Dollar attempted to edge lower earlier today but the bears are still not too committed. Selling has indeed turned to Yen in early US session, after some better than expected US data. The stocks markets are also lacking a clear direction as European indices open higher, but quickly reversed early gains. Australian and New Zealand Dollars are the firmer ones but we’ll have to see if they can extend the rally with help from US risk-takers.

Technically, 1.1752 resistance in EUR/USD, 1.3007 resistance in GBP/USD, 0.7192 resistance AUD/USD and 1.3259 support in USD/CAD remain the focuses for the rest of the week. Some levels are breached, but without conviction. We’d need to see these levels taken out cleanly to confirm completion of Dollar’s near term rebound. Gold is making some progress by breaking 1900 handle again. Focus is now on 1920.06 resistance.

In Europe, currently, FTSE is up 0.16%. DAX is down -0.12%. CAC is up 0.47%. German 10-year yield is up 0.0068 at -0.511. Earlier in Asia, Nikkei closed flat. Japan 10-year JGB yield rose 0.0001 to 0.015. Singapore Strait Times rose 1.38%. China and Hong Kong were on holiday.

US initial jobless claims dropped to 837k, continuing claims down to 11.8m

US initial jobless claims dropped -36k to 837k in the week ending September 26, below expectation of 850k. Four-week moving average of initial claims dropped -11.8k to 867.3k. Continuing claims dropped -980k to 11767k. Four-week moving average of continuing claims dropped -381k to 12701k.

Personal income dropped -2.7% or USD 543.4B in August, better than expectation of -2.3%. Personal spending 1.0% or USD 86.1B, above expectation of 0.7% mom. Headline PCE price index accelerated to 1.4% yoy, up form 1.1% yoy. Core PCE price index rose to 1.6% yoy, up from 1.4% yoy.

Eurozone unemployment rate rose to 8.1%, 5th straight month of increase

Eurozone unemployment rose for the 5th consecutive month to 8.1% in August, matched expectations. Around 13.2m people are unemployment in Eurozone, up 251k over the month. EU Unemployment rate also rose to 7.4%. 15.6m people were unemployments, up 238k over the month.

Eurozone PMI manufacturing finalized at 53.7, led by Germany

Eurozone PMI Manufacturing was finalized at 53.7 in September, up from August’s 51.7. Markit noted that output and news were both up sharply, supported by resurgence in export trade. Growth in region was led by strong manufacturing upturn in Germany. Looking at some member states, Germany PMI manufacturing hit 26-month high at 56.4. Italy hit 27-month high at 53.2. The Netherlands also hit 7-month high at 52.5. France was finalized at 51.2.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone’s manufacturing recovery gained further momentum in September… The recovery would have been far more modest without Germany… Germany’s performance contrasted markedly with modest production growth in Spain, slowdowns in Italy and Austria, plus a particularly worrying return to contraction in Ireland. Excluding Germany, output growth would have weakened to the lowest since June.”

Also released, Eurozone PPI came in at 0.1% mom, -2.5% yoy in August.

Swiss CPI came in at 0.0% mom, -0.8% yoy in September. Retail sales rose 2.5% yoy in August, below expectation of 4.5%. SVME PMI rose to 53.1 in September, below expectation of 53.4.

UK PMI manufacturing finalized at 54.1, considerable challenges ahead especially for jobs

UK PMI Manufacturing was finalized at 54.1 in September, down from two-and-a-half year high of 55.2 in August. Nevertheless, reading stayed expansionary above 50 for the fourth consecutive month, longest streak since early-2019. However, Markit also noted further job losses reported.

Rob Dobson, Director at IHS Markit: ” Although rates of expansion in output and new orders lost some of the bounce experienced in August, they remained solid and above the survey’s long-run averages. Export demand is also picking up… Business sentiment remained positive as a result… There remain considerable challenges ahead…. especially true for the labour market, which saw further job losses and redundancies in September.

“The full economic cost incurred by 2020 will likely rise further as governments look to re-introduce some restrictions, job support schemes are tapered and rising numbers of firms start focussing on Brexit as a further cause of uncertainty and disruption during the remainder of the year.”

Japan Tankan large manufacturers index improved from 11-yr low

Japan BoJ Tankan Large Manufacturers Index rose to -27 in Q3, up from , -34, but missed expectation of -23. Large Manufacturing Outlook rose to -17, up from -27, matched expectations. Large Non-Manufacturing Index rose to -12, up from -17, missed expectation of -9. Non-manufacturing outlook rose to -11, up from -14, missed expectation of -9. All industry capex rose 1.4%, slightly above expectation of 1.3%.

The improvement in large manufacturers’ mood was welcomed considering that the index just hit the lowest level in 11 years in Q2. But the bounce is disappointing with pandemic uncertainty persisting. There are increasing calls for additional fiscal stimulus from new Prime Minister Yoshihide Suga. Ruling coalition party leader Natsuo Yamaguchi indicated earlier that the government is considering addition large-scale spending package.

Japan PMI manufacturing finalized at 47.7, downturn lost intensity

Japan PMI Manufacturing was finalized at 47.7 in September, up from August’s 47.3. That’s the highest level since February, but it’s, nonetheless, still a contractionary reading. There were slower falls in output and new orders while business expectations continue to recover.

Tim Moore, Economics Director at IHS Markit, said: “Subdued business conditions persisted across the Japanese manufacturing sector in September, but there were signs that the downturn has lost intensity. The latest declines in output and new orders were the slowest since the first quarter of 2020 and much softer than seen earlier in the pandemic. Some manufacturers noted that a turnaround in export sales to clients elsewhere in Asia had helped to offset some of the demand weakness across Europe and the United States.

“The most encouraging aspect of the latest survey was a sustained rebound in business optimism from the low point seen during April. More than twice as many manufacturers plan to boost production in the next 12 months as those that forecast a decline, which pushed the survey measure of business expectations to its highest since May 2018.”

Australia AiG manufacturing dropped to 46.7, recovery prone to periodic setbacks

Australia AiG Performance of Manufacturing Index dropped to 46.7 in September, down from 49.3. Victoria reported the weakest result, down -6.4 to 37.6, due to stage four restrictions. But decline was also reported in New South Wales, down -6.7 to 44.3, and Queensland, down -3.8 to 43.3. Looking at some more details, production dropped -3.3 to 50.1. Employment dropped -2.5 to 47.7. New orders dropped -1.5 to 45.1. Exports dropped -5.7 to 46.5. Average wages rose 1.5 to 52.3.

Ai Group Chief Executive Innes Willox said: “The disappointing contraction of manufacturing and the slump in manufacturing employment in September is a timely reminder that recovery from the COVID-19 crisis, at least in its initial stages, will be tentative and prone to periodic setbacks… There is clearly a need for further fiscal stimulus in next week’s federal Budget to help rebuild the confidence that is needed to get businesses investing and households spending.”

USD/JPY Mid-Day Outlook

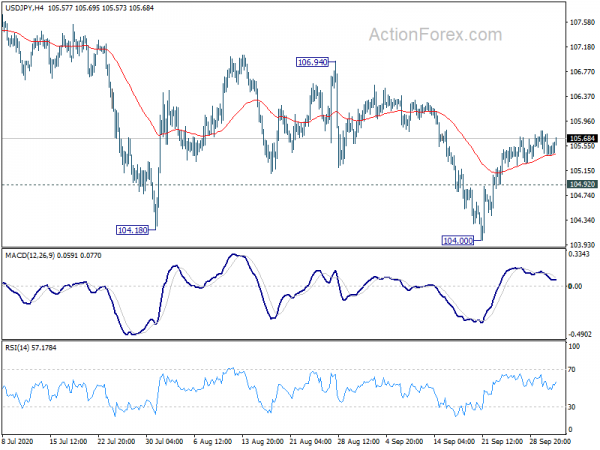

Daily Pivots: (S1) 105.30; (P) 105.55; (R1) 105.70; More…

No change in USD/JPY’s outlook. Upside momentum is unconvincing with 4 hour MACD staying below signal line. But with 104.92 support intact, further rise is still in favor. Sustained break of 55 day EMA (now at 105.94) will raise the chance of bullish reversal and target 106.94 resistance for confirmation. On the downside, though, below 104.92 minor support will turn bias back to the downside for retesting 104.00 instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Sep | 46.7 | 49.3 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | -27 | -23 | -34 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q3 | -12 | -9 | -17 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | -17 | -17 | -27 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q3 | -11 | -9 | -14 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 1.40% | 1.30% | 3.20% | |

| 00:30 | JPY | Manufacturing PMI Sep F | 47.7 | 47.3 | 47.3 | |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | 2.50% | 4.50% | 4.10% | 3.60% |

| 06:30 | CHF | CPI M/M Sep | 0.00% | 0.00% | 0.00% | |

| 06:30 | CHF | CPI Y/Y Sep | -0.80% | -0.70% | -0.90% | |

| 07:30 | CHF | SVME PMI Sep | 53.1 | 53.4 | 51.8 | |

| 07:45 | EUR | Italy Manufacturing PMI Sep | 53.2 | 53.5 | 53.1 | |

| 07:50 | EUR | France Manufacturing PMI Sep F | 51.2 | 50.9 | 50.9 | |

| 07:55 | EUR | France Manufacturing PMI Sep F | 56.4 | 56.6 | 56.6 | |

| 08:00 | EUR | Italy Unemployment Aug | 9.70% | 10.20% | 9.70% | 9.80% |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 53.7 | 53.7 | 53.7 | |

| 08:30 | GBP | Manufacturing PMI Sep F | 54.1 | 54.3 | 54.3 | |

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 8.10% | 8.10% | 7.90% | 8.00% |

| 09:00 | EUR | Eurozone PPI M/M Aug | 0.10% | 0.70% | 0.60% | 0.70% |

| 09:00 | EUR | Eurozone PPI Y/Y Aug | -2.50% | -2.10% | -3.30% | -3.10% |

| 11:30 | USD | Challenger Job Cuts Y.Y Sep | 185.90% | 116.50% | ||

| 12:30 | USD | Personal Income M/M Aug | -2.70% | -2.30% | 0.40% | 0.50% |

| 12:30 | USD | Personal Spending Aug | 1.00% | 0.70% | 1.90% | 1.50% |

| 12:30 | USD | PCE Price Index M/M Aug | 0.30% | 0.30% | 0.40% | |

| 12:30 | USD | PCE Price Index Y/Y Aug | 1.40% | 1.00% | 1.10% | |

| 12:30 | USD | PCE Core Price Index M/M Aug | 0.30% | 0.30% | 0.30% | 0.40% |

| 12:30 | USD | PCE Core Price Index Y/Y Aug | 1.60% | 1.40% | 1.30% | 1.40% |

| 12:30 | USD | Initial Jobless Claims (Sep 25) | 837K | 850K | 870K | 873K |

| 13:30 | CAD | Manufacturing PMI Sep | 55.1 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 53.5 | 53.5 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 56 | 56 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 59 | 59.5 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Sep | 46.4 | |||

| 14:00 | USD | Construction Spending M/M Aug | 0.80% | 0.10% | ||

| 14:30 | USD | Natural Gas Storage | 76B | 66B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals