Yen continues to feel much selling pressure, partly thanks to strength in treasury yields, and partly due to the strong rebound in US stocks overnight. Asian markets turned mixed, however, with Hong Kong and Singapore in slight red. New Zealand Dollar suffered notable selling on news that RBNZ is actively working on negative rates. Euro remains the strongest one for the week so far, but it will need some additional boost from ECB meeting minutes to push it out of recent range. Dollar softens mildly in Asian session but remains mixed for the week, awaiting fresh guidance.

Technically, USD/CAD’s breach of 1.3242 temporary low is a sign of Dollar weakness. But we’d firstly need to see a break of equivalent levels of 1.1807 minor resistance in EUR/USD and 0.9133 minor support in USD/CHF. Also, GBP/USD will also need to break through 1.3007 resistance to align the outlook with other Dollar pairs.

In Asia, Nikkei closed up 0.96%. 10-year JGB yield is down -0.0017 at 0.040. Hong Kong HSI is down -0.69%. Singapore Strait Times is down -0.13%. China is still on holiday. Overnight, DOW rose 1.91%. S&P 500 rose 1.74%. NASDAQ rose 1.88%. 10-year yield rose 0.043 to 0.785.

Fed Evans: Policy will stay accommodative after interest rate liftoff

Chicago Fed President Charles Evans said there is no “strict numerical formula” to determine the time of “liftoff” of interest rate, and “how long to keep policy accommodative after liftoff”. He added that the work on inflation is “unlikely to be complete when we first begin to raise rates”. That means, Fed will “maintain accommodative monetary conditions until our inflation averaging goal is met”. Even though,

Evans also said Fed has the “capacity to do more asset purchases” but he currently doesn’t see the need. At some point, Fed will need to give explicit guidance on future pace or type of asset purchases. Nevertheless, “that’s not where we are, and it’s probably going to be the Spring until I have a better sense”

Fed Williams: Moderate inflation overshoot, is a guard rail, about proportionality

New York Fed President John Williams said allowing “moderate” inflation overshoot “isn’t a number”. But it’s a “guard rail” against expectations that very persistently high inflation would be tolerated. And, “it’s also about proportionality”. “There’s flexibility, and there’s some discretion around that,” he added. “It is specific to the circumstances, and I would also say it is specific to where the economy is.”

Williams also reiterated that the economic outlook is “highly uncertain”. Fiscal policy actions can be very helpful in the short-run. As some parts of the economy have not recovered nearly as much, “target fiscal support would be helpful”.

FOMC Minutes: Economy Greatly Hinged on More Fiscal Stimulus.

The minutes for the September FOMC meeting reveals that the members generally agreed to adopt the new monetary policy framework and change the forward guidance in the way presented in the statement. While the economic projections were upgraded in the meeting, these were conditioned on the further fiscal stimulus implemented by the government. Inflation will remain sticky for an extended period of time. Despite increase in the price level in certain aspect, it is expected that overall inflation will remain “subdued” for the year ahead.

More in FOMC Minutes Reveal that Upgrade on Economy Greatly Hinged on More Fiscal Stimulus.

BoJ upgrades economic assessment on 9 of 10 regions

In the Regional Economic Report, BoJ upgraded assessment on 9 of the 10 regions, except Shikoku which was kept unchanged. The central bank noted, “many regions, while noting that their economy had been in a severe situation due to the impact of the novel coronavirus (COVID-19), reported that it had started to pick up or shown signs of a pick-up, with economic activity resuming gradually.”

“Once the impact of the coronavirus pandemic subsides globally, Japan’s economy is likely to continue improving further as overseas economies resume steady growth,” Governor Haruhiko Kuroda said in the quarterly branch managers’ meeting. “We’ll monitor the impact of COVID-19 and won’t hesitate taking additional easing measures as needed.”

Economy Minister Yasutoshi Nishimura also said the current economic sentiment is becoming really good. The Eco watchers current sentiment rose from 43.9 to 49.3 in September.

Also from Japan, current account surplus widened to JPY 1.65T in August, above expectation of JPY 1.50T.

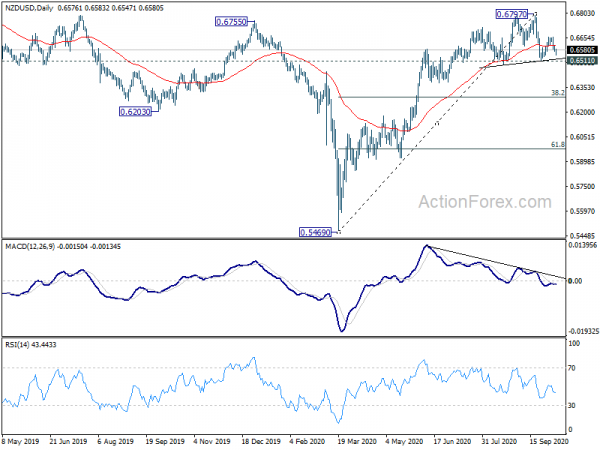

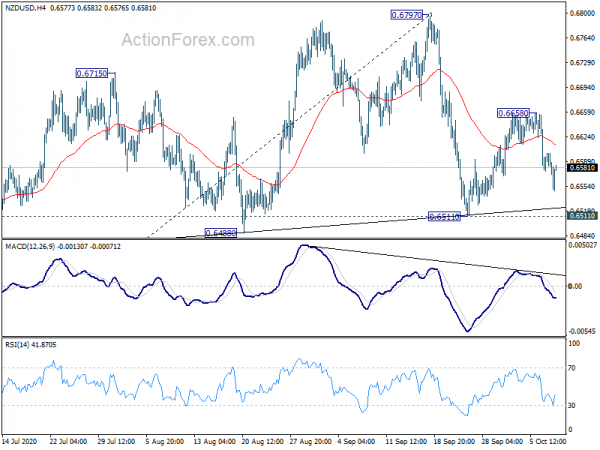

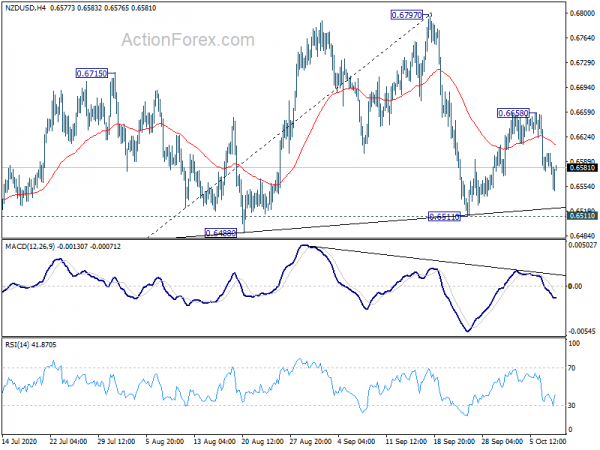

NZD/USD to complete head and shoulder top as RBNZ actively preparing for negative rates

RBNZ Assistant Governor Christian Hawkesby is quoted staying that the central bank is actively working on negative interest rates and funding for a lending program. Also, “inflation is likely to remain well below the target for three years.” Chief Economist Yuong Ha also noted that the central would rather be aggressive with stimulus, and do too much too soon than too late too little. The central bank is looking at tiering regime for negative rates plan.

NZD/USD drops notably today and it’s not looking at 0.6511 support. Break there will complete a head and shoulder top (ls: 0.6715, h: 0.6979, rs: 0.6658). In this case, we should at least see a deeper decline to 38.2% retracement of 0.5469 to 0.6797 at 0.6290, as a correction to rise from 0.5469 to 0.6797.

New Zealand ANZ business confidence improved, activity turned positive

In the preliminary survey results for October, New Zealand ANZ Business Confidence rose to -14.5, up from September’s -28.5. Own Activity Outlook turned positive to 3.6, up from -5.4. Employment intentions rose to -3.2, up from -11.8, but stayed negative.

ANZ said October’s data “saw another widespread improvement in the forward-looking activity indicators”. But, “key tests for the economy lie ahead: the winding down of the wage subsidy and the lost summer for tourism.”

Elsewhere

UK RICS house price balance rose to 61% in September, up from 44%, much stronger than expectation of 39%. Swiss unemployment rate dropped to 3.3% in September, down from 3.4%, beat expectations. Germany trade surplus narrowed to EUR 15.7B in August, smaller than expectation of EUR 17.1B.

ECB meeting accounts will be the main focus for the rest of the day. US will release jobless claims while Canada will release housing starts.

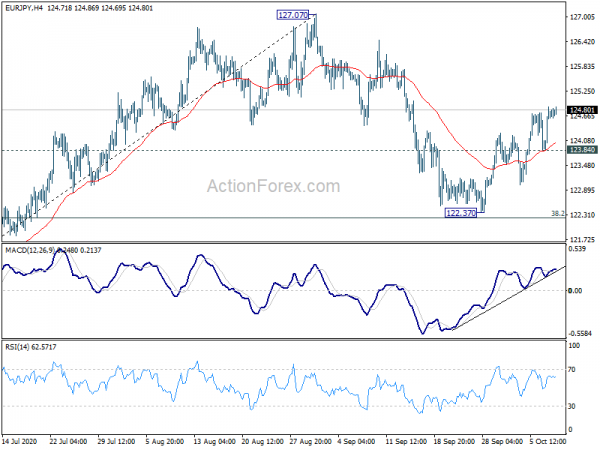

EUR/JPY Daily Outlook

Daily Pivots: (S1) 124.07; (P) 124.48; (R1) 125.08; More….

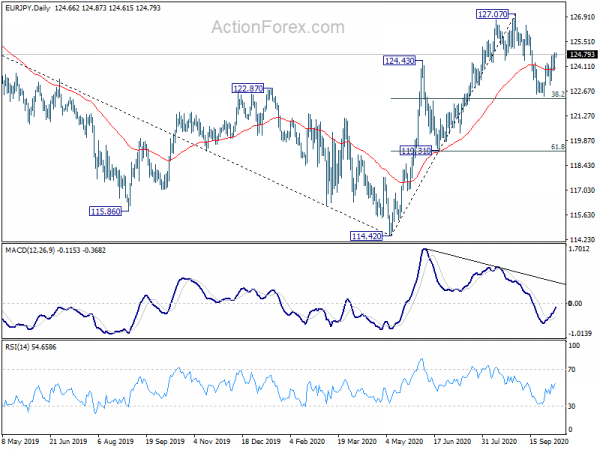

Intraday bias in EUR/JPY remains mildly on the upside at this point. Rise from 122.37 should target a test on 127.07 high. As 38.2% retracement of 114.42 to 127.07 at 122.23 was defended well, we’d expect larger rebound from 114.42 to resume later, with a break of 127.07. On the downside, though, break of 123.84 minor support will suggest that the recovery from 122.37 has completed. Intraday bias will be turned back to the downside for 122.23 fibonacci support.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 119.31 support holds. Break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 next. However, firm break of 119.31 will argue that the rise from 114.42 has completed and turn focus back to this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Sep | 61% | 39% | 44% | |

| 23:50 | JPY | Current Account (JPY) Aug | 1.65T | 1.50T | 0.96T | |

| 0:00 | NZD | ANZ Business Confidence Oct P | -14.5 | -28.5 | ||

| 5:00 | JPY | Eco Watchers Survey: Current Sep | 49.3 | 43.9 | ||

| 5:45 | CHF | Unemployment Rate Sep | 3.30% | 3.40% | 3.40% | |

| 6:00 | EUR | Germany Trade Balance (EUR) Aug | 15.7B | 17.1B | 18.0B | |

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:15 | CAD | Housing Starts Sep | 220.0K | 262.4K | ||

| 12:30 | USD | Initial Jobless Claims (Oct 2) | 820K | 837K | ||

| 14:30 | USD | Natural Gas Storage | 76B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals