 15.0% qoq in Q2.

China PMI manufacturing edged down to 51.0 in Aug

The official Chinese PMI Manufacturing edged down to 51.0 in August, from 51.1, slightly below expectation of 51.1. PMI Non-Manufacturing, on the other hand, rose to 55.2, up from 54.2, above expectation of 54.0.

Zhao Qinghe a senior statistician with the NBS noted, “demand continues to recover, and the supply-demand cycle is gradually improving” with new order index rising for the 4th month to 52.0. trade also improved with new export orders rising 0.7 to 49.1.

However, “some companies in Chongqing and Sichuan reported an impact from the heavy rains and floods, resulting in a prolonged procurement cycle for raw materials, reduced orders and a pullback in factory production.”

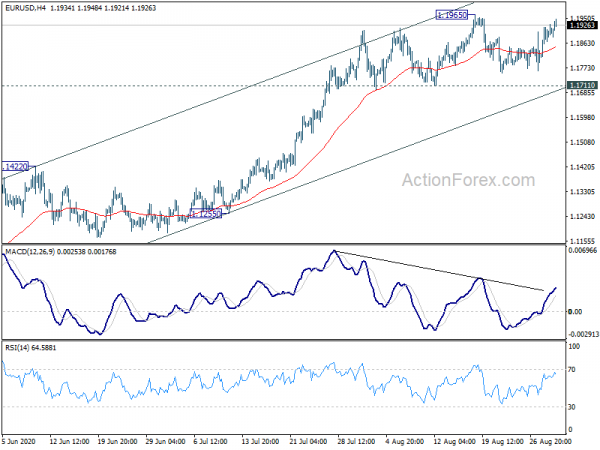

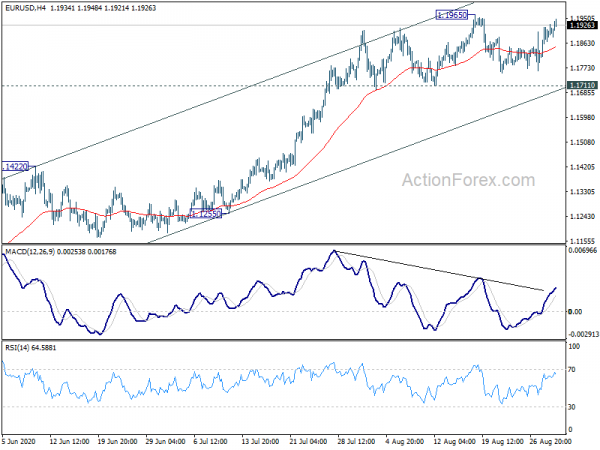

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1837; (P) 1.1879; (R1) 1.1946; More…..

EUR/USD is still staying below 1.1965 resistance despite today’s rebound. Intraday bias remains neutral first. Further rise is in favor with 1.1711 support intact. Firm break of 1.1965 will resume larger rise from 1.0635. On the downside, though, break of 1.1711 support should confirm short term topping and turn bias back to the downside for correction.

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jul P | 8.00% | 5.00% | 1.90% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | -2.80% | -1.70% | -1.30% | |

| 01:00 | CNY | Manufacturing PMI Aug | 51 | 51.1 | 51.1 | |

| 01:00 | CNY | Non-Manufacturing PMI Aug | 55.2 | 54 | 54.2 | |

| 01:00 | AUD | TD Securities Inflation M/M Aug | 0.10% | 0.90% | ||

| 01:00 | NZD | ANZ Business Confidence Aug | -41.8 | -42.4 | ||

| 01:30 | AUD | Private Sector Credit M/M Jul | -0.10% | 0.20% | -0.20% | |

| 01:30 | AUD | Company Gross Operating Profits Q/Q Q2 | 15.00% | -6.00% | 1.10% | 1.40% |

| 05:00 | JPY | Housing Starts Y/Y Jul | -11.40% | -13.70% | -12.80% | |

| 05:00 | JPY | Consumer Confidence Index Aug | 29.3 | 29.4 | 29.5 | |

| 06:30 | CHF | Real Retail Sales Y/Y Jul | 4.10% | 0.90% | 1.10% | 3.30% |

| 12:00 | EUR | Germany CPI M/M Aug P | -0.10% | -0.20% | -0.50% | |

| 12:00 | EUR | Germany CPI Y/Y Aug P | 0.00% | 0.20% | -0.10% | |

| 12:30 | CAD | Industrial Product Price M/M Jul | 0.70% | 0.50% | 0.40% | |

| 12:30 | CAD | Raw Material Price Index Jul | 3.00% | 6.90% | 7.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals