We expect the July Canadian GDP report to flag a slowing in the pace of the recovery. The release is likely to confirm Statistics Canada’s preliminary estimate that GDP rose 3% in July –a sizeable gain but smaller than the June (6.5%) and May (4.8%) increases. Even with the economy growing for a third consecutive month, July’s increase will leave activity running about 6% below February levels. A slowing in the pace of growth after an initial recovery surge has been long-expected. Household spending on goods had already recovered (surprisingly quickly) to above year-ago levels in June, leaving less room for additional marginal gains in the near-term. Growth in the industrial sector also slowed as the summer wore on – manufacturing hours worked edged up another 2% in August, but sales in the sector fell 2% after a 7% increase in July.

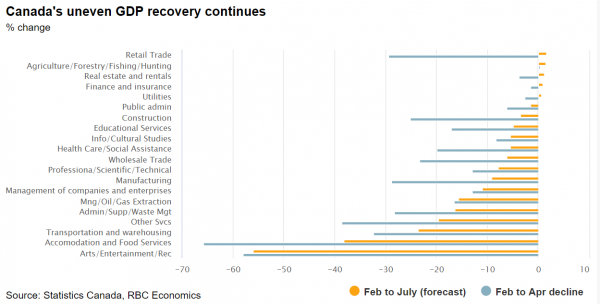

Indeed, the recovery has been (predictably) uneven with some industries, like retail, vastly outpacing the others. Housing markets have been surging over the summer as well. But investment in the oil & gas sector is still exceptionally soft. And activity in industries tied to tourism, like entertainment and accommodation & food services, remains very weak and will not fully recover while the virus risk remains. The strength of the early bounce-back in activity during the reopening phase put GDP on track to post a 40% (annualized) rebound in Q3. That pace of growth will be slower going forward – and still with downside risks should the latest bout of virus spread escalate to the point of prompting another round of more stringent containment measures.

Week ahead data watch:

- Next Friday’s US labour market report is expected to show further gains in employment, we are expecting a rise of 1200k. Though that would still leave the number of jobs lost at more than 10 million from February. We are expecting the unemployment rate to dip lower again.

- The Canadian September Markit PMI will give an early look at how well business confidence is holding up amid the latest uptick in virus counts. The August PMI reading was strong at 55.1.

- COVID-19 case counts will continue to be watched closely. Governments have been hesitant to-date to re-impose stringent lockdowns, both in Canada and abroad as hospitalizations and deaths from the disease have remained significantly lower than in the spring. But that could change if the virus spread continues to accelerate.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals