U.S. Highlights

- A wide dispersion of forecasts for U.S. growth over the next year reflects high levels of uncertainty around the duration of the health crisis as well as future government supports.

- Assuming a modest fiscal package passes Congress this fall and a vaccine becomes available by the middle of next year, the American economy should recover most of what was lost through the pandemic by the end of 2021.

- Inflation data showed an acceleration in price growth in August. Total CPI was up 1.3% year-on-year in August, continuing its recovery from only 0.1% in May.

Canadian Highlights

- Housing continues to defy expectations. Starts rose to 262k in August, the strongest performance since 2007. Skewed to condos in a likely reflection of pre-pandemic demand, such elevated levels are unlikely to persist given many headwinds.

- The depth of the recession brought healthier household finances, at least in aggregate. Net worth rose in the second quarter and relative indebtedness fell due to the unique nature of the pandemic, including government support measures.

- The impacts have not been even. This was a key theme of remarks from Bank of Canada Governor Macklem, who reinforced that lower borrowing costs are not going anywhere as the recovery enters a more challenging phase.

U.S. – A Wide Dispersion of Expectations for Recovery

As we head into the final days of summer, it’s a good time to step back and evaluate the prospects for the American economy over the next year. The dispersion of economic growth forecasts has perhaps never been higher. While forecasters all expect a meaningful decline in activity this year, that is due to what’s already been recorded. Meanwhile, forecasts for growth in 2021 in the Blue Chip survey range from over 6% at the high end, to under 2% at the low end. At the high-end, this recovers all the activity lost to the pandemic, while at the low end, it is nothing short of stagnation.

This wide dispersion reflects the unprecedented level of uncertainty around the course of the pandemic, as well as its secondary economic impacts. This can be seen in the wide array of underlying assumptions among forecasters around items key to the outlook. For example: when and if a vaccine becomes available, how effective and permanent it will be, how much future government support will be provided.

We do not claim to have any better insight on these questions than other forecasters, but we have tried to make plausible assumptions to ground our forecast. In the case of the health questions, we assume that a vaccine or effective treatment becomes widely available by the second half of 2020.

Beyond the basic uncertainty around when and if we recover fully from the pandemic, we have little in the way of traditional macro models to gauge how consumers and businesses respond to health crises. This was true on the way down, but also on the way up. We can observe, based on recent data, that after an initial plunge, households have been more than willing to increase spending on durable goods – suggesting little permanent damage to household confidence. Rather, what’s holding back a broader recovery is service-sector areas of the economy where activity is directly impacted by the potential risk of infection. This offers reason to expect a fairly solid bounce back once these fears are allayed.

In the case of government policy, we are equally in the dark. The extraordinary fiscal supports early in the year have divorced measures of overall economic activity from household income. Spending rebounded as it did due to these supports. Congress continues to debate another package, but the chasm between Republicans and Democratic bills is roughly 10 times ($300 billion versus $3 trillion). So, we’re left making assumptions. We assume that Congress does eventually come up with some additional support, but closer to the lower range of outcomes, around $400 billion, split between individual checks and unemployment benefits.

With these assumptions in place, and assuming no major second wave of the virus leads to another round of shutdowns, it is reasonable to expect the American economy to recover much of what was lost to the pandemic over the past year. While growth appears likely to slow after its initial burst on reopening, it should pick up again once a vaccine is available. Importantly, much of the deficit in spending is due to high-income individuals, who should be able to dip into these accumulated saving to support growth once the virus threat has passed. As a result, we expect the level of GDP to regain its pre-recession level by the first quarter of 2022. We will be publishing our full views on the economic outlook next week and hope you will give them a read.

Canada – Housing Up, Rates Staying Down

We had a somewhat “data light” week in Canada, but what we did receive revealed more about the unique and uneven nature of the pandemic-induced recession. Like other areas of housing such as resales, you’d never guess we were in the midst of a pandemic by looking at the August housing starts data. Led by Ontario, and the multiples segment (i.e. condos), starts surged to 262k at an annualized pace, the strongest monthly performance since 2007 (Chart 1). Housing starts are typically associated with earlier demand, and given the lead times from presale to construction when it comes to condos, August is likely a reflection of pre-pandemic demand. But, a start is a start, and this data should translate into construction activity at least through the remainder of the year. However, this pace is unlikely to be sustained given softer population growth, rising condo supply in resale markets, and the recent shift in demand towards low-rise dwellings in the wake of the pandemic.

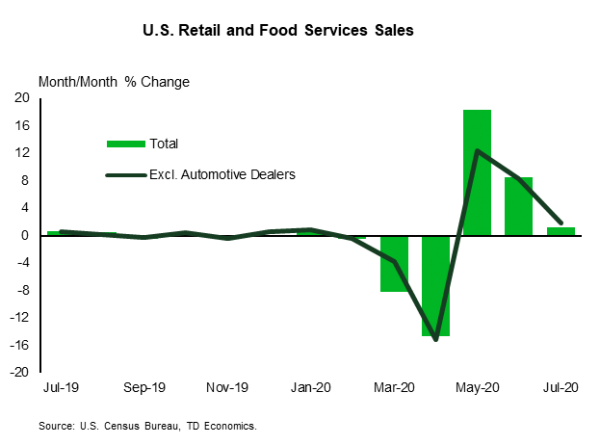

The other big piece of data was also backwards looking. Canadian household balance sheets, long a source of much consternation, improved markedly in the second quarter. A combination of much lower spending during the lockdown and substantial government transfers via CERB and other programs led to a more than 17 point drop in the debt-to-income ratio, to 158.2%, its lowest level since 2009. Rising equity markets helped drive a gain in net worth, and mortgage and other debt payment deferrals reduced the debt service ratio (See data summary). As with much of the economic outcomes lately, more than a few caveats apply. First, much of the improvement in household balance sheets and cash flows are likely to be temporary. Spending has bounced back strongly this summer (retail sales are already above pre-pandemic levels), income supports will become less generous, and deferrals begin to expire this fall. As noted in our data analysis, all of these will present challenges to households in the months and quarters to come.

The second caveat, as noted in Bank of Canada Governor Tiff Macklem’s speech this week, is that recent gains in financial market wealth and other areas are unlikely to be evenly shared. One core aspect of the pandemic has been the uneven nature of the impact. To take just one example, employment for the lowest-earning Canadians (earning less than $16.04 per hour) was 87.4% of pre-pandemic levels in August; for all other workers, it had recovered to within a percentage point of norms. Monetary policy is a blunt tool, but the Governor noted in his remarks that it can help reduce income inequality by, in effect, creating a rising tide.

Extending this metaphor a bit further, while monetary policy can raise tides, it cannot move boats into the water. Taking the governor’s remarks as a whole, they look like a tacit acknowledgment that fiscal policy will need to rule the day when it comes to economic recovery. So, the Bank’s role will be supporting growth by keeping borrowing costs low for both businesses and households, and also governments. Despite a near-term recovery that is tracking much stronger than the Bank’s earlier expectations (Chart 2; we will get an updated Bank of Canada outlook in October), borrowing costs will remain low for some time.

U.S: Upcoming Key Economic Releases

U.S. FOMC Meeting – September

Release Date: September 16, 2020

Previous: 0.0-0.25% funds rate

TD forecast: 0.0-0.25%

Consensus: 0.0-0.25%

The focus of the FOMC meeting will be on details other than the funds rate, which will almost certainly be left at close to 0%. In particular, the focus will be on follow-up to the formal adoption of average inflation targeting (AIT) last month. We don’t expect specific inflation-outcome-based forward guidance yet, raising the potential for disappointment in markets. However, we still expect plenty of dovishness, through the incorporation of AIT in the forward guidance—without specificity—the wording on QE, the tone on the economy, the dot plot, and the press conference.

U.S. Retail Sales – August

Release Date: September 16, 2020

Previous: 1.2% m/m total, 1.9% ex-autos, 1.4% control group

TD forecast: 0.2% m/m total, 0.1% ex autos, 0.0% control group

Consensus: 1.0% total, 1.0% ex-autos, 0.3% control group

Retail sales probably slowed again in August, with the boost from continued growth in employment through the month offset by a waning of fiscal support, most notably extended unemployment benefits. We forecast a rise of 0.2% m/m, following up 1.2% July and 8.4% in June. Even with slowing, spending is on track for a sharp increase in Q3 on a q/q basis. The slowing could be ominous for Q4, however, particularly if there is no “Phase 4” fiscal package.

Canada: Upcoming Key Economic Releases

Canadian Manufacturing Sales – July

Release Date: September 15, 2020

Previous: 20.7%

TD Forecast: 7.5%

Consensus: NA

Manufacturing sales are forecast to rise another 7.5% m/m in July on another sizeable advance in durable goods shipments. Transportation products should lead the advance, reflecting higher (seasonally adjusted) auto production and strong aerospace exports. Forestry products should provide another source of strength, due in part to higher lumber prices. Nondurables should see more modest gains; refinery output will benefit from higher petroleum prices, but food and beverage production already sits near pre-COVID levels and accounts for 44% of all nondurables. Real manufacturing shipments should see a similar increase to the nominal print which will reinforce expectations for another significant increase in industry-level GDP.

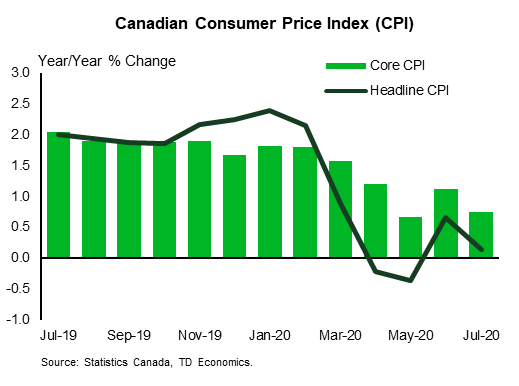

Canadian Consumer Price Index – August

Release Date: September 16, 2020

Previous: 0.0% m/m, 0.1% y/y, Index: 137.2

TD Forecast: 0.1% m/m, 0.4% y/y, index: 137.3

Consensus: NA

TD looks for inflation to recover to 0.4% y/y in August with prices up a muted 0.1% on the month. This reflects less drag from energy on a year-ago basis (-0.40pp vs -0.55pp in July), due largely to base-effects, with gasoline prices only slightly higher in August following the 4.4% increase in July and double-digit gains observed in May/June. Rising new home prices will provide a tailwind to the shelter component while clothing/apparel typically provides a source of strength in August (and into September) on back to school shopping, although COVID disruptions could result in lower prices on a seasonally adjusted basis. Broader seasonal headwinds paired with the COVID impact could hold CPI to an even weaker performance for the month, as the last four Augusts have seen CPI fall 0.1% m/m on average, but the significant (0.4pp) negative surprise on July CPI leaves us cautiously anticipating some mean-reversion to drive a modest increase. Looking past the headline we expect core CPI to hold near 1.6% on average with downside risk to the weighted-median measure.

Canadian Retail Sales – July

Release Date: September 18, 2020

Previous: 23.7%, ex-auto: 15.7%

TD Forecast: 2.0%, ex-auto: 1.2%

Consensus: NA

Retail sales growth is projected to slow markedly after a return to pre-COVID levels in June, with TD forecasting a 2.0% m/m increase for July. This is above StatCan estimates for 0.7% m/m, but well off the +20% prints for May/June. Motor vehicles should lead the increase with new car sales just 5% below year-ago levels alongside strong demand for used cars and recreational vehicles. Elsewhere, we look for a more modest 1.2% increase in the ex-autos measure. Gasoline station sales will be supported by higher prices and increased driving activity, as indicated by Apple mobility data, while home furnishings will benefit from record existing home sales. Other categories could see a weaker performance, reflecting in part less pent-up demand.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals