Yen picks up some upside momentum again today while the forex markets continue to flip-flop elsewhere. Australian Dollar turn softer, followed by Canadian and Swiss Franc. Kiwi is the second strongest next to Yen, followed by Sterling and Dollar. For the week, Yen remains the strongest one. There is potential for further rally should stocks head south before close.

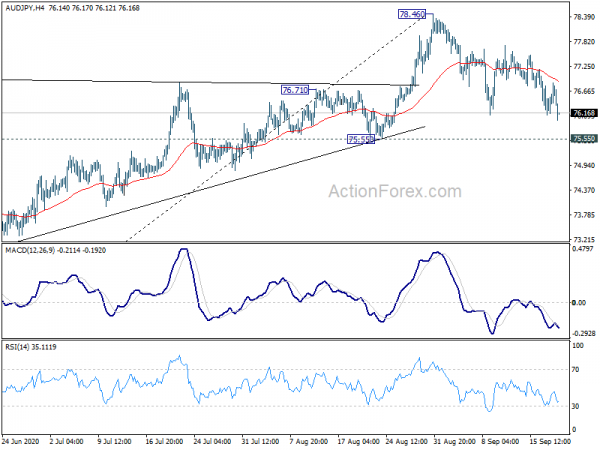

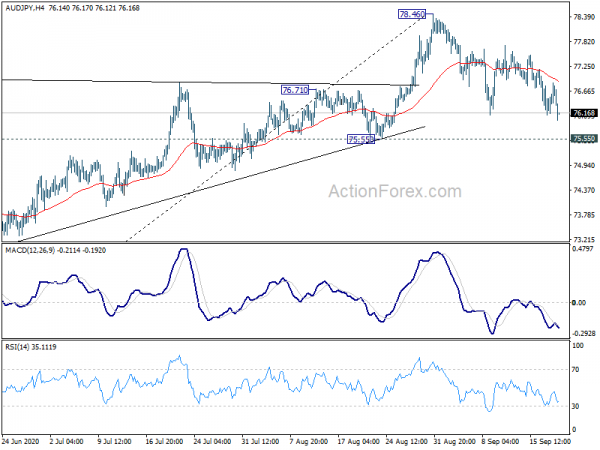

Technically, Australian Dollar weakens quite notably in some crosses. AUD/JPY’s fall from 78.46 resumes today and should be heading to 75.55 support next. Break there will solidify the case that it’s already in correction to whole rise from 59.98. AUD/NZD also broke 1.0814 support, finally resumes the corrective fall from 1.1043, towards 1.0565 support.

In Europe, currently, FTSE is down -0.51%. DAXC is up 0.14%. CAC is down -0.59%. Japan German 10-year yield is down -0.0104 at -0.501. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI rose 0.47%. China Shanghai SSE rose 2.07%. Singapore Strait Times dropped -0.12%. Japan 10-year JGB yield rose 0.0013 to 0.015.

Canada retail sales rose 0.6% in Jul, in V-shaped recovery

Canada retail sales rose 0.6% mom to CAD 52.9B in July, below expectation of 0.8% mom. Growth was led by higher sales at motor vehicles and parts dealers and gasoline stations. Core retail sales dropped -1.2% mom. StatCan said “overall, the recovery in total retail sales has been V-shaped, with sales in June and July, respectively, rebounding from the record low observed in April.”

Also from Canada, wholesale sales rose 4.3% mom in July, above expectation of 3.4% mom.

UK retail sales rose 0.8% in Aug, 4% above pre-pandemic level

UK Retail sales rose 0.8% mom in August, above expectations of 0.7% mom. Over the year, sales rose 2.8% yoy, below expectation of 3.0% yoy. That’s the fourth consecutive month of growth, resulting in an increase of 4.0% comparing with February’s pre-pandemic level.

From Germany, PPI came in at 0.0% mom, -1.2% yoy in August, versus expectation of 0.1% mom, -1.8% yoy. Eurozone current account surplus narrowed to EUR 16.6B, above expectation of EUR 12.0B.

CBI: 46% UK firms would cut jobs or not hire in 12 months

UK CBI found in a survey that 51% of firms are expecting to maintain or increase their permanent recruitment in the coming 12 months. At the same time, 46% are planning to either reduce permanent recruitment of not recruit at all. The balance of +5% was sharply lower than +56% in the survey last ear.

Matthew Fell, CBI Chief UK Policy Director, said: “The UK labour market has been under heavy stress since the outset of the Covid-19 crisis and, although the economy has started to re-open, pressure on firms remains acute… We are seeing a two-speed recovery. While some firms are already looking at creating new jobs, most others are in survival mode.”

Japan CPI core dropped to -0.4%, lowest in nearly four years

Japan CPI core (all items less fresh food) dropped to -0.4% yoy in August, down from 0.0% yoy, matched expectations. It’s the lowest readings in nearly four years, matching the low seen in November 2016. All item CPI slowed to 0.2% yoy, down form 0.3% yoy. CPI core-core (all items less fresh food and energy) turned negative to -0.1% yoy, down form 0.4% yoy. Downward pressure is generally expected on prices, which might send core CPI to as low as -1.0% later this year.

Separately, according to a telephone poll by Kydo news 66.4% of the public support new Prime Minister Yoshihide Suga’s cabinet. A survey by Nikkei newspaper and TV Tokyo showed 74% support. Suga is generally expected to follow most a large part of Abenomics as his economic policies.

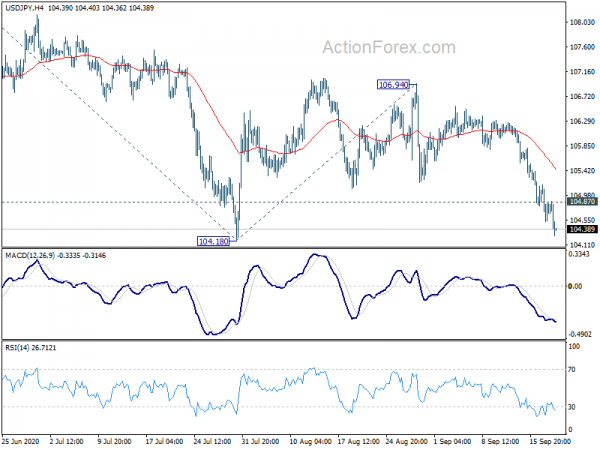

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 104.45; (P) 104.81; (R1) 105.10; More…

Intraday bias in USD/JPY remains on the downside for 104.18 support. Break there will resume larger fall from 111.71 and target 61.8% projection of 109.85 to 104.18 from 106.94 at 103.43 next. On the upside, above 104.87 minor resistance will turn intraday bias neutral first, for some consolidations, before staging another decline.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Aug | -0.40% | -0.40% | 0.00% | |

| 06:00 | GBP | Retail Sales M/M Aug | 0.80% | 0.70% | 3.60% | 3.70% |

| 06:00 | GBP | Retail Sales Y/Y Aug | 2.80% | 3.00% | 1.40% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Aug | 0.60% | 0.40% | 2.00% | 2.10% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Aug | 4.30% | 4.20% | 3.10% | |

| 06:00 | EUR | Germany PPI M/M Aug | 0.00% | 0.10% | 0.20% | |

| 06:00 | EUR | Germany PPI Y/Y Aug | -1.20% | -1.80% | -1.70% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Jul | 16.6B | 12.0B | 20.7B | |

| 12:30 | CAD | Wholesale Sales M/M Jul | 4.30% | 3.40% | 18.50% | |

| 12:30 | CAD | Retail Sales M/M Jul | 0.60% | 0.80% | 23.70% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | -0.40% | 0.50% | 15.70% | |

| 12:30 | USD | Current Account (USD) Q2 | -170.5B | -158B | -104B | |

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 76 | 74.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals