Dollar remains the strongest one for today but Swiss Franc and Sterling have overtaken as the next strongest. Sterling is some what helped by solid PMIs but Euro shrugged off the disappointing PMI readings. European stock markets are having a solid rebound today while US equities might further pare back recent losses. We’ll see if that would help Yen crosses rebound, or drag down the greenback a bit. At the same time, Australian and New Zealand Dollars remain the weakest on expectation of further central bank easing.

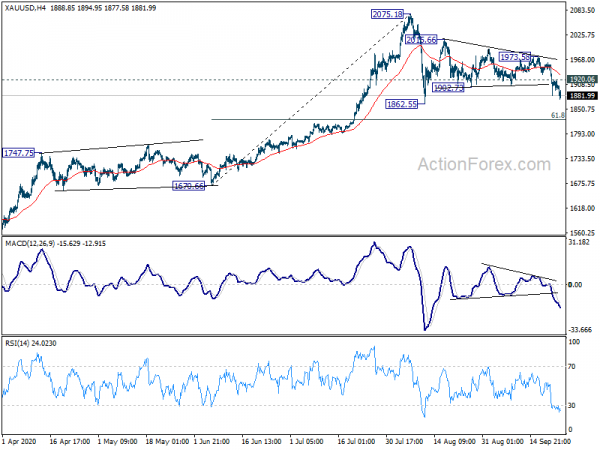

Technically, USD/JPY is pressing 105.20 minor resistance. Firm break there will temporarily neutralize near term bearishness and bring stronger rebound back towards 106.94 support. EUR/GBP is a pair to watch for today and tomorrow as. It’s currently in the middle of range of 0.9067/9291 and looks set to take on the lower side. Break of 0.9067 could be an early sign of near term bearish reversal. As long as 1920.06 resistance holds, Gold should extend the decline through 1862.55 to 61.8% retracement of 1670.66 to 2075.18 at 1825.16. Ideally, that should be accompanied by further rebound in Dollar.

In Europe, currently, FTSE is up 2.02%. DAX is up 1.21%. CAC is up 1.38%. German 10-year yield is up 0.0002 at -0.501. Earlier in Asia, Nikkei dropped -0.06%. Hong Kong HSI rose 0.11%. China Shanghai SSE rose 0.17%. Singapore Strait Times rose 0.72%. Japan 10-year JGB yield dropped -0.0033 at 0.010.

Fed Clarida: Interest rate at zero until inflation reaches 2% at least

Fed Vice Chair Richard Clarida told Bloomberg that “rates will be at the current level, which is basically zero, until actual observed PCE inflation has reached 2%.”

“That’s ‘at least.’ We could actually keep rates at this level beyond that. But we are not even going to begin thinking about lifting off, we expect, until we actually get observed inflation … equal to 2%. Also we want our labor market indicators to be consistent with maximum employment … So that is the whites of their eyes.”

UK PMIs retreated, but still point to solid Q3 GDP rebound

UK PMI Manufacturing dropped slightly to 54.3 in September, down form 55.2, above expectation of 54.0. PMI services dropped to 55.1, down form 58.8, missed expectation of 56.0. PMI Composite dropped to 55.7, down form 59.1.

Chris Williamson, Chief Business Economist at IHS Markit, said: “The UK economy lost some of its bounce in September, as the initial rebound from Covid-19 lockdowns showed signs of fading… It was not surprising to see that the slowdown was especially acute in services… Encouragingly, robust growth in manufacturing, business services and financial services has offset weakness in consumer-facing sectors, meaning the overall rate of expansion remained comfortably above the survey’s long-run average, which adds to expectations that the third quarter will see a solid rebound in GDP from the collapse seen in the second quarter.

Eurozone PMIs showed renewed downturn in services

Eurozone PMI Manufacturing rose to 53.7 in September, up from 51.7, and beat expectation of 51.9. That’s also the highest level in 25 months. However, PMI services dropped to 47.6, down from 50.5, back in contraction and missed expectation of 50.5. PMI Composite dropped to 50.1, down from 51.9.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone’s economic recovery stalled in September, as rising COVID-19 infections led to a renewed downturn of service sector activity across the region. A two-speed economy is evident… The main concern at present is therefore whether the weakness of the September data will intensify into the fourth quarter, and result in a slide back into recession after a frustratingly brief rebound in the third quarter.”

France PMI Manufacturing rose to 50.9 in September, up from 49.8, above expectation of 50.6. However, PMI Services dropped to 47.5, down from 51.5, missed expectation of 51.7. PMI Composite dropped to 48.5, down from 51.6, hitting a 4-month low and was back in contraction.

Germany PMI Manufacturing rose to 56.6, in September, up from 52.2, beat expectation of 52.5. That’s also a 26-month high. PMI Services, however, dropped to 49.1, down from 52.5, missed expectation of 53.0 and was back in contraction. PMI Composite dropped slightly to 53.7, down from 54.4.

Germany Gfk Consumer Confidence for October rose slightly to -1.6, up from -1.7. Economic expectations jumped sharply from 11.7 to 24.1 in September. Income expectations also improved from 12.8 to 16.1.

Japan PMI composite edged up to 45.5, setting the scene for more Q3 weakness

Japan PMI Manufacturing edged up to 47.3 in September, from August’s 47.2. PMI Services also rose to 45.6, up from 45.0. PMI Composite rose to 45.5, up from 45.2.

Bernard Aw, Principal Economist at IHS Markit, said: “Flash PMI survey data indicated a further decline in Japanese private sector output during September, setting the scene for further economic weakness in the third quarter… That said, the picture of the economy remained much improved when compared to the height of the pandemic during the second quarter.

“The survey also revealed some positive signs. Firstly, employment moved closer to stabilisation, with only a marginal drop in workforce numbers that was the weakest in the current sequence of job shedding. Secondly, business sentiment improved to the strongest since the start of the year, with manufacturing firms particularly optimistic about the year-ahead outlook.”

Australia PMI composite rose to 50.5 in Sep, retail sales dropped -4.2% mom in Aug

Australia PMI Manufacturing rose to 55.5 in September, up from 53.6, hitting a 29-month high. PMI Services also improved slightly to 50.0, up from 49.0. PMI Composite rose to 50.5, up from 49.4, back in expansion.

Bernard Aw, Principal Economist at IHS Markit, said: “The latest PMI data showed signs of stabilisation in Australia’s private sector business conditions during September, with activity and sales increasing marginally after falling in August amid tightening containment measures to contain a surge in new infection cases. However, other survey indicators suggest that the rebound may lack legs going forward. The absence of capacity pressure led to a further and sharper decline in workforce numbers, highlighting the prospect of rising unemployment.”

Retail sales dropped -4.2% mom, or AUD -1.28B, in August. Over the year, though, sales was up 6.9% yoy comparing with August 2019. Sales dropped sharply by -12.6 mom in Victoria, due to stage-4 restriction sin Melbourne. Excluding Victoria, sales in the rest of Australia dropped -1.5% mom.

RBNZ holds OCR at 0.25% and prepares for more stimulus

RBNZ held OCR unchanged at 0.25% as widely expected. The Large Scale Asset Purchase program is also kept at a maximum of NZD 100B by June 2022. The action is “necessary to further lower household and business borrowing rates in order to achieve the Committee’s inflation and employment remit.”

RBNZ also made progress on deploying additional monetary instruments, including “a Funding for Lending Programme (FLP), a negative OCR, and purchases of foreign assets.” It noted that “a package of an FLP and a lower or negative OCR could provide an effective way to deliver additional monetary stimulus.”

On the economy, RBNZ expects “a rise in unemployment and an increase in firm closures, as resource reallocation continues”. Significant monetary policy support is needed “for a long time”. In the minutes, it also noted that “further monetary stimulus may be needed” to help achieve its remit objectives and promote financial stability.

Suggested reading on RBNZ:

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 104.55; (P) 104.81; (R1) 105.22; More…

USD/JPY’s rebound from 104.00 continues today and focus is back on 105.20 support turned resistance. Decisive break there would indicate short term bottoming. Stronger rebound would be seen back to 106.94 resistance. Nevertheless, rejection by 105.20 will maintain near term bearishness for a break through 104.00 at a later stage.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | CBA Manufacturing PMI Sep P | 55.5 | 53.6 | ||

| 23:00 | AUD | CBA Services PMI Sep P | 50 | 49 | ||

| 00:30 | JPY | Manufacturing PMI Sep P | 47.3 | 47.3 | 47.2 | |

| 02:00 | NZD | RBNZ Rate Decision | 0.25% | 0.25% | 0.25% | |

| 04:30 | JPY | All Industry Activity Index M/M Jul | 1.30% | 1.30% | 6.10% | 6.80% |

| 06:00 | EUR | Germany Gfk Consumer Confidence Oct | -1.6 | -1 | -1.8 | -1.7 |

| 07:15 | EUR | France Manufacturing PMI Sep P | 50.9 | 50.6 | 49.8 | |

| 07:15 | EUR | France Services PMI Sep P | 47.5 | 51.7 | 51.5 | |

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 56.6 | 52.5 | 52.2 | |

| 07:30 | EUR | Germany Services PMI Sep P | 49.1 | 53 | 52.5 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 53.7 | 51.9 | 51.7 | |

| 08:00 | EUR | Eurozone Services PMI Sep P | 47.6 | 50.5 | 50.5 | |

| 08:30 | GBP | Manufacturing PMI Sep P | 54.3 | 54 | 55.2 | |

| 08:30 | GBP | Services PMI Sep P | 55.1 | 56 | 58.8 | |

| 13:00 | USD | Housing Price Index M/M Jul | 1.00% | 0.50% | 0.90% | 1.00% |

| 13:45 | USD | Manufacturing PMI Sep P | 53.1 | 53.1 | ||

| 13:45 | USD | Services PMI Sep P | 54.7 | 55 | ||

| 14:00 | USD | Fed’s Chair Powell testifies | ||||

| 14:30 | USD | Crude Oil Inventories | -2.5M | -4.4M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals