Trading in the forex markets remain generally subdued for now. While US stocks are set for a rebound, currency traders are not to bothered with that. Sterling is so far the stronger one for today, as traders take profits on shorts, ahead of of the string of UK data, BoE and Brexit developments. Australian Dollar is currently the weaker one, awaiting tomorrow’s RBA minutes. Dollar is also struggling mildly.

Technically, while the Pound recovers, there is no clear indication of bottoming yet. We’d expect further fall in the Pound as long as 1.3035 minor resistance in GBP/USD, 138.38 minor resistance in GBP/JPY and 0.9067 minor support in EUR/GBP hold. As for Dollar, we might not see some sustainable, committed move, until USD/JPY breaks out of range of 105.10/107.05.

In Europe, currently, FTSE is up 0.23%. DAX is up 0.07%. CAC is up 0.05%. Germany 10-year yield is down -0.010 at -0.488. Earlier in Asia, Nikkei rose 0.65%. Hong Kong HSI rose 0.56%. China Shanghai SSE rose 0.57%. Singapore Strait Times dropped -0.30%. Japan 10-year JGB yield dropped -0.0018 to 0.021.

ECB Makhlouf: Demand factors will dominate and lead to a fall in prices with coronavirus pandemic

ECB Governing Council member Gabriel Makhlouf said “predicting how demand and supply shocks will interact over the medium to long term is not straightforward”. “Both demand and supply side factors will continue to impact on inflation”. But he believed that “demand factors will dominate and lead to a fall in prices” with the coronavirus pandemic.

He explained, “fear of infection, weak labour markets, heightened uncertainty and higher precautionary savings will lead to lower demand for goods and services which implies that the real natural rate of interest is likely to remain at low levels.”

Eurozone industrial production rose 4.1% mom in Jul, strong rise in Portugal, Spain and Ireland

Eurozone industrial production rose 4.1% mom in July, above expectation of 2.8% mom. Production of capital goods rose by 5.3% mom, durable consumer goods by 4.7% mom, intermediate goods by 4.2% mom, non-durable consumer goods by 3.9% mom and energy by 1.1% mom.

EU industrial production also rose 4.1% mom in the month. The highest increases were registered in Portugal (+11.9% mom), Spain (+9.4% mom) and Ireland (+8.3% mom). Decreases were observed in Denmark (-4.9% mom), Latvia (-0.8% mom) and Belgium (-0.5% mom).

Germany’s economic catch-up process slows

Germany’s Economy Ministry said the “catch-up” process in the economy continues but “has recently weakened”. Recovery is “likely to continue as the year progresses”. But pre-pandemic level of activity won’t be reached beginning of 2022.

Also, the recovery is uneven. Automotive and parts sector slowed after the dynamic recovery in the previous months. But mechanical engineering sector reported a decline. However, sentiments continue to improve as business expectations are more optimistic again. Additionally, there was no coronavirus related rise in unemployment.

Suga won landslide victory in LDP leadership votes, paving way to be next Japanese PM

Japanese Chief Cabinet Secretary Yoshihide Suga won a landslide victory in the leadership election of the ruling Liberal Democratic Party today. He got 377 votes out of the 534 votes cast. former defence minister Rival Shigeru Ishiba for 68 votes while ex-Foreign Minister Fumio Kishida got 89.

Suga will become the next Prime Minister in the parliamentary vote on Wednesday with virtually no doubt. For now, he’s expected to serve out out-going Prime Minister Shinzo Abe’s remaining term through September 2021. But a snap election is a possibility for the new PM.

For the markets, most importantly, Suga has indicated that he would continue with the signature “Abenomics”, suggesting continuity with the currency economic policies.

Released from Japan, industrial production was finalized at 8.7% mom in July. Tertiary industry index dropped -0.5% mom.

GBP/USD Mid-Day Outlook

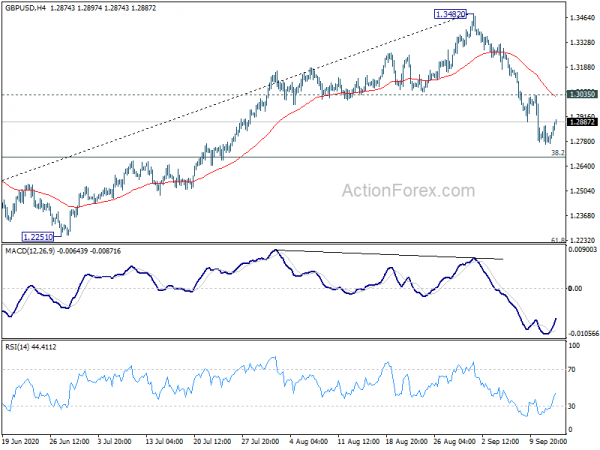

Daily Pivots: (S1) 1.2753; (P) 1.2809; (R1) 1.2853; More….

Intraday bias in GBP/USD is turned neutral as it lost down side momentum as seen in 4 hour MACD. Further decline remains in favor with 1.3035 minor resistance intact. Decisive break of 38.2% retracement of 1.1409 to 1.3482 at 1.2690 will argue that the rise from 1.1409 might be completed, and bring deeper fall to 61.8% retracement at 1.2201. Though, break of 1.3035 will suggest that decline from 1.3482 is merely a corrective move, and turn bias back to the upside for retesting 1.3482.

In the bigger picture, while the rebound from 1.1409 was strong, it’s limited by both 1.3514 resistance, as well as 55 week EMA (now at 1.3317). The development keeps outlook bearish. Sustained break of 55 week EMA (now at 1.2743) will add to medium term bearishness for a new low below 1.1409 at a later stage, resuming the down trend from 2.1161 (2007 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 4:30 | JPY | Tertiary Industry Index M/M Jul | -0.50% | 0.60% | 7.90% | |

| 4:30 | JPY | Industrial Production M/M Jul F | 8.70% | 8.00% | 8.00% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Jul | 4.1% | 2.80% | 9.10% | 9.5% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals